Summary:

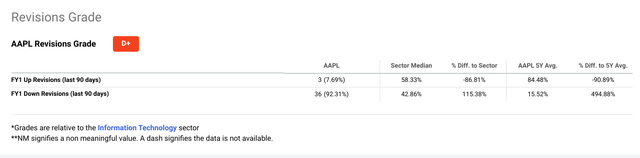

- Apple is facing mounting downward revisions as the most crucial quarter of the year for the world’s largest company approaches.

- The acute nature of supply concerns in China has receded, but I suspect this will be an enduring problem over the next few years.

- Recently, more evidence has been mounting that the company may be facing receding demand across several product lines.

- The company has reduced expectations and goals for two major future products that cast a shadow on future earnings.

- Apple is facing headwinds across multiple divisions going into its crucial first fiscal quarter of 2023, setting the stage for a big earnings miss.

chris-mueller

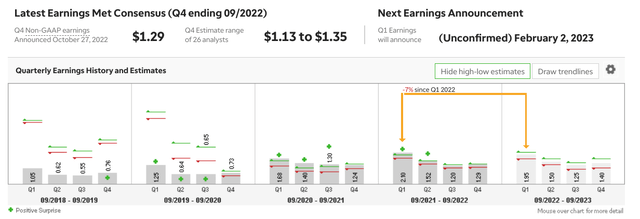

Apple (NASDAQ:AAPL) is the world’s largest company and one of the most successful companies in history. However, I believe it is likely approaching one of its worst quarterly earnings reports in the last decade. Multiple headwinds across Apple’s diverse segments suggest next quarter could be a big miss, or perhaps there could even be a pre-announcement. In the last eight quarters, Apple has beat expectations every time and met expectations once in October 2021.

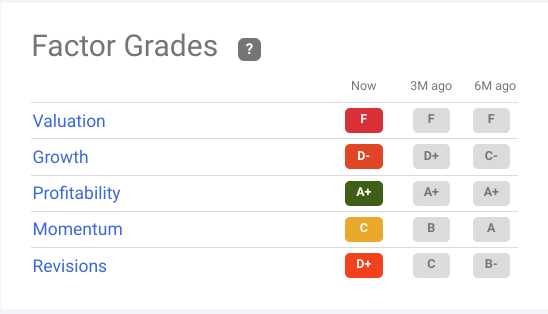

Apple’s multiple has grown recently as it proved its services business could be a true grower. However, the hardware segments still account for 80% of revenue, which is expected to be essentially flat this year. There have been continual problems with the development of future products. Given the company’s massive scale, I believe success here would have to be perfect to contribute to revenue meaningfully.

Apple has grown from $19.1 billion in annual revenue in 2006 to $394 billion in 2022. The impeccable record of the last decades seems too much to maintain, and while the firm successfully spun a lot of plates to keep delivering during COVID, this is the quarter where a few are likely to fall. Much of the recent behavior of management could suggest that a “mea culpa” quarter is what’s in store.

Seeking Alpha

The other thing is that the Services business is experiencing single-digit growth and has had personnel issues. Due to these issues, the vital segment is undergoing a complete restructuring: another source of risk for a company with no current roadmap to produce genre-defining blockbuster products that have a high chance of living up to the super-human expectations that investors have for this stock. Over the last quarters, Cupertino has beaten expectations by less and less. I suspect this next quarter is when they finally miss, perhaps in a shocking way.

Apple’s Performance Lately

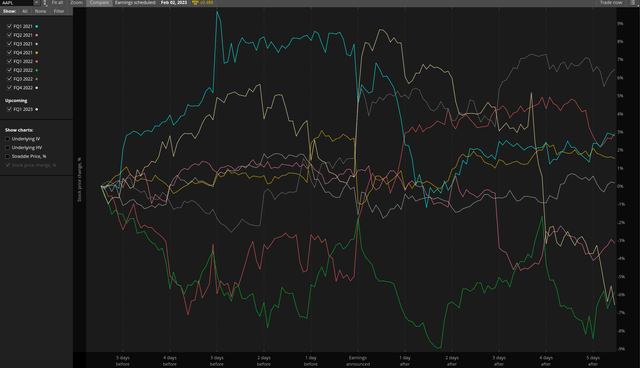

Last quarter, Apple held the line with record September sales of $90 billion that surpassed analyst estimates while its Tech Titan peers languished amid slowdowns in demand for core revenue drivers, including digital advertising. This quarter, I think Apple’s earnings will be very weak and lead to one of the most significant one-day drops for the stock in recent history. The stock only had one major post-earnings drop in the last eight quarters in FQ2022, and the stock was down almost 9% a day after that report. I suspect this earnings report on February 2nd will result in the stock dropping more than this.

