Summary:

- Apple’s stock has received mixed ratings since its earnings release, but I remain bullish on its future performance.

- I believe that the macro-environment is favorable for Apple, with lower interest rates and increased spending expected to drive growth.

- Despite a decline in revenue, Apple’s profitability and its ability to generate value for shareholders through buybacks make it an attractive investment.

Nikada/iStock Unreleased via Getty Images

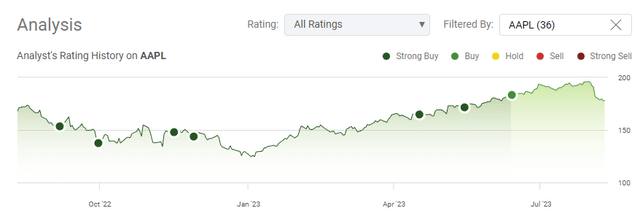

I am perplexed at how many people have turned bearish on shares of Apple (NASDAQ:AAPL). Since earnings were released on 8/3, there have been 3 buy ratings, 5 hold ratings, and 5 sell ratings on Seeking Alpha. In my article from 5/15/23 (can be read here), when shares traded at $173.16 I predicted that AAPL would reach all-time highs in 2023 and that we could see shares trade above $200 in 2024. Since then, AAPL reached new all-time highs of $198.23 going into Q3 earnings, and my 1st prediction came true while some doubted AAPL’s ability to move higher. Shares of AAPL have retraced -10.31% since reaching their new highs at the end of July, and the decline looks like an opportunity. AAPL doesn’t need to grow its top line every year to be an exciting company, as this cash cow is the most profitable company in the market and continues to repurchase shares at an overwhelming rate. AAPL’s profitability and what it does with those profits are more important than revenue growth at this point. AAPL is utilizing its profits to create immediate and long-term value for shareholders. I think the market is setting up for a bull run, and the retracement is another opportunity for investors to add AAPL to their portfolio. You can read my previous coverage on AAPL here.

I believe there is a bull market around the corner and that the future macro-environment sets up well for Apple

The short version is that I believe the macro-environment will loosen over the next 12-18 months, and this will become a catalyst for many tech companies, including AAPL. I believe AAPL will benefit from a business standpoint in a lower-rate environment as the cost of capital declines from business borrowing to interest rates on credit cards. From an investment perspective, I believe AAPL will become more profitable, and it will grow EPS leading to a larger valuation and price target while money flows in from the sideline.

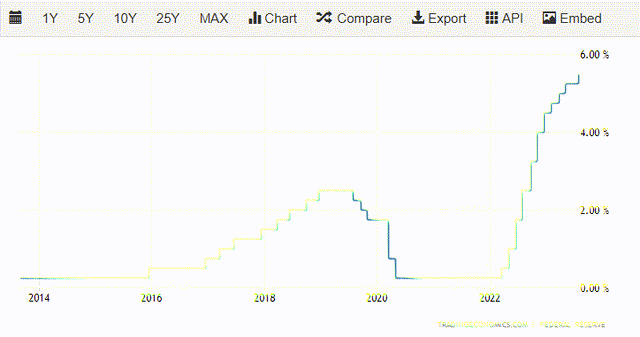

The Fed has increased rates quicker than at any point in the last 25 years. We have witnessed nearly $5 trillion of capital parked on the sidelines in money market accounts, according to CNBC, due to how lucrative risk-free assets have become. The 2-year T-bill yields 4.89%, the current yield on a Fidelity Money Market is 4.98%, and financial institutions such as SoFi Technologies (SoFi Technologies, Inc. (SOFI) Stock Price Today, Quote & News) are offering 4.5% on checking and savings when you sign up for direct deposit. The Nasdaq has seen a 31.88% gain YTD while the S&P 500 has increased by 16.74%. As yields crossed over the 4% level, many people fled to safety prior to the rally, as the winter felt like a much different market than the spring. Now those people who fled to safety are stuck because they locked their capital up at what was a lucrative APY, and to get the full APY, they need to stick out the duration of their investment, otherwise, they missed the current rally for nothing.

