Summary:

- Apple Inc.’s market cap reaches $3 trillion, competing with Microsoft and NVIDIA for the next milestone of $4 trillion.

- Apple’s WWDC24 conference highlighted the potential for a multi-year hardware upgrade cycle and growth in Services revenue.

- Despite risks such as inflation and competition, Apple’s strong financials, dividend growth, and buyback program make it a good long-term investment.

ozgurdonmaz

The king is back in the race, as shares of Apple Inc. (NASDAQ:AAPL) have broken through the $3 trillion market cap level once again. It’s a 3-way race to see which company will reach the next milestone of $4 trillion in market cap. Currently, Microsoft (MSFT) has a slight lead at $3.28 trillion over AAPL’s market cap of $3.27 trillion. Nvidia Corporation (NVDA) is right on their tail with a market cap of $3.08 trillion and has put a lot of space between itself, while Alphabet’s (GOOGL) market cap of $2.21 trillion.

Who reaches $4 trillion first is anyone’s guess, and an unlikely contender could shock investors if Amazon (AMZN) continues to execute on its operational dominance. I’m invested in each company I just discussed, and I have no intention of exiting any of these positions any time soon.

While the market wasn’t bullish on some of AAPL’s endeavors over the years, shares of AAPL are flexing their muscles coming from their recent WWDC conference, and some are now saying that AI stands for Apple Intelligence. Shares of AAPL added $215 billion to their market cap on Tuesday as the investing community bought into AAPL’s vision, while AAPL shares increased another 2.86% on Wednesday after adding another $5.92 per share.

As a long-term AAPL bull, I am thrilled about what I took away from WWDC. I was long AAPL when others bailed, and have never written an article that wasn’t bullish regarding AAPL since I started publishing articles on Seeking Alpha. What the investment community should keep in mind is that AAPL is never first, but they are dominant in just about everything they do.

AAPL just gave their entire ecosystem a reason to start upgrading, and it’s not about AAPL creating the next best thing, it’s now about what will be created on AAPL’s platform and the devices required to utilize it. Every time I say this, people laugh, but it becomes true. Even at all-time highs, AAPL is still a buy for long-term investors.

Following up on my previous article about Apple

Back in March, I wrote an article on AAPL (can be read here) that was titled “My Dark Horse Of The Magnificent 7 Could Lead The Pack In The Second Half.” I specifically made the case that AAPL’s innovation and focus on AI combined with hardware sales could lead to increased shareholder value. Since then, shares of AAPL have appreciated by 22.22% compared to the S&P 500, which has climbed by 5.49%. When AAPL’s dividend is factored in, its total return has been 22.38%.

I believe that this is just the beginning, and while shares of AAPL are at all-time highs, I think they will continue to be higher for years to come. There could certainly be retracements and profit-taking along the way, but AAPL is in a position where they could benefit from a multi-year upgrade cycle across their ecosystem and create new subscription models based on future AI offerings. I think the future looks bright for AAPL, and I am not worried about shares trading at all-time highs.

Risks to investing in Apple

While AAPL is the 2nd largest company and the most profitable company in the market, having generated $100.29 billion in net income over the trailing twelve months (TTM) there are still risks to my investment thesis. If inflation ends up ticking higher over the summer and causes the Fed to stay higher for longer or increase rates, the U.S. economy could be headed toward a recession.

In this scenario, not only will goods and services cost more, but the carrying cost of debt will also increase. This could cause individuals and businesses to delay participating in AAPL’s upgrade cycle. GOOGL, which owns Android, could come out of the shadows and introduce AI advancements that cause consumers to consider switching to the Android ecosystem to take advantage of the apps and services being built on its platform. There is also a large upgrade cycle coming in the PC market as Windows 10 will no longer be supported by MSFT after 10/14/25.

AAPL has been using its own chips, and while they are making bold breakthroughs, the next generation of PCs will have GPUs from NVDA. There could be functionality introduced that sways some AAPL computer users to the PC environment. If I am wrong about how impactful the next upgrade cycle will be, then AAPL could continue to see its revenue decline YoY, which would most likely cause a drawdown in its share price. Just because AAPL has had several strong days and sentiment is high doesn’t mean things will work out for the better, and investors should do their due diligence because there is always risk, even for the largest companies in the market.

Apples’s WWDC24 conference was bullish for Services and a multi-year hardware upgrade cycle

Everyone has an opinion, and instead of getting scared regarding the bear scenario about declining growth, I would rather make my investment decisions based on the underlying financials, forward estimates, and what the company is implementing. Part of the investment community has been bearish on AAPL for years, and others have joined the bear camp recently after they felt the Vision Pro was a bust and that VR/AR wouldn’t lead to the future revenue growth they had hoped for.

