Summary:

- Apple Inc. offers a compelling investment opportunity through its long-term bonds, particularly the 2046 maturity, providing a hedge against economic downturns and interest rate declines.

- Despite a decline in product sales, Apple’s growing service sales, with higher margins, have boosted overall profitability and operating margins to record levels.

- The 2046 Apple bond outperforms alternatives like TLT, offering higher income and potential capital gains, especially if interest rates fall.

- Risks include Apple’s heavy reliance on iPhone sales, potential antitrust issues with Google, and geographic exposure to weakening economies in Europe, China, and Japan.

ozgurdonmaz

Introduction

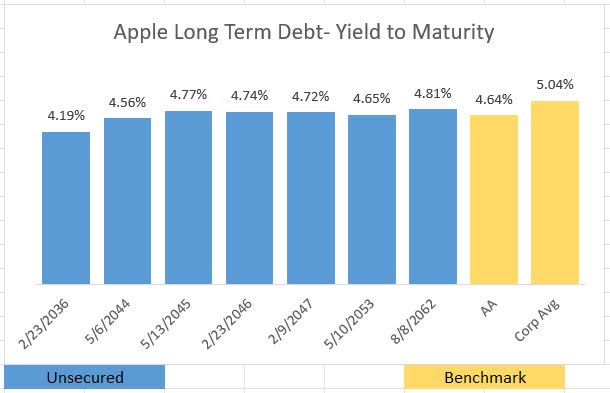

Aside from being one of the most recognizable technology companies in the world, Apple Inc. (NASDAQ:AAPL) (NEOE:AAPL:CA) is also the biggest with a market capitalization of over $3.4 trillion. Apple shares are some of the highest traded in the stock market. What is a little less known among investors is that Apple carries debt. In fact, the company has several long-term debt issuances that are only callable six months before maturity. For investors needing a hedge to protect against a hard landing, Apple’s long-term bonds (specifically the one maturing in 2046) offer great protection.

FINRA

Apple’s Pandemic Hangover

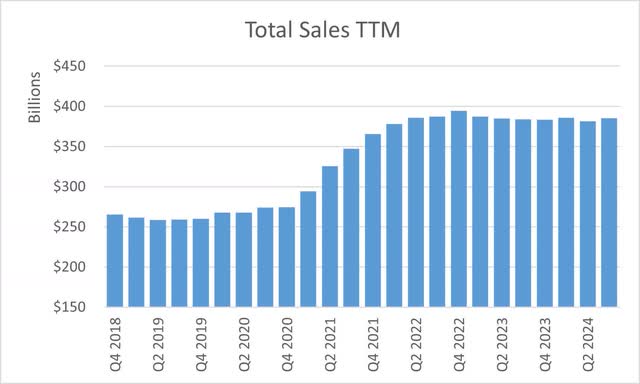

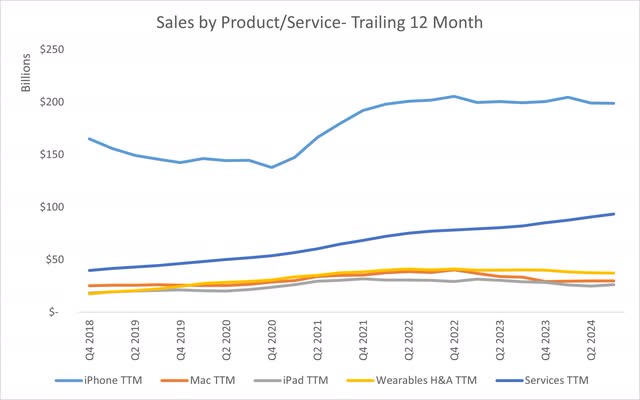

Apple was a company that generated $250 billion in sales over any twelve-month period prior to the pandemic. After the onset of the pandemic, sales edged up slightly in 2020 before shooting up to nearly $400 billion on a trailing twelve-month basis during 2022. Sales growth has evaded Apple for nearly two years, but a deeper dive into the data shows that Apple is becoming a more efficient company.