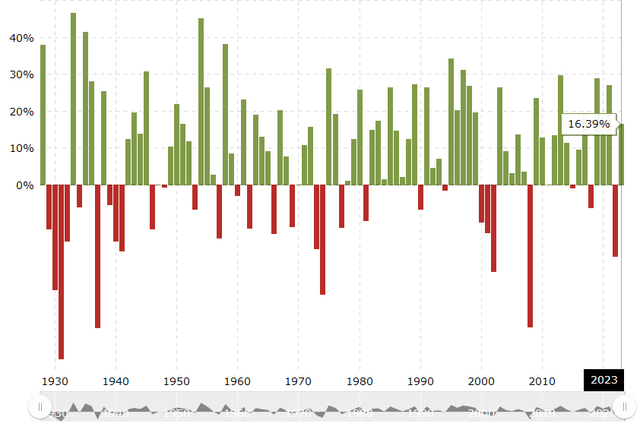

In my opinion, too many people try to time the market and get worried when the markets decline. Since 1973 we have only seen the market decline for at least 2 consecutive years twice, and after each down year, the market has rebounded with at least 2 positive years. There have always been perpetual bears, and there will always be perpetual bears. I remember hearing the market was too expensive when the Dow was at 15,000, then at 20,000, and so on. When the Nasdaq crossed 10,000, people were discussing how a large-scale retracement needed to occur. When I look at the historical market data and how the macro is set up, I see a bull market on the horizon.

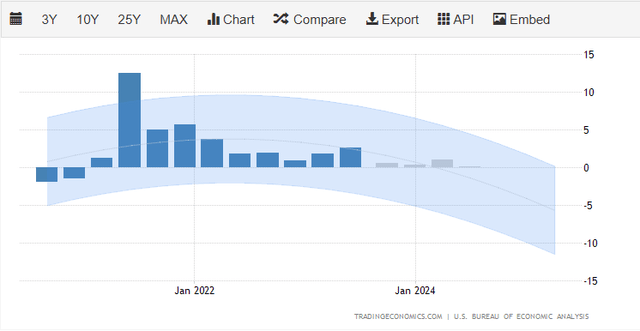

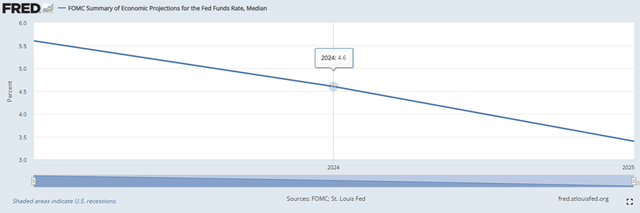

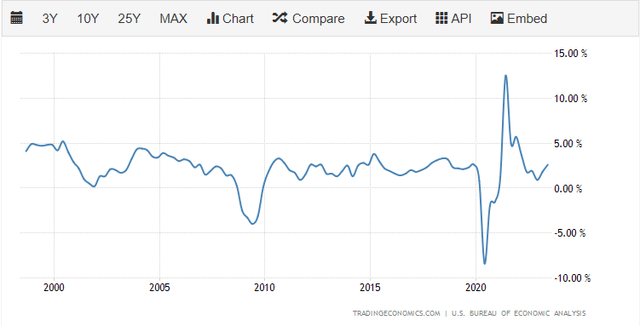

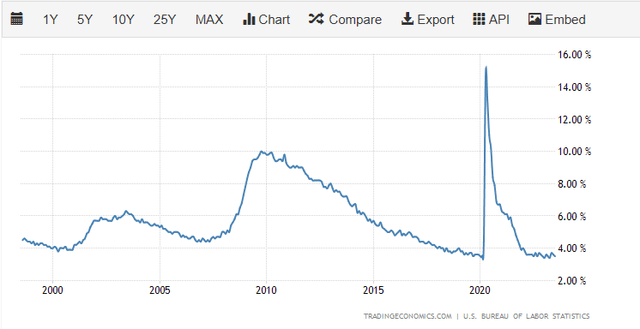

In order to have a recession, we need to see 2 consecutive quarters of negative GDP. We have seen positive GDP growth over the last 10 quarters, and the forecast going into 2024 is that we will see positive GDP growth over the next 4 quarters. I do not think a recession is in the cards, regardless of what the inverted yield curve tells us. The St. Louis Fed indicates that rates will decline to 4.6% in 2024 and 3.4% in 2025. Every time we have seen negative GDP growth and a recession occur in the last 2 decades, we have seen unemployment surge above 5%. Despite the Fed increasing rates, the economy has remained strong, GDP has increased, and unemployment has stayed below 4%.

