Summary:

- Despite the upside risks to my Sell rating, I remain bearish on Apple and expect a break of the current trend, as I believe the stock’s rally has no legs.

- In Q2 FY2023, Apple was able to “slightly” positively surprise the market precisely because of the cost reduction [better margins].

- The potential reduction in spending activity and the expansion of savings should lead to a decline in sales and thus in the margins and EPS for Apple shortly.

- Analysts predict high multiples and sales in FY2024, but even with these projections, the upside potential of 5-14% is considered too low to justify the risk, in my opinion.

- I don’t recommend buying Apple stock at current levels. For existing shareholders, I recommend selling covered calls.

BrianAJackson

My Updated Thesis

On April 27, 2023, I published an article previewing Apple Inc’s (NASDAQ:AAPL) financial results for the second quarter of fiscal 2023, in which I anticipated that the company’s cost optimization would show the first signs of completion and that it would be difficult for the company to maintain margins against the backdrop of a deteriorating macroeconomic environment – so I expected Tim Cook to issue relatively gloomy guidance, causing AAPL stock to fall under the weight of its overvaluation.

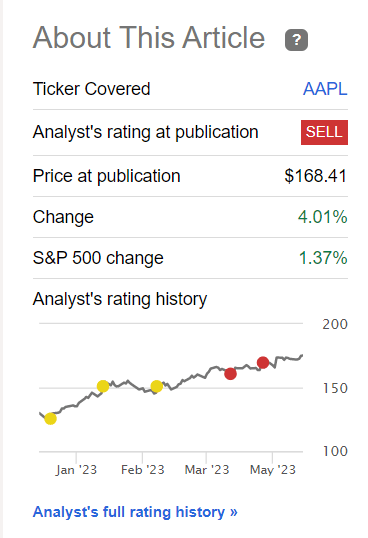

Although AAPL has proven to be one of the slowest-growing stocks [among FANGMAN companies] since the end of April, it has still gained more than 4% since the publication of my last article:

Seeking Alpha, my previous take on AAPL stock

Even though AAPL stock has so far performed contrary to my thesis, I’m in no hurry to upgrade my Sell rating – I remain convinced that the stock is obviously growing for non-fundamental reasons and that the rally we’ve seen lately has no legs and offers potential buyers limited upside in the medium term. Let me explain.

AAPL’s Q2 FY2023 Actual Results

Apple Inc. saw a 4.69% rise closing trading on May 5, 2023, after surpassing expectations in its fiscal 2Q FY2023 earnings report. Constant currency sales increased despite a 2.5% decline in revenue due to currency headwinds. iPhone revenue grew 2% and exceeded forecasts by $2.5 billion, while Mac revenue declined by 31% in line with the PC market. Services revenue reached a new high, growing by 6%. Apple’s management announced a 4% increase in its dividend and authorized an additional $90 billion for share repurchases.

While weak consumer demand for edge devices and high inventories affect Apple’s fiscal 3Q23 outlook [as I initially expected], the company continues to outperform the market. Argus Research wrote in its post-earnings note [proprietary source], that Apple shows potential for growth in smartphones, wearables, services, and other areas. With a base of over 2 billion active devices, including one billion iPhones, Apple maintains a competitive advantage.

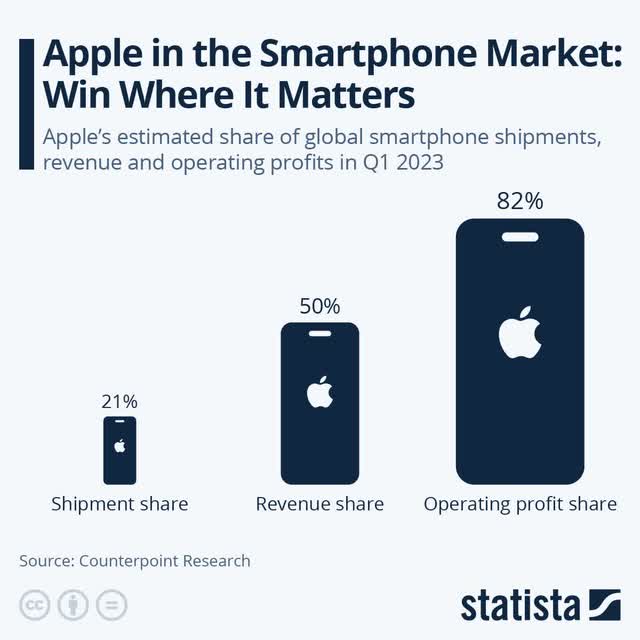

Concerning particular business segments: iPhone revenue increased by 1.5% as Apple shipped around 55.5 million iPhones, maintaining a 20.5% market share in smartphones. The average selling price [ASP] for iPhones rose to $925, and Apple deliberately differentiated features between iPhone 14 models to attract users across different price points. Mac revenue declined by 31%, similar to the PC market, while iPad revenue fell by 13% annually and 31% sequentially due to economic softness and production constraints. Services revenue reached an all-time high of $20.9 billion, driven by growth in various services and over 975 million paid subscriptions.

