Summary:

- The iOS 18 promised to make iPhones more personal and intelligent, which could drive future sales – at first glance at least, that’s true.

- Apple’s Q3 revenue of $85.8 billion and GAAP EPS of $1.4 beat consensus estimates, driven by geographic expansion and record services revenue.

- New Apple Intelligence features could drive future iPhone upgrades, but declining mobile carrier upgrade rates pose a long-term risk.

- My DCF valuation suggests AAPL is fairly valued at best, preventing a “Sell” rating but not justifying a “Buy” rating.

- We will have to wait for the pre-order data (lead time) to tell to what extent AI will be a game-changer for AAPL.

Nikada/iStock Unreleased via Getty Images

Intro & Thesis

I initiated coverage of Apple Inc. (NASDAQ:AAPL) (NEOE:AAPL:CA) stock in December 2021 and gave the stock a ‘Hold’ rating, pointing to the strength of the brand but also a fairly generous valuation at the time. A few articles later, on April 10, 2023, I downgraded AAPL stock to “Sell”, and since then, I kept my rating unchanged. Unfortunately, pricey stocks may stay pricey way longer than we can predict, so despite the stagnation of the business, AAPL stock beat the S&P 500 Index (SPX) (SP500) by 317 b.p. (36.91% vs. 33.74%) since I downgraded it.

In my latest bearish call, I noted that AAPL stock abruptly broke its medium-term sideways consolidation channel after investors and analysts cheered the company’s AI-centric plans unveiled at the WWDC developer conference on Monday. Since then, the AAPL stock price has been in a short-term consolidation, and even the recently introduced 16th generation of iPhones has not had a significant impact on the stock’s performance.

Today, I’ve decided to upgrade my rating to “Hold” and no longer try to fight the irrationality that has appeared in AAPL’s price action in recent months and even years. I still think Apple is a highly overvalued stock, but I definitely like the introduction of Apple Intelligence.

Why Do I Think So?

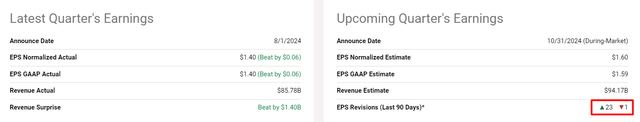

The company reported revenue of $85.8 billion for Q3 FY2024, which not only marked a 5% YoY increase, but it was enough to exceed the consensus forecast of $84.4 billion. This was particularly noteworthy given that the whole growth occurred during Apple’s seasonally weakest quarter. Thanks to its operating leverage, AAPL was able to deliver GAAP earnings per share of $1.4, up 11% YoY, also beating the consensus estimate of $1.34 (although there was a sequential decline of around $0.13). The double-beat results and no significant negative guidance changes led to Q4 earnings revisions en masse:

Seeking Alpha, AAPL, notes added

I think what we saw in Q3 again was that Apple’s geographic expansion strategy is indeed proving effective, as evidenced by record revenues in over two dozen countries, including major end-markets like Canada, Mexico, Germany, and the U.K., as well as growth economies such as Indonesia, the Philippines, and Thailand. It was these markets that helped offset the decline in sales in China (-7% YoY), which was anticipated due to “economic and competitive pressures.” Apple’s sales went up in the Americas region (a 7% YoY increase), and in Europe (an 8% YoY rise), so the firm kept capitalizing on diverse market opportunities. The company’s services segment, which achieved an all-time record revenue of ~$24.2 billion, up 14% YoY, further diversifying away from the hardware cyclicality dependence, which is, of course, good news for investors.

Despite a slight decline in market share to 15.8% from 16.6% a year earlier, Apple continues to lead in smartphone revenue and profit share globally. The iPhone generated $39.3 billion in revenue, accounting for 46% of total sales, with a slight YoY decline of <1%. Additionally, the growth in Mac sales, with revenue of $7.00 billion (+3% YoY), and iPad sales (+24% YoY growth to $7.2 billion), indicates Apple’s strength in the computing segment, in my opinion.

However, financials for Q3 are a thing of the past. In any case, they quickly faded into the background as Apple held its annual presentation of new products, where the main focus was, as always, on the iPhones.

While there were no major surprises, the event provided important details about the rollout of Apple Intelligence, iPhone pricing, and the new Visual Intelligence feature. The announcement that Apple plans to introduce Apple Intelligence to ~40% of the iPhone installed base by the end of this year, and >70% by the end of next year, aligns with the initial market’s expectations and suggests a slightly accelerated rollout, Morgan Stanley analysts noted in their recent research report (proprietary source, September 2024). They add that the “70% installed base” could potentially drive upgrades sooner than anticipated, as consumers may choose to “future-proof” their devices in anticipation of these new features.

