Summary:

- Apple has proven why the stock deserves its premium valuations, attributed to Tim Cook successfully carrying on Steve Jobs’ legacy.

- His crystal clear understanding of marketing strategies also fully demonstrated Vision Pro’s endless capabilities in multiple use cases, one that has oddly been neglected by META’s Quest.

- With impressive specifications and spatial experience (think Tom Cruise from Minority Report or Tony Stark from Iron Man), it has likely been designed as the next-gen computer – MacBook/ Mac Pro.

- Combined with the sustained buybacks retiring significant shares, there are many reasons why the AAPL stock remains a stellar store of value compared to the SPY and gold.

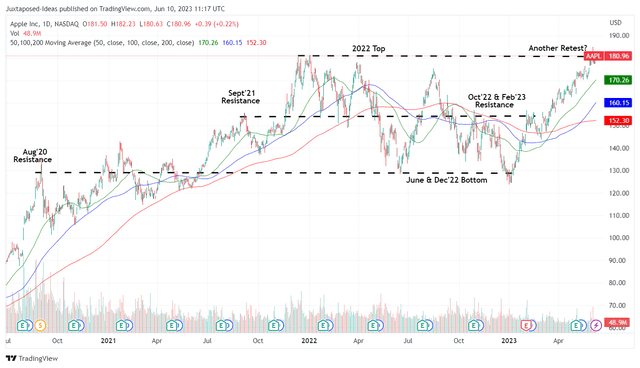

- Nonetheless, with the stock already retesting the 2022 resistance levels of $180s, we do not recommend anyone to chase the Vision Pro induced rally here.

Justin Sullivan/Getty Images News

We have previously covered Apple (NASDAQ:AAPL) in May 2023, suggesting the stock’s safe haven status against the market-wide destruction observed in the FAAMG stocks and the S&P 500 Index. Thanks to its strategic outsourcing to Foxconn, which bears the brunt of the low-margin, high-volume, and high-capex manufacturing lines, the Cupertino giant’s margins continue to expand as well.

Tim Cook Has Done Well In Fortifying The AAPL Investment Thesis

For this article, we will be focusing on AAPL’s latest product launch, namely the Vision Pro spatial headset. It goes without saying that Tim Cook has launched a revolutionary product, as Steve Jobs previously had with the iPhone in 2007 and iPad in 2010. Decades later, the smartphone is synonymous with personal devices, compared to the pre-iPhone eras of handphones or cell phones.

AAPL Revolutionizing The Personal Device Market For Good

In case anyone forgot how Nokia’s phones look like (GreenBot)

Most importantly, AAPL continues to demonstrate why it remains the market leader in the personal devices market, despite not having the first mover advantage as how Nokia has in the cell phone market or Dell/ HP in the desktop/ laptop market.

While Nokia had tried to introduce a certain form of touch screen phones then, it was apparent that the Cupertino giant had eventually been the more enduring and successful one. The latter revealed an entirely new user interface, while revolutionizing the device experience through the iPhone, one that we are already envisioning with Vision Pro.

We will not be boring the readers with another rehash of the spatial headset’s capabilities, which have been expounded by AAPL in their promotional video, or well-painted by a fellow SA contributor here. Either way, the bottom line is clear to us, Tim Cook has finally proved why he was appointed by Steve Jobs then, aside from the stellar supply chain management.

Through Vision Pro, Steve Jobs’ ideology of “Simplicity is the ultimate sophistication” has been exemplified indeed, given how intuitive the user experience will be as the next generation of computers – another extension of the original iPhone playbook.

Naturally, AAPL’s spatial headset marketing video sustains the very same elegant solutions that the founder has always been championing, due to its choice to go with natural gesture tracking instead of game-like controllers.

We believe the Vision Pro’s best selling point is the fact that the Cupertino giant has been able to successfully demonstrate the headset’s Spatial Computing Platform across its target audience at the most awaited annual company event, with the video already garnering an impressive 45M views over the past six days.

