Summary:

- Since I upgraded Apple stock to “Buy”, it has grown by ~32.5%, outperforming the S&P 500 by nearly 4x over the past quarter.

- What has driven the stock’s rapid growth in recent years and recent months, was, in my opinion, mainly the expectation of a new product upgrade cycle fueled by AI.

- Today, concerns about iPhone sales growth lagging behind the market, stretched valuations, and potential market correction led me to the decision to downgrade Apple stock.

- Realistically, I’d expect AAPL to trade at ~30x earnings by FY2025, which suggests the potential for a correction of ~5%.

- I currently see no margin of safety for Apple stock, so I downgrade AAPL to “Sell”, looking forward to seeing the company’s Q3 FY2024 earnings release on August 1.

undefined undefined/iStock via Getty Images

My Thesis Upgrade

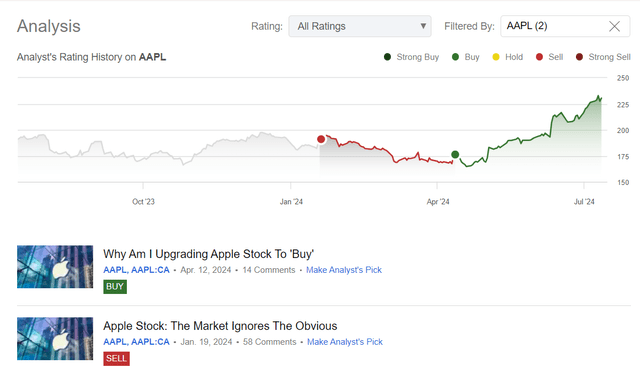

I initiated coverage on Apple Inc. (NASDAQ:AAPL) (NEOE:AAPL:CA) stock in January 2024 with a “Sell” rating when each share was trading at around $191. However, I upgraded my rating to “Buy” in mid-April 2024 when the stock fell to about $174 per share. Since then, I haven’t touched my bullish rating anyhow, so during the past quarter, Apple stock has grown by ~32.5%, outperforming the S&P 500 (SP500) (SPY) by nearly 4x:

Seeking Alpha, Oakoff’s coverage of AAPL

What has driven the stock’s rapid growth in recent years and recent months, was, in my opinion, mainly the expectation of a new product upgrade cycle fueled by the integration of AI into new devices. However, I believe that the current price has exceeded a justifiable valuation. Therefore, I’ve decided to lower my rating to “Sell” again, as I expect the coming months to be quite challenging for Apple’s stock price performance.

My Reasoning

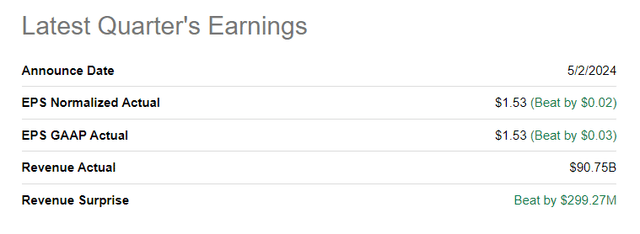

In fiscal Q2 2024, Apple reported revenue of ~$90.7 billion, which was a YoY decline of 4% and a QoQ decline of 24% (the latter is typical for Q2 due to poorer seasonality). Despite both YoY and QoQ declines, AAPL’s revenue was slightly above the consensus guidance of $90.5 billion. What surprised me was the GAAP gross margin improving to 46.6% from 45.9% in the prior quarter and 44.3% in the year-ago quarter. The GAAP EBIT margin decreased to 30.7% from 33.8% in the prior quarter but increased from 29.9% in Q2 FY2023, so EPS was $1.53 compared to $1.52 in the prior year, beating the consensus estimate of ~$1.50.

