Summary:

- After a blistering rally YTD, Apple stock is viewed by some investors as being overvalued.

- We believe that Apple should be viewed as a consumer staple company and should be compared with those types of companies on a valuation basis.

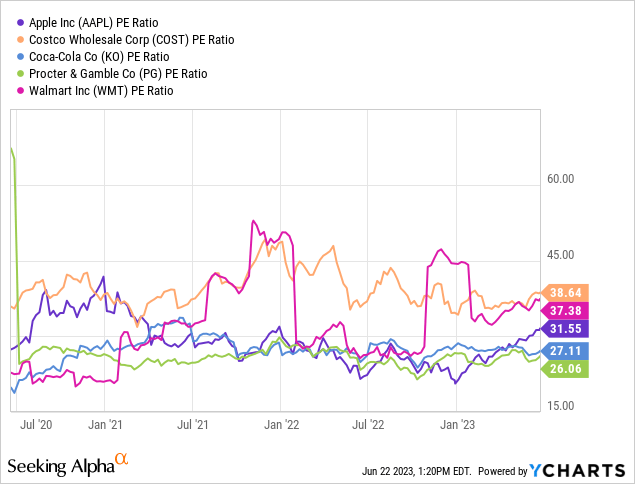

- Comparing Apple to consumer staple companies like Costco, Coca-Cola, Procter & Gamble, and Walmart, Apple’s P/E ratio sits in the middle, despite having more optionality and a stronger brand.

- Despite trading towards the high end of its long-term valuation range, Apple is suitable for investors looking for stability and consistency in their portfolio.

- Apple stock fills a specific role in a diversified portfolio, but may not be suitable for all investors depending on their specific financial plan.

Nikada/iStock Unreleased via Getty Images

Thesis

Some investors believe that Apple (NASDAQ:AAPL) is trading at a rich valuation after a blistering rally year to date. The value of Apple comes from their strong brand, loyal customer base, and wide moat. The company can be thought of and valued as a consumer staple rather than a tech company. There is a certain premium associated with stability, and when viewing Apple through a consumer staple lens the current valuation appears to be more than justified. Apple stock can play an important role in a diversified portfolio and in our opinion can take the place of lower quality consumer staple or consumer discretionary companies.

Apple’s Place in Society

Apple recently unveiled their VR Headset, but for a long time the company had gone without introducing a new product. The Apple Watch was the most recent high profile product launched before the headset was announced. Apple has spent the past few years iterating on their existing products, and in some cases has made few changes generation to generation. Despite their lack of hardware innovation relative to other phone manufacturers, the company has continued to grow. This is because Apple has become the default for many consumers around the globe. The ease of use of their products has resulted in familiarity in the eyes of the consumer. They know exactly what they are getting when they purchase an Apple product, and for the most part won’t have many issues with it.

The Case for Apple Being Viewed as a Consumer Staple

Apple has a strong brand, loyal customer base, and a wide moat. The result is a company who is able to consistently grow their revenues and profits despite already being the largest company in the world by market cap. Their quest to become net cash neutral has resulted in the largest capital return plan currently present in the public markets.

When investors think about consumer staples, the first thing that comes to mind is a consumer facing company that doesn’t grow much but grows steadily, is a household name with a loyal and satisfied customer base, and returns a large amount of capital to shareholders through buybacks and dividends. Apple has all of these characteristics and in our mind is much more like a consumer staple company than a traditional “tech” company like Microsoft (MSFT) or Nvidia (NVDA).

Valuation Comparison

For this comparison we have chosen to highlight Costco (COST), Coca-Cola (KO), Procter & Gamble (PG), and Walmart (WMT) as consumer staple comparables. As can be seen in the chart below, on a P/E basis Apple sits in the middle of these companies. This is despite having (in our opinion) far more optionality and a stronger brand than any of these other companies.

Investors can sometimes be confounded when high P/E valuations are granted to slow growing companies. Some companies are given a “stability premium” by the market. They can often be found in the consumer staple and utility sectors. The reason for this is that investors sometimes prioritize stability over return potential, especially in the case of investing for retirement or when in retirement. Capital preservation begins to have a larger importance in investor’s financial plans as they grow older, and is what leads to the stability premium observed in some stocks and sectors of the market.

