Summary:

- Apple’s stock has lagged the broader market in recent months.

- The stock is attractively valued based on historical price-EBITDA relationships and analyst estimates.

- A robust product release schedule for 2023 will provide a boost.

- Apple has best-in-class returns on capital which supports a premium valuation even in today’s market.

Nikada/iStock Unreleased via Getty Images

What Goes Down…

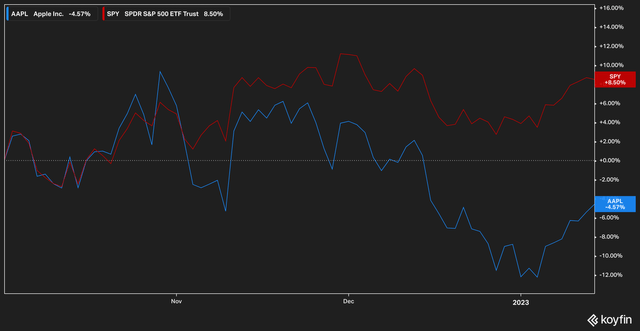

Over the last few months, Apple (NASDAQ:AAPL) stock has done something that it doesn’t often do: underperform. Since the company’s last earnings call on October 27th, the stock has broken away from the broader market, returning -4% while the S&P 500 (SPY) has delivered 8.5%.

AAPL vs SPY Since October 2022 (Koyfin)

The reason for this short-term underperformance isn’t exactly obvious. Apple, after all, reported record revenues in its October earnings release, and Tim Cook announced that the company has yet to feel the sting of consumer softness in the economy.

Investors, however, don’t seem to have believed him.

From worries about production issues in China to softening demand for the iPhone that investors seem certain will materialize at some point, investors just seem plain worried that something will go awry at the world’s largest company. We contend in this article that these concerns are overblown and that the current underperformance represents a buying opportunity.

The China Worry

Apple has faced down a multitude of investor worries regarding its relationship with China. Apple has been accused of being too cozy with China, of making secret deals with China, of having its supply chain being too exposed to China, and of being cowardly when it comes to China.

While the veracity of these claims are better left to other authors, we don’t think we’re overstepping by saying that China has been made into a bogeyman for Apple investors. Apple has arguably done better than almost any other American corporation at walking the fine line that western companies must navigate in order to successfully do business in China.

The current top-of-mind China worries for Apple investors, however, are supply-chain issues and questions surrounding lockdowns and China’s notorious zero-COVID policy. As long as the country is locking up millions of its citizens in forced isolation, things will be difficult for Apple.

Investors were delivered good news recently, then, when Bloomberg and the Wall Street Journal reported that Chinese officials were scaling back COVID lockdowns, potentially re-opening the economy at a much faster pace than expected. Importantly, Vice Premier Hiu Le told an audience at Davos that Beijing’s focus this year would be on “boosting domestic demand.”

In other words, we believe that Chinese leadership’s struggles with large scale problems such as population decline and slumping economic growth make it less likely to rock the boat with Apple, at least in the near term.

All of this bodes well for Apple’s business in China, which beat analyst estimates last quarter with $15.6 billion in revenue. Apple further stands to gain in the near term from the collapse of the U.S. dollar’s 2022 rally.

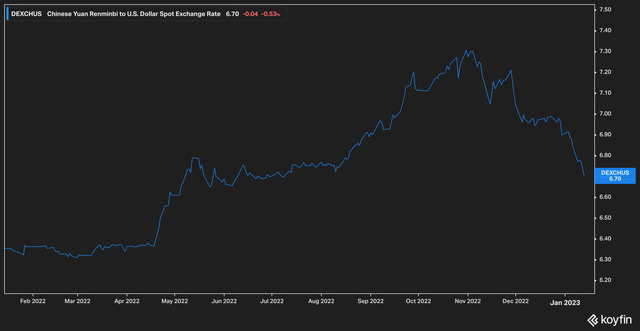

Yuan to Dollar Spot Exchange Rate (Koyfin)

A strong dollar reduces a company’s international sales because when revenues are recorded in dollars (as Apple’s are), they must be converted. When one Yuan converts to fewer and fewer dollars, the effects on the income statement quickly mount. Thus, the dollar’s recent decline is good news for Apple and American companies conducting business overseas in general. The easing of FX headwinds should give Apple’s international sales–and Chinese sales in particular–a welcome boost.

A Robust Product Pipeline

Steve Jobs is rumored to have said at one point that Tim Cook wasn’t “a product guy.” The long line of releases that Apple has in store for 2023 would probably beg to differ.

Only three weeks into the new year, Apple has already re-launched its HomePod product as well as a slew of new Mac variations. A full list of potential releases can be found here, but amidst the rumors of an Apple Car, something else very interesting has emerged–an Apple VR headset, reportedly ready for launch this year.

This is the product that, we think, should keep Mark Zuckerberg awake at night. Meta (META) has been at the forefront of the VR headset realm for some time since it purchased Oculus in 2014. Widespread adoption of the technology, however, has been a bit slow to catch on, which could have something to do with the fact that Meta is not principally a hardware company.

Apple, of course doesn’t have this problem. If the product does in fact launch in 2023, we expect that it will be maniacally engineered and deliver a user experience unmatched by current technology. Combine this with Apple’s dedicated user base and app ecosystem, as well as Apple’s influence with developers, and it’s quite possible to envision Apple launching VR adoption into the mainstream.

History is on our side with this claim. At its launch the iPad was met with a notorious level of criticism. Many companies had attempted to create a tablet in previous years (including Apple–remember the Newton?), but just couldn’t quite pull it off. The Apple Watch, too, was met with similar skepticism.

