Summary:

- Apple’s recent iPhone 15 launch and reasonable pricing make a compelling case for continued revenue growth in 2024.

- The company’s economic moat has been strengthened with the introduction of new features to its iPhone 15 lineup and Apple Watch products.

- Apple’s financial situation shows declining net sales but increased gross margins. New hardware may turnaround falling device sales.

- An intrinsic value update of around $164.00 means shares are currently fairly-valued in my opinion.

- Rating upgrade to Hold.

EKIN KIZILKAYA

Investment Thesis

Upon watching the recent “Wanderlust” Apple (NASDAQ:AAPL) event I was pleasantly surprised by the genuine innovation and advancements in product design offered by Apple to consumers. Furthermore, the competitive pricing is clearly aimed at harnessing sales despite rising inflation and falling real incomes.

These product improvements and competitive pricing create a compelling case to argue that Apple will continue growing their revenue at high-single digit figures for 2024.

Therefore, I have revisited my valuation calculation for Apple and derived a new base-case value of around $164.00. Considering the current 14% overvaluation, I believe a Hold rating is warranted to account for any potential random variables influencing the firm’s stock price.

For a full in-depth analysis please read my original article written back in February: “Apple: The Right Company At The Wrong Price” and my previous update from August: “Apple: I Don’t See A Recovery Anytime Soon”.

Company Background

Apple is an American MNC headquartered in Cupertino, California. The influence Apple holds from both fiscal and societal perspectives is truly unrivalled in the technology industry.

Most of Apple’s revenue arises from their physical technology sales with primary sales coming from their iPhone lineup, Mac personal computer range or from the host of other technological accessories such as smartwatches the brand pursues.

All of Apple’s products occupy the luxury end of personal technological devices. Significant diversification into the services industry has positively contributed to the firm’s overall revenue streams and signals a slight pivot in their business strategy.

The firm is trying to shift away from being just a device manufacturer and become a more integrated, unavoidable requirement in most people’s daily lives through the provision of a wide range of entertainment, financial and health services,

The company still has the highest valuation of any company currently being publicly traded. Their current market cap is around $2.80T.

Economic Moat – Q3 FY23 Update

The announcement of Apple’s new iPhone 15 range of smartphones genuinely delighted me from both a consumer and investor perspective. The introduction of previously pro-exclusive features to the standard 15 and 15 Plus devices such as Dynamic Island a new 48mp Sony camera sensor and the A16 Bionic chip means even more users get access to these great features.

Apple Events | Wanderlust iPhone

The significant focus on renewable materials usage, waste minimization and privacy protection features were great to see and illustrates Apple’s acute awareness of what consumers want in today’s market. The ability for the firm to quickly and effectively meet these targets is outstanding and what separates them from many other manufacturers in the smartphone market.

I believe the introduction of these features to the standard line of iPhones was absolutely necessary for the company to ensure that these products remain differentiated in the fiercely competitive smartphone market.

Increasing competition from the likes of Samsung and Xiaomi with the introduction of folding handsets has rapidly increased the differentiation these brands are achieving in the space.

I believe Apple’s introduction of these new and unique features to iPhone 15 and 15 Plus along with their outstanding software and app integrations will help reinvigorate a moat some argued was being eroded with their sub-standard and arguably boring iPhone 14.

The introduction of USB-C to all standard and Pro iPhone 15 models helps unify Apple’s mobile ecosystem when it comes to charging methods. While this was arguably only achieved thanks to the European Union’s push for a common charger on all handheld tech, Apple’s aging Lightning connector was bound to face the axe eventually.

Overall Apple’s iPhone launches illustrated that the company has not lost their laser-like understanding of what consumers want and how they want it. I believe the excellent myriad of – while not revolutionary – still innovative hardware and software integrations combined with excellent marketing material should see strong sales for their newest lineup of iPhones.

Apple Events | Wanderlust | Apple Watch

The updates to the Apple Watch 9 and Ultra 2 smartwatches while not revolutionary were still nice to see. The Ultra 2 is touted as Apple’s first “carbon neutral” product which sets a new benchmark both for the company itself and its competitors. The processor improvements in these devices should also provide consumers with a better overall product for what is essentially the same price.

Against my initial expectations, I believe Apple’s strong product launches at their Wanderlust event have actually acted to tangibly expand their robust economic moat even further. The strong and genuinely enticing product offerings could see great sales in the coming months especially around the holiday season.

Overall (including topics discussed in my in-depth analysis) I still rate Apple as having a very wide economic moat which provides the company a tangible competitive advantage for at least the next 15 years. While a very wide economic moat rating would usually warrant a longer timeframe of competitive advantage, the rapid nature of the tech industry limits my evaluation to 15 years.

Financial Situation – Q3 FY23 Update

Apple’s financial situation is still the same to our knowledge as was reported in their Q3 earnings release. In short the firm continued to see declining net sales by around 1.4% YoY with gains in their Services segment being offset by weak hardware sales.

