Summary:

- Warren Buffett has sold two-thirds of Berkshire Hathaway’s Apple Inc. shares in Q1 to Q3 2024.

- Investors should pay attention to rather than explain away Buffett’s Apple sale.

- AAPL faces heated competition and has been losing market share in China. This could potentially negatively impact overall financials for several years if its China performance reverts to FY17-20 levels.

Nikada/iStock Unreleased via Getty Images

In another news release after-hours, Berkshire Hathaway (BRK.A, BRK.B) disclosed the sale of 100 million shares of Apple Inc. (NASDAQ:AAPL) in Q3, 2024. (below, for simplicity, I will refer to this as Buffett’s AAPL sale even though it is technically Berkshire Hathaway’s AAPL sale).

This is similar to Buffett halving Berkshire Hathaway’s stake in AAPL in Q2 2024 (which I previously discussed here) whereby the sale was disclosed during afterhours as part of the release of Berkshire’s Q2 quarterly financials. This article discusses Buffett’s AAPL sale in the context of his historical sales and recent AAPL news.

- Buffett has sold two thirds of AAPL shares in Q1 to Q3 2024

The Q3 2024 sale brings the total amount of Apple shares sold by Buffett to 605 million in Q1 to Q3, 2024, with only 300 million shares remaining. As shown below, Buffett has been consistently selling Apple throughout 2024.

Summary (source): Buffett sale of AAPL sales in Q1 to Q3, 2024 (in millions of shares)

|

Q1-2024 |

Q2-2024 |

Q3-2024 |

Total |

|

116 |

389 |

100 |

605 |

2. Investors should pay attention rather than explain away Buffett’s AAPL sale

As I argued in my previous article, investors should pay attention to Buffett’s AAPL sale. Buffett bought heavily into AAPL in 2016-2018 when it was priced at a low P/E and there were doubts surrounding it. Now Buffett is selling, but it seems many analysts would rather not take it as a bearish signal. For example, there have been a plethora of explanations about why Buffet selling such a significant number of shares is not bearish for AAPL, such as:

- Saving on taxes: Buffett may have contributed to this explanation by hinting he may have sold Apple in Q1-2024, as he expected, higher corporate tax rates in the future.

- Symmetrical positioning in AAPL and Coca-Cola (KO): One commentator noted that Berkshire owned exactly 400 million shares of AAPL and KO at June 30, 2024, and wondered if Buffett intended to keep a symmetrical position in these two companies. With the Q3-sale, it turns out that may have just been a coincidence.

- Portfolio rebalancing: Some argue that as Buffett is getting older, he may want to preserve his legacy by de-concentrating Berkshire’s portfolio (at Q4-2023, AAPL accounted for roughly half of Berkshire’s stock holdings). Yet, the cash raised from his AAPL sale is going into US treasury bills, so it’s not really portfolio rebalancing per se in terms of investing in more attractive opportunities, but just stockpiling cash.

I think it’s better to adopt a simplified approach, if it quacks it’s a duck. If we go back and watch/read Buffett full response on May 4, 2024, to the question of why Berkshire sold AAPL in Q1-2024, it is quite illuminating (bold text by me):

Buffett: “We will have Apple as our largest investment, but I don’t mind at all, under current conditions, building the cash position. I think when I look at the alternative of what’s available, the equity markets, and I look at the composition of what’s going on in the world, we find it quite attractive.”

Buffett reaffirmed to keeping AAPL as his largest investment. So far, this is still true at September 30, 2024, where the value of Berkshire’s AAPL holdings was $70 bn (larger than any other stock in his portfolio). However, Buffett hinted that he found cash attractive compared to what’s alternatively available in the equity markets. So Buffett is warning about what he views as overly high equity valuations, and his persistent selling of AAPL and Bank of America (BAC) perhaps reflects this general concern as well.

A quick recap below shows Buffett’s entry and exit of AAPL compared to latest AAPL financials:

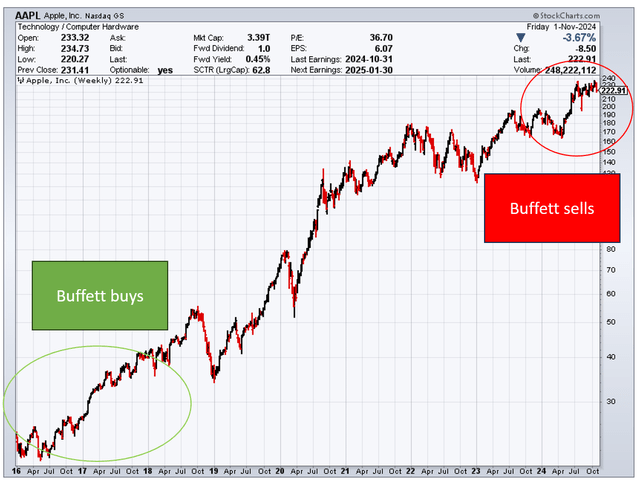

Buffett buy and sale of AAPL (StockCharts)

AAPL’s stock price has gone up five-fold or more (depending on which entry date is used) since Buffett’s purchases from 2016 to 2018, but operating profits have only doubled. Multiple expansion (doubling or tripling, again depending on entry date) was another major factor contributing to the overall returns.

|

Buffett’s major purchases from 2016 to 2018 |

Currently as at Nov 1, 2024 |

|

|

AAPL share price |

$20-$40/share |

$222.91/share |

|

AAPL Market cap |

$500 billion – $1 trillion |

$3.37 trillion |

|

AAPL annual operating pre-tax income* |

$60 – $70bn/year |

$123bn |

|

AAPL Forward P/E |

c.10 to mid-teens |

Source: Financials from Seeking Alpha, marketcap from Companiesmarketcap. *: I use operating income rather than net income, as FY24 AAPL net income was distorted by one-off items such as penalties etc.