In general, Apple was able to “slightly” positively surprise the market precisely because of the cost reduction – this can be seen from the comparative analysis by Goldman Sachs [proprietary source], which was published immediately after the release of the company’s quarterly report:

Goldman Sachs [May 04, 2023], proprietary source![Goldman Sachs [May 04, 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/5/22/49513514-16847284831188004.png)

The company reported gross margins of 44.3% for the March quarter, the highest in a decade, and guided gross margins for the June quarter to be between 44.0% and 44.5%. The guidance is higher than Morgan Stanley’s prior forecast of 44.1% [proprietary source] and is driven by more favorable commodities costs, logistics costs, and product mix. However, foreign exchange is expected to be a headwind. Inventory on the balance sheet increased by 10% QoQ due to Apple’s strategic pre-purchasing of components. Despite an expected 230 basis point YoY headwind in FX for the June quarter, Apple is confident in reaching mid-46% gross margins by the September/December quarters, MS reports.

If Everything Is This Good – Why Am I Bearish?

There are several reasons why I remain bearish on Apple. And the first one of them is the demand side’s current condition.

A decline in consumer demand for Apple’s products and services is a real risk I’ve been writing about since late 2022. Apple relies heavily on consumer purchases, particularly for iPhones, which accounted for over 50% of its revenue in FY2022. Any weakening in the macroeconomic environment could result in reduced demand for Apple’s products and services – factors such as longer replacement cycles and improved product durability could negatively impact the demand for upgrades.

Unfortunately, it’s difficult to assess the demand side of companies with broad moats like Apple – consumers of such companies’ products are too loyal to predict their actions amid macro turbulence. But despite its loyal customers, Apple is still subject to mood swings that are sometimes very difficult to gauge. There are several indirect signs I’d like to draw your attention to – one of which is consumers’ plans for using their tax refunds:

AlphaWise by Morgan Stanley [May 8, 2023], proprietary source![AlphaWise by Morgan Stanley [May 8, 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/5/22/49513514-16847297479420538.png)

Why does this matter? I don’t mean at all that tax refunds somehow directly affect purchasing power – again, it’s an indirect sign of what moves people. If the desire to “put money aside for a rainy day” is growing – the growth of the inflows into savings – I think that speaks volumes. First off, it means that less money is flowing into the real economy, especially for price-elastic goods like iPhones, Macs, and so on. The reduction in spending activity and the expansion of savings lead to a decline in sales and thus in the margins and EPS.

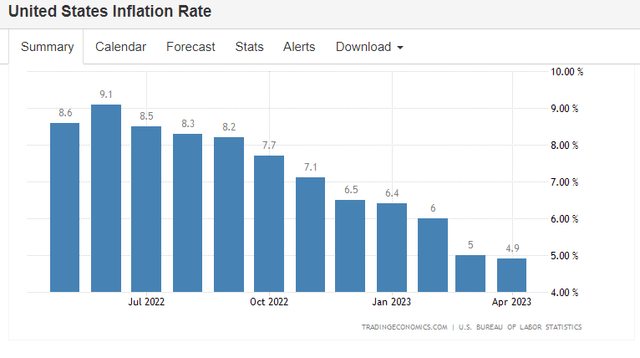

Another indirect sign of weakening demand is falling inflation. In case you didn’t know: in financial theory, lower inflation often indicates a weaker economy and can lead to a decline in consumer spending – when consumers are reluctant to spend or cut back on purchases, businesses see lower sales, leading to a decline in revenue and profitability.

And at this point, everyone is happy that inflation is falling very fast – according to some forecasts, it should reach 3% by 2024.

