Summary:

- As one of the most popular companies in the world, investors in Apple need to look behind the flux of contradicting news and analyses.

- Behind the noise, lies Apple’s unstoppable ecosystem business model, standing on the foundation of 2 billion active devices installed base which doubled in 7 years.

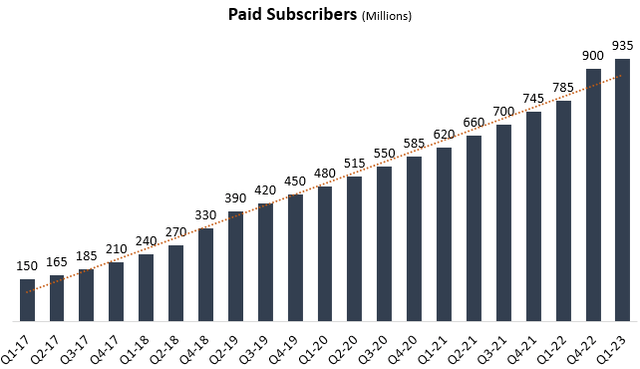

- With App Store, AppleCare, Apple Pay, Apple Music, Apple TV, cloud, gaming, podcasts, and fitness, Apple has the highest number of paid subscribers in the world, at 935 million.

- Apple is trading at what seems like a high multiple compared to its historical average. However, as services are now 20% of the company, I find the premium justified.

- I rate Apple a Buy, with a fair value estimate of $179 per share, reflecting an 11.2% upside.

Scott Olson

Apple Inc. (NASDAQ:AAPL) is one of the most popular companies in the world. As such, investors in the company are fluxed with contradicting news and analyses on a daily basis. Behind the noise, lies Apple’s unstoppable ecosystem business model. As the largest producer of free cash flows in the market, Apple now has an active device installed base of over 2 billion, and it’s the largest consumer subscription company in the world, with over 935 million paid subscribers. Although the company trades at a 27.6 P/E, which is higher than its 5-year average, as the services portion of total revenues continues to grow, I find the higher multiple justified. I rate the stock a Buy and estimate Apple’s fair value at $179 per share, which represents an 11.2% upside compared to its price at the time of writing.

Introduction

Apple is the largest company in the world and the only one to ever surpass the $3T market cap threshold. Apple’s ecosystem approach is based on the notion that its hardware is of such high quality, a customer’s engagement with one product will pull him into becoming a customer of many more products and services.

We can’t argue with the fact that this is the most successful company in the world. As such, this empire is the center of many investor debates and a regular topic in financial headlines.

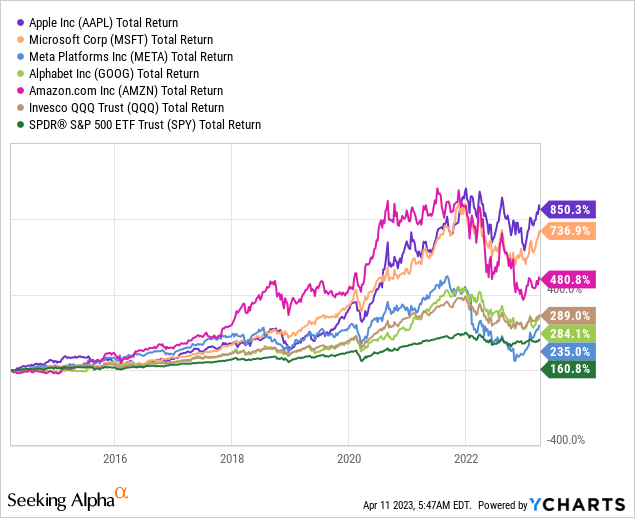

result – lifetime customers, sticky demand, immense pricing power, and a lot of upside for investors. Unsurprisingly, Apple has handily beaten down its other big-tech rivals and the overall market.

A common saying among long-term investors is that you shouldn’t sell a company based on one quarterly report, just like you shouldn’t sell a stock just because it went down or up, or because of the occasional bad headline. However, it’s easier said than done. As I’m writing this article, Apple’s stock declined by 1.6% at least in part because of a 3rd-party assessment that Mac sales dropped 40.5% year-over-year in the first quarter of 2023.