When I look at the rate forecast from the St. Louis Fed, I become more bullish on the economy because the cost of capital is set to decline over the next several years. As the cost of capital declines, businesses are more likely to allocate capital toward expansion, and consumers are more likely to spend as borrowing costs decline. AAPL could be a direct beneficiary of this because businesses and induvial consumers alike will likely be shopping for the latest technology, which could drive their EPS higher.

The other aspect of declining rates that is bullish for AAPL is that capital sitting in CDs or T-bills that mature won’t have the same enticing rates to lure individuals into locking their money up for another duration of time. I believe there are people itching to get back into the market, and a portion of the capital on the sidelines will be deployed over the next 12-18 months back into the market. AAPL is a likely beneficiary in this scenario as it’s one of the largest components of many indexes and total market funds, and with every share purchased, an allocation flows into shares of AAPL. The future macro sets up well for AAPL, and I still believe we will see shares exceed $200 in 2024.

GDP Forecast

Interest Rate Prediction

GDP

Unemployment

Apple posted strong earnings and they can drive value for shareholders even when revenue is stagnant or slightly declines

In Q3 2023, AAPL saw its revenue decline by -1.4% YoY. In its 2023 fiscal year, AAPL generated $293.79 billion in revenue compared to $304.18 billion in the first 9 months of 2022. Some are looking at the quarterly decline as a negative on the company and are reevaluating their investment thesis. I think it’s great to reassess all investments from time to time as everyone has to make the right decision for themselves and nobody ever got hurt taking a profit. For me, the quarterly declines in revenue isn’t alarming because of AAPL’s profitability.

Steven Fiorillo, Seeking Alpha

The bottom line is that AAPL has generated $74.04 billion in net income and $80.15 billion in free cash flow [FCF] over the past 9 months. To put that in perspective, AAPL is generating $8.23 billion in net income and $8.91 billion in FCF per month. When anyone makes an investment in a company, they are paying the present value for all future cash flow. While the top-line has declined by -3.42% YoY in the first 9 months of AAPL’s 2023 fiscal year, they are generating more profits and FCF than any other company in the market and utilizing those proceeds to generate value for shareholders.

