Summary:

- Apple’s Vision Pro captured 57% of the total value in its category globally in Q1 2024, despite only 17% unit share.

- Apple’s innovation strategy relies heavily on its App Store and developer community, allowing it to maintain a 45% gross margin.

- iOS 18 emphasizes customization and Apple Intelligence, aiming to increase user retention and switching costs.

- Apple’s strategy allows for integration of various LLM models, positioning it well in the AI competition without needing to develop the best model.

- Major risks to Apple include the potential loss of Google’s search engine placement fee (est. $20 billion), allowing external payments in apps which could impact service revenues, and declining market share in China due to regulatory issues and competition from local brands.

Maki Nakamura/DigitalVision via Getty Images

Introduction

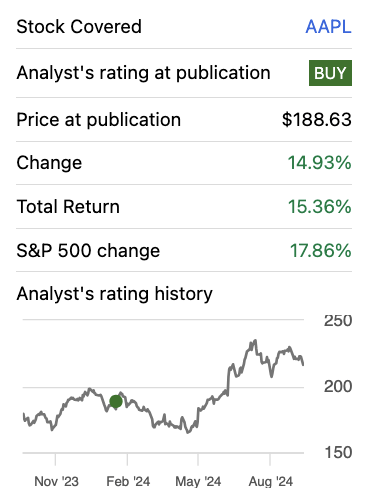

We last talked about Apple (NASDAQ:AAPL) back in Jan 2024 when we reviewed the potential of Vision Pro and AI. Now it is time to review the thesis.

History (Seeking Alpha)

Vision Pro: A Surprising Success

Its debut result has truly surprised us after a year. The Vision Pro appears to be forgotten by the capital market because Apple only anticipated 400k units to be sold by the device in 2024. With a $3500 purchase price, this is expected to be worth only $1.4 billion, which is a small portion of Apple’s revenue.

But in Q1 2024 (March Quarters), Vision Pro captured 57% of the total value created in the category globally, with a 17% unit selling share. What does this signify? Apple quickly overthrew Meta in less than a year. After June 28, 2024, Apple Vision Pro will likely be available in key Asian nations like China and Japan as well as Western nations like Germany, France, and the UK. This might further potentially increase Apple’s market share.

In case you are unaware of the connection between this and Apple’s business model and moat, allow us to clarify. Investors often “speculate” on how the market will react to events like a new iPhone launch, becoming overly focused on Apple’s iPhone innovations. While production innovation is crucial for long-term success, the key is that Apple’s innovation lies not in the iPhone itself, but elsewhere. Let’s clarify further.

Apple’s Business Model and Moat

The App Store Strategy

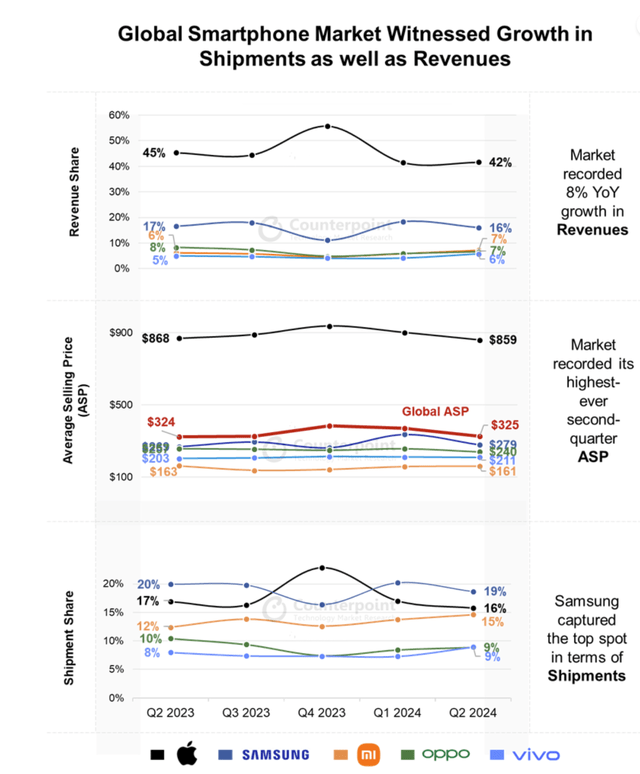

Apple made sure it had the largest consumer base with the most spending power by securing a 42% worldwide value (not shipment) market share. (see the chart below)