The Cupertino-based tech giant also faced ballooning inventories by around 100% YoY due to the aforementioned softening in hardware sales. This was most likely exacerbated by the inflationary environment particularly in European and Asian markets limiting the purchasing power consumers have for luxury products.

Notably Apple also managed to increase their gross margins in Q3 FY23 by 1.3% YoY thanks to a declined in the COGS for their products segment. While this does illustrate an efficiency gain in their overall business processes, it is highly unlikely that these improvements were made in their hardware supply chains due to the significant pricing increases in raw materials and labor.

Once again, I must admit that I was skeptical that any real update to Apple would be required after their Wanderlust event. However, I was wrong. I believe the iPhone 15 and 15 Pro devices should help Apple see a strong rebound in hardware sales for their iPhone segment.

The expected release of new Mac laptops and desktops in October should further buoy the firm’s hardware sales. As long as a very acute and sharp recession is avoided by the US markets, I believe Apple will see a distinct improvement both in income and total net sales.

My only concern regarding these new products and Apple’s ability to extract outsized profits from their sales is the price. Apple has maintained prices at previous levels avoiding a much expected price-hike.

While this will undoubtedly help maintain healthy sales figures as a lower price-tag makes these devices slightly more accessible for a larger demographic of customers, the highly inflationary market environment means Apple almost certainly is looking at slimmer margins for their products.

Common tech manufacturing practices dictate that Apple most likely has a large number of supply deals that layout prices for a certain period of time. As Apple doesn’t release these details to investors, it is pure speculation to deduce what these may be and how they affect the company’s bottom line.

Still, it is unquestionable that the price of raw materials has increased while the price of iPhones and Apple Watches has remained the same. Either Apple has managed to maintain supply chain costs to a minimum to ensure unit margins have remained the same, or Apple is accepting a slightly smaller profit per device in the name of increased overall sales.

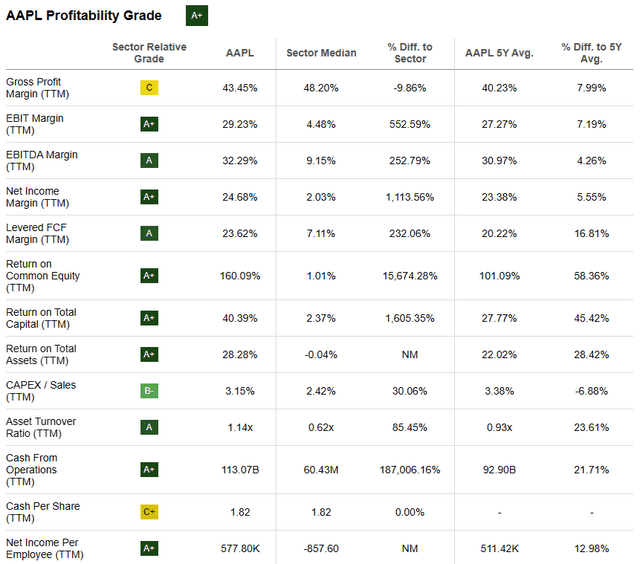

Seeking Alpha | AAPL | Profitability

Seeking Alpha’s Quant still assigns Apple an “A+” profitability metric which I believe still encapsulates Apple’s profit generating prowess accurately. I think the strength of their iPhone 15 devices should see even greater returns over the coming year.

Considering the above and topics discussed in my previous in-depth articles, Apple remains an incredibly cash-rich business which is optimized at generating real income for shareholders and the firm alike. While their long-term profitability is not at risk thanks to their robust economic moat, a short-term decrease in fiscal performance is possible despite a great set of product offerings in the form of iPhone 15 and Apple Watch 9/ Ultra 2.

Valuation

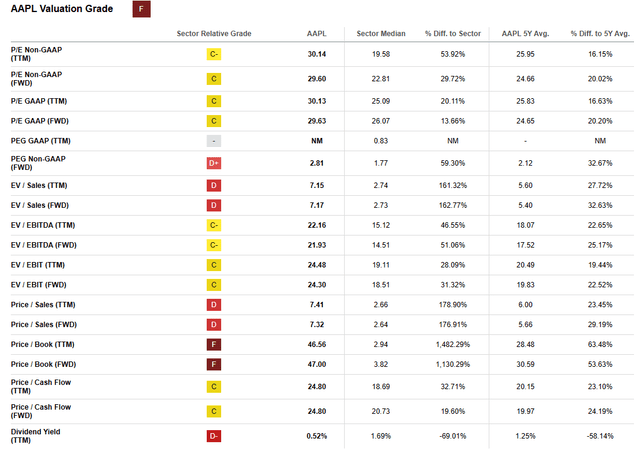

Seeking Alpha | AAPL | Valuation

Seeking Alpha’s Quant still assigns Apple with an “F” Valuation rating. I believe this assessment represents a relatively realistic evaluation of Apple’s current share price. Bear in mind, these figures are already including the 10% selloff that ensued post Q3 results.

The firm is currently trading at a P/E GAAP FWD ratio of 29.63x and a P/CF TTM ratio of 24.80x. When considered against a FWD Price/Book ratio of 47.00x and an EV/Sales FWD of 7.17x, it is clear that the from a relative perspective Apple is severely overvalued in relation to its peers.