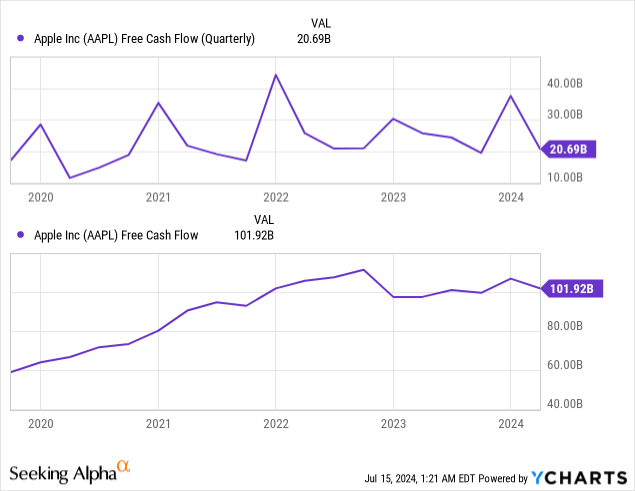

As can be seen from the cash flow statement, Apple made approximately $57.5 billion in net income for the fiscal year H1 2024, which is 6.3% less than a year ago, but it was able to bring out around $62.5 billion in operating cash flow due to a bit smaller negative impact of accounts payable compared to the same period last year. Thanks to a doubling of cash flows from investing activities (on a YoY basis) and a slightly lower outflow from financial activities, the amount of cash on the company’s balance sheet has increased significantly, amounting to $67.15 billion in cash and short- and long-term investments (+20% YoY), according to Seeking Alpha Premium data. In terms of free cash flow generation, Apple’s Q2 has remained approximately at the same level seen in the last 5 years (adjusted for seasonality). On a TTM basis, we see that AAPL’s FCF is growing in the long term, now exceeding $100 billion, which is positive, but it hasn’t grown beyond this mark since 2022.

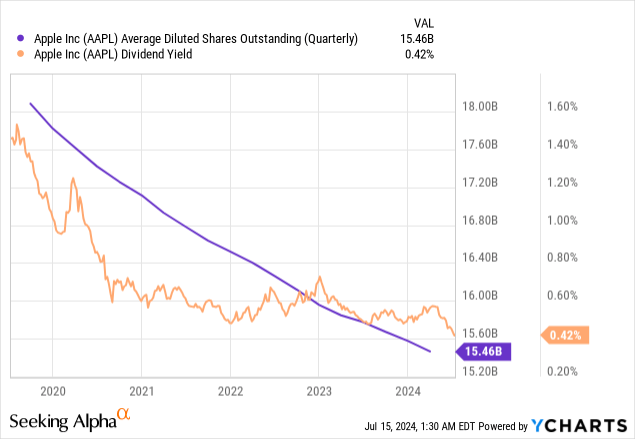

Such an enormous FCF should have been utilized somehow, and so Apple has actively repurchased its shares from the open market and maintained stable, albeit modest, dividends. In April 2024, the company boosted its buyback program by $110 billion, which was a bigger increase compared to the previous 2 years ($90 billion each). They also raised the quarterly dividend to $0.25 per share, up from last year’s increase of 4% to $0.24 per share in April 2023 and an increase of 5% from the previous year to $0.23 per share in April 2022. Thus, the long-term trend of decreasing shares outstanding continued, and the company’s dividend yield, due to the rise in the stock prices, became even lower:

In general, I can’t call Apple’s second fiscal quarter results outstanding. They weren’t groundbreaking; Apple’s Q2 financials were probably not the main reason for the recovery in the stock price, even though Apple managed to beat analysts’ consensus estimates. The main reason was the Worldwide Developers Conference (WWDC), where important changes were announced regarding the development of artificial intelligence in the company’s devices. They introduced the Apple Intelligence initiative, with the idea to build generative AI into the iPhone, iPad, and Mac. This would now include updates to its operating systems like iOS 18, iPadOS, and macOS Sequoia with integrated AI capabilities of Apple. Enhanced features include improved customizations, satellite messaging, and new functions for AirPods Pro as well as Apple Watch. It’s important to note that Siri has also been enhanced by Apple with more contextual relevance and personal intelligence capable of tasks such as responding to emails or making unique emojis in the iMessage app. This AI-realted strategic move from Apple, although quite late compared to other Big Tech companies, should trigger a new wave of iPhone sales according to many Wall Street analysts after WWDC, setting it up for EPS growth over the next 2 years driven by its strong hardware and services demand.

