Summary:

- Apple’s stock surged more than 12% after unveiling AI features at WWDC 2024, sparking excitement for potential upgrade cycle.

- The new AI features for writing, images, and Siri are unlikely to significantly drive upgrades, as similar capabilities are available on various other devices people already use.

- Despite the rollout of Apple Intelligence, it is unclear when Apple will introduce AI features to the iPhone in China, and consumers are increasingly turning to local brands.

- The stock is currently trading at premium valuations, with all of Apple’s valuation multiples significantly above their 5-year averages despite the current growth deceleration.

FlashMovie

Investment Thesis

The release of AI features across all Apple (NASDAQ:AAPL)’s products has sparked market excitement, pushing the stock higher by 12% in a week. Earlier this year, the stock was under pressure due to weak iPhone sales, particularly in China. However, given the intensifying competition from the current GenAI boom, it was not surprising that investors were eager to see Apple’s new AI initiatives at WWDC 2024.

What excites investors the most is the potential wave of an upgrade cycle for Apple devices. The WWDC event revealed that AI features included in iOS 18 will be supported only on iPhone 15 Pro models and later devices. This has ignited a heated debate about a potential increase in demand for the iPhone 16 later this year, which could represent a significant growth rebound, especially since iPhone sales have been sluggish this year.

However, I doubt that adding AI features to Apple devices will significantly accelerate the upgrade cycle, as AI features are not exclusive to Apple only. Given the recent price action and expansion in valuation multiple, I have issued a hold rating on the stock, as the AI-driven growth tailwinds appear to have been priced in too fast and too soon.

Apple Intelligence

Apple’s new AI features will mainly focus on writing, images, and Siri. Apple Intelligence will be available across devices with the new versions of iOS, iPadOS, and macOS. Most importantly, management has highlighted that all the AI features unveiled in the keynote will be available to users for free.

Similar to Microsoft’s (MSFT) ChatGPT and Google’s (GOOGL) Gemini, Apple’s AI writing tool helps users rewrite and suggest text, change the tone of text, and summarize emails, effectively simplifying communication on Apple devices. Additionally, Apple’s AI can make custom emojis and photos using the pictures you have in library, and it can turn a quick sketch into a related image that goes with your notes in class. For example, if you draw a complicated math formula with related inputs on your Apple notebook, you will immediately get an answer after drawing an “equal” sign.

Furthermore, Siri can now memorize your conversation history, perform tasks across different apps using App Intents. It can respond to voice, text, and images. The latest Apple devices also support third-party integrations like ChatGPT through Siri. I think the management is planning to announce more partnerships in the future.

Undoubtedly, I believe that the new AI features will expedite the upgrade cycle for consumers who primarily utilize AI tools on Apple devices. However, nowadays, people use multiple electronic devices from different companies that offer similar AI features, so they may not need to buy a new iPhone just to access these capabilities. It’s more of an option than a necessity. Therefore, we still need to wait and see how this upgrade cycle will boost Apple’s top-line sales in the coming quarters.

New AI Features, You Are Not The Only One

Since the GenAI boom, many tech giants like Microsoft and Google are developing their own GenAI roadmaps. Meta (META)’s Instagram even introduced “Ask Meta” in its search bar. Adding AI features doesn’t necessarily give Apple an edge over competitors. More phone makers, such as Samsung (OTCPK:SSNLF) and Google, are also entering the competition. For instance, Samsung’s new Galaxy S24 series boasts AI features like real-time translation, circle-to-search functionality, and chat/note assistance.

Similarly, Google’s Pixel 8 includes GenAI capabilities such as voice recognition and image processing. Besides these giants, numerous other phone makers are also incorporating AI into their devices.

Some iPhone users also use laptops or desktops from other brands running on Windows. For instance, professional investors often rely on Bloomberg terminals on their Windows desktops, as these are not natively available on macOS.

While the sell-sides are currently updating forecasts for the iPhone 16 and iPhone 17 cycle following the introduction of AI-powered devices, I believe that these AI features may not immediately lead to increased sales revenue for Apple, especially in the Chinese market.