Revenues share, ASP, Shipment Share (Counterpoint)

What does this mean for Apple? Constantly innovating the iPhone every year is not a wise strategy, as it would require heavy spending on R&D and marketing to drive sales. So how can Apple ensure innovation in its iPhone? The answer lies in its App Store. By leveraging its affluent customer base, Apple attracts the most attention from developers. If you want to start an app business, developing for the iOS store is the first choice. Not only does Apple have a wealthy consumer base, but you also avoid the need to create multiple versions for different Android devices.

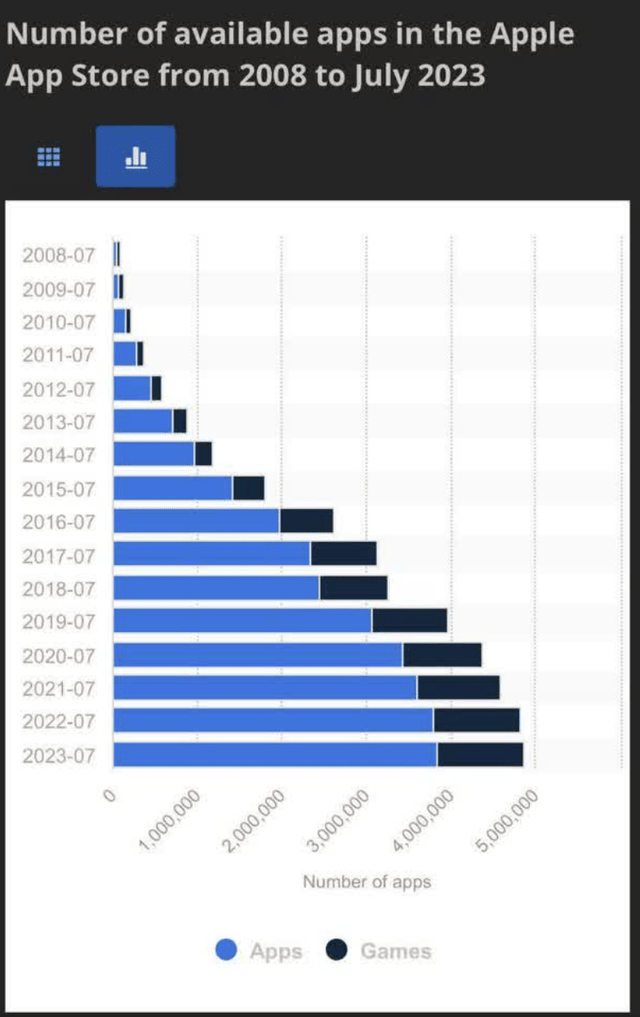

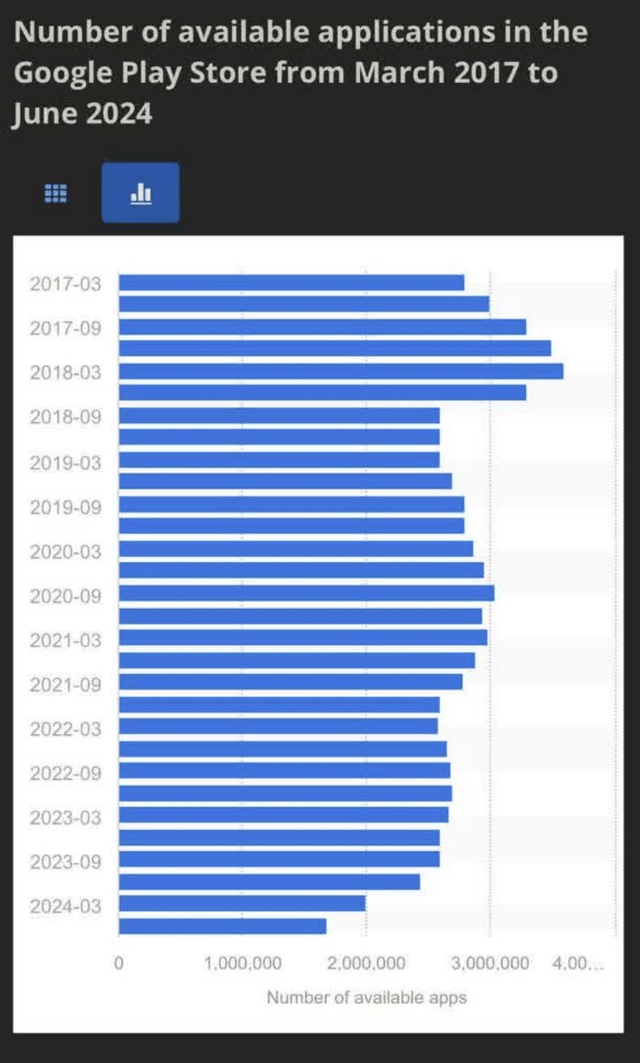

Therefore, Apple ensures that third-party developers handle the “innovation” aspect for them. This allows Apple to save significant resources and capital on iPhone development. Its affluent customer base guarantees a steady stream of new apps in the iOS store every year, maintaining competitive momentum against Android phones. (See chart below)

Number of available apps in iOS (Statista) Number of available apps in Google Play (Statista)

Hardware Performance Leadership

This is one of the reasons Apple enjoys a 45% gross margin compared to its peers—it leverages its developer community to drive innovation. A similar strategy is applied on the supply side, as Apple partners with TSMC (TSM) to advance chip manufacturing technology and maintain its hardware performance leadership.