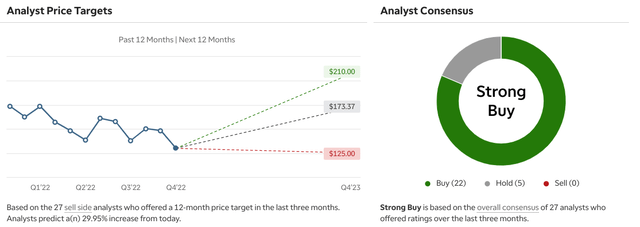

The uncertainty and obstacles casting a shadow over this coming earnings report are significant for Apple. The first fiscal quarter of the year reflects Apple’s holiday sales, and over the last five years, this quarter has been responsible for around a third of the total revenue for the year. Downward revisions have flurried in.

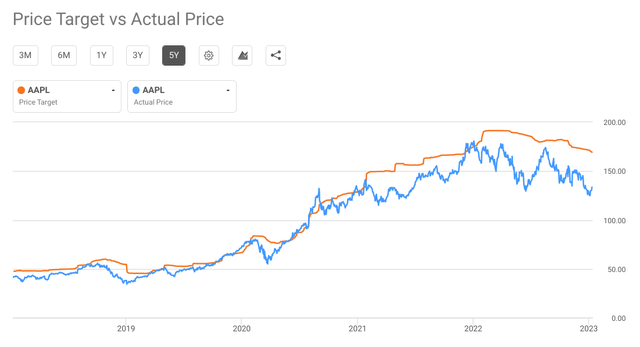

As I will argue in this article, the headwinds for Apple are mounting across the entire business, and uncertainty is building. It’s essential also to remember that if a stock has a P/E of 20, that 95% of the value is based on earnings far in the future. Apple has recently set diminished expectations for the two future products that will need to drive a lot of revenue to live up to the high expectations for the stock, the iCar and the AR headset.

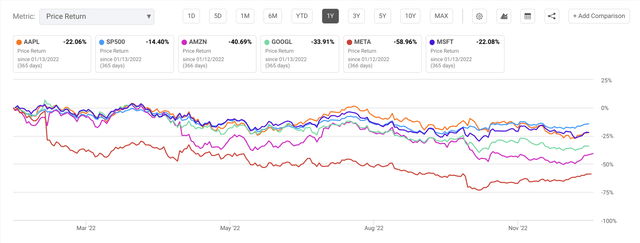

Over the last year, Technology got hit very hard as the Federal Reserve brought the pain with the second-fastest tightening cycle in history. Some large-cap tech names lost close to most of their market cap, some even more. However, Apple was a relative haven compared to many of its peers. The world’s largest company has done a lot to earn investors’ trust. It is perhaps the most successful company in history and the largest company on the planet by market cap.

