Summary:

- Apple has launched its maiden retail store in India. Drawing from its China playbook, the move is expected to ignite a new growth phase for Apple.

- AAPL’s surge has surpassed its February highs, sparking excitement amongst bullish investors. However, it has also increased its overvaluation risks markedly.

- Apple’s mixed reality device will likely be its most crucial launch in recent times.

- However, with AAPL’s valuation at relatively unattractive levels, investors have likely not baked in considerable execution risks on Apple’s strategy.

Scott Olson

Apple Inc. (NASDAQ:AAPL) bulls have continued to defy gravity, as its previous bottom in January 2023 has proved more robust than we previously anticipated.

Bottom-fishers who picked those lows deserve a pat on their backs as they assessed peak pessimism then. However, investors must note that AAPL’s valuation remains expensive and has worsened since buyers lifted AAPL past its February highs.

As a result, the bull trap or false upside breakout has been invalidated, suggesting that a re-test of its August 2022 highs ($170 to $175 levels) is in store.

With AAPL closing in fast toward those levels (implied upside of 5%), AAPL investors should consider rotating some exposure away from the Cupertino company to mitigate potential downside volatility.

We discussed in our previous update that AAPL investors face significantly higher risks even as AAPL bulls piled in, likely expecting a more robust H2CY2023 recovery in its device sales.

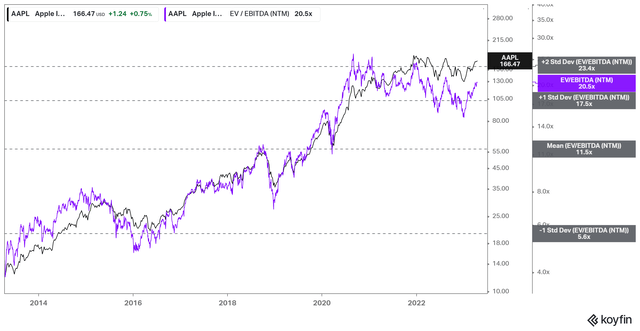

AAPL NTM EBITDA multiples valuation trend (koyfin)

However, with AAPL’s NTM EBITDA multiples hovering closer to the two standard deviation zone over its 10Y average, it’s increasingly risky to consider adding exposure.

As seen above, AAPL buyers have struggled to push its valuation higher past the 23.4x EBITDA zone since August 2020.

Still, it suggests that AAPL buyers are not concerned with recent reports highlighting that Mac sales underperformed the industry average, as consumer spending remains weak.

Investors need to consider a forward-looking outlook when considering AAPL sales, as AAPL’s January lows likely reflected these headwinds. Hence, the market had probably moved on by the time the IDC report was released.

With that in mind, Apple investors have likely priced in a more robust H2CY2023 recovery for its operating performance.

The revised consensus estimates suggest that AAPL’s topline growth should see an inflection point in FQ2’23 (results due on May 4), reaching 9.3% by the quarter ending December 2023.

China’s recent GDP release has likely spurred further optimism that a sustained recovery in H2CY2023 for the Chinese looks achievable, with economists also upgrading their forecasts.

Accordingly, China posted a 4.5% YoY growth in Q1, signaling a marked improvement from the 2.9% uptick in Q4’22. Moreover, consumer spending has continued to gain traction, up by 10.6%, suggesting that consumers have continued to spend.

Moreover, Apple’s iPhone has continued to gain share against its Android peers in China, despite still weak smartphone spending. Therefore, Apple’s premium positioning hasn’t been weakened significantly and could improve as the Chinese economic engine continues its recovery.

Apple started its full-fledged retail journey in India by opening its first Apple store in Mumbai on Tuesday (April 18), with CEO Tim Cook in attendance. Apple is leveraging smartly on its China playbook to build out its manufacturing and consumer ecosystem in India.

Apple’s nascent retail foray into India is expected to see sales reaching $20B by 2025, up from just $6B in 2022, representing a CAGR of nearly 50%, matching last year’s YoY growth.

However, investors should be careful in getting overly excited about India’s short- and medium-term prospects, given Apple’s $445B in projected revenue for FY25 (year ending September 2025).

As such, sales in India are expected to account for less than 5% of its FY25 topline, suggesting that any potential valuation upside is likely limited and already reflected.

Therefore, we believe all eyes remain on Apple’s WWDC in June 2023 as it unveils its highly anticipated mixed reality device, which could improve the adoption of the next computing platform defined by Apple.

Meta’s (META) forays into the metaverse have seen mixed results, while Microsoft (MSFT) has likely slowed down its metaverse projects while focusing on its efforts in generative AI.

Hence, Apple probably sensed a fantastic opportunity for the company to enter at the opportune time and help reinvigorate interest and potential success, even as Meta and Microsoft have not done so.

Bloomberg reported recently that Apple had upped the ante on its mixed reality device launch. Accordingly, the company “is working to build a range of software and services” in time for the launch of its first version.

Hence, Apple knows the playbook well and is leveraging it effectively to increase its device’s hype and potential success with developers.

Accordingly, consumers should expect offerings ranging from “gaming, fitness, and collaboration tools.” It will also likely feature a “new 3D interface,” allowing Apple to offer “millions of existing apps from third-party developers.”

Therefore, we believe that AAPL buyers also expect a potentially category-defining success from Tim Cook & his team as the company offers its take on mixed reality.

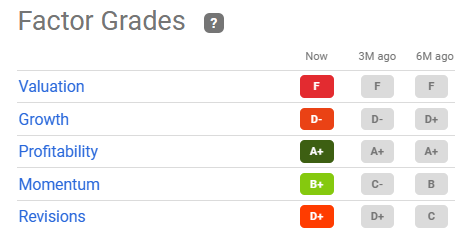

AAPL quant factor ratings (Seeking Alpha)

While Apple’s wide economic moat suggests it is expected to remain a core position in investors’ portfolios, it shouldn’t deter them from cutting some exposure and rotating.

New investors to AAPL must be extremely cautious, as Seeking Alpha’s quant ratings suggest that AAPL’s valuation is given an “F’ grade (the worst possible).

It’s also in line with our relative valuation assessment, as the execution risks of defining a new category must be considered carefully, as AAPL is expensive.

As such, we continue to encourage investors to consider rotating out, given the recent remarkable recovery.

Rating: Sell (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!