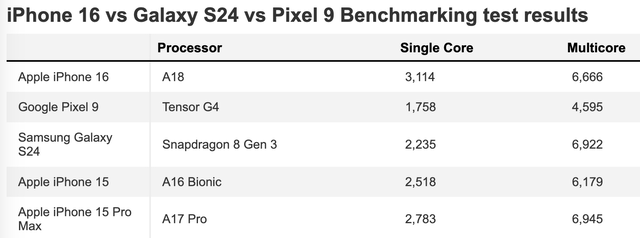

For instance, before Nvidia’s rise, Apple was the only company able to secure the latest node technology production capacity from TSMC, thanks to its purchasing power and ability to pay a premium. This gave the iPhone a performance edge over its competitors (see chart below).

Benchmarking test results (Tom’s guide)

By ensuring top hardware performance, the iPhone can run apps as well or better than its peers. By leveraging suppliers, Apple allows its teams to focus on simpler tasks, reducing the need to pay premium salaries to compete for top talent and ultimately driving higher profits for shareholders.

By recognizing the importance of dollar share, we can assess Apple’s progress with the Vision Pro. Although it only holds 17% of unit sales, its dominance in dollar share ensures that developers will prioritize VisionOS apps over those for Meta Quest. If Vision Pro gains more dollar share following its global launch, Apple can position itself to dominate the VR/AR space, regardless of the industry’s long-term success. This likely explains why IDC forecasts VisionOS devices to grow at a CAGR of 59% from 2024 to 2028. By securing a dominant share of purchases, Apple ensures that VisionOS remains a priority for developers over other AR/VR platforms.

iOS 18: Driving the Upgrade Cycle

Another key topic is iOS 18. Specifically, we will be focusing on Customization and Apple Intelligence.