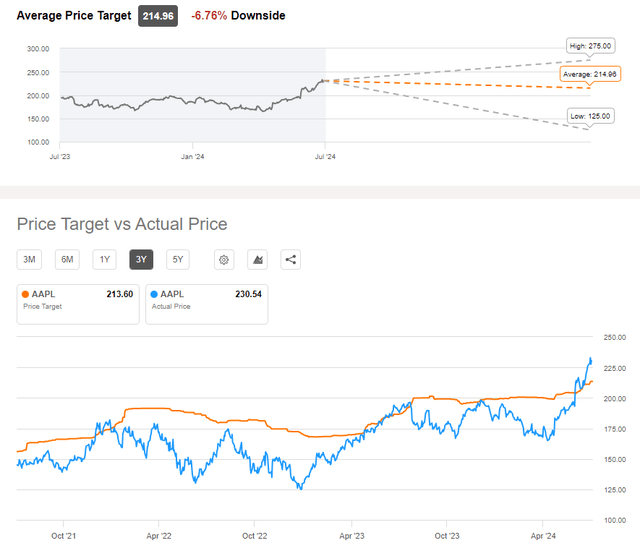

I believe the company has a great opportunity to monetize its AI initiatives, especially with the continued growth in service revenue, which was a lifeline in the second quarter. However, I believe the company is still a long way from realizing the full potential benefits, and the recent market reaction seems overly optimistic. Even the majority of bullish analysts at Wall Street’s major investment banks haven’t been as bullish as recent price movements suggest; Apple’s stock has significantly outperformed analysts’ average price targets. The highest estimate is now $275 per share, which represents a further 19.5% increase from the current price, but this remains the most optimistic scenario within a broader range. So given the already bullish outlook on its growth prospects, the stock price seems “overheated” to me.

Seeking Alpha, AAPL stock, Wall Street Ratings

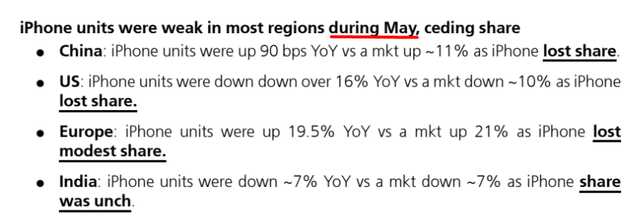

I’m also concerned by the fact that the actual number of iPhones sold (“sell-through”) in recent months has lagged behind the average growth rate of the market. UBS reported on this at the end of June (proprietary source, June 2024), citing data from May that showed a 2% year-on-year decline in iPhone sales, marking the 5th consecutive month of weakness.

UBS, proprietary source, June 2024

To date, the latest (June-dated) data confirms Apple’s continued weakness compared to the broader market.

UBS reported that preliminary June sell-through data provided by Counterpoint indicates that the Apple’s iPhone unit sell-through was up roughly 1% last month, which compares to global smartphone growth of about 4%. For the June quarter, preliminary data indicate iPhone unit sell-through was 45M units, or down 1% year-over-year, compared to 6% growth for the market, according to the analyst, who keeps a Neutral rating and $190 price target on Apple shares.

Source: TipRanks [July 12, 2024]

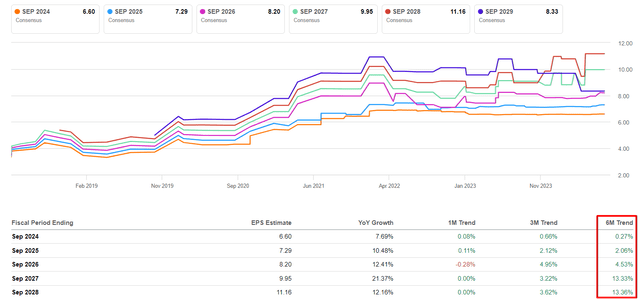

Although the share of service revenue is growing, it remains a secondary source of sales for Apple. Although the artificial intelligence initiatives are important milestones in the company’s development, the actual iPhone sales growth compared to the market has not lived up to the expectations raised after the “AI announcement”. Perhaps anticipation is building for the release of the iPhone 16. I don’t want to draw any definitive conclusions here, but the current sales momentum suggests caution rather than maintaining the overly bullish sentiment we had immediately after WWDC. Meanwhile, over the past six months, Wall Street analysts have continued to raise their estimates for EPS significantly, seemingly overlooking potential risks.

