Summary:

- Apple Inc.’s integration of AI in the iPhone 16 and other products has reignited growth and positioned it at the forefront of innovation.

- With record Q4 revenue and a thriving Services segment, Apple excels in navigating competitive markets and emerging trends.

- The launch of AI-powered desktops and laptops with the M4 chip highlights Apple’s leadership in the AI revolution.

- Apple’s significant R&D investments ensure a steady flow of innovations, reinforcing its long-term growth trajectory.

- My DCF model indicates substantial upside potential remains for AAPL stock.

husayno

Introduction

Three months ago, I shared my “Strong Buy” recommendation regarding Apple Inc. (NASDAQ:AAPL). The stock price has been approximately flat over the period, almost in line with the S&P 500 (SP500). After the fresh fiscal Q4 earnings release, Apple remains my number one holding by weight.

Apple’s recent earnings release increases my confidence in the company’s bullish prospects. The company’s ability to navigate a highly competitive market with its strong business mix positions it well for sustained growth. The iPhone 16 debut was solid, highly likely thanks to the AI-powered Apple Intelligence functionality. The company’s R&D spending is comparable to the GDP of some European countries, and this makes me expect new disruptive features introduced within the next twelve months. Moreover, the recent release of various upgraded desktops and laptops make the company well-prepared to absorb AI tailwinds. Furthermore, a 13% upside potential figured out by my DCF model suggests that AAPL is still a “Strong Buy.”

Fundamental analysis

Apple reported a record Q4 revenue of $94.9 billion for the September quarter. This is around 6% higher year-over-year, driven by robust iPhone sales and a thriving Services segment.

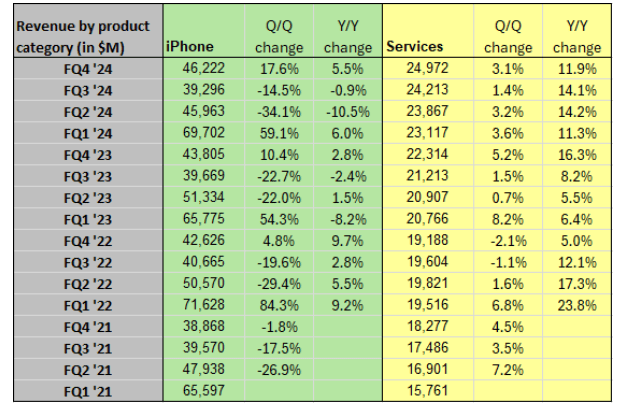

The most important information for me is that FQ4 was an inflection point for the iPhone sales, which grew by 5.5% year-over-year and by 17.6% sequentially. I emphasize on the sequential growth because the Q/Q growth in FQ4 this year was much stronger compared to the same quarter last year. The latest iPhone 16 sales commenced during FQ4, and the positive dynamic in overall iPhone sales during the quarter suggests that the new model has been met with enthusiasm.

I believe this enthusiasm is due to the more powerful A18 chip, which drives the new model’s Apple Intelligence functionality. Since Apple Intelligence is in its initial iteration, and Apple is renowned for significantly enhancing each new generation, I think this functionality will likely help Apple return its flagship product to a sustainable growth path.

SA

Services revenue remained the fastest growing business line, with a 12% year-over-year increase. The segment’s revenue achieved its all-time revenue record of $25 billion. Through its multiple services, including Apple TV+, Apple Music, and Apple Pay, customer interaction has climbed, and the number of paid subscriptions has grown. Apple’s platform, with more than 1 billion paid subscriptions, is a formidable asset that compliments its hardware revenue. Apple Intelligence as part of its services is highly likely to further optimize the user experience and lead to increased customer retention and loyalty. The fact that Apple’s services revenue has a recurring nature, means that it will be in a stable position moving forward.