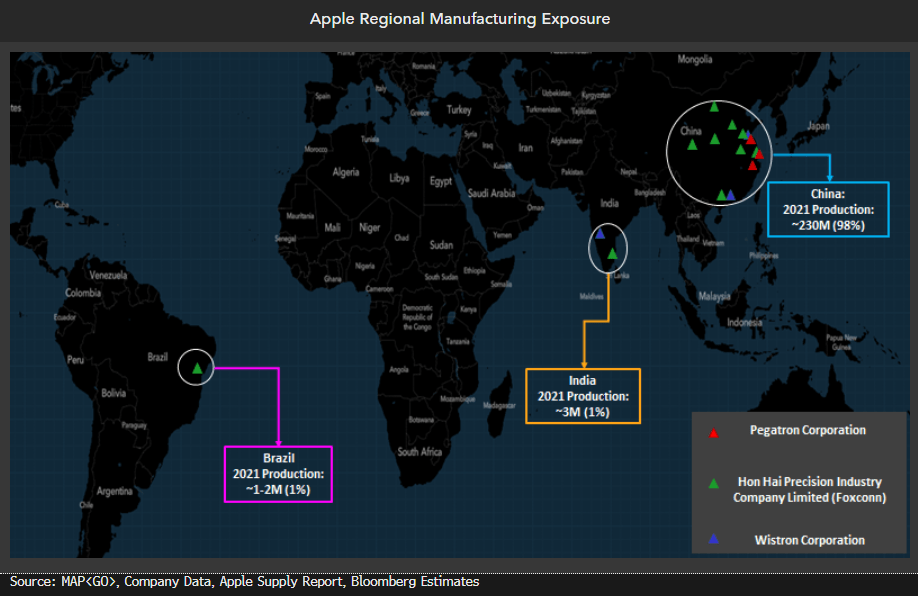

However, during November and December, alarming developments came out of Apple’s Shenzen manufacturing cluster, where it produces the vast majority of its most important product, the iPhone. First, production was interrupted by a COVID outbreak, and second by a riot and mass worker walk-outs.

This led to significant production interruptions. While many companies had been relocating operations out of China due to an increasingly challenging operating environment, Apple remained steadfast. However, in December, Apple finally cracked after the unseemly riot and announced plans to accelerate its supply chain diversification out of China.

Bloomberg

I did an article last month on Apple’s increasing supply chain woes called Apple’s China Curse Has Likely Only Just Begun. In this piece, I detailed why I thought the issues emerging from China were more consequential than a mere hiccup in the headline cycle. The low costs and stability that Apple’s Chinese partners have provided have been critical to the firm’s ability to generate the “super profits” that shareholders so love it for. Here is an excerpt summarizing my thoughts on the supply problem below.

The production issues in China and the subsequent efforts to diversify them at an accelerated pace means that the only direction for costs over the next couple of years will be up, at the expense of increasingly superior shareholder returns relative to peers. The product cycle depends on new models to sustain demand, so the interruption in the most advanced models is especially concerning and potentially very problematic. Already there are reports that Apple’s next model will require the largest price hike in the history of the iPhone. Apple must avoid losing its high-tempo iPhone product cadence at all costs. And cost it will.

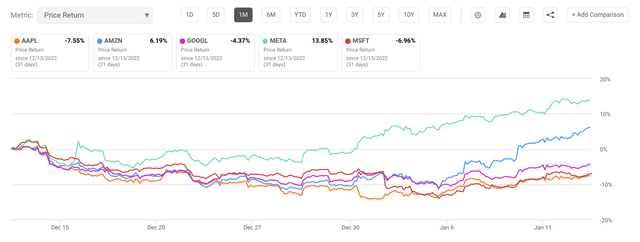

Since my article was published, Apple has significantly lagged behind its Tech peers, reversing the relative leadership it showed in 2022. Apple was down about 7.5% over the last month, with Microsoft not far behind. However, the rest of the large-cap tech titans did significantly better. Amazon gained over 6%, and Meta gained over 14%.

Apple dipped to a 52-week low of $124.17 on January 3rd and has since recovered to around $134 as of the writing of this article. Another big part of my bearishness on Apple was that its earnings are forecast to decelerate throughout the first half. It is tough comps off a COVID peak. But earnings are forecast to contract slightly the quarter after as well.

That article was focused on the supply-side issue in China, which has improved since, and the difficulty of moving away from China. However, many other headwinds are coming to roost as Apple approaches its most vital report of the year. As I previously argued, the issues from dependence on the Chinese manufacturing cluster won’t be going away anytime soon despite the improvement in what was an extremely acute situation. There are also other risks vexing Cupertino.

A Constellation of Risks Across Apple’s Business Casts a Dark Cloud in 2023

Apple is a genuinely excellent business that has changed the human experience profoundly, but it is also the largest business in the world. No matter what it is, the world’s largest business will always have a royal list of problems that defy comprehension. Indeed, it is a miracle that Apple performed so well during the global pandemic and a testament to the excellent management team.