When it comes to Apple, I believe investors should not be selling even based on one annual report. Apple’s products have a lifetime value of more than a year, and as products become more and more durable, we can’t expect a linear increase in the company’s product revenues. However, with its best-in-class ecosystem business model, Apple has cemented a very high floor for the foreseeable future, and with its creative innovative management, Apple also has a very high ceiling.

The Ecosystem Business Model (The Floor)

Apple divides its offerings into five reportable sub-categories: iPhone; Mac; iPad; Wearables, Home & Accessories; and Services. Four of the five categories are Apple’s famous hardware products. Under services, the company aggregates advertising (app store and traffic acquisition costs), cloud, digital content (which includes books, music, video, games, podcasts, tv, news, and fitness), AppleCare (technical support, and repair & replacement services), and Apple’s payment services (which include Apple Pay, and Apple Card).

Apple’s ecosystem business model is quite simple. Usually, a customer first engages with Apple through an iPhone. Then, as every other piece of hardware the company offers is seamlessly integrated with the iPhone, the customer will most likely elect an Apple product rather than a competitor’s substitute offering, despite Apple’s products being typically more expensive. The customer will elect to do so not only because of the individual quality of the product by itself but also due to the value of integration between all of the customer’s Apple products.

In addition to the hardware, the customer will most likely choose to use Apple’s services, as they are the most convenient option and sometimes the only option when using Apple’s hardware.

The Foundation – Apple’s Hardware Installed Base

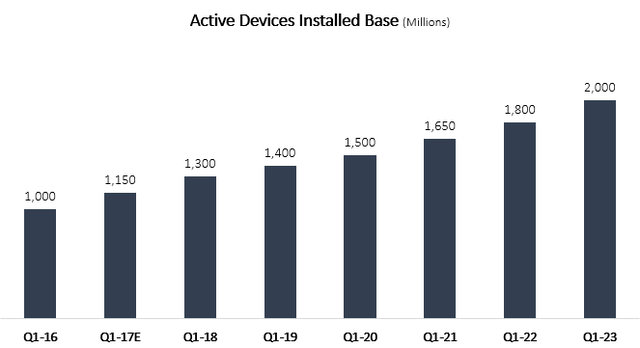

The most important metric to look at when assessing Apple’s ecosystem strength is the active devices installed base. Apple doesn’t provide the number in its press releases, so I collected the numbers from the management’s remarks in earning calls.

Created by the author based on management remarks in Apple’s earning calls 2016-2022

As we can see, Apple’s active devices installed base has doubled in the last 7 years, with growth across all subcategories. With an active installed base surpassing 2 billion, we know Apple has a vast customer audience. Apple views this installed base as people who will continue to buy its products forever and in my view, rightfully so, as the company receives above 95% satisfaction scores for all its products, and 88% of teens expect an iPhone to be their next phone.

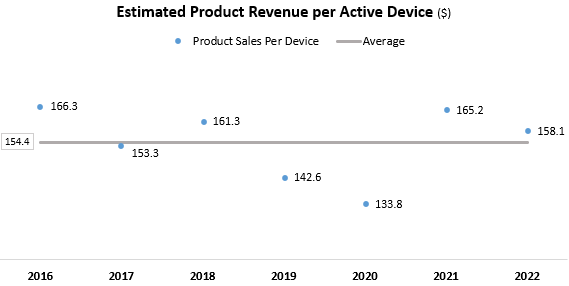

A common argument I’d expect to get is that Apple is growing its installed base through cheaper products under the accessories subcategory. Well, it’s true that Wearables, Home & Accessories are now a larger portion of Apple’s product revenues, as in 2022 they amounted to 13.0% compared to 5.8% in 2016. However, looking at the estimated product revenue per active device, we see the last two years have been above average:

Created and calculated by the author based on data from Apple’s financial reports and earning calls

So, Apple’s active devices installed base is growing impressively, and it isn’t the result of lower-priced products. Moreover, its installed base represents lifetime customers. They might not buy a new iPhone every year, but they are very unlikely to replace their iPhone with a competitor’s product.

