Summary:

- When assessing Apple, many investors and analysts focus on the prospects of the iPhone and AI, which is understandable.

- But today, I take a step back and assess the quality of the business model from the perspective of return on invested capital.

- AAPL is highly efficient at producing massive amounts of value “out of thin air”, grossly speaking.

- That said, few would consider a current-year earnings multiple of 34.8 times conservative.

hapabapa

When it comes to Apple Inc. (NASDAQ:AAPL) and the potential investment opportunity, many discussions revolve around the company’s growth prospects, which are often closely tied to the success of the iPhone cycle. Sometimes, the topic of conversation also centers around AI, the prospects of the high-margin services business, virtual reality, growth in China and other key global markets, or the direction of margins.

Today, I want to take a different route and explain why I think that Apple is one of the best businesses in the world. Rather than the topics listed above, I will approach the analysis from the perspective of return on capital and its implications for value creation.

Apple’s massive ROIC

Fundamentally, one way to assess how well a company performs is to first measure how much return it produces relative to its invested capital – what many know as ROIC. More specifically, “return” in this case can be defined as NOPAT, or after-tax net operating profit. “Invested capital” is the sum of fixed assets, net working capital (NWC), acquired intangibles, and goodwill, as defined by Wall Street Prep. Worth noting, many define invested capital simply as equity plus net debt, which could yield a figure similar to the original definition above considering the double-sided nature of accounting entries (i.e., debits and credits).

If the ratio above is higher than the cost of capital (think of it as the risk-adjusted opportunity cost), the company produces positive economic value, and investing in it might make sense.

In fiscal 2023, Apple’s NOPAT reached $97.2 billion, or $6.25 per share, assuming an effective tax rate of 15%. Set that figure aside to be used in our ROIC numerator.

Regarding invested capital, below are the key figures:

- Fixed assets at the end of the most recent fiscal year were $43.7 billion.

- Net working capital was a negative number: -$47.5 billion. This is the case primarily due to Apple’s large payables and other current liability balances (likely accrued expenses and deferred revenue) relative to small amounts of receivables and inventory.

- Intangibles and goodwill added up to $36.2 billion at most, which is the balance left in non-current assets after subtracting deferred taxes and operating leases.

Given the figures above, Apple’s ROIC in fiscal 2023 was $97.2 billion divided by $32.4 billion for a whopping 300%! Whether we set Apple’s weighted average cost of capital at a mere 8% or an aggressive 15%, the conclusion is the same: the Cupertino company is highly efficient at producing massive amounts of value for its stakeholders, especially stock owners.

Money-making machine

The section above was quite heavy on numbers. But what does it all mean?

A stratospheric ROIC of 300%, as calculated above (to reemphasize, the ratio can be calculated in a few different ways and the answer may vary depending on the approach), reflects Apple’s lean, highly efficient business model that allows the company to “make money out of thin air”, grossly speaking.

For comparison, think of a traditional industrial company like Ford Motor Company (F). In order to produce $10.4 billion in non-GAAP operating profits last year (NOPAT of roughly $9.4 billion), the automaker had to rely on its massive invested capital of $68.1 billion, as calculated and reported by the company. The business model is capital-heavy: PP&E and leases amount to nearly one-fourth of total assets, while the company holds over $100 billion in receivables (that is, cash that customers have yet to pay Ford).

Ford’s adjusted ROIC of less than 14%, while not pitiful, pales in comparison to Apple’s 300%. Unlike the US automaker, the iPhone vendor needs very little capital to generate large amounts of profits.

Apple’s fixed assets represent only 12% of total assets. A negative working capital balance suggests that Apple’s vendors primarily finance the business: payables of $64.1 billion last year amounted to more than one-third of the company’s total liabilities ex-debt. Meanwhile, Apple holds minimal levels of inventory, which frees up cash to be deployed elsewhere.

From the above, one can probably understand why Apple has been so aggressive at returning cash to its shareholders through dividends and stock repurchases. While the company produces large quantities of free cash flow (nearly $100 billion last fiscal year, about 28% of total assets), it barely needs any of it to continue to operate and produce even more cash in the future.

What does this mean for AAPL investors?

The narrative above helps to explain why Apple runs one of the most successful business models in the world. The discussion goes beyond the iPhone or AI to include lean, efficient operations and the company’s uncanny ability to create value out of very little capital.

In my view, this helps to explain why Apple stock is so richly valued: a market cap of around $3.5 trillion and current-year earnings multiple of 34.8 times that few would consider conservative, given the modest expected 2025 EPS growth of 12% that points at a PEG of nearly 3.0 times. Still, while I don’t consider Apple’s share price a bargain, I appreciate the quality of the business enough to think that owning the stock at current levels might make sense.

A quick word on earnings

With Apple’s earnings scheduled to be released on Thursday, October 31, this may be a good opportunity to zoom back in and talk about what to expect in a couple of weeks.

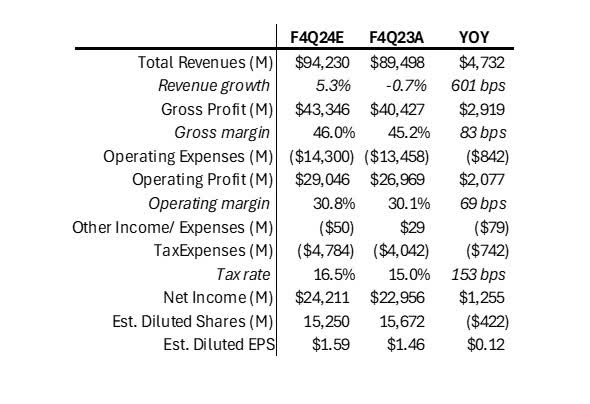

On average, analysts expect to see EPS of $1.55, which would suggest a mere 6% growth rate on revenues of $94.2 billion that, if achieved, would represent a modest 5% increase YOY. None of these figures are particularly impressive, but note that:

- A projected FX headwind of 1.5 percentage points to revenue growth, not something that usually matters much to any investment thesis, will likely be a drag across the P&L;

- These are the lowest quarterly growth rates expected to be achieved in the next five periods at least; and

- A low bar ahead of earnings is not always a bad thing, and can actually set the stock up for a post-earnings rally if the company delivers solid results and narrative for the following quarter.

When measuring Apple’s performance vs. estimates, keep in mind the company’s own guidance offered during the most recent earnings call. Using the midpoint of the outlook for each main line item of the P&L, and assuming that Wall Street is correct about top-line growth of 5%, below is what I would expect Apple’s fiscal Q4 income statement to look like:

DM Martins Research

Having said the above, I don’t particularly think that Apple’s upcoming earnings present a short-term bullish or bearish opportunity. In fact, I believe that long-term investors who subscribe to the arguments presented earlier in this article are probably better off ignoring the day-to-day or week-to-week volatility and focusing on the company’s business fundamentals and the stock’s valuation instead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.