This does not mean I think Buffett believes or is predicting valuations will revert to lower levels any time soon. As covered in my previous article and is evidently visible in the above chart, it took years for Buffett’s investment in AAPL to really pay off, as the stock languished at low levels for many years. But eventually the value that Buffett saw in AAPL shone through. So now that Buffett is selling, AAPL’s stock price might not fall any time soon. It actually rose to near record highs after Buffett’s Q2 sale sparked a mini-crash in August 2024, but I would tend to trust Buffett’s judgment over the long run.

3. China’s woes in recent data may impact growth trajectory

AAPL’s most recent quarterly earnings release beat estimates, but analysts were worried by the persistent sales decline in China (source:“The iPhone maker’s sales in the Greater China market fell to US$15.03 billion in the three months through September from US$15.08 billion in the same period last year, according to the company’s latest financial report. Revenue for the region in the 12 months ended September 28 also fell 7.7 percent to US$66.95 billion”). Upon further analysis, it appears the concern is warranted.

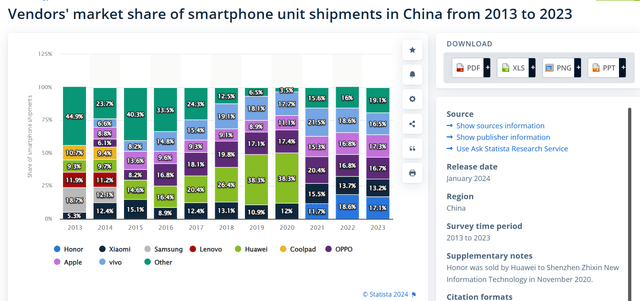

Apple’s share of China smartphone shipments (purple below) was around 10% from 2016 to 2020 before soaring to 15-17% during 2021 to 2023 as a result of new products as well as its local competitor Huawei stumbling.

AAPL smartphone market share in China (Statista)

However as shown below, in 2024, AAPL has lost ground against Huawei in the China market, capturing only 16%, 14% and 15.6% of the China market in the first three quarters of 2024 respectively (which would average about 15%, on par with 2021 levels). Given Huawei’s comeback in the Chinese market (from 10% in Q1 2023 to 15% in Q3 2024) with what China attributes to technology breakthroughs and the US attributes to government subsidies. Either way, Huawei will probably gain on AAPL given (i) it is a national champion in a critical area and (ii) AAPL faces hurdles such as an uncertain timeline for rollout of AI features in China.

Source: Counterpoint for Q1-22 to Q2-24, IDC for Q3-24. Above are calendar years, not Apple fiscal years.

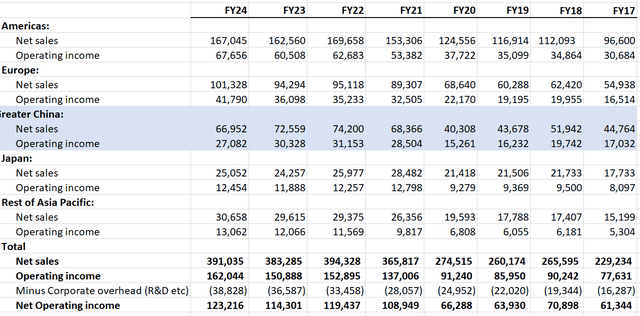

If AAPL smartphone market share in China falls back to 2017-2020 levels of 9-11%, AAPL China revenues could drop by a third, if not more. They could revert to FY17 levels of $44bn revenues and $17bn operating profit as shown below, which is a $22bn decline in revenues and $10bn decline in operating profit versus FY24 levels.

To put that in context, AAPL total sales growth and operating income in FY24 versus FY23 was $8bn and $12bn increase respectively. A reversion to pre-COVID China market share for AAPL could have a big drag on AAPL’s earning growth for several years.

AAPL revenue profit by region (AAPL 10-K)

AAPL’s doubling in operating income from FY17 to FY24 is a CAGR of roughly 10%, which is impressive for a company of AAPL’s size but not anywhere close to what would typically support a P/E of 30 (i.e., assuming a PEG ratio of 1, then the annual growth rate should be near 30%). If revenue/profit growth for AAPL slows or near nil, dragged down by its performance in China for years, markets could lose patience and revalue it at a PE closer to its trend growth rate (e.g., maybe 10 or the teens like in the 2010s).

Conclusion

Buffett has been selling AAPL shares for three quarters straight and has hinted that he feels cash is more attractive than equity markets. My opinion is that Buffett feels AAPL/market valuations are overall stretched and investors should heed his implicit warning. Again, I would not go short given the stellar track record tech stocks have had in the past decade in proving naysayers wrong, but perhaps a bit of caution is warranted like I believe Buffett is hinting at.

In conclusion, AAPL’s dwindling market share in recent quarters in China could be a drag on AAPL’s performance in the coming years and may negatively impact AAPL’s earnings and valuation multiple.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.