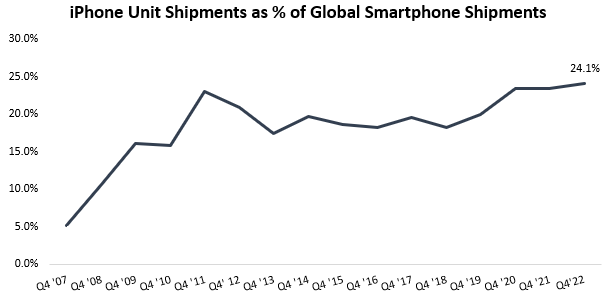

Created by the author using data from IDC, Gartner, and Statista

Overall, Apple’s product revenues do have a recurring aspect. It’s just that the recurring cycle length is more likely around 2-3 years, rather than a steady annual cycle which short-term investors might want to see. Thus, we can expect some cyclicality, but over a longer period, I find Apple’s product revenue growth trend extremely safe. As its installed base grows, new customers enter the cycle and join the Apple ecosystem. Then, they become customers of Apple’s non-cyclical offering – services.

The Engine – Apple’s Services

Just like any other software services company, one of the most important metrics would be the number of subscribers. Well, a fact that seems to go under the radar is that Apple currently has the highest number of paid subscribers in the world, with 935 million paid subscribers across all its services, as of February 2023. To put this in context, other large consumer companies like Netflix and Spotify have 230 and 205 paid subscribers, respectively.

Created by the author based on management remarks in Apple’s earning calls 2016-2022

While Apple’s installed base grew at a 9.7% CAGR between Q1-17 and Q1-23, Apple’s paid subscribers grew at a whopping 35.7% CAGR. The subscriber growth is naturally decelerating and still, we saw a 19.1% growth last year. It wouldn’t be a bold take to assume Apple surpasses 1 billion subscribers by the end of 2023.

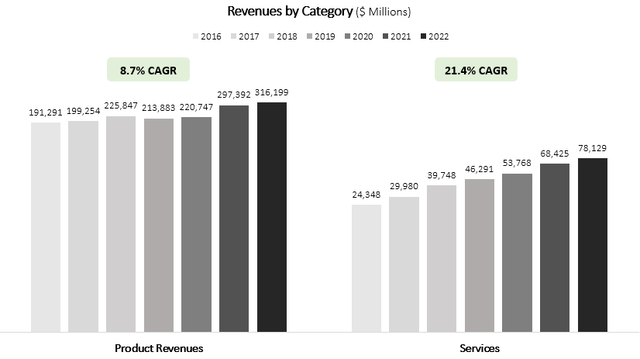

Unlike product revenues, which we said are somewhat cyclical, services revenues are growing linearly, steadily, and at a very impressive pace.

Created and calculated by the author using data from Apple’s financial reports (10-K)

As we can see, service revenues are becoming increasingly significant for Apple, and as they reached 19.8% of total revenues in FY22, Apple’s margins have reached an all-time high accordingly.

Just to put the Apple services growth in context, this segment outgrew Adobe (ADBE), which is considered by many an exceptional growth company. Not only did it outgrow Adobe, but Apple services also bring in X4.4 revenues. When we get to the valuation section, this will be the key point in justifying the historically high multiple Apple is trading at.

Growth Prospects (The Ceiling)

We can divide Apple’s growth prospects into three categories – core products, services, and long shots. Overall, I believe that through these three categories, Apple has the potential to grow at least at a mid-single-digit pace for the foreseeable future.

Core Products

Under core products, we’ll aggregate the iPhone; Mac; iPad; and Wearables, Home & Accessories. As a group, product revenues grew YoY by 6.3% last year and declined by 7.7% in Q1-23. As we talked about under the installed base section, we cannot expect linear growth for the products category. After the category grew by an astounding 34.7% in FY21, a few slower years were inevitable. Still, according to management, product revenues grew in constant currency. Over the long term, I expect mid-to-high single-digit growth in core products, with some years below that mark and other years significantly above it. Remember, the robust installed base is most likely going to continue to buy new editions of Apple’s core products, it’s just that an upgrade isn’t going to occur every year.