The iOS 18 promised to make iPhones more personal and intelligent, which could drive future sales – at first glance at least, that’s true. The Apple Intelligence suite of tools should focus on 4 use cases:

- expressions (new writing tools, emojis);

- re-living memories (enhancing photo capture and editing);

- prioritization and focus (email/notification summaries), and

- command/control (an updated Siri, better natural language context, new settings and feature knowledge, new personal context).

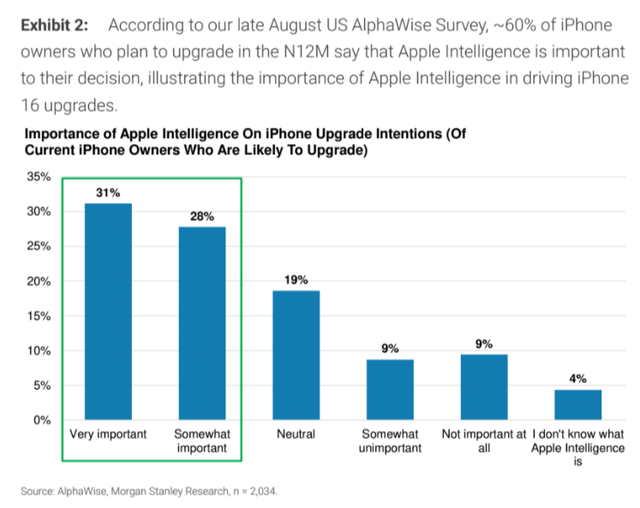

In a survey by US AlphaWise Survey (part of Morgan Stanley, proprietary source), ~60% of iPhone owners planning to upgrade in the next 12 months said Apple Intelligence was important to their decision. The analysts conclude that this “illustrates the importance of Apple Intelligence to the iPhone 16 upgrade,” but I think those who were planning to upgrade their iPhone would have done so anyway, with or without Apple Intelligence features.

US AlphaWise Survey (part of Morgan Stanley, proprietary source)

I believe what really matters now for the market’s further reaction to the iPhone 16 is the early pre-order data and the subsequent rollout of Apple Intelligence.

Although the company may currently lag behind peers like Alphabet (GOOG), Microsoft (MSFT), and Meta (META) in AI development, its focus on privacy and on-device processing could become a significant differentiator in the long term, Argus Research analysts noted in their August report (proprietary source, August 2024). From a technological innovation perspective, I have a few questions about Apple Intelligence’s new features, but I’m concerned about the long-term trend of declining mobile carrier upgrade rates (postpaid upgrade rates) that we have been seeing for several years now.

Goldman Sachs [data shared on X]![Goldman Sachs [data shared on X]](https://static.seekingalpha.com/uploads/2024/9/11/49513514-17260418488305645.jpg)

This data tells me that people are keeping their devices longer: either for economic reasons, satisfaction with current technology, or lack of compelling new features in the latest models, but the trend itself is not healthy for Apple. The chart above suggests that Apple’s seasonal sales figures should improve soon, but it’s by no means clear that Apple Intelligence will be a sufficient argument for consumers to rush to upgrade their devices. We’re going to see soon.

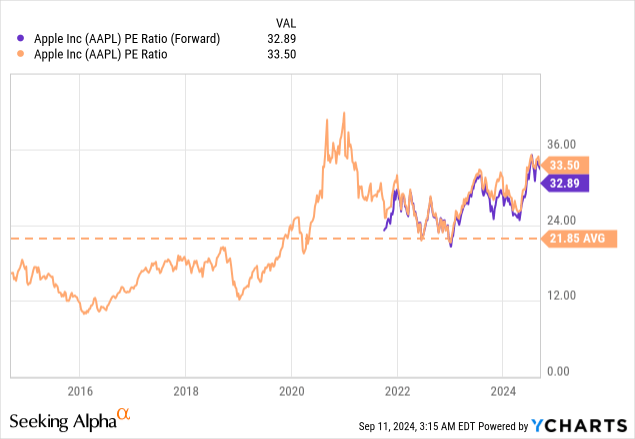

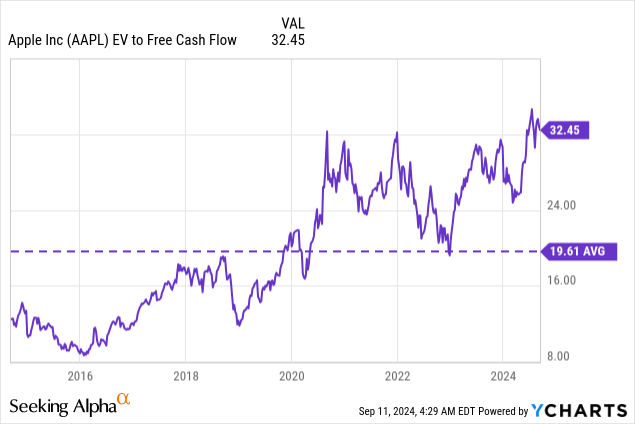

Now, a few words about Apple’s valuation. The company’s capital return strategy, including a large share buyback authorization of $110 billion and a systematic dividend increase (recently by 4% to $0.25 per share), is helping to create shareholder value and a valuation premium. In my opinion, however, the multiple expansion has gone too far.

