Summary:

- Apple is a leading designer and manufacturer of mobile devices, PCs, and accessories, with a strong focus on product design and user experience.

- Despite challenges in the Chinese market, iPhone sales remain stable, while Services segment shows positive momentum and record revenues.

- The company’s target price is based on a sum-of-the-parts analysis, with reasonable multiples reflecting its ecosystem and aggressive cash returns to shareholders.

Tom Werner

Summary

Apple (NASDAQ:AAPL) (NEOE:AAPL:CA) is a designer and manufacturer of mobile communications and personal media devices, PCs, and accessories. It sells a range of software, services, and third-party digital content and apps. Over the past decade, it has made significant innovations in smartphones and tablets, launching the marquee iPhone and iPad products. Its focus on product design and UX extends beyond hardware (e.g., Mac, Apple Watch, Apple TV, AirPods, and HomePod) to operating systems (e.g., iOS, macOS, watchOS, and tvOS) and software and content delivery services (e.g., iTunes Store, App Store, Mac App Store, TV App Store, Book Store, Apple Music, iCloud, and Apple Pay). In FY23, iPhone sales accounted for over 50% of sales, followed by Services (+20%).

While the company’s dominant position in its core hardware offerings and long-term growth potential via Services are highly attractive to us, we need to see a more attractive valuation (i.e., ~$210/share) before upgrading to Buy.

Earnings Update

AAPL’s FQ3 revenue and guidance were in line with consensus, with EPS slightly above due to favorable gross margins and opex. China revenues for the first half of the year were down ~7% YoY, primarily due to FX movements and ~5% iPhone share loss. The company guided to Services growth of 13% YoY for the upcoming FQ4, which we view as a positive given it will face tougher comps. In advance of upcoming product launches (e.g., AI features, iPhone 16), R&D spend was up ~8% YoY to ~$8Bn.

iPhone

Revenues were down 1% YoY. Guidance for FQ4 implies a flat or a modest decline YoY, with sales of ~46MM units. In China, revenue growth was -6.5% YoY on a reported basis (n.b., -3% on a constant currency basis). While still negative, this was much improved from the -11% reported growth in the first half of the fiscal year. While the company did not break out iPhone-specific data for this segment, it noted that the iPhone 15 line has been significantly outperforming the 14. Huawei’s re-entry into the market in August 2023 has weighed on AAPL’s market share. We have seen research notes estimating total smartphone sales in China to be up 10% YoY, while Apple’s sales were -2% YoY (i.e., AAPL is losing share, likely to Huawei). We believe AAPL has lost ~5% market share since Huawei’s re-entry (n.b., the equivalent of ~10-15MM units).

iPad & Mac

Revenues were up 24% YoY, benefitting from the new Air and M4-based Pro product launches. Mac growth (n.b., +2% YoY) remains subdued, as it faces demand softness similar to that of the wider PC market.

Services

This segment, key to the bull thesis, reached record revenues of +$24Bn, up 14% YoY and representing ~28% of total revenue, driven by strength in ads, cloud services, and payments. Enforcement of new DMA policies for the European App Store (n.b., ~7% of total App Store revenues) appears to be having a modest impact (n.b., likely <1% of total revenue). Wider global adoption of DMA policies remains a risk to AAPL. Additionally, Google traffic acquisition costs (“TAC”) payments could reach ~$17Bn (n.b., ~9-10% of gross profit) by the end of FY2024 – another potential risk. AAPL’s partnership with OpenAI for future AI features is a potential upside.

Dividends & Buybacks

The company returned ~$32Bn to shareholders (n.b., ~$4Bn of dividends, the remainder in buybacks, a record for AAPL and its second consecutive quarter of >$20Bn).

Overall, despite weakness in the overall macro environment and China, demand for the iPhone and other hardware remains relatively stable. The Services segment’s momentum remains a positive and underpins our long-term outlook for FCF growth.

Valuation

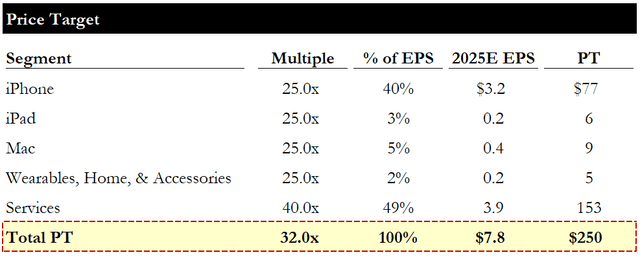

Our target price is based on a sum-of-the-parts analysis. We apply a 25x forward P/E multiple to the core business lines (i.e., iPhone, iPad, Mac, and wearables etc.) and a 40x multiple to the Services business, blending to a 32x P/E multiple on our calendar 2025E EPS of ~$7.8.

We believe these multiples are reasonable, considering the median P/E over the last 3 years of ~26x (n.b., ~1x higher than our assumption for the core hardware businesses), the company’s strong product ecosystem and brand loyalty, and aggressive pace of cash returns to shareholders (n.b., in FQ3, AAPL returned +$30Bn to shareholders by repurchasing ~139MM shares and paying ~$3.9Bn of dividends).

Risks

Slowdown in Services

The biggest risk to our thesis is a slowdown in Services revenue growth, which could occur as a result of lower App Store growth, lower penetration of content offerings in Music, Video, or News subscriptions, or deflationary pressures on Licensing revenue streams. Any of the above would result in a decreased outlook for EPS and likely lead to multiple compression.

Increasing Competition in China

As evidenced by AAPL’s loss of market share in China since Huawei’s re-entry in late-2023, AAPL is facing increased competition in China. If this trend continues, it could threaten the overall growth story for iPhone, potentially leading to lower earnings growth and multiple compression.

Generic PC/Tablet Market Risk

A broad-based secular decline in the PC/tablet markets could also negatively affect the forward earnings outlook.

Catalysts

We see the key near-term driver of iPhone demand being upgrades incorporating GenAI features and the launch of iPhone 16 in September. While we expect that new AI features could well drive an acceleration of growth, it could take until 2025 to materialize given the tech’s early stages of development. Earlier this month, AAPL began rolling out Apple Intelligence features to developers to enable them to begin incorporating them into apps. AAPL’s near-term approach to AI upgrades is to begin with limited English-language features (e.g., ChatGPT integration to come by the end of the year) before expanding to other languages and regions.

Product refreshes in the iPad portfolio could drive a revenue acceleration in that segment. We see limited opportunities for meaningful new product innovation in Mac, though an eventual M4 chip-based product that could support AI features could change this.

Conclusion

We rate AAPL a Hold given the modest discount to our target price (n.b., ~10% implied upside). We believe in its long-term growth prospects, given the strengths and opportunities in Services, the annuity-like profile of the iPhone business (n.b., installed base is +1.4Bn units with an average age of 6-7 years, implying an annualized replacement demand of ~220MM units), and strong cash returns to shareholders (n.b., ~100% of FCF given AAPL’s goal to be net cash neutral). We would look to change our rating closer to $210/share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.