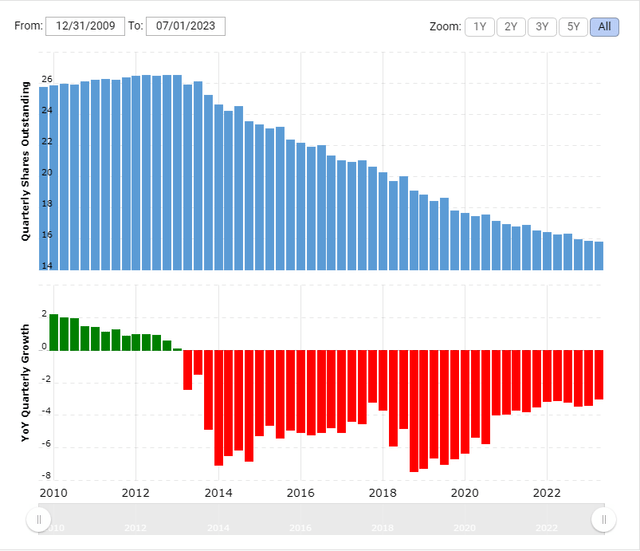

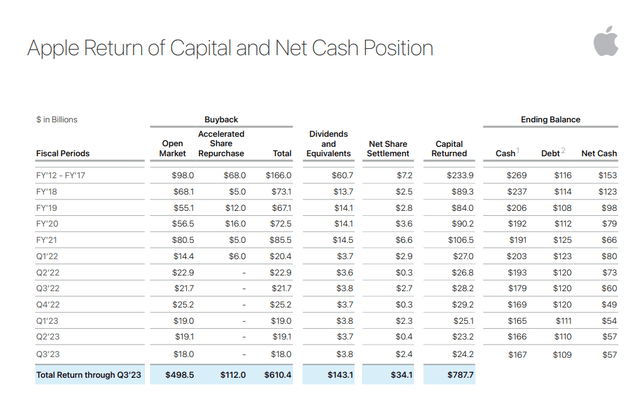

Since the close of 2012, AAPL has repurchased 10.75 billion shares as they allocated $610.4 billion toward buybacks. In just over a decade, AAPL has repurchased 40.52% of its shares outstanding. This has increased the level of ownership for each remaining share as they represent a larger percentage of AAPL’s revenue and earnings. In 2023 AAPL has repurchased $56.1 billion of its shares and continues to allocate tens of billions every 3 months toward buybacks. By repurchasing such a large amount of shares, AAPL can manufacture increased EPS as their earnings from operations is spread across fewer shares and even though revenue has slightly declined, AAPL can still grow their earnings going forward.

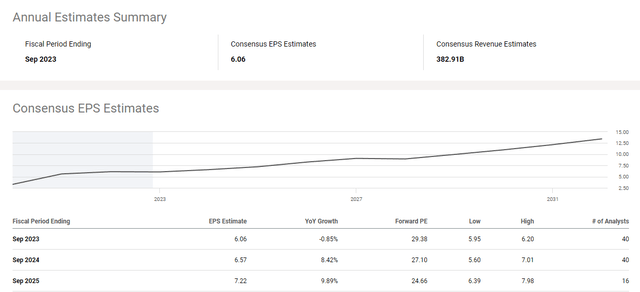

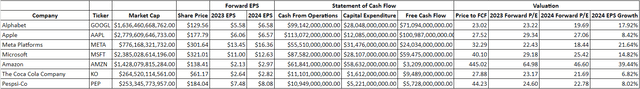

In 2022 AAPL generated $6.15 in EPS. Their consensus EPS from 40 analysts in 2023 is that AAPL will generate 6.06 placing their forward P/E at 29.38. While this is a slight YoY decline, the amount of EPS generated in 2024 is projected to increase by 8.42% YoY to 6.57, placing AAPL’s 2024 forward P/E at 27.1x. There are also 16 analysts who have provided EPS estimates for 2025, and the consensus number is 7.22, placing AAPL’s 2025 forward P/E at 24.66x. If we enter an environment where the macro improves in 2024 and 2025 and AAPL sees an inflow of sales due to increased spending combined with its current level of buybacks, we could get EPS revisions, and the forward projections could become more enticing.

Looking at big tech, which includes Amazon (AMZN), Meta Platforms (META), Microsoft (MSFT), and Alphabet (GOOGL), AAPL doesn’t necessarily look expensive. When I look at companies, I view it from the lens of purchasing a piece of a company’s current and future cash generation. AAPL on a TTM basis, is still the only company that is generating $100 billion in FCF, with the next being GOOGL at $71.09 billion. MSFT has generated $59.48 billion of FCF in the TTM and trades at 40x its FCF, while AAPL has generated $100 billion in FCF and trades at 27.52x its FCF.

Look at The Coca-Cola Company (KO) and PepsiCo (PEP) for those who think these numbers are expensive. KO generates a tenth of the FCF that AAPL does and their trading at roughly the same price to FCF, while PEP generates less than 6% of AAPL’s FCF and trades at a much larger valuation than AAPL. For the level of profitability AAPL generates, I don’t think it’s expensive because, from an earnings perspective, AAPL in my opinion, has more growth potential than KO or PEP so their P/E should be higher. Overall, paying less than 30x earnings and FCF for AAPL looks cheap when I compare these metrics to their peers and American icons such as KO and PEP.

