Summary:

- Apple has reached a record market capitalization of over $3 trillion, solidifying its position as a global industry leader due to its innovative products and customer loyalty.

- The tech giant has entered the “buy now, pay later” market with its Pay Later service, raising concerns about potential harm to customers’ financial health and regulatory scrutiny.

- Despite long-term concerns about inflation, interest rates, and consumer purchasing power, Apple’s short-term outlook remains bullish, with potential future ventures in artificial intelligence.

Scott Olson

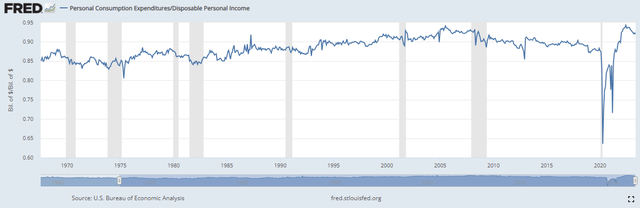

With a new all-time high, Apple Inc. (NASDAQ:AAPL), the technology behemoth, has claimed the crown of the world’s highest market capitalization ever at $3 trillion plus, a testament to its unwavering dominance in the global market. With a track record of innovation, relentless customer loyalty, and a diverse product portfolio, Apple has solidified its position as an industry leader and has captured the hearts and wallets of consumers worldwide, driving its market cap to unprecedented heights. Of the smartphone users in the United States, it is estimated that approximately half use Apple’s iPhone as their product of choice and that number has continued to grow over the years.

Apple iPhone Smartphone Market Share (Statista)

Apple has capitalized on their easy access to consumers through smart devices by establishing a robust ecosystem, including its App Store and services like Apple Music and iCloud, that has created a substantial recurring revenue stream. While the company has been in the finance game for a few years since the launch of the Apple Card in 2019, Apple has decided to take it a step further.

In March, Apple announced its entry into the “buy now, pay later” (BNPL) market with its Pay Later service integrated into Apple Pay and Apple Wallet. While Apple emphasizes that the service is designed with users’ financial health in mind, BNPL practices have attracted scrutiny from regulators concerned about potential harm to customers. The Pay Later service allows users to make a purchase with Apple Pay and repay it in four equal installments over six weeks, with no interest or late fees. BNPL services, on the surface, appear harmless, offering an easy way to pay for big purchases in chunks. However, reports suggest that 30% of users struggle to make their BNPL payments, with some prioritizing these bills over essential expenses like rent and utilities. BNPL services have also been linked to larger purchases, with consumers using them to buy fashion items and other nonessential goods. Concerns have also been raised about overdraft fees and the potential inclusion of BNPL loans on credit reports. The rise of BNPL services has led to increased scrutiny from government watchdogs globally, with investigations and regulatory policies being introduced to address issues such as accumulating debt and data harvesting. Apple’s entry into the BNPL market with Pay Later poses risks to both consumers and competing businesses, given its vast user base and influence. Some argue that attaching a potentially risky service like BNPL to Apple’s brand conflicts with the company’s stated commitment to doing the right thing for customers.

Apple is new to the BNPL game having just launched, but others like PayPal started years ago. And after only 3 years of offering the service, PayPal has reached a deal with Private equity firm KKR for them to acquire a significant portion of PayPal’s buy now, pay later (BNPL) loans in Europe, with the deal estimated to be worth up to 40 billion euros ($43.71 billion). Despite the popularity of BNPL services, the sector faced challenges last year due to rising interest rates and inflation, impacting consumer purchasing power. The announcement of the deal led to a 1.7% increase in PayPal’s shares. The transaction is expected to generate approximately $1.8 billion in gross proceeds and is set to close in the second half of the year. After the deal’s completion, PayPal plans to allocate around $1 billion to incremental share repurchases in 2023. The move is seen as positive for payment processors, as it reduces credit risk and mitigates uncertainty surrounding the future performance of BNPL offerings.

So it is positive news for PayPal that it offloaded BNPL loans, but Apple has climbed to new all-time highs after launching its service? Sure, this rally has nothing to do with BNPL and is pumped by the AI hype, but the risks to BNPL are risks to Apple (and the US economy as a whole) as there is a troubling trend in the relationship between real disposable income and personal consumption expenditures and the capital allocated to mitigate loan risk could be better used elsewhere like PayPal repurchasing shares.

