Summary:

- Apple continues struggling getting an AR/VR device to market and the Car has been delayed until at least FY26.

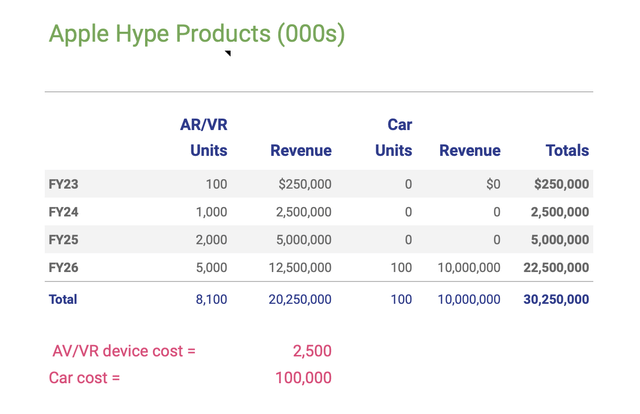

- Based on a rough estimate, these new products might only produce $22.5 billion worth of sales in FY26 at the earliest.

- The tech giant faces a massive EPS decline in the holiday quarter due to well-documented iPhone 14 production issues.

- The stock remains too expensive at 23x forward EPS.

Brankospejs/iStock via Getty Images

In the matter of weeks, Apple (NASDAQ:AAPL) has apparently pushed back the 2 most promising future technology products of the company. The stock rallied to $180 earlier this year on a lot of hype from the Apple Car and the new mixed reality devices while the near-term growth prospects are actually slim. My investment thesis remains ultra-Bearish on the stock incorrectly priced for the market realities of iPhone 14 production issues and larger product delays.

Product Hype Collapses

Apple investors should consider the Apple Car project indefinitely delayed. The tech giant has apparently pushed out Project Titan until 2026 with the company still in pre-prototype stage with the actual design not even formalized.

The company has outlined the following path to an Apple Car release suggesting the 2026 timeline could still be pushed back:

- 2023 – design release

- 2024 – features in place

- 2025 – extensive testing

- 2026 – product launch

The biggest issue is that Apple still lacks a manufacturing partner as the calendar is turning towards 2023. The tech giant can have all the designs and latest features, but Apple still needs a manufacturing partner or the company will have to invest billions and years into building manufacturing facilities.

Apple is currently having problems producing the iPhone 14 in China in a huge reminder of how the company is still highly reliant on a product first launched in 2007 and now on version 14. The production issues are alarming considering Apple was only targeted at matching the unit sales of 2021 levels.

Most analysts appear to have the tech giant cutting iPhone unit sales from 8 million to 20 million units. The latest estimate from Morgan Stanley has Apple only selling 75.5 million iPhones in FQ1’23 with an EPS estimate of $1.88 predicting a massive dip from the $2.10 earned last year.

The Apple Car delay is a long-term story with no real expectations for sales prior to FY25. The real issue is signs that the mixed reality device appears delayed yet again.

Influential analyst Ming-Chi Kuo is now predicting a delay in the MR headset until the 2H’23 from an estimate of early 2023 with an event launch potentially in January. The analyst is now estimating total shipments of only 500K units in 2023 which could actually be mostly FY24 revenues with the fiscal year starting in October.

If these shipment levels are indeed for the 2023 holidays, the FY23 revenues would be very limited. Even 1 million units of a $2,500 device in FY24 would only amount to $2.5 billion in revenues, yet the number appears very high for the first year of a Pro mixed-reality device competing with Meta Platforms (META).

Meta released the Meta Quest Pro costing $1,500 back in October and Apple is now nearly a year behind the competing device from Meta. The social media giant is forecast to release another update to the Oculus 2 consumer VR device next year with plans for smart glasses in the next couple of years.

Meta appears to have the AR/VR product pipeline that Apple now enjoys with the iPhone. Apple definitely has a history of perfecting a product once launched, but the tech giant has a very formidable peer in Meta this time that some other products probably didn’t face.

In total, these 2 hyped new products of AR/VR devices and the Car have the below revenue estimates through FY26 amounting to $22.5 billion in revenues in 4 years. The only real question is how much the AR/VR device sales can grow over the following 3 years after a launch while the Car is clearly going to have limited sales through FY26.

By FY26, Apple is forecast to reach annual revenues of $486 billion. The tech giant would need to sell far more items of each new product in order to materially move the needle.

The AR/VR category would have $10+ billion in annual sales by FY26 based on 5 million units sold for $2,500, though the cost of the devices would need to slip for Apple to sell a material amount of units to consumers. The tech giant has long been rumored to produce a second-generation model in 2025, alongside a cheaper and more affordable device, though another 2 years could leave Apple far behind Meta.

The Apple Car units are harder to forecast. An official launch in FY26 would be followed by limited units available for sale. In addition, the tech giant would need a lengthy ramp up period to reach something material like 1 million annual vehicles unless an existing auto manufacturer converts production lines to produce vehicles for Apple.

A prime example is that Tesla (TSLA) is forecasted to generate $84 billion in sales in 2022 after eclipsing the 1 million annual run rate this year. The EV manufacturer produced the first vehicle in 2008, but Tesla chose to go alone versus working with a partner where a production ramp could’ve accelerated.

The Apple Car continues to see rumors of prices around $100K suggesting the vehicle could hit this price point 4 years from now. The addition, the vehicle is focused on autonomous driving questioning whether the technology will even be ready for a release by this time frame.

Still Elevated Price

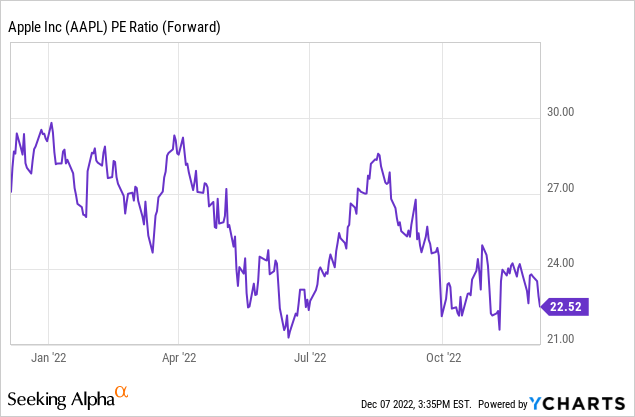

Despite all the weakness in tech, Apple still trades at $140. The stock trades at 23x forward EPS targets. The tech giant traded much higher at the peak with a 30x target at several points in the last year.

Apple needs the above hyped new products in order to generate the growth rates to warrant the current valuation, much less a rally from this level. Also remember, Apple still has to successfully release these products after years of delay.

Takeaway

The key investor takeaway is that Apple is starting to become the king of delays with the 2 most hyped products struggling to reach market while competitors are already releasing annual products. Investors should continue avoiding the stock until the valuation improves or these hyped products actually reach market on time with material sales.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during the 2022 sell off, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.