Steven Fiorillo, Seeking Alpha

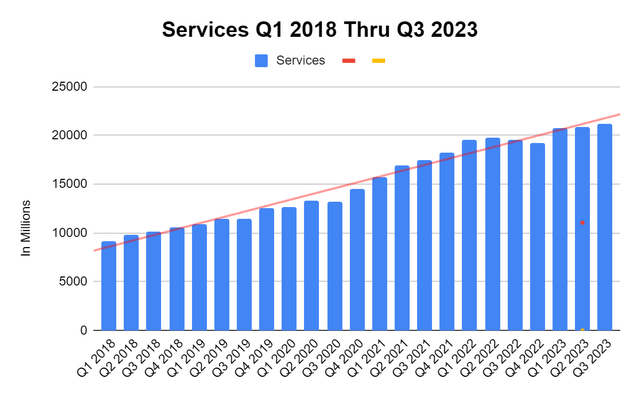

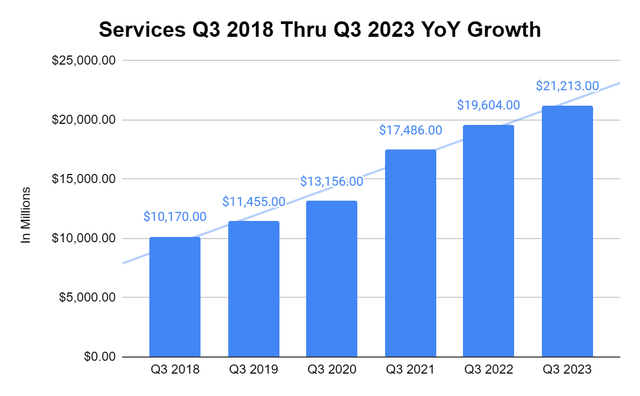

In addition to AAPL’s profitability, AAPL has a great track record of deploying capital and revolutionizing industries. I look at Services as the blueprint of what’s to come down the pipe. Services have now generated $82.07 billion of revenue in the TTM, which is up 84.94% ($37.7 billion) over the same period since Q3 2019 earnings. AAPL has increased its Q3 revenue from Services by 108.58% ($11.04 billion) since its Q3 2018 quarter. AAPL is still finding ways to monetize Services and is well on its way to having this be a $100 billion revenue segment in its growing portfolio of business segments.

Apple, Steven Fiorillo Apple, Steven Fiorillo

I think AAPL has a huge catalyst on the horizon, and it’s the Apple Vision Pro. On the Q3 conference call, AAPL discussed getting it into the hands of customers early next year. AAPL and Major League Baseball just announced their September Friday Night schedule on Apple TV+. To think that computing and consuming media content will stay bound to screens isn’t realistic. The evolution of computers and TVs has been immense, and they aren’t stopping at 8k resolutions. AAPL has the war chest to make the Apple Vision Pro a reality. I predict that AAPL will partner with sports leagues and individual sports franchises to offer virtual game tickets. We could see them do a season pass, such as the MLB package, or replicate a virtual season ticket experience, set up several VR cameras throughout the stadium, and provide a new viewing experience. I think sometimes people underestimate the power of new ideas, especially when they are combined with the power of sports. I am excited about AAPL’s future and think the Vision Pro will boost hardware sales on the wearable side but provide a larger boost on the Services side as the possibilities are enormous.

Conclusion

If you’re a long-term investor, I still feel that there is never a bad time to buy AAPL. AAPL continues to allocate tens of billions quarterly toward buybacks and generate value for shareholders. AAPL is the most profitable company in the market, and with a cash flow of over $80 billion in net income and $100 billion in FCF in the TTM, AAPL has more than enough room to fuel its buybacks and dividends while investing for its future. Looking at its peers and other spectacular American companies, paying just under 30x for AAPL’s earnings and FCF doesn’t seem that expensive from a long-term perspective. Shares could continue to retrace, but I think we’re setting up for a multi-year bull market, and if we are, then AAPL could certainly repeat history and be the first company to reach a $4 trillion market cap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, META, GOOGL, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.