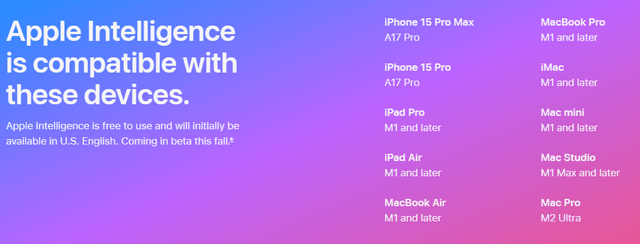

I have always said it’s difficult for me to get bearish on the most profitable company in the market, as they have been generating in excess of $90 billion in profits since their 2021 fiscal year. The WWDC24 conference was a breath of fresh air as AAPL is playing to its strengths. AAPL just introduced iOS18, and Apple Intelligence, which should create a multi-year upgrade cycle across their installed base that accounts for billions of devices.

AAPL is never first, but no matter what sector they ultimately compete in, they are a dominant force. What they have done with Services is a testament to how they can scale a business from the ground up in the information age, and I suspect there will be several new ways for AAPL to generate revenue from their next computing platform.

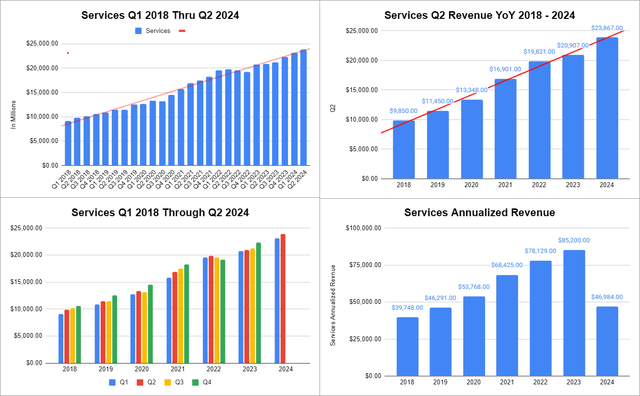

After going through AAPL’s earnings reports, I think a portion of the investment community is overlooking the power of Services, which generates reoccurring revenue from its install base. Once AAPL gets a consumer involved in their ecosystem, the revenue continues to be generated. Over the past 6 years, Services revenue in Q2 has grown by 142.30% ($14.02 billion) to $23.87 billion. Q2 2024 represents another record quarter as its revenue increased by 12.4% YoY with a gross margin on Services of 46.6%. After the first half of AAPL’s 2024 fiscal year, Services have generated 55.15% of the total revenue they generated in 2023.

Unlike their hardware segment, where Q1 represents the largest quarterly revenue due to the holiday season, Services continues to expand throughout the year, and since Q1 2018, there has only been 3 quarters of negative growth from the past 25 quarters. Based on the current trajectory, AAPL has the potential for Services to generate more than $100 billion of revenue in their 2025 fiscal year and continue to grow it moving forward.

AAPL has established a long-term track record of creating more use cases for its Services division as they are rapidly approaching generating $25 billion in reoccurring revenue each quarter. Through Apple Intelligence and iOS 18, the next generation of apps have yet to be built. AAPL just gave every user across its install base reasons to upgrade their hardware over the next several years, as customers will need the latest hardware from AAPL to utilize its features. The personal intelligence that AAPL is embedding into its future devices will only get better and more efficient as its AI continues to learn from each task that is performed.

Eventually, users will be disadvantaged if they don’t have the latest hardware, and based on what AAPL has done in the past, they are likely to have premium levels of features added into their services bundle. I won’t be surprised if they make different AI service features to select from or add an all-inclusive service bundle to its service tiers. This should play out well for AAPL because they will benefit from a multi-year hardware upgrade cycle while also having the potential to cross-sell higher-tiered Services packages. This could keep AAPL’s revenue deceleration at a 1-year occurrence, rather than making this an ongoing trend.

Why I believe Apple is still a good investment at all-time highs

It’s hard for me to be bearish on the most profitable company in the market. When you invest in AAPL, you become an equity owner in a company with $67.15 billion in cash and short-term investments readily available to them, with another $95.19 billion in marketable securities on their balance sheet. This is also a company that has generated $381.62 billion in revenue over the TTM. On a profitability level, AAPL has produced $173.97 billion in gross profit at a 45.59% margin. After all their expenses are factored in, AAPL’s operating income is $118.24 billion at a 30.98% operating margin, and after all their taxes and interest expenses are factored in AAPL has produced $100.29 billion in net income for a 26.31% profit margin. On an EBITDA and free cash flow perspective, AAPL has produced $129.63 billion and $101.92 billion in the TTM.

It’s very hard for me to get bearish on a company that is generating $100 billion annually in profitability at margins that exceed 25% for net income, EBITDA, and FCF. Apple can pay a dividend, buy back shares, and invest for its future without having to worry about overleveraging itself. As we just saw from WWDC24, AAPL’s innovation isn’t stopping, and we could see a wave of new products that create a large upgrade cycle and new revenue streams for Services. As AAPL is driving at least $0.25 on every additional dollar generated to the bottom line, it is an exciting time to be a shareholder in AAPL.