In short, if anyone can pull off a VR coup, we believe Apple can.

A Compelling Valuation

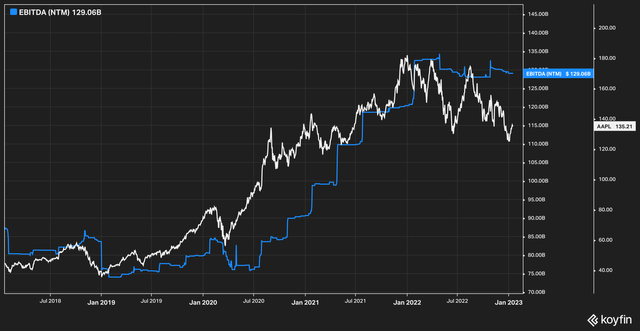

Over the past five years, Apple’s stock has maintained a fairly consistent relationship to forward EBITDA.

Overlaid against each other, the stock has consistently tracked above forward EBITDA estimates. In 2022, estimates began to flatten as inflation took hold and recession fears set in and the relationship reversed, with the stock price falling beneath forward EBITDA. We believe that the current inversion of this historical relationship presents an attractive opportunity for investors. This reflects our belief that Apple’s stock won’t be stuck in the doldrums forever.

Analysts, too, believe that Apple has better days ahead.

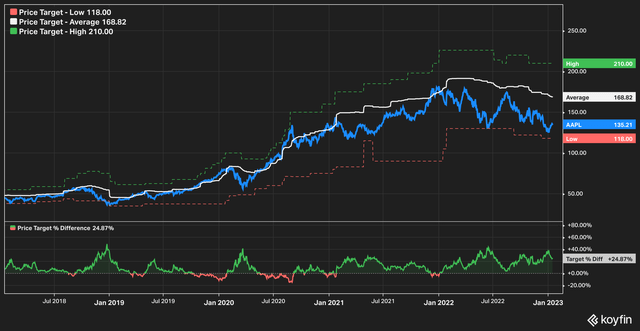

Apple Analyst Price Consensus (Koyfin)

Of the 45 analysts estimates tracked, the average price target is $168.82. With its current price of $135, Apple has an almost 25% upside to its consensus target.

Normally we take analyst targets with a grain of salt, but an interesting pattern seems to emerge in the lower pane of the above chart–each time Apple’s stock price slumps causing the distance between price and target price to exceed 20%, the stock tends to respond to the upside.

Some investors may agree up to this point but wonder–why, in the face of rising interest rates, does Apple continue to deserve such a premium valuation? Shouldn’t Apple, at some point, be affected by the same gravity that has pulled down the likes of Amazon (AMZN) and Alphabet (GOOG) (GOOGL) in the last year?

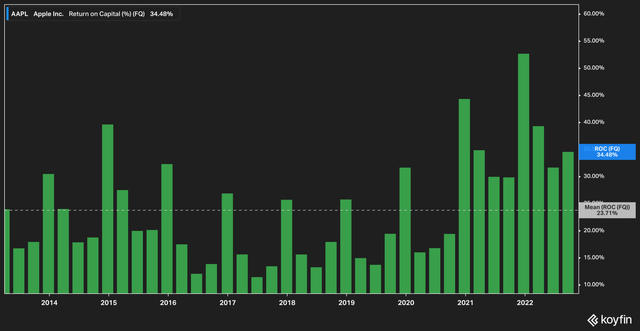

We’re glad you asked, because a piece of the Apple puzzle that we believe is under-reported is the company’s sheer efficiency. Apple’s business is simply an earnings machine, reporting world-class returns on capital quarter after quarter.

In the last 10 years, Apple has averaged an eye-popping 23.7% quarterly return on capital, and performance over the past two years has been even stronger. For reference, we prefer return on capital over other metrics such as return on equity since ROC can be directly compared to a company’s estimated cost of capital. Comparing those two figures is helpful in inferring the profitability and sustainability of a business.

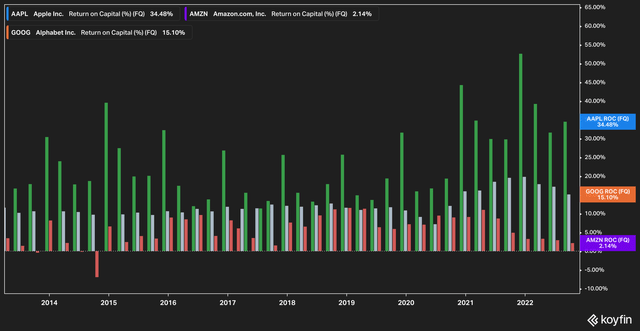

Now, just for kicks, let’s compare Apple’s reported ROC with Alphabet and Amazon.

AAPL, GOOG, AMZN 10 Year Quarterly ROC (Koyfin)

It isn’t even close. Compared with Apple’s 23.7% ROC, Alphabet’s average quarterly ROC over 10 years was 12.3% (the bars in white), while Amazon’s was 5.7% (the bars in red).

Apple really is that good.

The Bottom Line

In sum, we believe that Apple shares present a highly compelling opportunity for investors.

- Apple’s business is world-class, with best-in-industry returns on capital that continue to justify a premium valuation.

- Fears about China–including FX headwinds–may dissipate or prove less impactful than feared.

- Apple continues to innovate and is expected to bring fresh products to market in 2023.

- There currently exists a price-EBITDA discrepancy which could present a compelling entry or position building point.

We believe a price of $165 for Apple is a fair target. That price represents a 24x multiple on estimated 2024 earnings, which is well within the stock’s historical multiple trading range. We believe the premium multiple is justified for the reasons outlined above.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.