Sales Slowdown Amid Competition In China

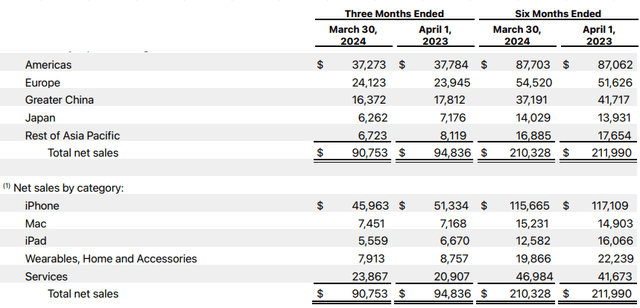

Let’s examine Apple’s current financials. Despite a better-than-expected 2Q FY2024 earnings result, its total sales revenue has declined by 4.3% YoY, mainly due to an 8.1% YoY drop in China. In addition, Apple’s diluted EPS came in $1.53, topped estimate by $0.03 in 2Q FY2024. However, it only grew 0.66% YoY compared to 2Q FY2023. The market is currently expected Apple to generate 8.7% YoY in FY2024.

However, investors have looked past the sluggish growth trajectory over the past quarters. After WWDC event, the street has significantly boosted iPhone revenue outlook. In my view, the most significant challenge for Apple’s growth is the competitive landscape in international markets. For example, local players in China, like Huawei and Xiaomi (OTCPK:XIACF), have a stronger position and can use competitive pricing to compete more aggressively in the market. I believe that adding new AI features to Apple devices may not persuade Chinese consumers to accelerate their upgrade cycles. We know that ChatGPT is not available in China. Furthermore, due to privacy concerns related to GenAI, these AI features may encounter regulatory risks compared to domestic phone makers.

Valuation

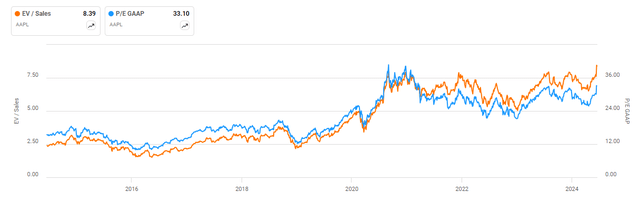

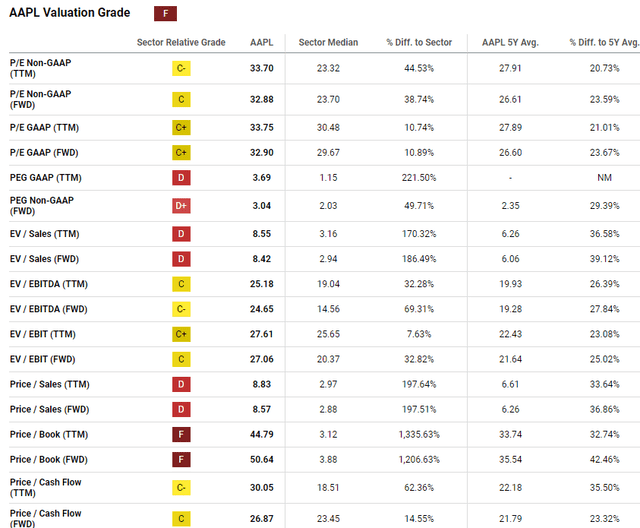

As shown in the chart, AAPL has seen an expansion in its valuation multiples over the past year. Currently, the stock is trading at premium valuations, with an EV/Sales TTM of 8.39x and a P/E GAAP TTM of 33.1x. We can see that its EV/Sales has reached a decade high. Due to the sluggish growth outlook, the forward-looking EV/Sales multiple is also elevated at 8.42x.

We also observe that all of Apple’s valuation multiples are significantly above their 5-year averages despite the current growth deceleration. However, we should know that historical data may not accurately reflect the company’s future growth outlook. Therefore, investors should be cautious that at the current price level, the stock may have already priced in multiple growth catalysts stemming from its new AI features.

Let’s step back for a moment. Based on the market consensus for FY2026E EPS driven by potential upgrade cycle benefits, Apple is trading at a P/E of 22.3x for FY2026E, which is roughly in line with the current valuation of the S&P 500 index.

Conclusion

In conclusion, Apple’s debut of AI features has sparked optimism and driven a significant rally in its stock price. However, I believe the potential growth from an upgrade cycle will be balanced out by tough competition and regulatory challenges. We should know that iPhone users aren’t compelled to upgrade just for AI features, as most of capabilities are already accessible on many other devices they own. Despite Apple’s impressive AI rollout, it faces high competition in a crowded market where rivals innovate aggressively. The uncertainty remains about how much the upgrade cycle will contribute sales growth, especially given economic fluctuations and competition, particularly in China. Therefore, I remain cautiously optimistic about the company and issued a hold on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.