However, the influx of demand during that period almost necessarily means growth will be subdued in the coming years, given the prodigious scale of the company and dismal economic conditions in key global markets. As you can see, one of the critical things Apple has been demonstrating to the joy of its shareholders over the last years is a diversification of revenue away from the iPhone, mainly from the fast-growing services segment. This is one of the main reasons the multiple expanded beyond its hardware peers, but there has been a weakness in services in past quarters that will likely only be getting worse.

The iPhone is a pretty mature product dependent on a highly synchronized global dance where thousands of suppliers from dozens of countries ship their wares to Foxconn facilities in China to be assembled. The upcoming quarter is already slated to be impacted significantly because of the supply disruptions in Apple’s core revenue driver.

Big Tech’s reporting relative to large non-Tech companies is somewhat more opaque, likely to deceive competitors on crucial profit centers, but this also makes it hard for analysts to understand the scale of adverse developments, which is only exacerbated by recency bias. This is not to imply any wrongdoing by the company or Big Tech in general. But, given that the size of their segments is larger than most companies and that Apple and its peers tend to lump a lot of business lines into fewer segments than non-tech peers, it can be challenging to know where potential risks can emerge after three bumper years in a row.

For example, the Economist reported that the five largest Technology firms have thirty-two reporting segments compared to fifty-six reporting segments for the largest five non-Tech firms. When you have the best of the best aiding in preparing your 10-Ks, there’s some perfectly legal wiggle room in how to present yourself best. You can bet that Big Tech is putting on its best face and not advertising its competitive edge, but this can also produce unwelcome surprises.

However, other emerging risks across the business make me think that the upcoming report could be even worse than the revised downward momentum in estimates revisions suggest. This is because the emerging constellation of risks goes far beyond the problems in Zhengzhou (iPhone city).

The first problem is also the most obvious one. You see that spike in iPhone sales, well the one coming next quarter will be severely diminished by the production issues I’ve already thoroughly discussed. What is less considered, though, is the recent reports that Apple is starting to experience reduced demand across several product lines. It is also estimated that up to 10% of Apple’s revenue could be threatened by looming antitrust efforts. One potential shock to investors would be if the multi-billion dollar payment Google pays for the exclusive search were to come under scrutiny. There are many moving parts and potential for unpleasant surprises in 2023.

Slowing Demand, Rising Costs, and Tough Comps: The production problems are well-known, and fears around this issue are probably the primary reason the stock recently hit a 52-week low. Still, rising concerns about demand for Apple products amid a general global electronics slowdown have cropped up recently. One Apple supplier recently told the media that the company has been asking its suppliers to produce fewer critical components because of weak demand “across almost all products.” The bumper demand for Macs and iPads that helped the company achieve record earnings in the wake of COVID is likely to reverse significantly.

Seeking Alpha

Also, despite being overshadowed by the problems at Zhengzhou and COVID protests, Apple has already cut production targets because of diminishing consumer demand. Remember that Apple is a global company and significant portions of sales come from Europe and China, both experiencing significant and potentially prolonged economic weakness. The economic weakness may be finally making its way to the high-end consumers that Apple largely depends on, and if a “richcession” occurs, the firm’s sales could suffer in an outsized way. It’s not just the products themselves; Apple services revenues depend on a high-spending customer in gaming, for instance. In this subsection of services, 1% of customers (presumably affluent) account for two-thirds of revenue.

The other thing is that the foregone iPhone demand from production issues won’t necessarily be recovered as in the past. Some expect Apple to revise estimates for the March quarter, but if we’re in the teeth of an economic slowdown, these upward projections might be too optimistic. Some analysts see the demand as increasingly perishable. If this is the case, then estimates for Apple’s earnings are still far too high. Price targets have decreased significantly, which may reach a crescendo after the following report.