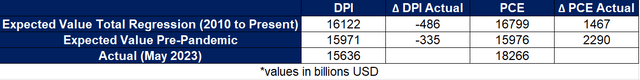

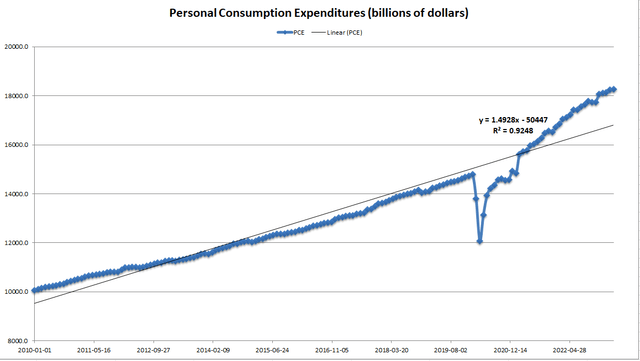

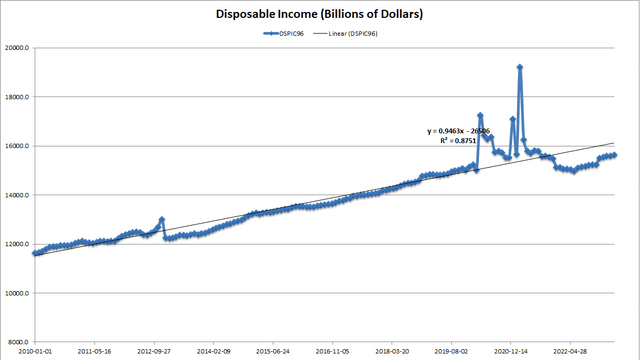

I took the Real Disposable Personal Income (DPI) data and the Personal Consumption Expenditures (PCE) data from the FRED site (Federal Reserve Economic Data) and plotted in excel to fit a linear regression trend line. Detailed definitions and explanations of DPI and PCE can be found from Investopedia, but the quick summary is DPI measures how much money an individual or household has after taxes and PCE is a measurement of consumer spending and is a significant driver of GDP.

FRED PCE Data Input to Microsoft Excel FRED DPI Data Input to Microsoft Excel

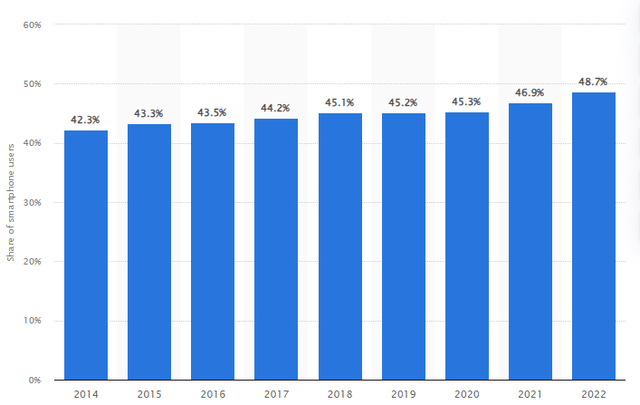

PCE is well above its trend from 2010 to present which could be pumping the economy while disposable income is below leading to questions about this rally’s sustainability. I also ran a trend line from January 2010 to December 2019 to get a regression equation without any pandemic interference. I found that actual DPI as of May 2023 was -335 to -486 billion below expected value based on the historical data and that actual PCE for the same time period was 1,467 to 2,290 billion above expected value.

The ratio of PCE to DPI is also historically very high as shown below but has declined since last year. The grey highlights indicate recessions and are typically preceded by a declining PCE/DPI ratio. A mean reversion in the coming years for expenditures could be a drag for the economy, but hopefully wages rise and DPI can mean revert as well to help keep PCE strong. These are strange economic times indeed with the pandemic interrupting the normal ebb and flow like never seen before but it is hard to see how consumer spending is sustainable while being such a high percentage of DPI.

While viewed as a necessity by most and deeply entrenched in many people’s daily life, Apple products and services are not immune to declining consumer spending. In April 2023, consumer spending declined by more than 3 percent compared to the year prior. New iPhone models topping a $1000 will not fly off the shelves like in years past if DPI stays suppressed and has me worried about Apple’s venture into the BNPL segment.

But there is more to BNPL than meets the eye. The real strength of all the big tech companies is in their data harvesting and usage. With a constant monitoring device on millions of people around the globe, Apple has insights into consumer’s habits that give it a competitive advantage. The Consumer Financial Protection Bureau is currently investigating BNPL companies, including Klarna, Zip, Afterpay, Affirm, and PayPal, citing concerns about “accumulating debt, regulatory arbitrage, and data harvesting in a consumer credit market already quickly changing with technology.” Apple even referenced data harvesting during the 2019 launch of its Apple Card.

Apple Card delivers new experiences only possible with the power of iPhone, including reaching support 24/7 by simply sending a text from Messages. To help customers better understand their spending, Apple Card uses machine learning and Apple Maps to clearly label transactions with merchant names and locations in Wallet,5 and provides weekly and monthly spending summaries.

What has fueled the big tech hype machine this year? Artificial Intelligence…and what needs a lot of data to be effective? You probably guessed it…Artificial Intelligence. I do not know what Apple has planned but they always seem to be ahead of the curve so this BNPL adventure may have a tie-in to something far more important in the future. While I do not like Apple’s financial services expansion and exposure to default risk, especially as others are reducing BNPL loan exposure, I have faith their leadership team has something bigger in mind.

