Summary:

- We’re upgrading Apple to a buy after a long, neutral stance.

- We’re more positive about Apple’s ability to outperform with Apple Intelligence, a catalyst for new iPhone releases.

- We also think smartphone demand bottomed and expect to see smartphone TAM expansion in 2025.

- The stock has traded in-line with the S&P 500 since our hold-rating in 2H23. We see more upside from current levels in 2025.

CasarsaGuru/E+ via Getty Images

We’re upgrading Apple Inc. (NASDAQ:AAPL) to a buy after a long, neutral stance on the stock as we see more upside on two factors. First, we think the market has recognized the muted smartphone demand and intensified competition on the Chinese front, particularly after Apple’s March quarter results, in which iPhone sales dropped Y/Y, causing a pullback in total sales for the quarter. Second, we think the company is better positioned to reverse its lackluster iPhone sales with Apple Intelligence integrated into iOS 18, announced at the WWDC event. Apple Intelligence is supported by the latest iPhones, specifically the iPhone 15, iPhone 15 Pro Max, and M-series iPads and Macs. We think the main attraction of Apple Intelligence is that it could incentivize an upgrade cycle despite the macro slowdown, or at least improve sales for the new line-up to beat expectations.

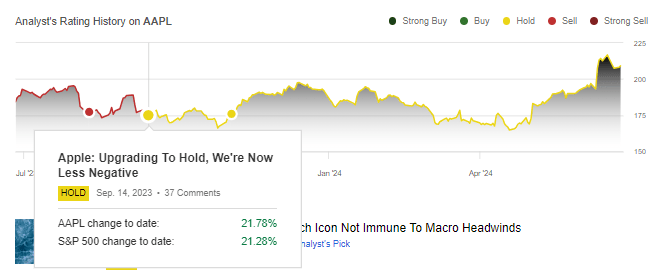

Since our upgrade to a hold in September 2023, the stock has performed in line with the S&P 500; our November thesis played out. We had stated in our November article, “We expect the current macro headwinds to continue weighing on end demand and see a limited upside to the company’s financial outperformance in the back end of the year and into calendar 1H24.” Street expectations of iPhone sales have been revised down since January, making expectations low enough to support outperformance in a difficult macro backdrop. The more recent optimism on the stock is supported by the share buy-back program and the new AI features.

We now think Apple is better positioned to outperform after the negatives have played out. Apple Intelligence serves as a catalyst for the new iPhone release and provides an edge for the anticipated smartphone TAM growth in 2025.

The following chart outlines our rating history on Apple.

SeekingAlpha

Our industry research continues to signify muted smartphone demand for 2024, but we expect a material recovery in 2025 as the industry cannot continue to sustain itself on current run rates. Management across the semi-peer group also confirmed the weak smartphone demand this year. This is important because we believe this means demand will bottom this year to recover in 2025. Just last week, Micron (MU) management noted “only steady near-term demand in PCs and smartphones.” TSMC (TSM) confirmed this outlook, reporting a smartphone revenue decline of 16% Y/Y and noting muted growth with the expectation of AI; this matters because Apple is “customer A” at TSMC and accounted for ~25% of total sales last year. Skyworks (SWKS), Qualcomm (QCOM), and Qorvo (QRVO), all of which share Apple as their largest customer, reported weak mobile sales in the first half of the year because of weaker demand from Apple. Skyworks reported mobile sales down 19% Q/Q; Qualcomm reported handset sales down 8% Q/Q; Qorvo’s advanced cellular group sales declined 23% Q/Q. These results tell us that the market recognizes the weaker demand in the post-inventory correction environment. We like Apple’s odds in the second half of the year and 1H25, as high expectations have been re-adjusted in the first half of the year.

