Summary:

- Despite Apple stock reaching an all-time high, I advise new investors to wait for a potential pullback due to negative global economic sentiment.

- AAPL’s brand loyalty and emerging market demand, especially in Mexico, India, and China, are seen as key growth drivers for the future.

- Though Apple’s financials are strong, its current valuation may be too high for new investors, so I recommend patience for a potential price drop.

Nikada/iStock Unreleased via Getty Images

Investment Thesis

With Apple Inc. (NASDAQ:AAPL) reaching an all-time high, I wanted to take a look at the company’s outlook and financials to see if it would be a good time to invest right now or wait for a pullback. The company has been run very well over the last couple of decades and I don’t see it changing anytime soon, however, since the company is trading at an all-time high, I would caution new investors to be patient and wait for some profit-taking in the near future that could be brought on by the negative sentiment in the global economy that is supposedly on a verge of a recession.

Outlook

The company had a great rally YTD, up 54%, which is an incredible achievement even for a mid-size company, and Apple is trading over $3T!

Brand Loyalty

Customers of Apple are very loyal to the brand. Usually, if a person has an iPhone, they most likely will have another Apple accessory or service. The ecosystem that the company has created is impressive. It is very easy to sync your devices and transfer data. That is one of the main reasons I believe attracts so many people. There will never be a shortage of customers because with such an ecosystem in place, it would be very tedious to go from an Apple device to an Android one and that is why a lot of people tend to stick with Apple.

People who own an iPhone typically upgrade their device as soon it’s available for them to upgrade, so within a year or two, Gen Z especially would opt to upgrade, just to get the latest hardware from their favorite brand. The younger generations prefer to own the latest offerings from Apple, frankly because it’s “cool” and there will be no shortage of revenue for the company because iPhone set a March quarter record just a few months ago.

Emerging Markets Demand

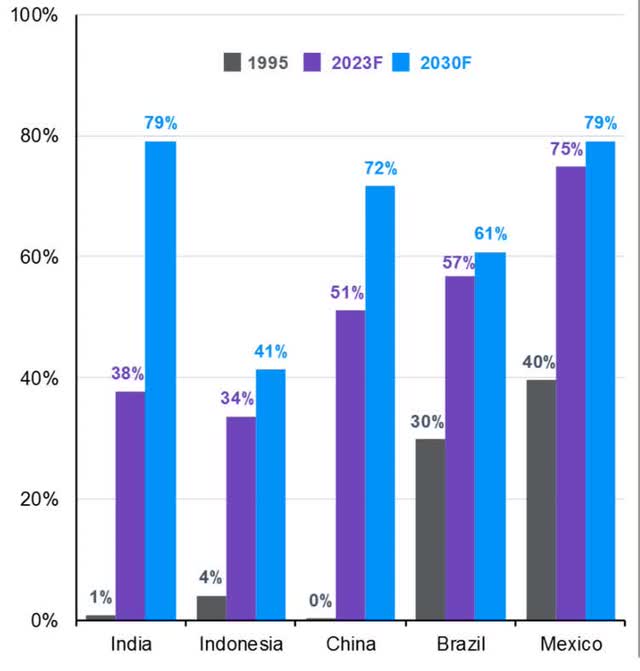

While the demand for Apple products has pretty much peaked in the developed economies, emerging markets provide serious growth potential for Apple, especially in countries like Mexico, India, and China. These three countries in particular are forecasted to see an explosion of middle-class population in the next decade and the demand for Apple products is evident. In the latest quarter transcript, the company reported that the Indian market grew double-digits, which most likely means low double-digits, because I think if that number was bigger, say 20%, they would say it’s 20%.

Emerging Markets Growth of the Middle Class (JP Morgan)

The successful opening of two Apple stores in India is an indication that the company is serious about expanding into this market and with the forecasted explosion of the middle class in the region, Apple is going to bank on it and will be able to secure a much larger audience for their products for the long-term.

With the annual releases of the iPhone, coupled with brand loyalty, Apple will enjoy revenues until the end of time. I wouldn’t be surprised if the company manages to grow at higher rates in the future once the Emerging Market economies develop further.

