Summary:

- With the improvement of the macroeconomic environment, we expect an improvement of the firm’s financial performance in the coming quarters, including supply, demand, costs and the FX environment.

- The dependence on China is likely to remain a significant risk in the years to come.

- The increase in services revenue is an attractive sign and may contribute significantly to margin expansions in the quarters to come.

- All in all, we remain bullish on Apple.

Shahid Jamil

Introduction

Apple Inc. (NASDAQ:AAPL) designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

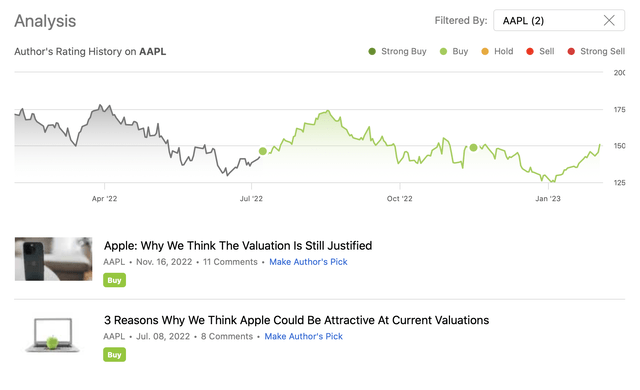

We have written two articles on Apple’s stock in 2022. Both times, we had a bullish view.

Today, after the earnings release, we are revisiting Apple once again, but now taking a look at the business from a different perspective. We will examine Apple’s profitability and efficiency over time, while discussing the latest quarterly results and their implications going forward. We will also give an updated view on the “China risk” that we have elaborated on in our previous article.

Quarterly results

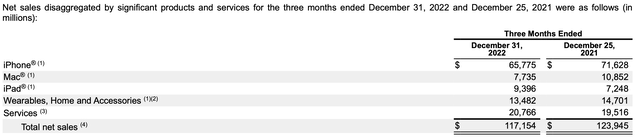

In the first quarter of FY2023 (Q1-23), Apple has posted revenues, which have declined 5% year-over-year, reaching $117.2 billion. At the same time, earnings per share came at $1.88 per share.

Important to point out that the weakening of the product revenue has been partially offset by the increase in services revenue.

Only the iPad and the Services segments have not seen a decline in revenue in the past quarter.

While the revenue decline may appear discouraging for many, we have to understand the factors that have been playing a major role in this development. The macroeconomic environment in 2022 has been quite challenging, leading to problems both on the supply and demand sides, and resulting in elevated costs.

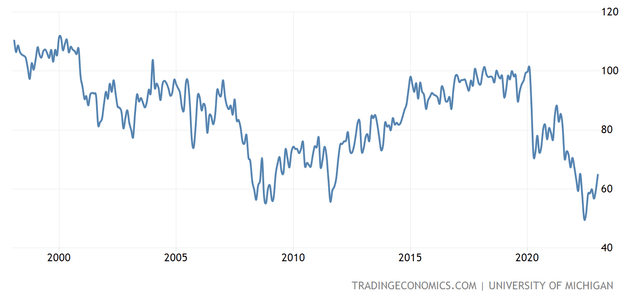

Demand

Consumer confidence in 2022 has hit historic lows. During times of poor consumer sentiment, people are less likely to spend on discretionary, durable items, such as personal electronics.

Consumer sentiment (Tradingeconomics.com)

Since its lows in June, this indicator has been gradually improving, albeit continuing to stay at relatively low levels.

Consumer confidence is often treated as a leading economic indicator, which can be used to gauge the change in trend in the spending behaviour of the consumer. We believe that consumer sentiment is likely to keep increasing (however, probably at a slower pace) in 2023, potentially leading to positive impacts on the spending. This in turn could lead to even higher demand for Apple’s products and services.

Supply

The Covid-19 restrictions in China, due to the country’s zero Covid policy has played a major role in creating supply side issues over the past years. In our previous article we have articulated the problems in detail, which have been primarily related to the fact that most of Apple’s manufacturing is concentrated in China. Therefore factory shut downs and the dissatisfaction of the workers with the policies have led to substantial declines in output. The manufacturing issues have been primarily related to the higher end iPhones, potentially contributing significantly to the sales decline in the iPhone segment.

Looking forward, we are happy to see that services revenue has increased, because it is not directly limited by any supply side problems. While the zero Covid policy has been since then suspended, China is “reopening”, and Apple has also taken steps to diversify its manufacturing, shifting the production of some of its products to India, it may take several years to fully materialise and become less dependent on China. For now, the firm’s dependence on China and on the revenue of iPhone sales remain significant risks. Therefore, we believe that the service revenue stream is strategically important.

Costs

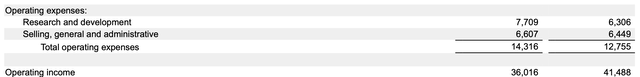

While revenue has declined by about 5%, cost of sales has only declined by about 4%, leading to a gross margin contraction.