It is apparent that Tim Cook and his team have been able to create the necessary hype for the spatial headset, easily proving why AAPL is able to remain at the top of the game.

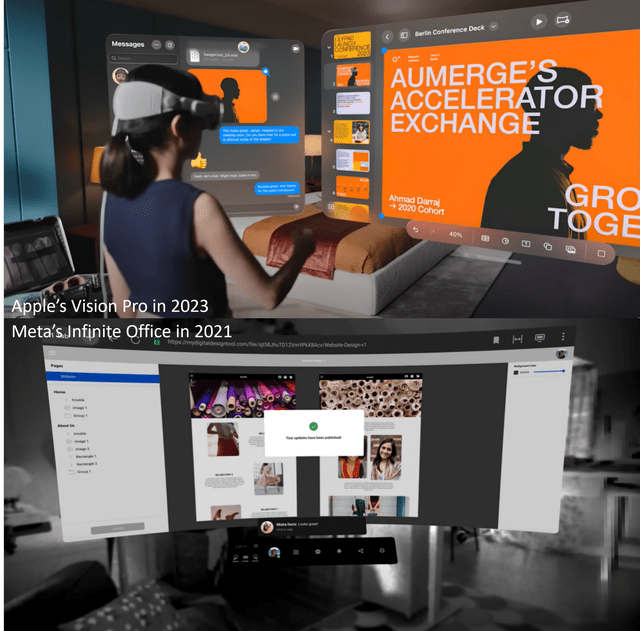

AAPL & META’s Similar Offerings, But Different Marketing Strategy

On the other hand, Meta (META) has handled its marketing poorly, in our view. Instead of going with a similarly compelling Quest and Metaverse marketing video during the 2023 Super Bowl, the advertising company chose to go with ambiguous commercials, leaving the audience with minimal takeaways. This marketing strategy is odd indeed, since the Super Bowl is an excellent platform with 113M in viewership.

In addition, the Infinite Office marketing material that actually demonstrated a similar work, live, and play cadence for the Quest VR headset was not strategically announced, naturally relegating the headset’s capabilities to an unknown abyss for the past two years. This underwhelming approach is exacerbated by individual reviewers that provide comparatively deeper and more valuable insights.

This cadence proved that AAPL is highly effective in communicating the Vision Pro’s computer capabilities to the target audience and market analysts, while going premium with its display quality and specifications to enhance the headset’s potential use cases in professional and retail settings.

With Tim Cook leading the company, Steve Jobs’ legacy has been carried on after all, while proving that the first-mover advantage is nothing to boast about.

While many naysayers have contested AAPL Vision Pro’s battery life of 6,500 mAH, we must also highlight that the very first iPhone only had a battery capacity of 1,400 mAH, with the iPhone 15 expected to boast up to 4,323 mAH.

While it may not be directly related, the very first EV introduced by Tesla (TSLA) in 2008, Roadster, only came with a 53 kWh lithium-ion battery pack with a range of 245 miles on a single charge. By now, the Austin automaker has introduced its proprietary 100 kWh ONE pack with a range of up to 752 miles on a single charge.

It is clear that AAPL will eventually improve Vision Pro’s battery life moving forward, due to the advancements in battery technology thus far. We suppose the headset may also be smaller in size while being lighter, with the current offering only being the first launched iteration.

The spatial headset is also priced with profit in mind, obviously, at an eye-watering price tag of $3.49K, compared to Meta Quest 3 at $499.99 or Quest Pro at $999.

Then again, with the impressive specifications and tactile experience (think Tom Cruise from Minority Report or Tony Stark from Iron Man), it is evident that AAPL has designed Vision Pro as the next-gen upgrade from the MacBook/ Mac Pro and Personal Computer, instead of just a gaming headset as that of Meta’s Quest.