This coincides well with what Morgan Stanley’s AlphaWise team conclude based on their survey of ~2,000 consumers in the U.S. from April 28 to May 1: consumers are cutting back on discretionary spending, particularly on consumer electronics, leisure activities, household appliances, and restaurant visits. Groceries are the only category in which low- and moderate-income individuals plan to spend more in the next 6 months. They don’t plan to spend more on services. High-income consumers have positive spending intentions on travel, the only service category, and food is the only goods category with positive spending intentions. Interestingly, the high-income group’s spending intentions for eating out/leisure services are negative this month.

At this point, I’d like to refer once again to Morgan Stanley’s report that recommends buying AAPL shares based on its Q2 results:

Morgan Stanley [May 04, 2023], proprietary source![Morgan Stanley [May 04, 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/5/22/49513514-16847312763304012.png)

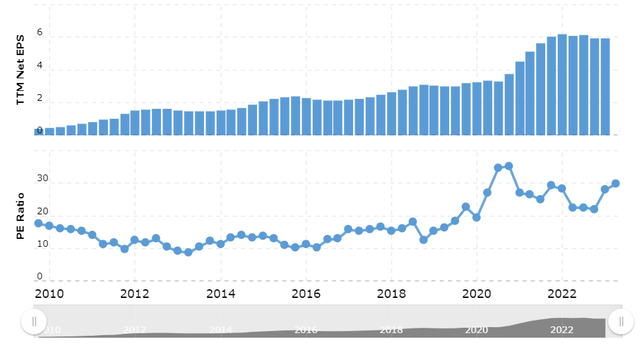

As you can see, the bank is assuming a very generous price-to-earnings ratio of 25.5x for FY2024 – and this generous forecast represents only 5.61% of the closing price on May 19. And this against the background that the current P/E ratio is close to its local and historical highs:

Another investment bank sees a 12-month price target of $200, which implies 14.2% growth from the last closing price. At the same time, EV/EBITDA for FY2024 should be 18.4x – so no significant decline in the multiple is expected.

Goldman Sachs [May 04, 2023], proprietary source Seeking Alpha, AAPL, Charting![Goldman Sachs [May 04, 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/5/22/49513514-1684731738880301.png)

This state of demand and its likely decline that I wrote about above is permanent – it doesn’t occur all at once, and the actual change in consumer behavior is somewhat lagging behind the indicators we’re watching for. So the 11% YoY revenue growth in FY2024 predicted by Morgan Stanley’s tech team differs from the findings of another study by the bank [AlphaWise], which suggests that Apple’s revenue decline could last longer than currently priced in.

Morgan Stanley [May 04, 2023], proprietary source![Morgan Stanley [May 04, 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/5/22/49513514-16847322116981578.png)

Therefore, I don’t believe that the current risk-reward ratio is on the side of the buyers with a close-to-high valuation of the company.

The Bottom Line

As last time, I must again warn of the risks to my thesis. First, the strong rally in technology companies that we have been seeing since early 2023, although it looks very unstable now, has every chance of lasting until the end of this year and perhaps even longer. No one knows exactly when the inflated valuation multiples will burst [if they’ll burst at all], so I’m not trying to time the market at that particular point – I’m just arguing that the risk-reward ratio looks unfavorable at this point. Even the bulls’ targets of 5-14% of upside potential look bleak amid all the challenges we’ll likely face ahead. The second risk to my thesis is Apple’s phenomenal resilience. I have to give management credit – they’re doing a great job of keeping such a large company alive and running despite the headwinds. From a strategic standpoint, I’m not bearish on Apple stock, as I believe the company is the best in its niche. Tactical positioning may lose to strategic positioning this time as well – my thesis isn’t immune to such an outcome of events.

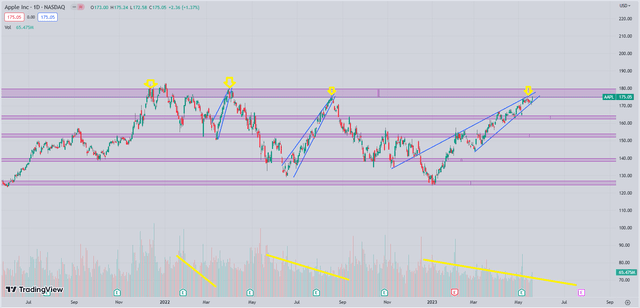

However, despite the upside risks to my thesis, I remain bearish on Apple and expect a break of the current trend, as I believe the stock’s rally has no legs.

Shared by @blakestonks on Twitter

I don’t recommend buying Apple stock at current levels, and for existing shareholders, I recommend selling covered calls – an options trading strategy in which an investor who owns the underlying asset (e.g., stock) sells call options on that asset.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!