Summary:

- After reporting a double beat for FQ2 2023, Apple’s stock jumped up +5% in Friday’s session. We review the quarterly report in this note.

- On the back of a stunning ~40% YTD rally, investors are starting to experience FOMO (fear of missing out) despite AAPL stock looking over-loved and overvalued at current levels.

- Based on TQI’s Quantamental Analysis process, I rate Apple a “Neutral/Hold/Avoid” at $174 per share.

Shahid Jamil

Brief Review Of Apple’s FQ2 2023 Report

Last week, Apple (NASDAQ:AAPL) reported a beat on both top and bottom lines driven by stronger-than-expected iPhone sales and resilience in Services.

SeekingAlpha

Now, if consensus estimates are low enough, any report could look like a beat. And I think this is the case with Apple. Heading into its FQ2 2023 report, Apple’s revenues and EPS were expected to decline -4.5% y/y and -10% y/y. And as you may know, the company reported a revenue decline of -2.5% y/y, with EPS coming in flat y/y. Yes, it’s a double beat from Apple; however, the absolute numbers are not that great in isolation [especially when looked upon in the context of Apple’s rich valuation (~30x P/E)].

For FQ2 2023, Apple’s revenue came in at $94.84B, with the management attributing this quarterly beat to iPhone sales, which grew by +1.3% to $51.33B against a -13% decline in the global smartphone market. While the iPhone numbers look impressive, given the macroeconomic backdrop, I think the Q2 beat is a result of deferred consumer demand caused by Apple’s supply chain issues (production closures) in China in Q4. Hence, I am not getting overly excited about Apple’s iPhone numbers here.

Apple Investor Relations

As you can see above, Apple’s Mac and iPad sales plunged -31% y/y and -13% y/y in FQ2 2023 as the macroeconomic environment took its toll on consumer spending. While Apple’s Wearables segment held up quite well on the back of strong performance of the Apple Watch, it still declined by -0.6% y/y. Lastly, Apple’s Services revenue grew to $20.9B (up 5.5% y/y), with the company boasting over 975M active subscriptions across its various digital services in FQ2 2023. Despite Apple’s hardware business struggling for growth, its installed user base and ecosystem are still in expansion mode, with the technology giant recently pushing into financial services with products such as Apple Pay Later and Apple Card (Credit + High Yield Savings).

During the earnings call, Tim Cook, Apple’s CEO, highlighted growth in emerging markets like India and Brazil. While Apple’s market share is quite low in these geographies, I am not sure how Apple drives double-digit revenue growth via geographic expansion. In my view, Apple must launch a needle-moving product in the near future to re-invigorate the growth story. For the next quarter, Apple’s management guided revenue growth “similar to Q2 results”, i.e., -2.5% y/y (if macroeconomic conditions don’t decline). With banks blowing up like dominoes and the FED seemingly tightening into a slowing economy, the macroeconomic environment (and consumer spending) is likely to worsen over the coming months. Hence, Apple’s business performance is still in decline, and it is unlikely to recover dramatically in the near term.

In FQ2 2023, Apple generated $28.4B in free cash flows. From this pot, Apple’s management spent ~$19.1B on stock repurchases and ~$3.7B on dividends. With its earnings report, Apple announced a 4% hike in quarterly dividends to $0.24 per share. Furthermore, Apple’s board authorized an additional $90B for stock repurchases in a sign of confidence in future cash flow generation. On the earnings call, Apple’s CFO reiterated management’s commitment to making Apple a net cash-neutral business, which means Apple’s buybacks could exceed the $90B mark over the next 12 months.

Apple Investor Relations

Given Apple’s cash-rich balance sheet and robust free cash flow generation, I expect Apple to remain an infinite buyback pump for several years to come. That said, AAPL is getting very expensive, and the risk/reward is becoming quite unfavorable. Let’s understand this through a discussion on valuations.