Customization

iOS 18 gives users the option to personalize their home screen by rearranging widgets and app icons to suit their preferences. Furthermore, the customization tools encompass additional controls on third-party apps, such as requiring facial ID to use the app. We’ll avoid going into specifics about these features and instead concentrate on how important they are to investors.

Beginning with iOS 17, Apple has prioritized personalization in its iOS releases. These personalization options have been available for Android smartphones for many years. So why now, then? Is it because Apple doesn’t innovate enough?

iOS focus (Apple)

Apple initially did not provide customization in any way. In doing so, it gives developers a unified development environment so they can concentrate on the app’s functionality. Furthermore, the initial simplicity provides a cohesive user experience and establishes a uniform perception of Apple’s user interface among consumers. These actions are crucial when a business is first trying to establish a first impression and persuade customers to use it. But as Apple reached a certain size, everything changed. Present estimates have the number of sold iPhones at $2 trillion, and the number of active iPhone users worldwide at 1.46 billion. Rather than pursuing new clients, Apple now focuses on keeping its current clientele.

Customization is Apple’s latest strategy to boost customer retention by giving users more control, thereby increasing switching costs. Apple has long supported this by helping users store personalized data (such as photos and app history) on iCloud. While this may not be seen as “innovation” in the industry, the Customization approach is likely to further strengthen customer loyalty to Apple.

Apple Intelligence

Let’s talk about Apple Intelligence. The absence of any “cool” features during the September 2024 Apple event disappointed investors. We take an opposing view. In actuality, Apple Intelligence established the foundation for upcoming AI players. For example, users can select various LLM models including ChatGPT to utilize with Siri. This ensures that Apple can make money from the LLM that comes preloaded on the devices because you may subsequently replace it with another LLM that you like.

This is precisely how Apple collaborates with several service providers, like YELP (YELP), Affirm (AFRM), and Google (GOOG). Thus, Apple does not need to possess the best LLM model to prevail in the AI war—at least when it comes to the rivalry involving smartphones or other iOS devices. As a result, LLM developers probably give priority to optimizing LLM for iOS devices, similar to the App Store scenario mentioned above, which strengthens Apple’s position against LLM models.

Apple’s Strategy: A Digital Costco

Apple operates much like a digital Costco. How? It primarily sells third-party services through its App Store but occasionally launches its own “private label” products when it spots an opportunity. For instance, Apple introduced Apple Music after Spotify, Apple TV after Netflix, and Apple Fitness after Peloton. To ensure there’s strong demand, Apple develops its in-house software. While these ventures may not always dominate the market, they expand the Apple ecosystem and enhance customer retention. In 2024, Apple introduced a national park mapping feature in Apple Maps after witnessing the success of AllTrails, the top revenue-generating app in 2023. So, Apple’s “innovation” is predictable and easy to grasp if you look beyond the yearly iPhone updates.

Valuation

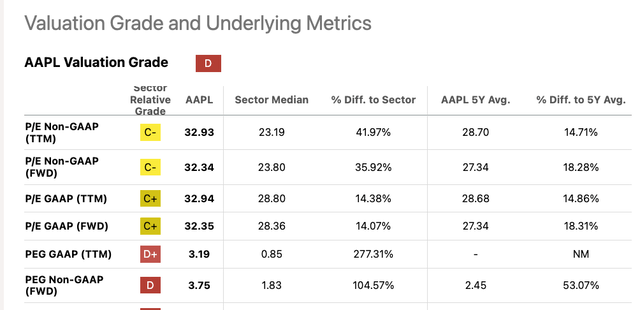

On the surface, Apple’s stock is not cheaply valued. Its stock trades at a 3x PEG ratio.

For the following three years, analysts projected low teens for EPS growth. Thus, Apple must grow at least into its high teens or early twenties to justify the valuation.