Earnings Releases

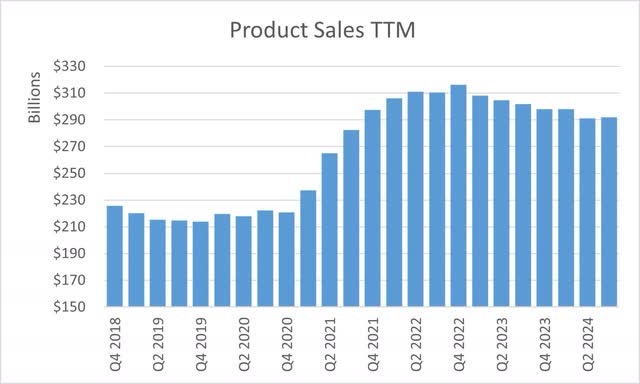

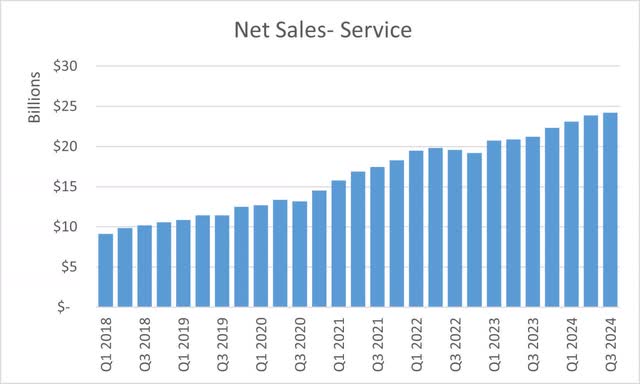

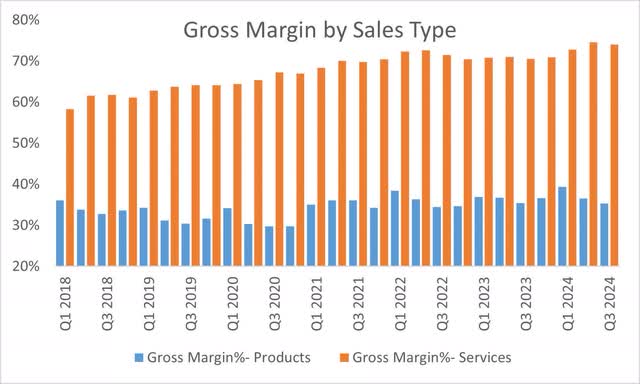

Apple sells products and services. The headwinds on the sales side come exclusively from lower product sales, which are more than $20 billion lower on a trailing twelve-month basis than they were in 2022. Apple is making up for the product sales decline by increasing its service-related sales. In fact, except for a couple quarters in 2022, Apple has steadily grown its sales of services over the last five years and has turned it into a major part of the company’s business.

Earnings Releases

Earnings Releases

Turning Service Sales in Profits

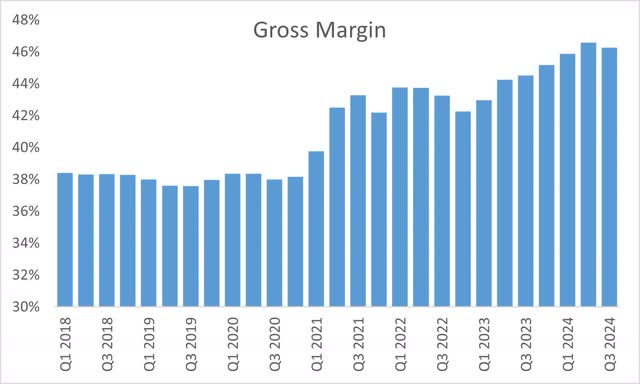

Selling services not only helps maintain the top line for Apple but also helps grow the bottom line. Service sales carry a 70% gross margin on average for the company. While the gross margin for products improved for Apple during the pandemic, the level currently sits at half of where it does for services, at around 35%. Due to the greater mix of service sales, Apple’s overall gross margin has risen.

Earnings Releases

Earnings Releases

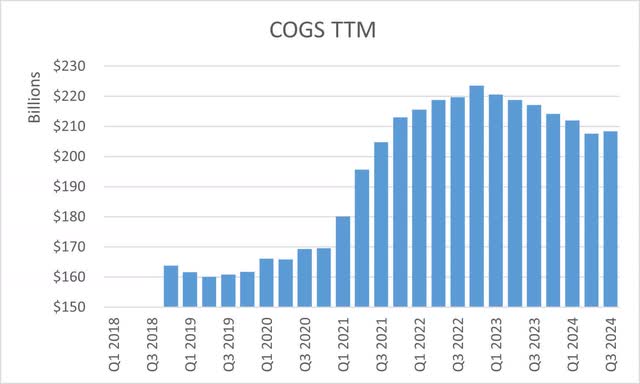

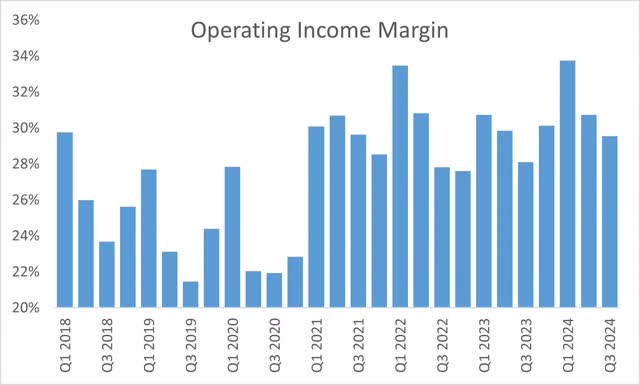

By selling a greater service mix in its overall sales, Apple has managed to notably reduce its cost of goods sold, which has boosted its gross profit. Apple has also managed to control its fixed costs during the growth in service sales, which helps bring the growth in gross profit to the bottom line. Apple’s operating margins have increased from the low 20s to around 30% and operating income hit $120 billion on a trailing twelve-month basis in the third quarter, its highest level ever.

