Summary:

- Apple’s highly anticipated June WWDC has investors eagerly anticipating the unveiling of the company’s first-ever mixed-reality device.

- Although Apple’s MR device has enormous potential for Tim Cook and his team, don’t expect widespread adoption until two years from now when a cheaper version hits the market.

- India is poised to become the key driving force behind Apple’s iPhone shipment growth, potentially supplanting China as its most important growth region. However, the opportunity is still nascent.

- AAPL is currently trading above its fair value estimates and faces significant growth challenges, making it an unattractive buy for new investors at the current levels.

- Existing investors should consider capitalizing on the recent recovery to cut more exposure and rotate.

Scott Olson

Apple Inc. (NASDAQ:AAPL) has announced the date for its highly-anticipated Worldwide Developers Conference, or WWDC, to be held from June 5 to 9.

Without a doubt, all eyes will be on the launch of its mixed reality or MR device, which is expected to cost around $3K and sell about 1M units in the first year.

Given the hype surrounding the development of Apple’s MR device heading into June’s WWDC, we believe CEO Tim Cook and his team are not expected to disappoint. Moreover, Apple recently showed its device to its “Top 100” executives, suggesting that a public launch is imminent.

However, doubts have begun to creep into the financial media before its MR launch. The “lack of a clear killer app” could also complicate its initial adoption to justify its $3K price tag. As such, Apple executives are said to be “hoping for a similar trajectory to the Apple Watch.”

Therefore, we believe Apple will likely expect a more tepid buying reception from consumers at its initial launch. Instead, we expect the launch event to set the stage for its less expensive version, expected to be “released within two years of the initial model.”

As such, investors will likely need to assess the near-term earnings accretion to Apple’s operating performance from its MR launch. Notably, analysts have probably marked up their expectations of its MR device, increasing the execution risks for Apple.

Accordingly, Morningstar highlighted it expects Apple’s MR device “to contribute to wearables growth.” Moreover, the research firm expects Apple’s Wearables segment to generate “strong high-teens growth” over the next five years, embedded in AAPL’s fair value estimates.

Apple’s Wearables growth was also impacted in FQ1, down 8.3% YoY, after notching a 9.8% gain in the previous quarter. As such, Apple likely needs a breakthrough device to drive growth in the segment. However, as highlighted earlier, a cheaper product to facilitate broader adoption is likely two years away. With that in mind, investors need to differentiate hype from reality.

Despite that, to the credit of CEO Tim Cook, Apple has a significant Indian market that could alter its growth algorithm in the medium- and long term if executed well.

Apple’s supply chain diversification from China isn’t simply about geopolitical risks. While the Greater China region accounted for more than 20% of Apple’s revenue in FY22, growth is expected to slow further. Apple’s forays in China have been successful, forming a symbiotic relationship with the Chinese government and its local partners.

However, Apple needs a significant growth driver that has the potential of China’s population size but is still nascent. In addition, while India has already been penetrated by Android-based smartphone OEMs, iPhone’s shipment share is still very low.

According to DIGITIMES, India’s premium smartphone segment accounted for just 7% of shipment share in 2022. However, it was up significantly from 2021’s 4% share.

Notably, Apple also saw iPhone shipment growth of 40% over the same period, shipping 6.7M iPhones in 2022. Still, it’s a small fraction of the nearly 229M iPhone shipments that Apple could deliver this year. Hence, we believe it represents Apple’s most promising iPhone growth vector that investors should follow carefully.

Despite that, given the scale of India’s shipment share, we don’t expect it to significantly drive Apple’s operating performance in the near term.

As such, that brings us back to the same question. Is AAPL worth buying at its current valuation?

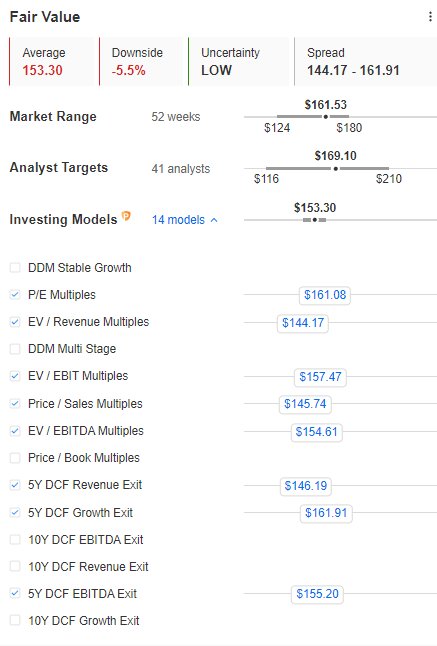

AAPL blended fair value estimates (InvestingPro)

AAPL’s blended fair value estimate indicates a 5.5% downside from the current levels. It’s in line with Morningstar’s $150 estimate. Trefis’ sum-of-the-parts or SOTP estimate is about $159. If we average the above, we get $154.

With AAPL trading at $162 as of writing, it represents a 5% downside from our average $154 estimate. Hence, is AAPL grossly overvalued? It doesn’t seem like it.

However, we discuss why Apple could face execution risks in the two growth vectors we discussed above as Apple charts a new growth journey. Hence, investors should expect to factor in a more considerable margin of safety to account for these challenges.

With that in mind, we believe there are better bargains to pick up as the market recovers. Accordingly, investors sitting on significant gains should consider cutting some exposure.

Rating: Sell (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have you spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment and let us know why, and help everyone to learn better!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!