Cost of sales (Apple) Gross margins (Apple)

Another reason why we are actually happy to see the services segment expanding is its high gross margin. While the services gross margin has also contracted in the prior quarter, it still remains more than 30% higher than the products gross margin.

Operating expenses have even increased during the period, leading to substantial decline in operating income and in net income. Both the R&D and the SG&A expense increases have been related to the headcount increase.

Looking forward, we expect the macroeconomic environment to keep improving in 2023. In our opinion, the positive effects of this improvement are likely to be already more visible in the second half of the year. We believe that energy prices are not likely to increase again to their 2022 highs in the near future, which could have a positive impact on the freight and raw material costs. Inflationary pressures are likely to be easing too, potentially resulting in a downward pressure on wages.

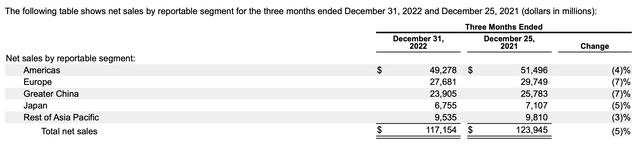

Currency

When looking at the sales result by geography, we can see that sales have declined in all regions. The firm has been citing the relative strength of the USD compared to other currencies as the main driver of the decline.

The dollar index has, however, peaked mid-2022 and has been falling sharply since then.

Dollar index (Tradingeconomics.com)

Looking forward, we believe that this development is likely to benefit AAPL’s financial performance in the coming quarters.

Overall, we are not discouraged by the revenue and earnings decline reported, and our view remains bullish on the firm.

Now that we have looked at the latest quarterly report, let us take a look at the firm’s profitability and efficiency and their dynamics over the past years.

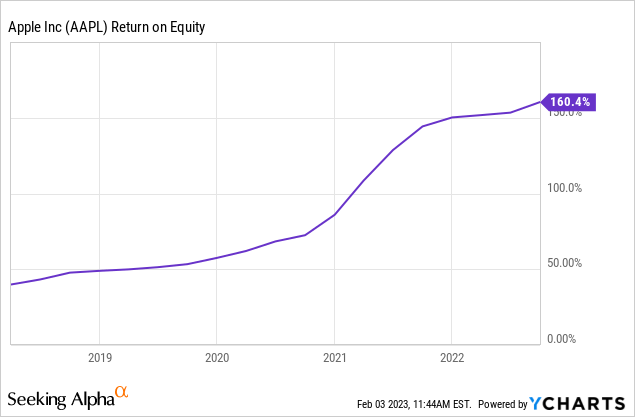

Return on equity

ROE is an important measure of financial performance and it is often used to gauge the corporation’s profitability and its efficiency of generating profits. An improving or stable ROE is encouraging.

Apple’s ROE has been gradually improving over the past 5 years, increasing significantly above 100%. Let us decompose this measure into three parts, namely the net profit margin, the asset turnover and the equity multiplier to analyse what factor has been primarily responsible for this apparently outstanding performance.

ROE decomposition (investopedia.com)

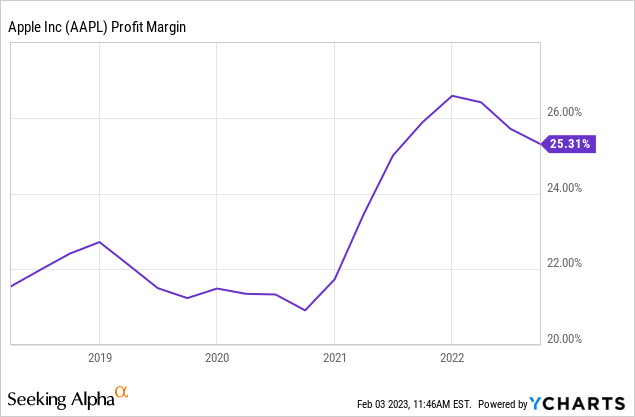

Net profit margin

Net profit margin measures how much net income or profit is generated as a percentage of revenue.

Despite the recent decline due to the challenging macroeconomic environment, AAPL has managed to substantially improve its net margin over the past 5 years.

Looking forward, if the firm manages to keep increasing the share of services revenue stream, the net margin is likely to keep expanding further. Moreover, we believe that the improving macroeconomic environment, and its implications on the costs, as explained earlier, are also likely to positively impact AAPL’s profitability measure.