We don’t know exactly what P/E multiple is appropriate for AAPL, but the company has been generating positive cash flow for many years, so we can try to value it using DCF. I know that many are skeptical about the DCF method, but in my opinion, no better method has been invented yet.

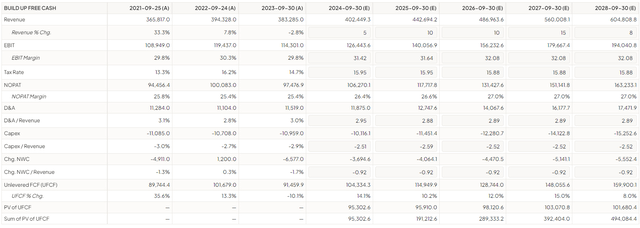

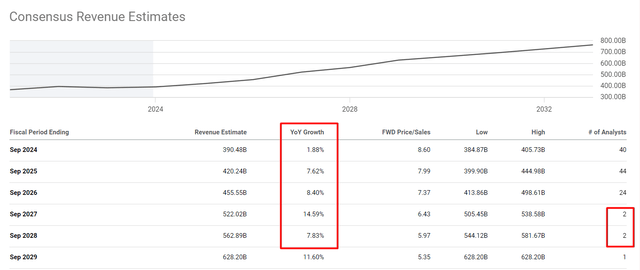

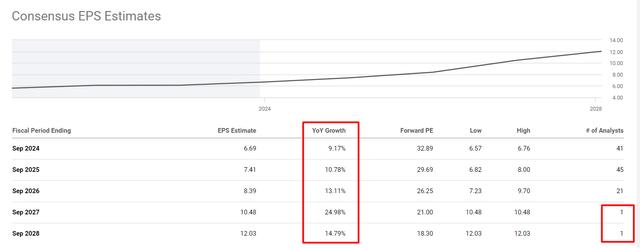

I will deliberately take the consensus proposed today as a basis, even if I consider the forecast EPS growth rate of almost 25% in FY2026 to be too optimistic – and this forecast is based on only one opinion, according to Seeking Alpha Premium data.

Seeking Alpha Premium data, notes added Seeking Alpha Premium data, notes added

Be that as it may, I added a generous premium to each forecast year sales figure and left the forecast EBIT margin above 32% for the period 2026-2028. I also left other driving assumptions on their default mode, which reflects long-term averages. Here’s what I get for my operations model:

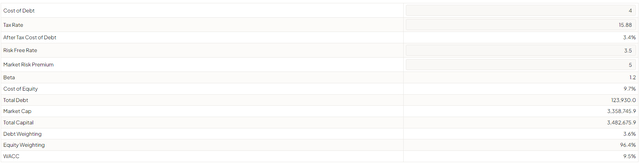

Assuming a cost of debt of 4% (with a risk-free rate of 3.5%, so the spread is minimal in this case), I also assume an MRP of 5%, as I normally do when valuing any business. As a result, I get a WACC of 9.5%, which seems to me to be an appropriate discount rate under today’s conditions.

AAPL is currently trading at an EV/FCF of about 32.45x, which is more than 65% above its 10-year average. I expect this multiple to fall to 30x at least by the end of FY2028, kind of mean-reverting.

Taking all these factors into account, I arrive at a fair value of AAPL stock, which limits its intrinsic growth potential in light of all my optimistic assumptions.

The Verdict

As Morningstar analyst William Kerwin recently noted (proprietary source), Apple is a differentiated consumer technology provider with tight integration between its hardware and software driving a wide economic moat. Indeed, I can’t argue with this statement. I like how management has adeptly addressed weaknesses in certain regions, such as China, by leveraging strengths in other regions, like the Americas and Europe. Additionally, the increasing share of services revenue is noteworthy, as it’s likely to continue growing and reducing reliance on hardware sales. This shift is beneficial in terms of gaining at least partial independence from market cyclicality.

The recently unveiled new Apple Intelligence features have created a wave of interest among investors and users, but it’s not yet clear how this will affect upgrades and prospective sales figures. We will have to wait for the pre-order data (lead time) to tell what extent this will be a game-changer for AAPL. But the stagnant momentum in postpaid upgrade rates looks kind of scary.

Today’s DCF valuation model of mine suggests that even if we add a meaningful premium to Apple’s consensus revenue figures and margins, the stock would turn out to be at best fairly valued.

The lack of a strong overvaluation prevents me from confirming my previous “Sell” rating this time, but I also see no reason to raise the rating to “Buy”.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!