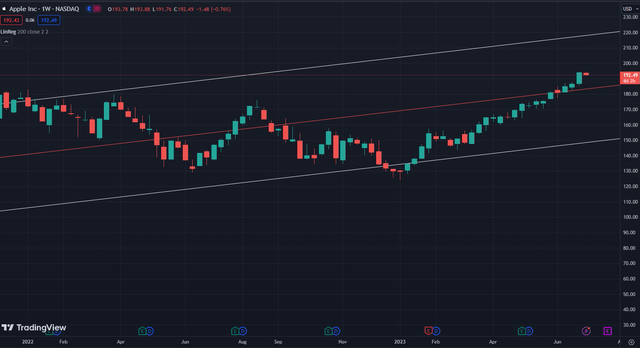

The effects of inflation, interest rates, and consumer purchasing power are long term concerns especially as Apple expands its financial division. However, the short term outlook is still bullish and we are talking about a stock that just hit a new all-time high. Below is a weekly chart with a 200 week linear regression channel with bands at plus/minus 2 standard deviations.

Apple Weekly Stock Chart (Tradingview)

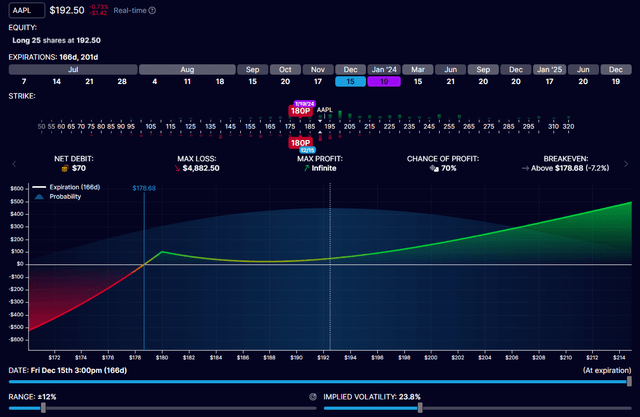

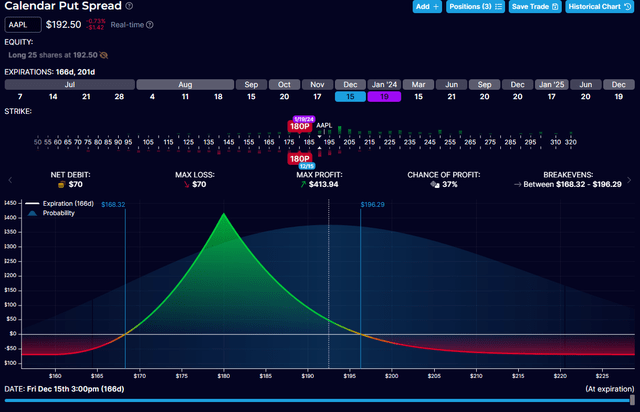

Even at a new all time high, the price is still well within the channel and shows room to expand to the $220 level. I am at more of a hold level right now as there is something psychological about buying after a huge price run-up so my trade idea is to add some downside hedging by buying shares and adding a calendar put spread going out to the end of the year. It is only a $70 debit to get a December 2023/January 2024 $180 put calendar spread and this hedge gives you downside and volatility coverage as calendar spreads are positive vega instruments (i.e. value increases with higher volatility). Below images shows the put calendar spread with 25 shares profitability estimate and the calendar spread alone. As always, options calculators have their limitations and are typically a bit idealistic on calendar spreads, but the $180 price action area has been a strong area for Apple so any downside should run to this point possibly stall or bounce giving you a window to exit your long position with a minimal loss or small profit if the timing works out just right if sentiment changes towards the end of the year.

Trade Example

BUY 25 Apple shares

SELL TO OPEN $180 PUT December 2023 Expiration

BUY TO OPEN $180 PUT January 2024 Expiration

Apple Long 25 Shares Plus Put Calendar Spread (OptionStrat) Apple December 2023/January 2024 Put Calendar Spread (OptionStrat)

Apple’s ascent to a market capitalization exceeding $3 trillion is a testament to its unparalleled dominance in the global market. The company’s history of groundbreaking inventions, unwavering customer support, and wide-ranging product portfolio has propelled it to the forefront of the industry, captivating consumers globally and solidifying its position as a market leader. While the introduction of Apple’s Pay Later service into the “buy now, pay later” market may seem like a natural progression, concerns persist around BNPL practices and their potential impact on consumers’ financial health. As Apple expands its financial division, the effects of inflation, interest rates, and consumer purchasing power become long-term concerns. Nevertheless, with its vast ecosystem and access to consumer data, Apple holds a unique advantage that may pave the way for exciting future ventures, particularly in the realm of artificial intelligence. In the short term, Apple’s stock continues to thrive, buoyed by its recent all-time high. However, as it steps into the BNPL space and explores new horizons, the company must navigate carefully to uphold its commitment to doing the right thing for its customers and shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.