Earnings Releases

Earnings Releases

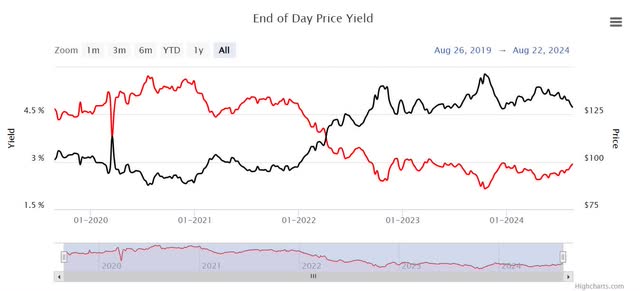

What Does the Long-Term Debt Trade Offer?

The long-term debt of Apple offers fixed income investors the opportunity to collect capital gains in the event of a large decline in interest rates. Such a circumstance would likely occur if the economy suffered a hard landing/recession. Using the 2046 maturing debt as an example, the bond currently trades at 98 cents on the dollar, but the bond traded at 145 cents on the dollar, or nearly 50% higher during the height of the pandemic before crashing down in price when the Federal Reserve began aggressively hiking rates to battle inflation in 2022.

FINRA

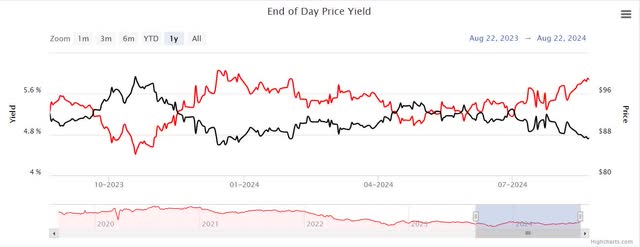

Why Not TLT versus Apple?

The iShares long-term treasury bond ETF (TLT) is a noteworthy alternative and popular ETF for investors seeking to hedge against a hard landing. While I hold TLT and have nothing against it, investors should note that the 2046 Apple bond has outperformed TLT in price (up 7% versus 3%) in the last year and offers a coupon yield (income) that is 100 basis points higher. It is also worth mentioning that due to high government deficits, the US government’s credit rating could become lower than Apple’s, which would affect the pricing of TLT.

FINRA

TLT 1 Year Price History (Seeking Alpha)

Risks to Apple

While the chances of Apple facing bankruptcy and impairing bondholder value are next to nothing, that is not the primary risk here. The risk to Apple debt holders involves events that could cause Apple’s debt to be downgraded and hurt the value of its bonds, which would limit the capital gains capability of bondholders in the event of a hard landing.

The first risk is embedded in Apple’s sales data. Apple is still heavily dependent on one product, the iPhone. The iPhone accounts for more product sales than the Mac, iPad, wearables, and services combined. Should one of Apple’s competitors offer a superior phone or a disruptive product to the industry, the loss in sales would certainly have a material impact. Secondly, Apple has risk to sales outside of the iPhone, as it was recently revealed in Google’s antitrust lawsuit that Apple received $18 billion per year in exchange for Google to be the default search engine on all Apple devices. The loss of Google’s antitrust suit could adversely affect that source of revenue.

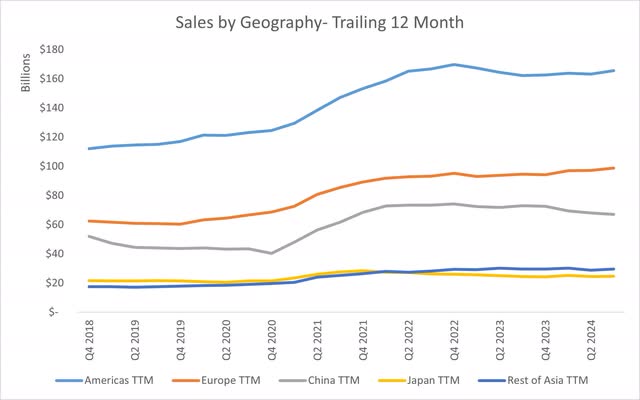

Earnings Releases

Additionally, Apple has geographic exposure. The company has a material level of sales in Europe (where antitrust laws have dogged them), China (where the economy is weakening as are Apple sales), Japan (where sales are lagging), and the rest of Asia. Whether it’s the yen carry trade undermining the Japanese economy or the Chinese consumer pulling back due to its economic problems, Apple has exposure to the global economy and problems abroad could trigger credit downgrades that affect bondholders.

Earnings Releases

Conclusion

There’s considerable uncertainty ahead as to what the appropriate interest rate should be long term in the US economy and whether a soft landing is possible. Investors in the equity markets face volatility if economic news begins to show we are headed towards a recession. Instead of being overexposed to cash and witnessing your interest payments plummet, or overexposed to equities during volatility, investors should consider Apple long-term bonds for a healthy long-term income and an opportunity to earn capital gains.

CUSIP: 037833BX7

Price: $98.81

Coupon: 4.65%

Yield to Maturity: 4.73%

Maturity Date: 2/23/2046 (Callable on 8/23/2045)

Credit Rating (Moody’s/S&P): Aaa/AA+

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own Apple bonds maturing in 2046.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.