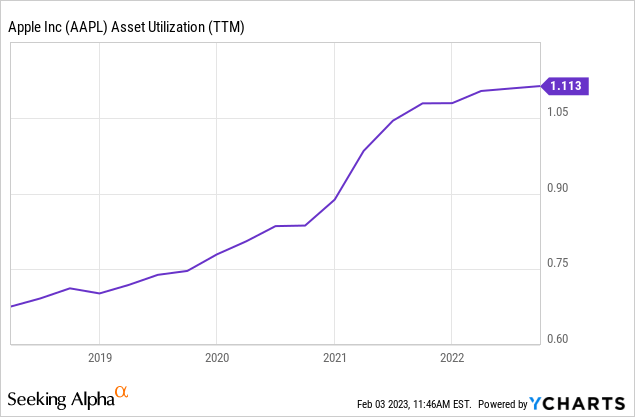

Asset turnover

The asset turnover ratio (or sometimes called asset utilization) measures the value of a company’s sales or revenues relative to the value of its assets. It indicates how effectively the company is using its assets to generate sales. Promising to see that Apple has been gradually getting more efficient in using its assets to generate more revenue.

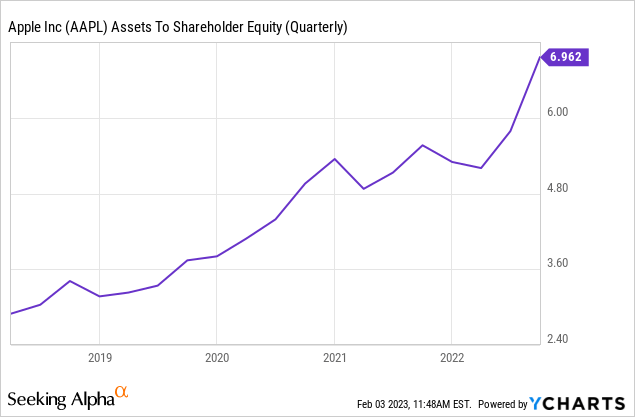

Equity multiplier

The last part of the three step decomposition of the ROE is the equity multiplier, which is simply the ratio of assets to shareholder equity. A higher ratio indicates more leverage, meaning that the firm is using a larger amount of debt to finance its assets.

Apple’s leverage has been increasing at a rapid pace. This is a development that we do not find that appealing and could also present some risks going forward. True, that Apple is using its assets more and more efficiently, including its debt as well, however it has unwanted impacts on the firm’s liquidity.

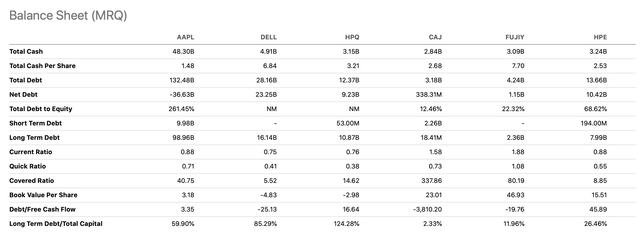

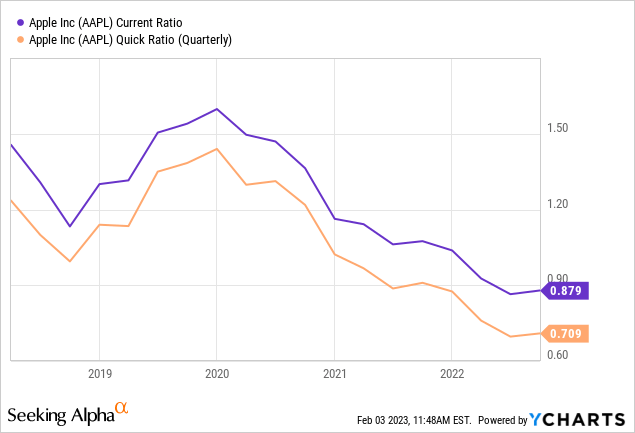

Apple’s liquidity ratios have been gradually declining since 2020. The current- and quick ratios measures whether the company is able to cover its current liabilities using its current assets. The difference between the quick- and the current ratio is that the quick ratio excludes the inventory from the calculation. Ideally, we would like to see these ratios above 1, or at least gradually trending upwards. It is, however, not the case.

Before sounding too alarming, we also have to take a look at these measures of some of AAPL’s peers. Relative to the companies mentioned below, Apple’s measures look quite average.

Further, Apple is generating substantial cash flow from operations, which are more than enough to sustain their debt levels at the moment.

Regardless, we would like to see Apple’s liquidity ratios improving to make sure that the firm has enough financial flexibility in case the macroeconomic environment does not improve as expected.

To remember

Despite the decline in sales in the latest quarter, our view remains bullish on Apple’s business. With the improvement of the macroeconomic environment, we expect an improvement in the firm’s financial performance in the coming quarters, including supply, demand, costs and the FX environment.

Apple has been increasing its efficiency and profitability gradually over the years. If the services revenue stream can grow further, it could have additional positive impacts on the profitability, due to its exceptionally high margins.

The dependence on China for manufacturing and the substantial dependence of the revenue on iPhone sales are likely to remain risk factors for the coming years.

We also would like to see the company’s liquidity ratios improving.

All in all, we remain bullish on Apple.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.