Relative And Absolute Valuations For Apple

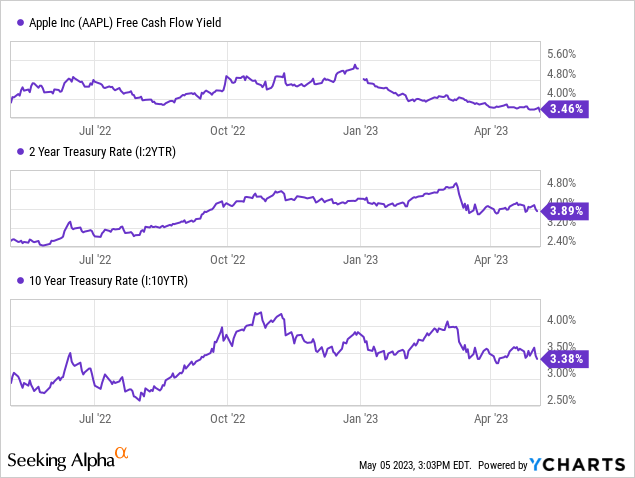

With Apple’s stock rallying ~39% YTD on the back of trading multiple expansion, its free cash flow yield has dropped to 3.46%. Since Apple’s free cash flow yield has dropped below risk-free treasury bond yields, AAPL stock is priced for perfection and more at a time when its revenue growth rates are negative. Hence, in my view, Apple’s stock offers little to no margin of safety at its current levels.

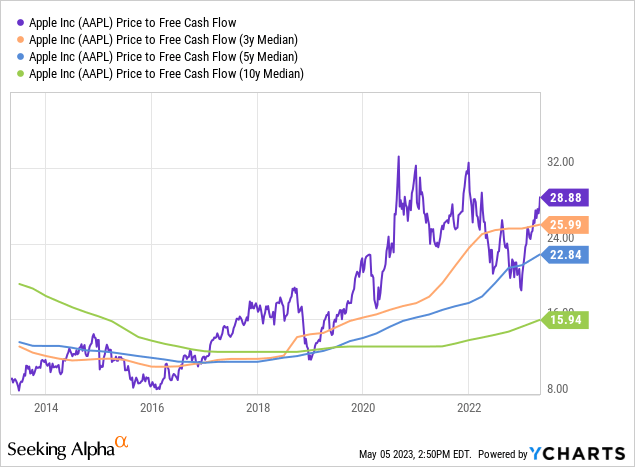

From a historical standpoint, Apple is currently trading well above its median P/FCF multiples, as shown below. And we are closing in on trading multiples of ~32x P/FCF, which were last seen during the liquidity boom of 2020-21.

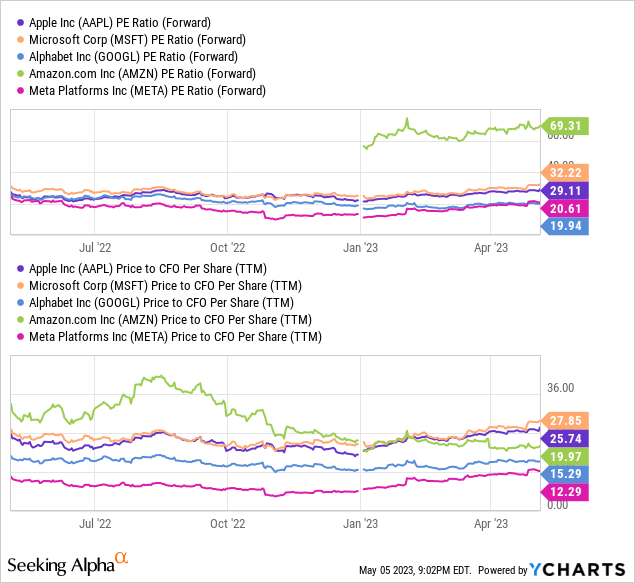

With the S&P 500 (SPX) trading at ~19x forward P/E, Apple’s ~29x forward P/E renders it expensive on a relative basis. And while Apple’s trading multiples are not among the highest in its peer group (with Microsoft taking that honor), it is still richly valued.

Now let’s review Apple’s absolute valuation. To do so, we have utilized TQI’s Valuation with the following assumptions:

TQI Valuation Model (TQIG.org)

According to TQI’s Valuation Model, Apple’s fair value is ~$118.83 per share (or $1.88T). With the stock trading at ~$174 per share, I think it is significantly overvalued at current levels.

While some of you may disagree with this assessment, I feel the model assumptions are quite generous. For the modeling period, we have assumed an FCF margin expansion for Apple to 27.5% and a 7.5% CAGR revenue growth rate (higher than consensus analyst estimates).

SeekingAlpha

Therefore, I am not a fan of Apple’s current valuation.

Now, predicting where a stock would trade in the short term is impossible; however, over the long run, a stock would track its business fundamentals and obey the immutable laws of money. If the interest rates were to stay depressed, higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x [P/FCF].