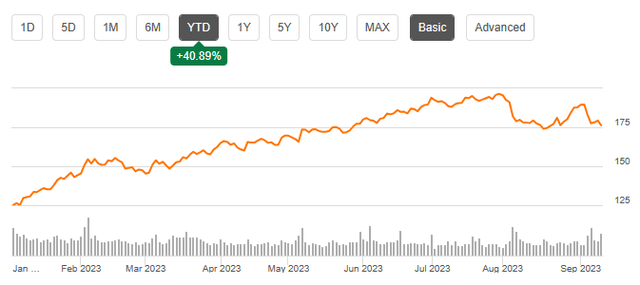

Seeking Alpha | AAPL | Summary Chart

From an absolute perspective, Apple shares have risen 41% YTD but are down almost 15% since their highs in late July. The hype-driven bull run came on the heels of Apple’s worst Q1 and Q2 results in almost 20 years.

As the firm’s fundamental profitability decreased, Vision Pro hype and a “this time it’s different” sentiment overruled. The fall in valuations represents a movement back towards a more realistic valuation.

Still, I believe Apple’s strong launch of iPhone 15 devices combined with a positively revised outlook on the performance of the expected Mac launches in October means annual EPS estimates should be increased by around 5-8%.

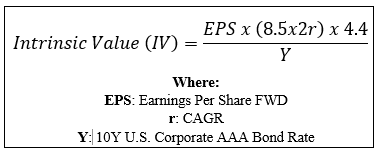

By accomplishing a simple financial valuation based on the calculation below and using a 5% upwards revised estimated 2024 EPS of $6.92 a realistic r value of 0.09 (9%) and the current Moody’s Seasoned AAA Corporate Bond Yield of 4.95x, we can derive a base-case IV for Apple of $164.00.

The Value Corner

When using this realistic CAGR value for r, Apple appears to be overvalued by only around 7%. By using a more pessimistic worst-case 2024 growth estimate (which aims to replicate a late 2023 recession softening iPhone and Christmas sales) CAGR value of 0.07 (7%), shares are valued at around the $149.00-mark, around 35% lower than currently.

Therefore, I believe Apple is currently trading somewhere between overvalued and fair-value. This represents an update from a previously overvalued state according to my calculations.

It must also be considered that Apple has historically been able to command a slight premium for its shares compared to their intrinsic value. Then again, in just December 2022 Apple shares were trading at a 10% discount relative to their fair value.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. While strong iPhone and Mac sales could help Q4 and full year figures rebound from the weaker performance otherwise seen in 2023, I believe the poor momentum and lack luster results will continue to drive prices lower in the short-term.

In the long term (2-4 years) I fully expect their position as a leader in the industry to become even stronger. Their unique product offerings combined with the undoubted branding power places little doubt in my mind over the almost undoubted returns the company should be able to provide to shareholders.

The Wanderlust event confirms that Apple is firmly in control of their products with superb execution being the only term that comes to mind. This further increases my confidence in the firm’s ability to extract outsized returns from their products and deliver these gains to investors.

Risks Facing Apple – Q3 FY 23 Update

While Apple still faces risk from increased competition in the market eroding pricing power, I have decided to remove the risk of failed execution from my risk analysis for the time being.

Apple has had a recent slew of great successes starting from their Apple Silicon “M” series of processors and running all the way up to the newest iPhone 15 devices. While the firm is not immune to missteps, recent pro-consumer decisions regarding pricing and superb products has mitigated this risk for now.

Nonetheless, the risk of competitors such as Samsung, Xiaomi and Google producing unique and moaty products themselves is real. Apple’s relatively slow response to a large number of folding phones from competing brands places the company at real risk of falling behind in this growing market segment.

While I believe Apple is surely working on a folding phone of their own, the lack of information or leaks regarding this project from Cupertino is beginning to raise some concern over the firms overall pursuit of such a device.

Such a lag in responding to a new market segment is what ultimately almost killed off companies such as Nokia and Blackberry. While I do not believe this to be a real risk for Apple, an erosion of their image and ensuing pricing power due to a perceived lack of innovation in this critical business segment could see real returns drop for the firm in the mid-term.

Summary

Apple has had an incredibly impressive history from an investor standpoint. Their robust, premium business model, excellent operational efficiency and iconic brand reputation have allowed the company to become a true profit generation powerhouse.

While share prices remain quite elevated, the company seems to be executing a truly remarkable launch of their newest flagship iPhone devices. This raises my expectations for the October launch of Macs too which, combined with what I believe will be strong iPhone sales could see Apple return to sizable high-single digit revenue growth figures.

Therefore, I have elevated my intrinsic value estimate to around $164.00 which places Apple in what can only be considered fair-value territory once a margin of error of around 10% either-way is applied. This returns my rating for the company to a Hold.

I will begin building my position in Apple once shares are around 10% undervalued. While this may require patience, I believe the current sell-off of shares may yield such an opportunity within the next 1-4 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.