It is also no accident that the Cupertino Giant has grown its gross margins tremendously from 37.8% in FY2019 to 43.2% in the last twelve months [LTM]. The same cadence has been observed in its operating margins from 24.6% to 29.2%, and net income margins from 21.2% to 24.5% at the same time.

The premium branding has naturally improved AAPL’s Free Cash Flow margin from 22.6% to 25.3% as well, triggering a cash flow generation of $97.49B by the LTM (-7.8% sequentially).

While we generally prefer a deleveraging cadence from the excellent cash flow, the Cupertino Giant has opted to maintain its long-term debts at $97.04B compared to $91.8B in FY2019, while also depleting its balance sheet to $55.87B. The latter is nearly half of the $100.55B reported in FY2019.

Then again, the silver lining is that the AAPL management has opted to pour $365.54B into its share repurchase programs since FY2019. This cadence allowed a retirement of 2.96B shares or the equivalent of -15.7% to 15.84B (-3.4% YoY) by the latest quarter. This is on top of the $61.35B paid out in dividends.

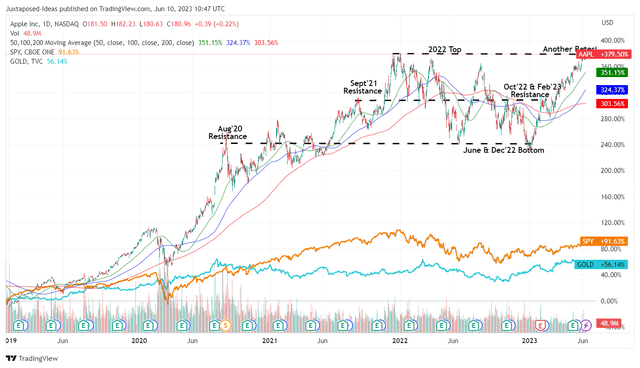

AAPL 5Y Stock Returns Including Dividends

While many may disagree with their capital allocation, no one can deny the fact that AAPL has been shareholder friendly thus far, significantly aided by the stellar total stock returns of +379.50% since early 2019 (including dividends), compared to the SPY at +91.63%.

In addition, due to the outperformance compared to Gold’s appreciation of +56.14% at the same time, we continue to hold our belief that the stock remains a stellar hold of value no matter the bull or bear markets.

With an initial Vision Pro sales target of 500K units in 2024, we are already looking at a potential top-line contribution of up to $1.75B, naturally boosting AAPL’s bottom line, assuming a similar gross margin as its other offerings.

While the sum may seem negligible compared to its revenues of $385B over the LTM, we believe the spatial headset may herald a new era for the company’s offerings, especially due to the multitude of new apps launched by market developers and the highly symbiotic iOS ecosystem.

The App Store remains a significant revenue driver as well, since AAPL maintains its 30% commission, with the ecosystem facilitating $1.1T in billings and sales in 2022. This is on top of the iOS commanding 67% of the global app consumer spending in 2022, generating app and game revenues of $86.8B then.

AAPL 10Y EV/Revenue, Market Cap/ FCF, and P/E Valuations

Given the dual-pronged strategy in hardware breakthroughs and the iOS software ecosystem, the premium embedded in AAPL’s valuations is justified, in our opinion. The stock is now trading at NTM EV/ Revenues of 6.99x and NTM Market Cap/ FCF of 27.84x, compared to its 5Y mean of 5.07x and 22.04x, respectively, or 1Y mean of 5.92x and 23.49x, respectively.

Then again, there appears to be a minimal margin of safety for adding here, against our price target of $188.73, based on the elevated NTM P/E of 28.77x and market analysts’ FY2024 EPS projection of $6.56.

AAPL 2Y Stock Price

Combined with the +35.64% rally since our previous Buy article, we prefer to rate AAPL stock as a Hold here. The stock is also testing the 2022 top of $180 at the moment, potentially signaling more volatility in the near term. As a result, we do not advise investors to chase the Vision Pro spatial headset rally here, since the exercise naturally increases the dollar cost averages.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, TSLA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.