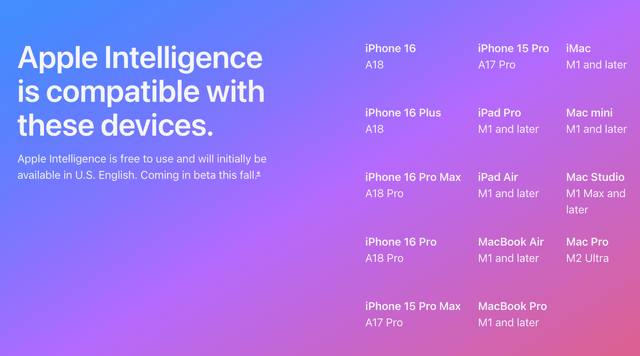

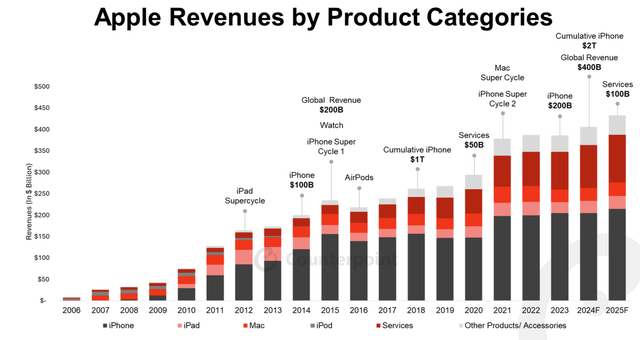

Behind the high valuation, the market is likely anticipating AI-driven upgrades for iOS devices. AI features are available only on iPhone 15 and later models, as well as iPads and Macs with M1 chips or newer. (see the below chart) In our opinion, although the generative AI boom currently impacts a small group of users, this group is likely to be the first one to upgrade their devices across the Apple ecosystem.

Looking at past supercycles, which occurred in 2012 and 2021, we are likely in the midst of another one. Given the current push for generative AI upgrades, we can expect higher sales compared to last year. Therefore, in our view, analysts’ estimates might be conservative regarding this upgrade boost.

Apple revenues history (Counterpoint)

Risk

For the following two years, analysts now predict a single-digit growth in revenues.

Revenue estimates (Seeking Alpha)

Losing Google as Default Search Engine

If AI advancements drive additional sales, analysts may still be concerned about risks related to Apple’s services and the Chinese market. Service revenue could be negatively affected by losing Google’s payment for default search engine placement, which amounts to at least $20 billion, or 23% of Apple’s service revenue. However, this impact is likely to be short-term, given Apple’s strong position with its service providers, built on its value share in iOS devices. While the government can prevent giants like Google from paying Apple, it cannot stop other service providers like Yelp from paying to be featured as default in Apple Maps. As a result, Google’s position may be replaced by smaller companies. Although Apple’s revenue will be affected, its long-term position remains secure.

External Payment Systems

Another risk to service revenues is Apple’s need to allow app developers to bypass Apple Pay. In our opinion, this poses a more significant risk, as losing a cut from these transactions could have a substantial impact on Apple’s revenue and margins. However, many users still prefer Apple Pay for its added security and the trust Apple has built with its customers. In a worst-case scenario where Apple does not receive a cut from third-party apps, the company could charge alternative fees directly to app developers. As long as Apple maintains its strong value proposition, app developers may end up paying these additional fees in the absence of a payment cut. Thus, Apple is likely to remain successful in the long term.

China Market Challenges

Apple has been losing market share in China, which we attribute to regulatory issues. The Chinese government has banned the use of iPhones for government employees, and Apple is also facing potential disputes with Tencent. Tencent was negotiating with Apple to avoid paying cuts for transactions in its mini-apps on WeChat, which raises the possibility that Apple might remove WeChat from its App Store. Although Apple extended the fee arrangement negotiation with Tencent, we wouldn’t be surprised if Apple one day decided to walk away. As iPhone functionality in China has already been restricted, including features like FaceTime, call recording, iMessage, and satellite capabilities. Additionally, social apps like Instagram and YouTube are unavailable. Given these limitations, it is somewhat surprising that Chinese users continue to buy iPhones today.

