Summary:

- Apple’s new mixed reality device could be a flop due to the high price tag, the questionable value proposition, and the unproven market.

- But the fact that the 2023 model of Apple’s headset might look ugly or cost too much is the wrong conversation to be had.

- To understand the value that mixed reality can create to Apple investors, one must look past 2027 and imagine a post-smartphone world.

Luis Alvarez

Reports have recently surfaced regarding Apple’s (NASDAQ:AAPL) mixed reality efforts – and the news are not all that encouraging. According to the New York Times, the Cupertino company’s upcoming product launch, a mixed reality headset, is basically shaping up to be a flop. It is unclear if the stock’s modest market value loss of $50 billion in the past one and a half trading days against the S&P 500’s (SP500) sideways movement has to do with this particular development.

What is clearer to me is that skeptics seem to be getting the story wrong once again. While the success of Apple’s first iteration of its mixed reality device is anyone’s guess at this point, thinking about the opportunity in the short term is a mistake that could keep potential investors away from AAPL out of unjustified fear. Below, I explain what I mean.

Apple’s New Device: Underwhelming?

The New York Times’ report speaks of several issues associated with Apple’s new mixed reality headset. The first has to do with the design that resembles that of ski goggles, according to the newspaper. Alphabet (GOOG) has learned firsthand what underwhelming design can do to the adoption of a new wearable product. But this is only the first of many potential problems listed.

Other concerns identified, maybe even more important than the first, were (1) the high price tag of $3,000 per device, (2) the utility of the product (“a solution looking for a problem”, as described by the New York Times), and (3) the potential lack of a scaled market.

AAPL Could Take A Hit

To be clear, I have no particular opinion about Apple’s first mixed reality device model, which is still widely expected to be announced around June of this year. For starters, I have no knowledge of the company’s plans and execution around this initiative — if I did, I would not be sharing non-public information on this or any other platform anyway.

In fact, for the sake of conservatism, I am not expecting much at all from Apple’s headset this year or next. Counterpoint Research’s estimate of only 500,000 devices sold annually (for an implied revenue opportunity of $1.5 billion at an ASP of $3,000, or only 0.4% of Apple’s total sales) is good enough for me, for now.

If Apple’s mixed reality device announcement in the summer impresses no one, I find it plausible that the stock could take a hit due to bearish sentiment — another way of saying psychological rather than quantitative reasons. But I would not expect the potential dip in share price to be long-lasting for a few reasons:

- Clearly, judging by reports like the NYT’s, expectations for the new device should already be de-risked enough.

- I doubt that many analysts and investors already have mixed reality-related revenues and earnings fully factored into their models.

- The factors that have supported AAPL in the past few months, namely its “safe haven status” amid a challenging economic and market landscape, would still remain in place.

The much more important point, however, is that Apple’s yet-to-be-announced mixed reality segment could be a game changer not now, but over the next many years. And ultimately, this is what matters the most for shareholders’ value creation.

Think Much Longer Term

For a second, I could entertain the argument that mixed reality and the metaverse (or “copresence”, as Apple’s insiders seem to call it) will never catch on, and that the smartphone will remain the mobile device of choice for billions of consumers around the world for many decades to come. But I don’t think that this will be the case.

It is unlikely that Alphabet, Microsoft (MSFT), Meta (META) and Apple are all wrong in their visions for the future, regardless of how disappointing some of the AR/VR hardware launches have been so far. Soon enough, although how soon is still very unclear, we will all be waving our hands in the air to interact with our computers, like Tom Cruise did in Minority Report in 2001.

Should this turn out to be true and AR/VR becomes “the next big thing” in mobile consumer technology, the opportunity for Apple could be massive. Consider that, since the 2007 launch of the iPhone, nearly 15 billion smartphones have been sold. Of these, more than one-third are still in operation. While not all of them are likely to be replaced by virtual reality wearable devices soon or at once, many will.

Morgan Stanley once defended that Apple will be the key piece of the puzzle that will finally allow the metaverse to take off. The argument makes sense to me, considering how relevant and popular of a consumer brand Apple has become in the past decade-plus. That implies that the Cupertino company is likely to command a larger share of the global mixed reality market vs. its current 19% share of the smartphone space.

Needless to say, modeling the results of Apple’s mixed reality segment today is very hard. But at a high level, let’s assume that Apple eventually controls 25% of the global market, and that the average price of each device drops to $1,000 (roughly in line with the average price of the iPhone 14 Pro today).

Each 1 billion units sold worldwide, whether as smartphone replacements or complements, would impact Apple’s P&L by $250 billion in revenues. For reference, this number is about 25% larger than total iPhone sales produced in the past four quarters combined. Replacing all 6.8 billion smartphones currently in existence, using the assumptions above, would present Apple with a $1.7 trillion opportunity — granted, very much at the expense of iPhone sales in a classic case of product cannibalization.

Note that this opportunity (1) is largely independent of whatever may happen to Apple’s first mixed reality model in 2023 or even 2024, and (2) considers no additional long-term benefit to the services segment, which I think is a very conservative approach.

Apple: Value Is Created Over Time

Yes, all of the above may sound a bit “pie in the sky” to some. Why bother looking so far out in the future, when it is nearly impossible to predict the direction that AR and VR will take in the next 12 to 24 months alone?

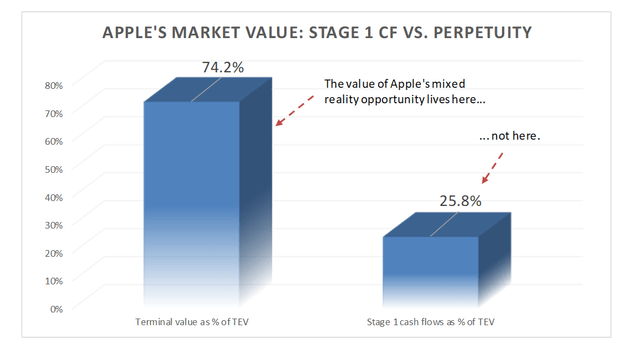

The answer can be found in my recent article about Apple’s DCF (discounted cash flow) value calculations. Through my two-stage model, I concluded that nearly three-fourths of Apple’s current market value comes from the perpetuity piece, also known as the terminal value. That is: in a discounted cash flow analysis, around $1.9 billion of AAPL’s current market value comes from the financial results that the company is expected to produce not in the next five years, but beyond 2027.

Therefore, it is nearly irrelevant to think about the mixed reality opportunity for the benefits that it can bring to the Cupertino company and its investors in the next handful of years. The fact that the 2023 model of Apple’s headset might look ugly or cost too much is the wrong conversation to be had. The right one should be about the importance of this segment in a post-smartphone environment — one of the key reasons for my bullishness toward Apple stock today.

Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.