Some might say that the annual cycle of new iPhones doesn’t add very much value due to very few incremental updates, but I would say if people were buying then why not keep doing it?

In summary, the company is not going anywhere soon and will continue its climb to new highs for years to come. Apple is never a bad investment in the long run, except if you buy it at the wrong price, which may deliver suboptimal results. I will cover this topic in a later section.

Financials

Just to note the following graphs will be as of FY22 which ended in September ’22. I will provide the most recent relevant figures if I feel they are needed for extra color.

As of the most recent quarter, the company had around $56B in cash and marketable securities against $97B in long-term debt. For a company that has breached the $3T market cap recently, the debt is negligible and is not a problem at all. Interest expense as of six months ended April ’23 was $1.9B and EBIT was $64B, which means the coverage ratio is around 33x and that is not taking into account the net income from short-term investments that totaled around $1.8B, making actual net expense $330m. It is safe to say Apple is not in any danger of defaulting on its debt. There’s no bank in the world that wouldn’t provide funding to Apple.

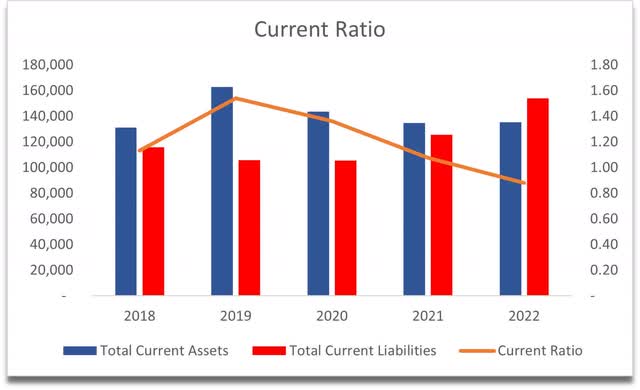

Surprisingly, Apple’s current ratio as of FY22 was below 1 and even in Q2 ’23, however, since it’s Apple, the financial position is just so strong that there is no way that a current ratio below one is any issue at all. Besides, in the previous years, it was well above 1 so I don’t see any issues here.

Current Ratio (Own Calculations)

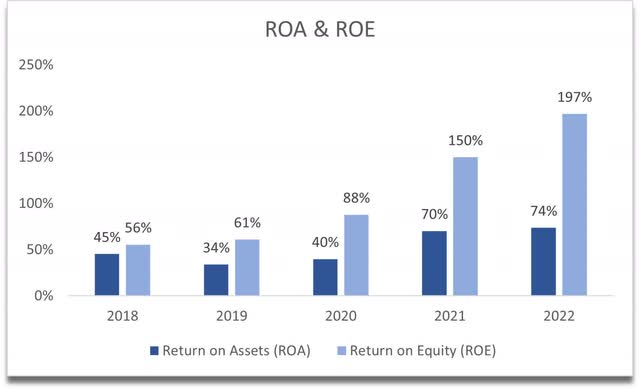

In terms of efficiency and profitability, it is not hard to see why the company is so valuable. The company’s ROA and ROE are outstanding. The management is utilizing the company’s assets and shareholder capital very efficiently, and it has created value and will continue to create value in the future if it continues on this trajectory.

ROA and ROE (Own Calculations)

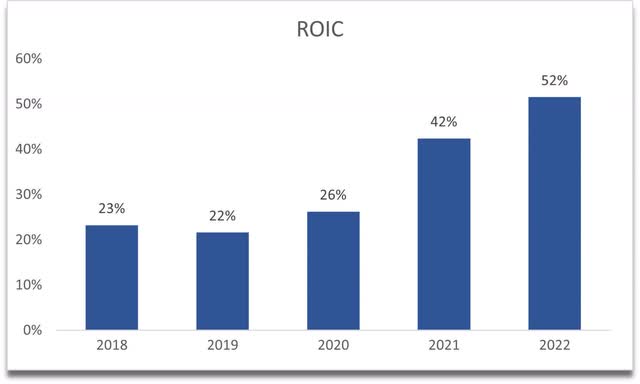

One of the most important metrics I like to look at and the one Warren Buffett said “If there was one metric that could tell me what is up with the company, or that I could judge the quality by it is ROIC.” Of course, Apple shines here and it’s no wonder that almost 46% of Buffett’s holdings are in Apple. Just like ROA and ROE, ROIC has been in an uptrend also, which just confirms what everyone already knew, that Apple has a competitive advantage and a very strong moat. I wouldn’t mind paying a premium for such a great return also.