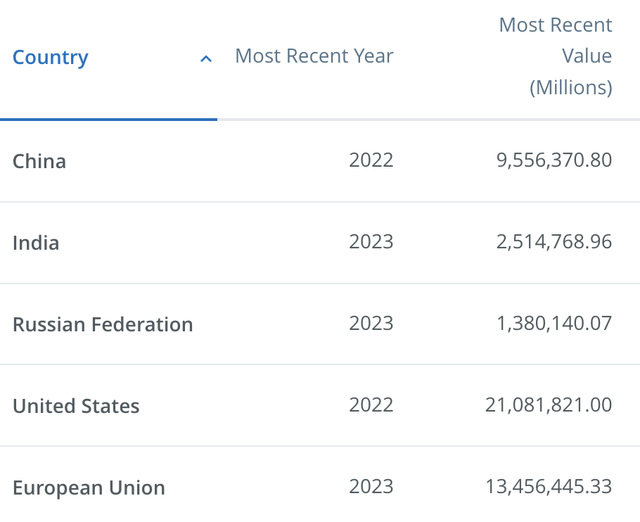

However, we do not view the loss of the Chinese market as a significant risk to Apple in the long term. As we previously analyzed, Apple acquires customer spending power to control the market. Even though China has the second-biggest economy in the world, Apple dominates the US and EU markets for value shares.

China is only worth 70% of the EU’s purchasing power and 26% of the combined purchasing power of the US and EU. (View the chart below.)

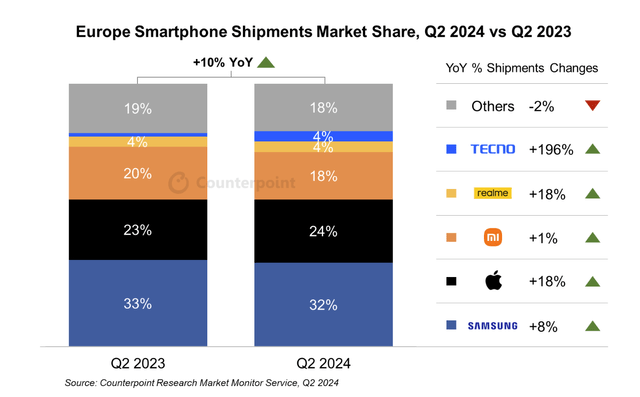

Personal consumption (World Bank)

As of Q2 2024 (quarters ending in June), Apple maintains the second-largest share of shipments within the EU. (see the chart below) Given that Apple has an ASP of $859 and Samsung has an ASP of $279, Apple is probably the company that dominated valued shares as well. Thus, Apple can afford for its Chinese peers to triumph in China because it leads in value share in both the US and the EU. Particularly because Xiaomi is ranked third in the EU, but only fifth in China. (Huawei is leading in China) Therefore, Chinese competitors like Huawei and Xiaomi do not yet pose a serious threat to Apple’s leadership position globally in our view.

EU shipment market share (Counterpoint)

Conclusion

We felt that the analysts’ estimations, considering the AI drive for an upgrade cycle, were conservative. Furthermore, we believe that investors should be focused on Apple’s long-term competitive landscape, which remains unchanged notwithstanding Google’s antitrust action and the third-party payment case. Although there is a chance Apple may lose the Chinese market, its dominant market shares worldwide—particularly in the US and the EU—will not alter. Therefore, we are confident that Apple’s long-term competitive advantage remains strong. With Apple successfully expanding into areas like VisionOS and Apple Intelligence to counter potential disruptors, we are comfortable recommending a buy rating at the current levels. Additionally, we suggest buying more if the stock price declines further due to valuation concerns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.