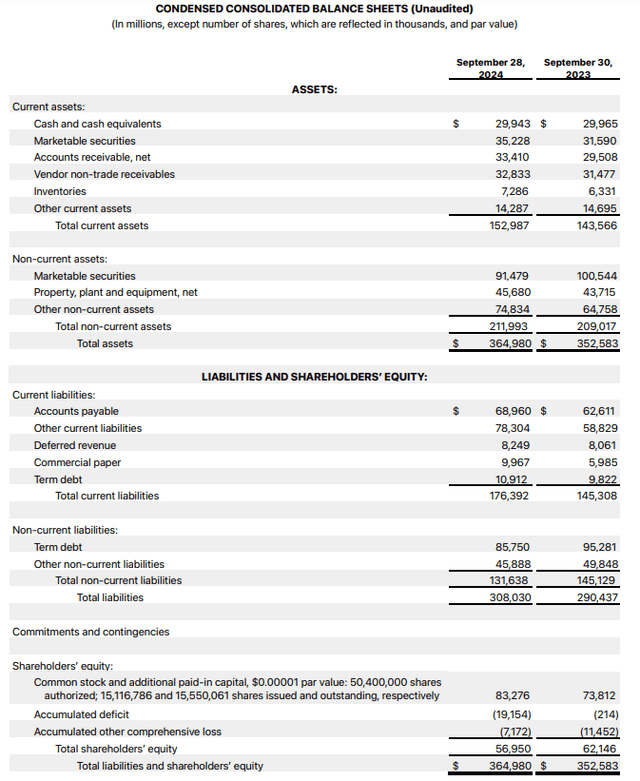

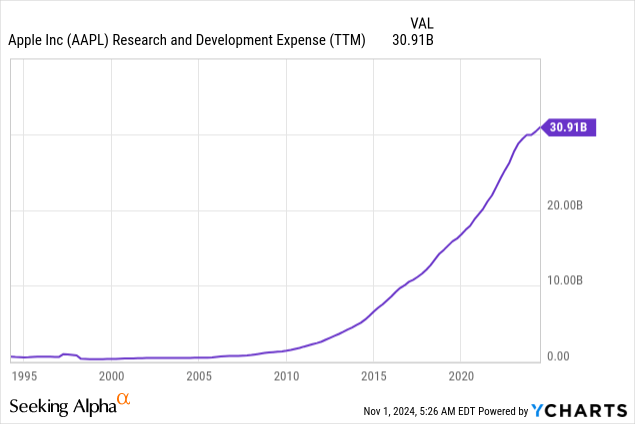

It is highly likely that Apple Intelligence will be able to become a solid value proposition for subscribers because the company invests vast amounts in innovation. The TTM R&D spending is above $30 billion, which is comparable to GDP of some European countries. The amount allocated to R&D is unlikely to shrink anytime soon, as the company is in a strong financial position with more than $60 billion in cash and marketable securities. Apple’s financial position is poised to remain a fortress as long as the company generates far more than $100 billion in cash from operations per year.

Apart from the strong potential for the iPhone and Services, let me remind readers that Apple is an ecosystem. The company develops all products across its ecosystem to address technological disruptions caused by the wide adoption of AI. The company presented its revolutionary M4 chip in May, and it is now incorporated in most products across Apple’s ecosystem. Over the last few weeks, Apple rolled out several products powered by its AI chip: the MacBook Pro, the new iMac, and the Mac mini.

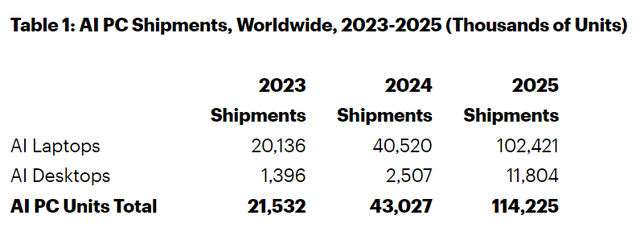

Developments surrounding the introduction of AI-powered desktops and laptops from Apple are vital as the AI revolution is poised to penetrate the PC industry. According to Gartner, shipments of AI laptops and desktops are expected to more than double in 2025. This presents a significant tailwind for Apple, and we can only applaud the management’s visionary talent in recognizing major new secular trends.

Apple remains extremely strong fundamentally, and the company’s compelling new Apple Intelligence offering has likely helped reverse the negative trends in recent quarters’ iPhone sales. With the success of AI features for the iPhone, I am optimistic about the company’s ability to boost laptop and desktop sales. This is due to the recent introduction of new M4-powered offerings, which are poised to capitalize on a major new secular trend.