Chinese demand for iPhones is challenging as the country endures a wrenching COVID outbreak after the nation’s leadership ended years of draconian anti-virus measures. The numbers of infected are in closing in on a billion cases. Significantly, the Chinese population may have diminished capacity for purchasing in the wake of such a ubiquitous scourge. Much of China’s population tends to save a high proportion of their income in savings, which may have been exhausted from medical expenses. A hefty proportion of the population has no proper health insurance. CFO Luca Maestri also predicted Mac sales would drop substantially this quarter.

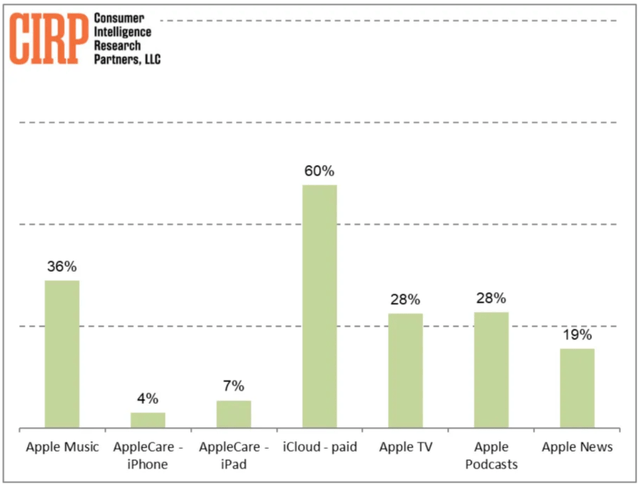

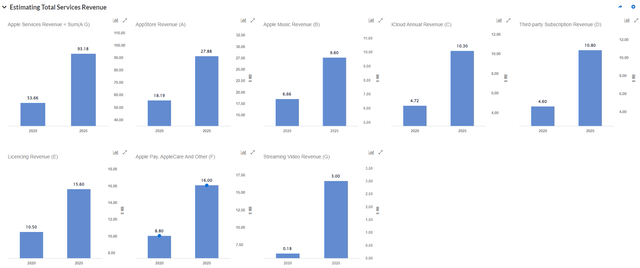

Problems With Services Segment: Wall Street Analysts have long been wary of Apple’s overconcentration in iPhones for revenue. The company’s answer was to create a diversified model that would become increasingly dependent on subscription revenue for Apple Services, including the App Store, Apple TV+, Apple Music, and cloud services.

The story of the Services growth has mainly been positive, but the massive influx of new activity seen around stay-at-home restrictions from COVID will be hard to maintain or supersede. Apple’s Services growth has been decelerating. In Apple’s earnings report two quarters ago, Services grew at the slowest pace since 2015.

There doesn’t seem to be any help on the way, and I suspect continued muted growth rates in the Services segment. Without the high growth in the non-hardware segment, Apple’s multiple will likely come under additional pressure. Rising costs for diminishing returns in areas like Apple’s streaming segment, which are necessary to compete, are not a good sign for those hoping to maintain similar levels of growth and profitability in the future.

The growth assumptions for the Services components appear very precarious at this time. While Apple streaming has been a great success, it will require increasing investments with diminishing returns to stay competitive. App store revenue, licensing revenue, and third-party subscriptions could all experience obstacles to realizing expected growth.

This is crucial because part of the reason Apple had begun to have its multiple expand was that it was seen as delivering on the high-stakes effort to have services be the growth engine. Of course, the high-margin services segment also is essential for profitability to continue at levels investors have become expected. The firm is also facing antitrust issues in Europe, and an antitrust proceeding from the DOJ is rumored to be in the works.

Remember that the inability to meet iPhone demand because of production problems could also be problematic for bringing new users into the Apple services ecosystem. Apple Services is also leaving a key executive who has shepherded its robust growth over the last years, Peter Stern. This has led to a personnel reshuffling and uncertainty over succession in the vital segment as he was the ordained heir. Succession for critical roles is particularly delicate at Apple, which I believe is an underappreciated headwind to the vital division. Without dazzling investors with Services growth, the P/E seems more likely to be in the range from 2012-2019 than the range seen in the last three years.