Services

As a group, services revenues grew YoY by 14.2% last year and by 6.4% (13.4% in constant currency) in Q1-23. As many of Apple’s services are still in the early stages, I think a reasonable expectation would be continued double-digit growth for the foreseeable future. The majority of Apple’s services are based on subscriptions, meaning there needs to be a material shift in customers’ preferences which will result in significant churn if this segment ever slows down. Since it was introduced, the services segment has never grown at an annual place lower than 14%, and I don’t see any reason for customers to forego Apple’s services. Most of them are not too expensive, so even through a tough economic environment, I doubt we’ll see a slowdown. Additionally, Apple is constantly launching new services, like the recently announced Buy-Now-Pay-Later. Those will support the double-digit growth in this segment for many more years.

Long Shots

Before I get into long shots, let’s make it clear – in my view, these are all worth $0 for investors at the time of writing this article. However, as Apple is the world’s largest producer of cash flows, and its management has demonstrated the very rare ability to manage the company’s resources in an efficient shareholder-friendly manner (unlike other big-tech companies), I believe we need to keep these on our minds as investors. Under long shots, we have three major projects.

First, we have the VR headset. Personally, I have no desire for such a product and it seems like teens are also not so enthusiastic about it, so I cannot understand why Apple and Meta (META) are so attracted to it. However, Apple has a history of changing consumer behavior with its high-quality products, even when in many cases it wasn’t the first-to-market product. Thus, I’m skeptical, yet I do believe this will be value accretive for Apple.

Second, we have the Apple car. Unlike the headset, which seems to be very close to an official launch, the Apple car is no more than a rumor. Thus, let’s not waste too much time on it.

Third, we have Apple’s healthcare ambitions. Tim Cook has been quoted a bunch of times saying Apple’s greatest opportunity lies in healthcare. Currently, the company does have some offerings catering to that opportunity, mainly through the Apple Watch which has a wide set of tools for fitness and has lifesaving capabilities like detecting abnormal heart rates, crashes and falls. If Tim Cook’s statement is true, then the recently published non-invasive blood glucose monitoring is an important step in that direction. According to Bloomberg, this is a multibillion-dollar industry, with 1 in 10 Americans relying on devices that require them to poke their skin in order to monitor their glucose levels.

Valuation

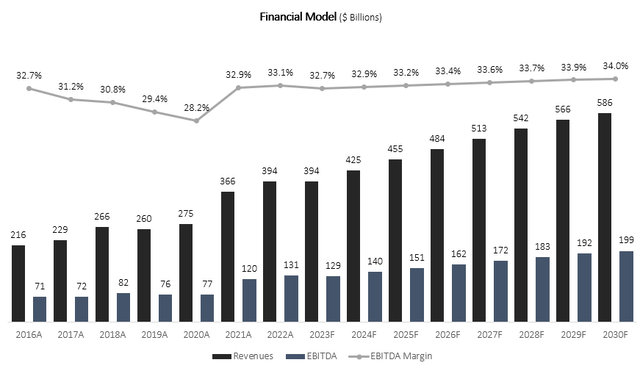

I used a discounted cash flow methodology to evaluate Apple’s fair value. I forecast Apple will grow revenues at a 5.0% CAGR between 2022-2030, based on what I described under the growth prospects section. My projection is in line with the consensus but significantly below Apple’s past 7-year CAGR of 10.6%.

I project EBITDA margins will increase incrementally up to 34.0% in 2030, as the services portion of total revenues continues to grow. I find this projection conservative, as the company achieved a 33.1% EBITDA margin in 2022, a year in which it had a 43.3% gross margin, which is 1.2% below management’s guidance for 2023. Thus, I believe the company is already capable of a higher margin than 34.0%, and there’s no reason it shouldn’t surpass it in the mid-term.

Overall, my assumptions result in EBITDA growth slightly above revenue.