Return on Invested Capital (Own Calculations)

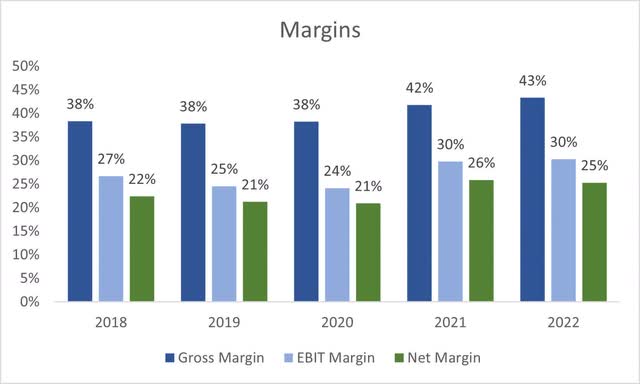

In terms of margins, these have improved over the last couple of years. Net margins of over 25% are very impressive and I could still see some further improvements in the next decade, even if it’s just a couple of percent.

Overall, an outstanding company no doubt, which should be in everyone’s long-term portfolio. The management is capable of running this juggernaut efficiently and I wouldn’t be surprised that with further advancements in technology and innovation, the company could achieve even higher profitability. The question is how much I am willing to pay for such a company. Let’s find out.

Valuation

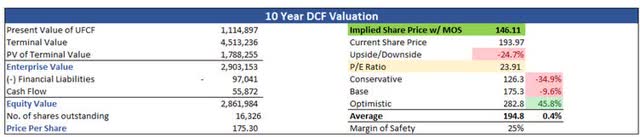

For the base case, I could see the company still growing at that double-digit growth that it has averaged for the last decade, which is 10%. With the explosion of the middle-class as mentioned previously, I don’t see how it could perform below this number. For the conservative case, I went with 8.6% and for the optimistic case, I went with 14% CAGR for the next decade.

I believe that the customer base is very resilient and loyal and that they will continue to buy the company’s products until the end of time.

In terms of margins, I went with a slight improvement in gross and operating margins of around 200bps or 2% each over the next decade for the base case. For the conservative case, I improved them by around 100bps while for the optimistic case, I improved them by 275bps.

On top of these assumptions, I will add a 25% margin of safety to keep it on the conservative side, which will yield a better risk/reward profile for me.

With that said, Apple’s intrinsic value with these assumptions is $146.11, implying around 25% downside from the current valuation.

Intrinsic Value (Own Calculations)

Closing Comments

To be honest, I wanted to give a smaller margin of safety, but the risk/reward ratio is so much more attractive if Apple was trading at the implied share price of $146, which it saw just 3 or 4 months ago. I could see the price retracing slightly if volatility in the markets stays for a little while longer, which it will because the Fed is still thinking of raising interest rates two more times, and interest rates are going to stay at elevated levels for a while until inflation numbers come down significantly.

If you are a new investor who is looking to buy a company as solid as Apple, I would hold off for now and wait for substantial profit taking, just like we saw in August ’22 because right now the stock is a little expensive in my opinion. It is a solid company, one of the best ones to hold for a long time, however, if bought at the wrong time, the returns will be below par.

If you already are a long-term holder of the stock, I wouldn’t sell either because it’s such a good company. I would certainly add on any substantial weakness. A lot of stocks have ripped up in the last couple of months and it is quite hard to find a decent deal out there right now, so patience is key right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.