Summary:

- Apple is surely a great company renowned for its brand.

- The company is in a pretty good financial position. Its sales and profits have been rising for a while.

- AAPL stock is somewhat overvalued and close to its 52-week highs.

- I will explain why this stock will be a buy after the great correction I am afraid will come soon enough.

Scott Olson

Apple (NASDAQ:AAPL) stock is Warren Buffett’s favorite. The corporation is the most valuable one in the world, not just the US. A lot has been written about the high-tech sector’s correction. But AAPL stock has stayed almost intact. Sure, the company is highly profitable and influential and therefore very popular among investors. Yet, I am not particularly bullish on it as of the time of writing. For me to buy its stock, AAPL has to substantially decrease in value. But I am sure it would happen soon enough thanks to the broader correction expected.

Apple’s news

Although it might seem that Apple is quite a saturated company thanks to its long operational history, the Cupertino-based business is still expanding by opening new stores. For example, it was recently announced Apple would open its first official store in Mumbai, India.

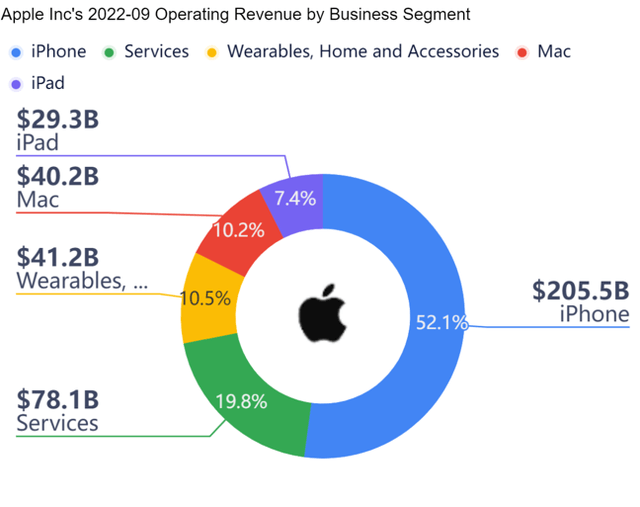

At the same time, the company’s market position is also very resilient. Many analysts argue that one of the reasons why Warren Buffett’s Berkshire Hathaway actually bought the stock and has been holding it for years is because of its market share. Well, it is still high and not decreasing. Particularly noteworthy is the fact Apple’s market share in China is rising in spite of the tensions between the US and China. For the past 12 months, the Cupertino-based company’s market share increased by 3%. Apple’s key customers are teenagers. Some research was done on the most popular smartphone brands. 87% of respondents in their teens said they owned an iPhone. In spite of the very strong competitors, including Samsung (OTCPK:SSNLF) and Huawei, it still remains a question of prestige to own an iPhone. This is quite an achievement because more than 50% of Apple’s sales are due to iPhones. I will explain this point in some more detail later on.

Apple’s fundamentals

The corporation’s fundamentals seem to be sound, overall.

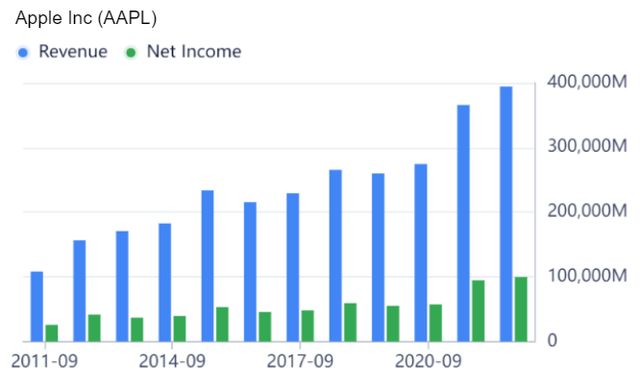

I decided to have a look at Apple’s annual revenues and its net earnings history first. Particularly good in terms of sales and profits seem to be the last two years, namely 2022 and 2021. Compared to the 2020-2022 period the company showed moderate, yet very steady growth. In my view, the recent couple of years of substantial growth was largely due to the large amounts of money printed by the leading central banks all over the world, most notably the Fed and the ECB, to support the aggregate demand in their economies. Some of the money was also distributed among the citizens as unemployment benefits and other forms of social welfare, which also enabled many people to buy various consumer goods, including iPhones.

However, the pandemic-related demand surge might not last for a while since the Fed is tightening and a recession is likely to be near. I do earnestly believe Apple will do relatively well thanks to its financial soundness and the great brand but the sales growth might slow down somewhat.