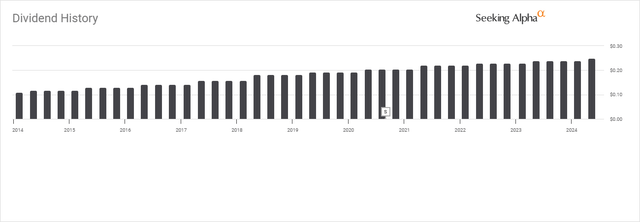

While the dividend yield is less than 1% at 0.47%, AAPL is now paying a dividend of $1 per share. What is exciting about the dividend is its growth. AAPL has grown its dividends over the past 10 years, and the dividend growth rate over the past 5 years is 5.56%. The dividend accounts for less than 15% of AAPL’s earnings, which leaves a lot of room for buybacks and future dividend increases.

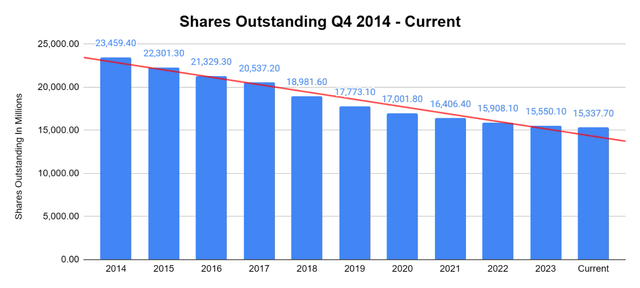

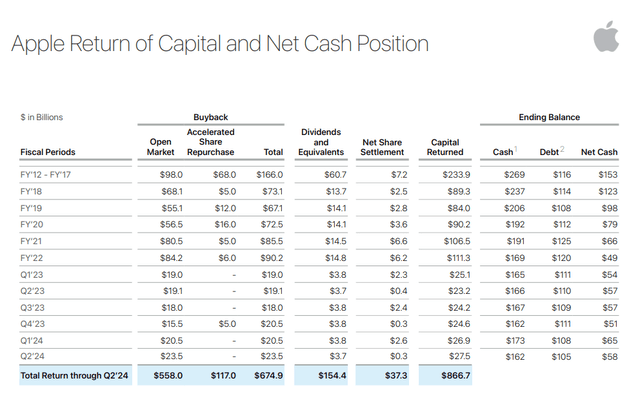

AAPL has used its profitability to reward shareholders by allocating $674.9 billion toward buybacks since the 2012 fiscal year. Over the past 6 months, AAPL has utilized $44 billion to repurchase shares, and they continue to be committed to their buyback program. Since the end of 2014, AAPL has repurchased over 8 billion shares and reduced the total shares outstanding by -34.62%. Some have had an issue with the amount of capital AAPL has allocated toward buybacks, but I think it’s been a brilliant use of their cash.

This hasn’t stopped AAPL from making innovations to their products and services or paying a dividend. AAPL has been able to grow its revenue from $182.8 billion to $381.62 billion and its net income from $39.51 billion to $100.39 billion from the close of 2014 to the TTM while repurchasing more than 1/3rd of the company. The repurchases have allowed AAPL to expand their EPS at a quicker rate as their increased earnings have been spread across fewer shares.

Steven Fiorillo, Seeking Alpha Apple

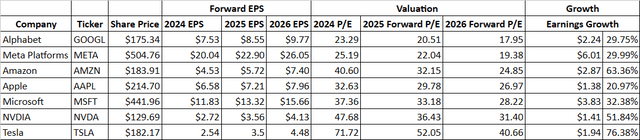

AAPL’s forward earnings have barely changed since the WWDC24 conference, and these could be conservative, as analysts are probably trying to figure out how to incorporate a future upgrade cycle’s impact to earnings based on the news. Currently, AAPL is expected to grow its earnings by 7.34% in 2024, 9.62% in 2025, and by 10.4% in 2026. Over the next 2 years, AAPL is expected to grow its earnings by 20.97%, and shares are trading at 26.97 times 2026 earnings.

AAPL isn’t in value territory, but I don’t believe shares are expensive either, considering their dominant position in the marketplace and their scale of profitability. As AAPL continues to repurchase shares and grow its top-line, there is a chance that they will significantly exceed these projections, and its forward P/E will become more attractive. AAPL is in a strong position as a strong upgrade cycle, and additional services can increase analyst EPS projections and ultimately have new price targets assigned to shares of AAPL.

Steven Fiorillo, Seeking Alpha

Conclusion

I have been bullish on AAPL For years, and I will continue to be bullish on AAPL until they give me a real reason not to be. AAPL continues to prove the bears wrong, and while shares have made a sharp move higher, this is still likely to be a good investment for long-term investors. AAPL has one of the most loyal followings, with an installed base in the billions. In the age of AI, many users will need to upgrade their hardware to take advantage of the latest offerings, and AAPL can introduce new service packages based on AI offerings to drive higher incremental reoccurring revenue.

I think that this was an ultra-bullish conference from Apple Inc. because they just set the stage for a multi-year upgrade cycle that expands past the iPhone. Shares of AAPL could certainly retrace, but every time AAPL has made all-time highs, they eventually make new all-time highs in the future. AAPL is in a position to grow its EPS and revenue for years to come, and at the end of 2024, I believe shares will trade at higher prices than they do today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, GOOGL, META, TSLA, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.