Seeking Alpha, AAPL’s EPS revisions

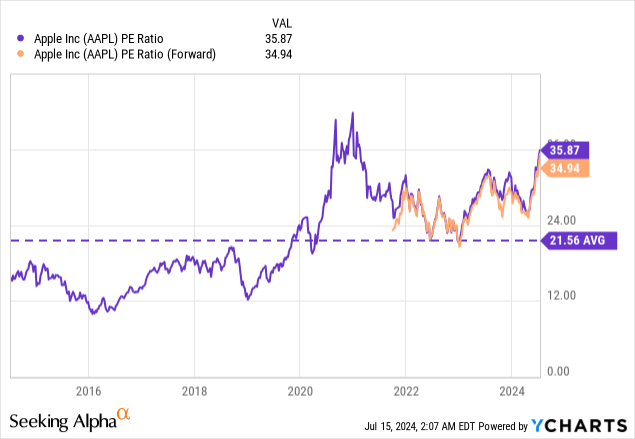

Analysts predict an 11% annual growth rate (CAGR) in EPS over the next 5 years. However, I’m concerned that this expected growth rate would only value the company at 20x net earnings by FY2028. Of course, by the end of FY2028, this multiplier will likely be higher. Currently, the forwarding P/E ratio stands at about 35x net earnings (the end of 2024). This is close to Apple’s limit, historically speaking. Therefore, in 5 years, maintaining the buyback and assuming stable FCF and EPS growth based on today’s consensus, we can most likely expect a 25-30x P/E multiple for Apple – this gives a potential price of $307/sh. In other words: In 5 years, the stock may expand by 33% based on quite optimistic (the current consensus) expectations, which would mean a CAGR of about 5.9% per annum. Many A2-rated bonds (based on Moody’s rating) yield much more today, so I don’t think this projected growth rate is justified. I see no margin of safety in Apple’s current valuation.

According to analysts, today’s 35x in FWD P/E may decrease to ~31.6x by the end of 2025. I believe that, in reality, the P/E multiple should drop to at least 30 times earnings. With the current consensus EPS estimate at $7.29, this would imply a stock price of ~$218, which is ~5% lower than today’s price, highlighting the lack of a safety margin in Apple stock, in my opinion.

As for the technical analysis, I also see some potential short-term problems for Apple. Firstly, by September, the current strength in terms of seasonality is likely to diminish, if the past 10 years of statistics are something to rely on. Secondly, the stock price’s distance from its 52-week exponential moving average has increased rapidly, reaching peaks seen in previous expansions. In the previous expansion, the stock rose from the bottom to a local peak over about 6 months, gaining 59.5%. Today, we see that Apple stock has grown by 40.5% in just 3 months, which is very fast. This makes the price action look very extended, and a pullback to the moving averages seems like the most logical outcome.

TrendSpider Software, AAPL stock, Oakoff’s notes

Thus, based on my findings, I think it should be logical to downgrade Apple stock to “Sell” today.

Upside Risks To My Thesis

First, one of the major upside risks to my today’s downgrade is that I don’t agree with the common view, which encompasses the judgments and thoughts of those who have been following Apple for a longer time and more closely than me. Therefore, there are chances that I may be absolutely wrong about something obvious to the bulls.

Second, I find Argus Research’s latest report (proprietary source, dated June 2024) to contain a whole lot of bullish arguments that appear very solid to me and could easily negate my conclusions if the company fulfills what is anticipated:

We believe on-device Gen AI has the potential to drive the next big round of iPhone sales. Timing of product readiness and in particular customer acceptance is uncertain. Apple recently reported solid fiscal 2Q24 results, with record service revenue partly offsetting lower iPhone sales. Currently, Apple is on track for EPS growth over the next two years. This reflects strong appetite for Apple’s hardware, and its brand loyalty in turn spurs demand for Apple’s services, including iTunes, App Store, and iCloud.

Apple has entered the generative AI space after being on the sidelines for the first year and a half after ChatGPT’s launch in November 2022. By mainly positioning these new enhancements on its highest-end existing iPhone and mainly on future models, the company seeks to drive a robust new upgrade cycle in 2025 and beyond.

We believe the current environment represents an opportunity to establish or dollar-average into positions in AAPL.

Third, my conclusions about the company’s valuation are somewhat subjective, as I’m basing them on historical norms and what I, personally, think is fair for Apple stock. The market’s assessments of the company’s prospects and the prices investors are willing to pay may differ significantly from my opinion and conclusions. It’s important to note that numerous funds and other institutional investors hold significant stakes in Apple – their reluctance to sell or trim positions could contribute to the continued upward momentum of the stock amid the absence of strong selling pressure.

Your Takeaway

Despite the recent rise in Apple’s stock price and excitement about its artificial intelligence initiatives, I remain concerned about iPhone sales, which are up just 1% year-on-year in June, compared to a 4% rise in the broader market. This is against a backdrop of stretched valuations and the high possibility of a market correction (i.e. mean reversion).

In my opinion, the current market forecast for Apple’s P/E multiple by the end of FY2025 is too optimistic. Realistically, I’d expect it to be ~30 times earnings, which suggests the potential for a correction of ~5%. This forecast is subject to change, of course, but significant adjustments are unlikely, in my view. Therefore, I currently see no margin of safety for Apple stock. A further upward move would only increase its expensiveness, which runs counter to logic. I have decided to downgrade AAPL to “Sell”, looking forward to seeing the company’s Q3 FY2024 earnings release on August 1.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.