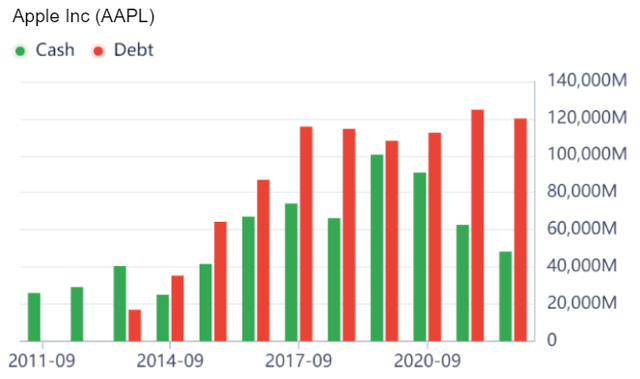

The cash-debt position, however, is not as good as it used to be several years ago. The company used to be virtually free of debt compared to where it is now. But Apple is expanding after all and cannot afford to have lots of idle cash.

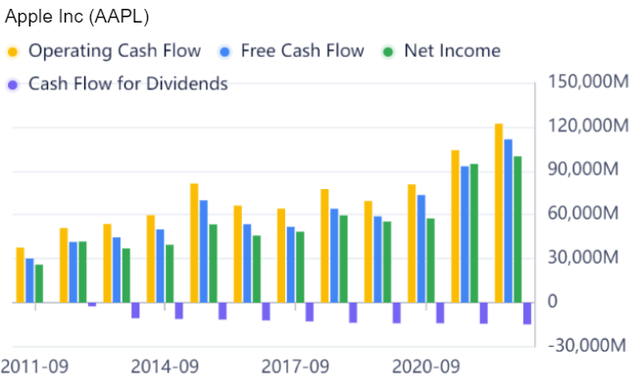

The good thing for Apple is its growing operating cash flow. It was over $122 billion in 2022. The steady growth trend also inspires optimism.

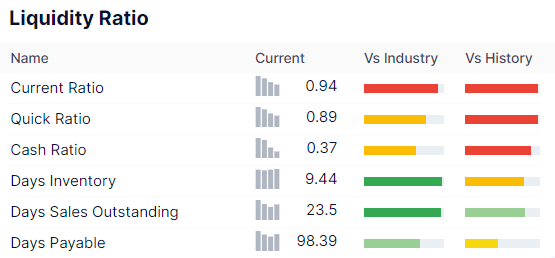

The short-term cash position, however, is not brilliant, indeed. The cash ratio, the quick ratio, and even the current ratio is all less than 1, which is not very healthy.

GuruFocus

One might say that Apple is not diversified enough since more than half of its operating revenues are due to iPhones. But in fact, I think it is even an advantage of Apple, given the iPhone’s popularity and desirability, especially in developing countries. The company is actively expanding its operations in India and other developing countries where consumer incomes are rising.

AAPL stock – valuations

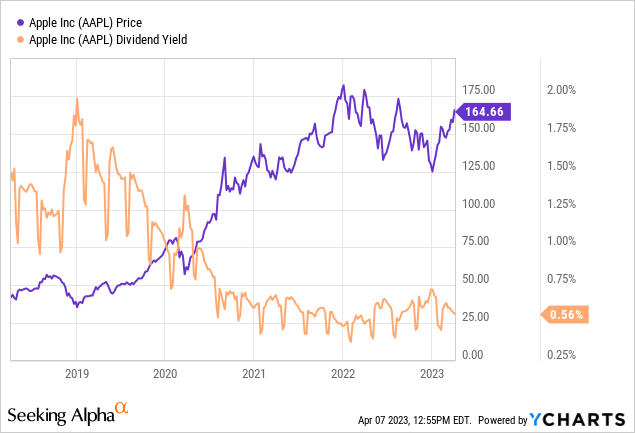

To start with, AAPL is lingering near its 52-week high. The corporation’s stock is not particularly volatile though. Its beta is about 1, which is quite good for a high-tech company.

I wish I was wrong. But it is highly likely we will have a full-scale recession soon enough thanks to the Fed’s hawkishness and the already high interest rates. So, the sales growth between 2020 and 2022 will most probably not endure since we won’t have as much cheap money available.

But the valuations assume the opposite is true.