Other Issues Are Emerging

One of the hidden secrets behind Silicon Valley’s awe-inspiring success is that at the heart of the fantastic technology and shiny things the bloc produces is a vicious battle for the talent that makes it happen. Unfortunately, there’s been mounting issues at Apple in this area which should be very disturbing for shareholders. According to Glassdoor, Apple is no longer one of the top places to work for the first time in over a decade. Issues are emerging in some important new initiatives. The company has touted efforts to bring chip design in-house to the benefit of consumers. However, any benefit of this is likely to be erased by the increased costs of hurriedly exiting China for other locales that won’t be able to deliver a fraction of the subsidization that the Chinese Communist Party does. But even more than this, Apple’s internal chip efforts have been beset by personnel problems and a significant engineering error that resulted in an inferior iPhone iteration.

One of Apple’s key suppliers, TSMC, also reported earnings that suggest a global slowdown in demand for advanced electronics. This and other information suggest that Apple faces more headwinds than many are willing to admit. However, an even bigger problem is that there are growing morale problems amongst Apple’s core employees that are emblematic of a growing malaise. Granted, it’s a growing malaise from one of human history’s most significant commercial achievements. Peak Apple may come back eventually, but it’s likely gone for now. Consistently attracting the highest quality personnel in their field is essential to everything Apple does.

Risks to My Bearish Thesis

Apple is a fantastic company with a competent management team. But seemingly, the risk is to the downside as we approach Cupertino’s most crucial report of the year. In my estimation, the supply problems in China and the associated effort to diversify it are a secular risk that will pressure Apple’s margins for the foreseeable future. However, I am surprised the company has already got factories back to 90% capacity. So, if the Chinese production issues are less acute and sticky than I thought, then Apple is in a considerably better position than my analysis would suggest.

Economic data has been coming suggesting that we may get a mild recession or that the Fed may be able to pivot to an accommodative posture sooner than you would think, taking them at face value. If we get a bullish development there and the Fed begins cutting around mid-2023, then Apple will likely be able to rally because of the pressure being taken off valuations for the whole market.

There is also a chance that murmurings of weakness in the services segment are overblown. Apple sold many products and brought many people into the ecosystem over the past years. The firm has also been making the ecosystem a better value for consumers, which could prove particularly successful, leading to better performance in the services segment I currently expect. Apple has a lot of resources as the world’s largest company and still has a lot of gravitas to pull strings when needed. However, I am still firmly convinced the risk is to the downside for the earnings report coming in early February.

Because of these risks, it is my recommendation not to short-sell Apple. One of the benefits of owning a stock like Apple is the deep and liquid derivatives markets. I believe long put options or covered calls are the best way to play my recommendation for those who don’t want to sell their position or expose themselves to the potentially limitless loss that can occur with a short sale.

Conclusion

I realize that my bearish call on Apple is quite a contrarian one. I also realize it is a very loved company, and I am not trying to diminish the accomplishments of current management teams or past ones. However, Apple’s earnings growth this year will be subdued by tough comps and is subject to more uncertainty than at any time in the recent past. No new products are coming that aren’t in a market with high barriers to entry. For example, if Apple succeeds with its AR headset, it would be a first in the valley. Cars are a tricky business as well.

This was the case before the acute problems in China and rising concerns about demand across different Apple products. I suspect that the levels of uncertainty will make forecasting more complex than it’s been for years, raising the prospect of an ugly earnings miss on Apple’s next quarterly call.

Apple is a large company that would be exposed to a global recession. But the signs of problems in the touted chip segment, decelerating growth in the services segment, and reports of growing employee dissatisfaction make me think that this quarter could see some anomalously bad performance from Cupertino.

China was central to the formula shareholders loved. According to my analysis, the consensus is missing the scale of the costs and risks associated with an accelerated diversification of Apple’s manufacturing capacity. Growing headwinds on the demand side and in the cherished services segment add to my concern. I remain bearish on Apple in the short and medium term and consider it a strong sell. To reiterate, I suggest using long-put options or covered calls rather than exposing yourself to the considerable risk of short-selling. I think March expirations are advantageous here as I suspect there could be some price weakness between the early February earnings and Apple’s coming investor day in March.

Disclosure: I/we have a beneficial short position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.