Applying this figure as an exit multiple, I see Apple stock rising to $241.64 by 2027-28 at a CAGR of 6.79%. Since Apple’s expected return falls short of my investment hurdle rate of 15%, I am not a buyer here.

TQI Valuation Model (TQIG.org)

With short-duration treasuries offering ~5-5.5%, treasury bonds offer significantly better risk/reward than Apple’s stock. In the event of a hard landing, I could see Apple re-tracing to its fair value (and maybe, it could probably overshoot to the downside). Hence, I see a downside risk of around 30% in AAPL stock based on DCF valuation.

Alright, it’s now time to evaluate Apple’s technical charts and quant factor grades to make an informed investment decision.

AAPL’s Tryst With Technicals and QF Grades

After a ~5% jump on Friday, Apple’s stock is now sitting at a stone’s throw away from its all-time high of $180.68 per share [recorded on 3rd Jan 2022]. With this latest jump, AAPL stock appears to have broken out of the bearish megaphone pattern it has traded in over the last year or so. If the stock holds this bounce, we are more than likely to hit new all-time highs within the next few sessions.

WeBull Desktop

However, if this post-earnings bounce turns out to be a false breakout, I can see Apple breaking the rising wedge pattern (marked in purple) to the downside and re-tracing back down to the $145 level. While momentum can carry Apple higher in the near term, I think business fundamentals and valuations do not permit much upside from here. Conversely, the stock could easily lose ~25-50% in the event of a hard landing in the economy. Hence, the risk/reward on AAPL looks highly unfavorable.

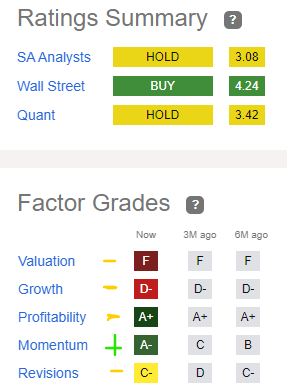

Despite Apple being a consensus “Buy” among Wall Street analysts, AAPL is rated a “Hold” by SA’s Quant Rating system and my fellow SA analysts.

SeekingAlpha

According to Seeking Alpha’s Quant Rating system, Apple is rated a “Hold” with a score of 3.42/5. With its stock doing exceptionally well since the turn of the year, Apple’s “Momentum” grade has improved from “B” to “A-“. All other factor grades for Apple have held steady over the last six months. With Apple recording negative revenue growth in recent quarters, a “D-” for “Growth” seems a little generous. However, these factor grades are relative, and many peers (tech names) are probably doing far worse than Apple on sales growth amid a tough macroeconomic backdrop.

Now, Apple remains a free cash flow printing machine, and as such, its “Profitability” grade of “A+” is well deserved. While macroeconomic headwinds should subside over time, Apple’s earnings “Revisions” grade still stands at “C-” for now, and rightly so. As we saw in the previous section of this note, Apple’s stock is overvalued on an absolute and relative basis. And so Apple’s “Valuation” factor grade of “F” shouldn’t surprise anybody one bit.

Overall, Apple’s quant factor grades and technical charts do not support a new long position at this time.

Concluding Thoughts

At TQI, we own Apple within our Buyback-Dividend strategy. However, the stock is looking unattractive at current levels based on a mix of fundamental, quantitative, technical, and valuation analyses. Apple’s FQ2 2023 report was a solid double beat on lowered expectations, but the absolute numbers failed to impress. With Apple showing negative revenue growth and flat earnings, I expect the market to de-rate AAPL stock to a more reasonable trading multiple like 20x P/E. Even if we see a mean reversion on trading multiples, AAPL could fall by ~30% in the near to medium term. And with Apple’s 5-yr expected CAGR return falling well short of my investment hurdle rate, I don’t like the risk/reward setup at current levels.

Given Apple’s robust FCF generation and shareholder-friendly capital return programs, I am not selling my Apple holdings here (despite having strong valuation concerns). However, I am not a buyer at current levels either. Yes, if the stock were to get back down to $145, we would resume our DCA into Apple. Until then, I prefer short-term treasuries over Apple stock.

Key Takeaway: I rate Apple a “Neutral/Hold/Avoid” at $174 per share.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why I tailored my marketplace service – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

TQI’s core idea is to generate wealth sustainably through tailored portfolio strategies that meet investor needs across different investor lifecycle stages. Each of our five model portfolios comes with thoroughly vetted investment ideas, embedded risk management, and specialized financial engineering for alpha generation.