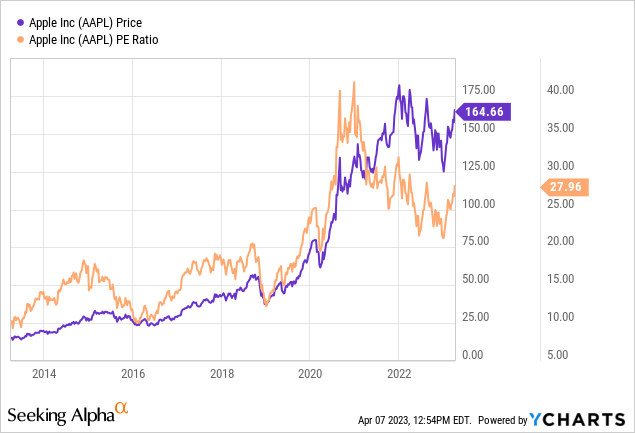

Overall, Apple’s price-to-earnings (P/E) ratio is not too high for a popular high-tech company. After all, in 2021 the corporation’s P/E used to be over 40. But still, the entry point could have been much better.

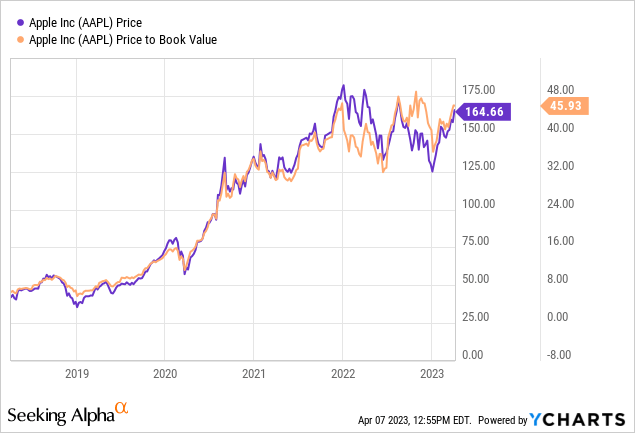

But Apple’s price-to-book (P/B) is almost 46. A standard P/B is normally between 1 and 3. It is understandable for Apple’s to be somewhat higher than that. But 46 is still far too high, indeed.

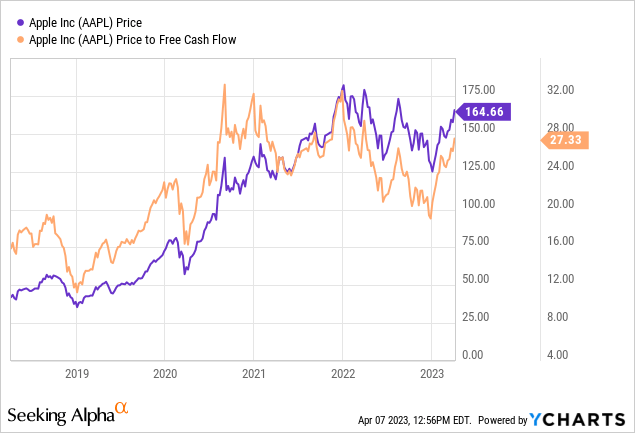

Apple’s price-to-free cash flow ratio is also somewhat elevated right now. Ideally, it should be below 10. Apple’s is higher than that.

Apple is a champion when it comes to dividend stability. Yet, a yield of less than 1% is not too attractive and also suggests some overvaluation.

So, we can say Apple’s stock is quite expensive, given the high interest rates.

Risks

The biggest risk, in my view, is that of the stock’s overvaluation. The corporation is far too popular and AAPL’s margin of safety is not particularly brilliant right now. As I have mentioned before, the high-tech sector has suffered hard times in 2022. At the same time, in spite of higher recession risks in 2023, the Nasdaq index has almost erased all losses. The same applies to Apple. True, it is one of the most stable and profitable companies in the US. But it is still overvalued.

More than half of Apple’s revenues are due to iPhones which can easily be considered to be luxury items. Now that a recession seems to be near Apple’s sales might not show brilliant growth, which will obviously affect both the company’s profits and its stock price. Consumers might prefer cheaper Chinese smartphones instead. Yet, as opposed to other companies, Apple’s position still seems to be firm.

The only thing I am saying is that I would wait for the next stock market correction to buy AAPL.

Conclusion

AAPL stock is sound by all means. Although I still think the high-tech sector is not worth much attention from investors right now, Apple is an exception thanks to its consistent profits, cash flows, stability, and long operational history. But due to a likely recession in the near future, the stock should be bought somewhat later and certainly not near its all-time highs.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.