Valuation analysis

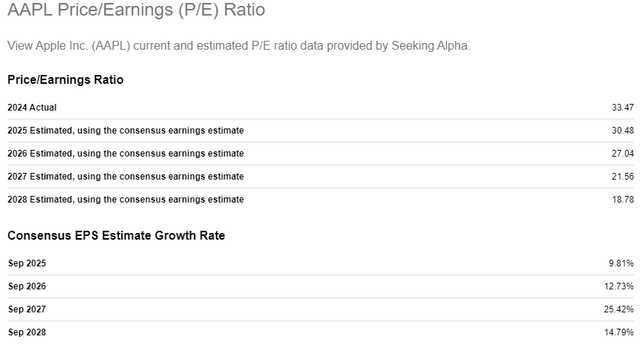

Per the below table, AAPL’s P/E ratio is projected to dip below 20 within the next five years. Given all fundamental tailwinds, I think that EPS growth projections are fair. For a company like AAPL, the expected forward P/E ratio decrease by almost two times between 2024 and 2028 means that the stock is reasonably valued.

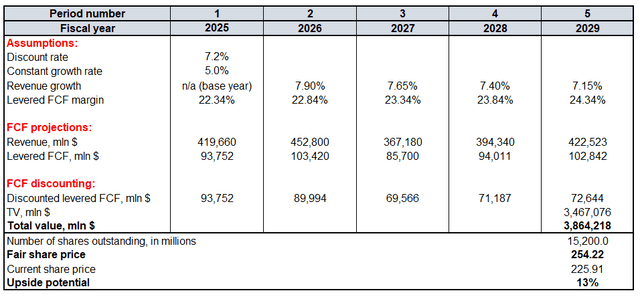

AAPL’s fair share price will be determined using the DCF approach. A 7.2% WACC is used as a discount rate. Relying on FY 2025-2026 revenue consensus is sound because the sample of more than 20 Wall Street analysts is representative, in my opinion. As comparatives expand, I incorporate a steady 25 bps annual revenue growth rate decrease. The TTM FCF margin is 22.34%, and I anticipate a 50 bps yearly expansion. Due to Apple’s increased AI exposure after rolling out a new line-up of products powered with more powerful chips, I incorporate a 5% constant growth rate for the terminal value (‘TV’) calculation.

The below DCF model suggests that the stock’s fair price is $254. This is 13% higher than the last close, meaning that there is a solid upside potential. A 13% discount for a stock like AAPL looks like a compelling investment opportunity, in my opinion.

Mitigating factors

Despite the iPhone returning to its growth path, sales of the company’s flagship product in China remain a big headwind. With its 1.4 billion population, China is a crucial market for any product, and recent news suggests that the company continues facing struggles in this market. Despite consolidated FQ4 iPhone sales growth, revenue generated in China showed a slight decline. Apple’s smartphone market share in China during calendar Q3 slipped by 50 basis points, while Huawei’s shipments soared.

Significant geopolitical risks should be mentioned as well. The company’s supply chain is heavily concentrated in China. Despite Apple’s initiatives to diversify production and rapid growth in exports of India-made iPhones, the Chinese exposure is highly likely still significant. I think so because in early 2023 it was reported that more than 95% of iPhones, AirPods, Macs, and iPads were made in China. Therefore, the shift to India definitely won’t be rapid.

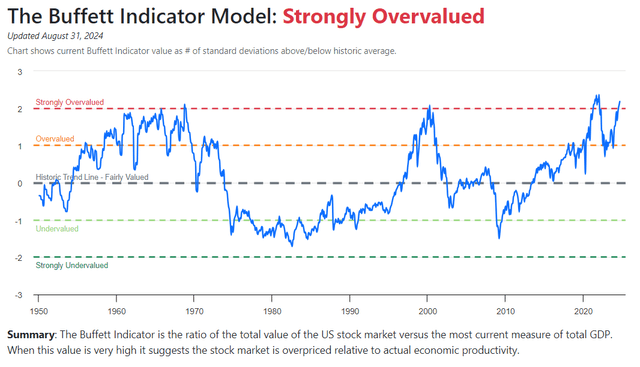

According to some approaches, the U.S. stock market is considered overvalued. While I do not agree with these approaches, I might be too optimistic. Apple is the largest company in the U.S. stock market, and a potential correction might hit the stock significantly.

Conclusion

Apple is very attractively valued since there is a 13% upside potential. I think that the company remains fundamentally quite strong, and recent new products releases make AAPL well positioned to absorb AI tailwinds.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.