Created and calculated by the author based on data from Apple’s financial reports and the author’s projections

Taking a WACC of 7.4%, I estimate Apple’s fair value at $179 per share, which represents an 11.2% upside compared to the market price at the time of writing. This valuation reflects an arguably high forward P/E multiple of 28 based on my EPS projection for 2023. However, today’s Apple isn’t the old Apple. Its historical average P/E ratio reflects a product company, whereas the services side of the business is becoming increasingly important, amounting to 20% of total revenues in 2022.

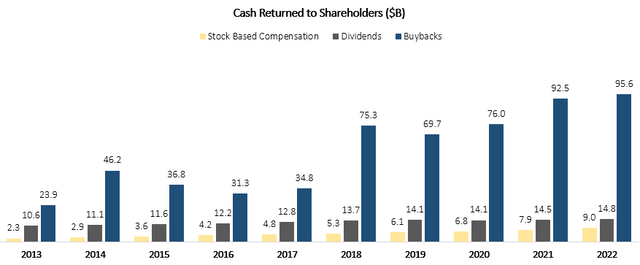

Dividend & Buybacks

Apple is a natural constituent in dividend growth portfolios. The company has raised its dividend for 9 consecutive years and has bought back 37.5% of its shares outstanding.

Created and calculated by the author using data from Seeking Alpha

Between 2013-2022, the company increased its dividend at an 8.7% CAGR, and it returned a cumulative $658.5B to shareholders. At the beginning of 2013, Apple’s market cap amounted to approximately $500B. In essence, if you bought the stock around January 1st, 2013, you would have gotten 130% of your investment returned to you via cash from the company alone.

Risks

First, I want to address Apple’s popularity as a risk. The company is the largest constituent in the world’s most-traded indexes and is probably the most popular share held by individual investors as well. if you invest in Apple, you need to expect to encounter good and bad news on a daily basis, as well as contradicting analyses, simply because the company draws attention. It’s extremely important to be able to screen between what’s relevant and what’s irrelevant, as Apple is not a company that’s going to hold for the short term.

Now, let’s talk about operational risks, beginning with Apple’s supply chain and reliance on China. Since the break of Covid-19, Apple has been stating it’s dealing with supply chain issues, mainly due to China lockdowns, where it assembles its iPhones and the silicone shortage. As Apple’s reliance on China hurt its supply chain already, investors are worried problems will continue, along with the potential harm if political tensions with China get too heated.

According to Apple’s management, the supply chain issues of the last two years are behind us –

From a supply point of view, we did see disruption from early November through most of December. And from a supply chain point of view, we’re now at a point where production is what we need it to be. And so the problem is behind us.

— Timothy Cook – CEO & Director, Apple’s Q1-23 Earnings Call

Regarding China, Apple has been trying to shift production to other countries, most notably India. However, Apple is still very reliant on China, and building a full replacement will take many years. Additionally, Apple’s prominent chip manufacturer TSMC (TSM) is also at risk from a potential China invasion of Taiwan. These risks should be thoroughly considered when investing in Apple.

Another cause for concern is competition. Apple’s products generally come at higher price points compared to its competitors. With deteriorating financial conditions and a stretched consumer, Apple is presumably at risk of losing customers to competitors.

Overall, I do find many valid concerns around Apple, but most of them are very short-term. Apple’s integration into people’s lives is so deep, and the company’s products are undeniably the best quality. I strongly believe that in the long term, those short-term risks won’t be an issue.

The iPhone has become so integral into so many people’s lives. It contains their contacts and their health information and their banking information and their smart home and their payment vehicle and so many different parts of their lives. So I think people are willing to really stretch to get the best they can afford.

— Timothy Cook – CEO & Director, Apple’s Q1-23 Earnings Call

Conclusion

Apple’s ecosystem business model is working like a charm. The high quality of its hardware products pulls customers in, and once they’re in, they will probably turn to Apple for additional hardware products and services, as the company’s entire offerings are seamlessly integrated. I can’t think of any other company in the world with such a strong ecosystem, that plays such a major role in its customers’ lives. While its product revenues are somewhat cyclical, its 2 billion installed base is expected to grow sequentially, as new and existing customers upgrade and buy new products. As I find most of the risks regarding the company overexaggerated and short-term, I rate the stock a Buy, with a price target of $179 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.