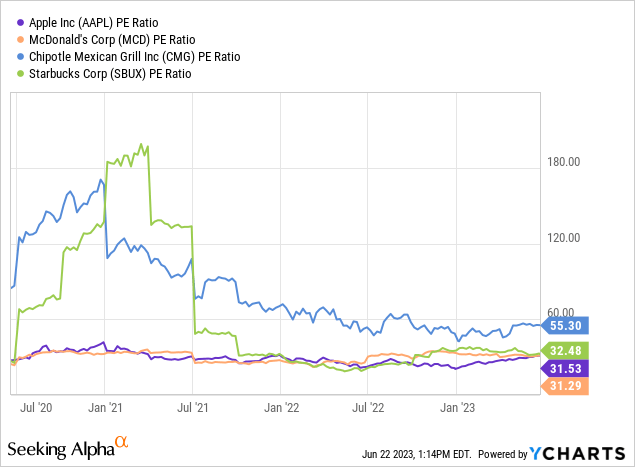

In our mind, value investors have much more to gripe about when it comes to consumer discretionary companies that are often given these high valuations as well. We find it difficult to believe that any of the companies in the below chart are on the same level as Apple, and yet they are given an equal or greater P/E valuation. Are these companies overvalued or is Apple undervalued? Only time will tell.

In our mind, Apple looks like a no-brainer when compared to the above consumer staple and consumer discretionary companies. We suggest that bearish investors view Apple in a new light and consider Apple stock as being for those who seek stability and consistency, and value it as such. When changing the comparables used to value Apple the company actually appears to be reasonably valued for the role it plays in a portfolio.

The Added Benefit of Optionality

Apple has many irons in the fire and the potential to unlock new high margin revenue streams. Their brand strength gives them additional flexibility in their business model. This is in contrast to many consumer staple companies whose expertise lies in low margin physical goods and whose brands are not as strong as Apple’s.

Apple’s greatest advantage is that they are more than a brand/company, they are an ecosystem.

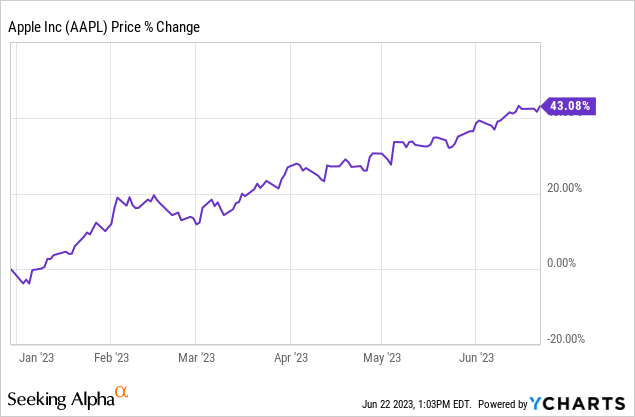

Price Action

Apple has had a blistering rally year to date and is a member of the so called “Magnificent Seven”. This rally has rightly led to some investors becoming cautious on the name. We view the rally as being justified given our opinion that Apple should trade in line with notable consumer staple companies on a valuation basis.

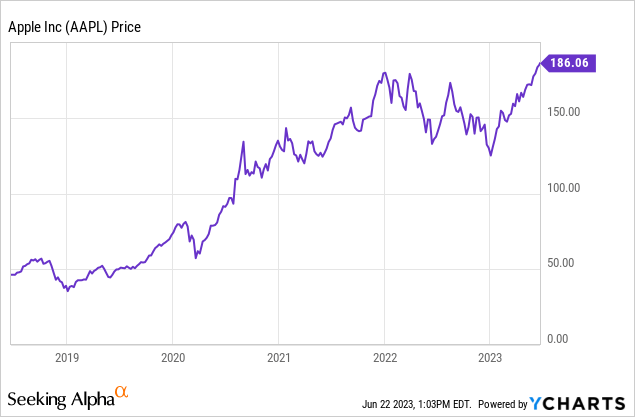

Apple is making all-time highs and the company is on its way to breaching the three trillion market cap threshold.

Investors should look at an investment in Apple through the lens of their financial goals. Investors looking for maximum capital appreciation may want to look elsewhere. Investors looking for stability and consistency in their portfolio (in our opinion) shouldn’t be scared away by the momentum and can still build a position despite the stock being on a hot YTD run and making all-time highs.

Valuation

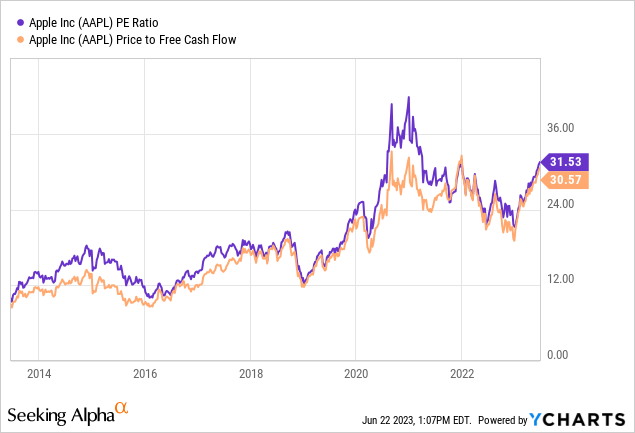

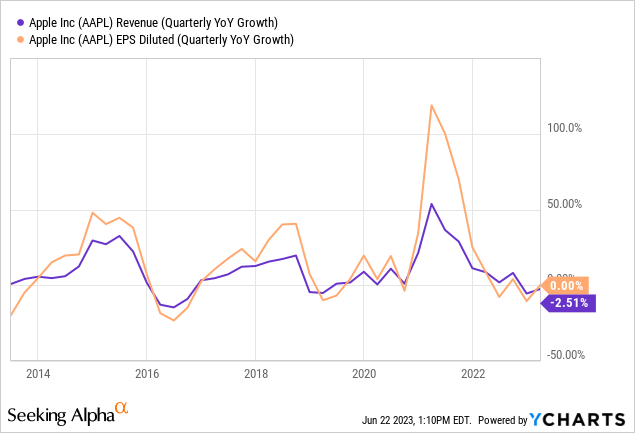

Apple is certainly trading towards the high end of its long-term valuation range, however as discussed earlier this makes sense when the company is viewed as a consumer staple. The stability premium assigned to Apple causes it to trade above where many value investors would deem as acceptable, especially given their depressed level of revenue and earnings growth.

We view Apple as being suitable for investors despite the somewhat stretched valuation relative to their recent history. The caveat being that those investors want to build a diversified portfolio and aren’t seeking maximum potential capital appreciation. In a diversified portfolio we believe that Apple can take the place of lower quality consumer staple or consumer discretionary picks, depending on how the investor leans regarding Apple and how they personally want to classify the company.

Risks

There are some notable risks regarding Apple which we will briefly outline below.

Geopolitical Tensions

Since Apple relies heavily on China and Taiwan for their manufacturing needs, the company is highly sensitive to tensions heating up in that geographic region. Apple is currently diversifying their supply chain in order to mitigate this risk.

Loss of Brand Appeal

Apple’s brand could lose its luster with younger generations and be replaced by some other company. This eventually happens with all companies but still seems a ways out for Apple, though a challenger will eventually emerge.

Loss of Interest in Current Product Lines

Apple’s products could be viewed as stale if the company fails to make meaningful iterations.

Inability to Expand Into New End Markets

Apple may be unable to meaningfully expand into new markets such as India. This would limit their growth going forward and lead to less investor enthusiasm surrounding the stock.

Inability to Develop New Products

Apple’s VR Headset may be a flop and the company could struggle to innovate going forward.

We view the risk/reward as being reasonable at these levels, but as with any company, the risks are worth monitoring.

Key Takeaway

Apple appears to be expensive by some metrics but the stock serves a specific purpose in a diversified portfolio. We believe that the stock should be viewed as a consumer staple and valued as such. Investors can continue to own this high quality name if it fits within their financial plan and ignore the short-term noise surrounding valuation concerns or a perceived lack of innovation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to AAPL, MSFT, and NVDA.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.