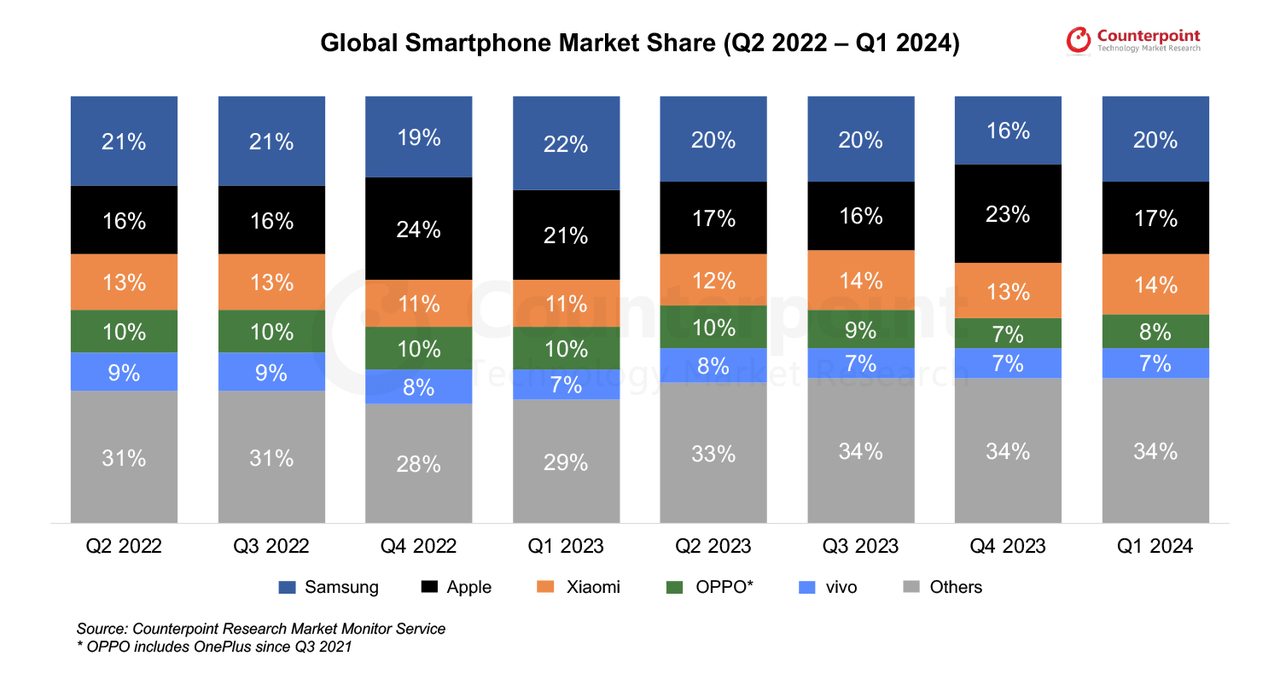

Looking forward, IDC forecasts global smartphone shipments to grow low single digits at ~4% this year; we think there will be a slow recovery in the back end of the year before a true-end demand recovery in 2025. We know so far that in the first quarter of CY2024, smartphone shipments grew ~6% Y/Y, and we’re still waiting on the second quarter numbers. We’re more positive about Apple’s new iPhone lineup sales in 2H24 because the company has given us a catalyst: Apple Intelligence.

The company is branding Apple Intelligence as “AI for the rest of us,” partnering with OpenAI’s ChatGPT. AI features will be incorporated into iOS 18, iPadOS 18, and MacOS sequoia. Apple Intelligence will allow the use of ChatGPT to generate personalized answers using images and text for the user through access to personal data (calendar, mail, etc.). The upgrade will benefit Siri as it’ll also be tapped into ChatGPT. It’s important to think about the improvements that’ll come to Siri with this upgrade because Siri could potentially serve as an alternative search engine for users.

Still, we expect Apple Intelligence will have its hurdles along the way; we’ve already seen this with the limitations of use depending on the Apple product, necessitating an upgrade cycle for mass adoption. This could be more challenging in the current economic backdrop, but is achievable for 2025 as the Fed forecasts a cut this year that should help with macro recovery next year. There are also concerns over access to features of Apple Intelligence being blocked due to the EU’s Digital Markets Act or DMA regulations; it seems that the regulations “could force us [Apple] to compromise the integrity of our products in ways that risk user privacy and data security” according to a statement from the company. It’s still unclear if Apple Intelligence will be available to EU users when it goes live this Fall. Our positive outlook on Apple Intelligence is longer-term, and we don’t think the regulatory concerns would stick for 2025 without resolution. It’s also not Apple’s first rodeo with regulatory scrutiny.

The China question

The past three quarters reminded us that Apple’s top-line growth is highly reliant on iPhone sales, which makes the stock more exposed to China than most of us would have liked. China remains the world’s largest smartphone market. In late 2022, that exposure showed up on the manufacturing side of Apple’s business, with the largest iPhone assembly factory shutting down on protests and Zero COVID restrictions, causing a slowdown in production. In 2H23 and 1H24, the company’s exposure to China is visible in the iPhone sales slowdown, as 1. The broader smartphone industry experienced a slowdown in demand, and 2. Competition from Huawei and Samsung intensifies, with the former gaining more ground in the Chinese market. Apple lost its status as the world’s largest smartphone provider in the first quarter, with 20% of the global market, to Samsung early this year after the pullback in shipments, as shown below. We’re not as concerned about exposure to China as we were in 2H23, and the reason is that the company’s vulnerability to China has been priced into the stock and investor expectations.

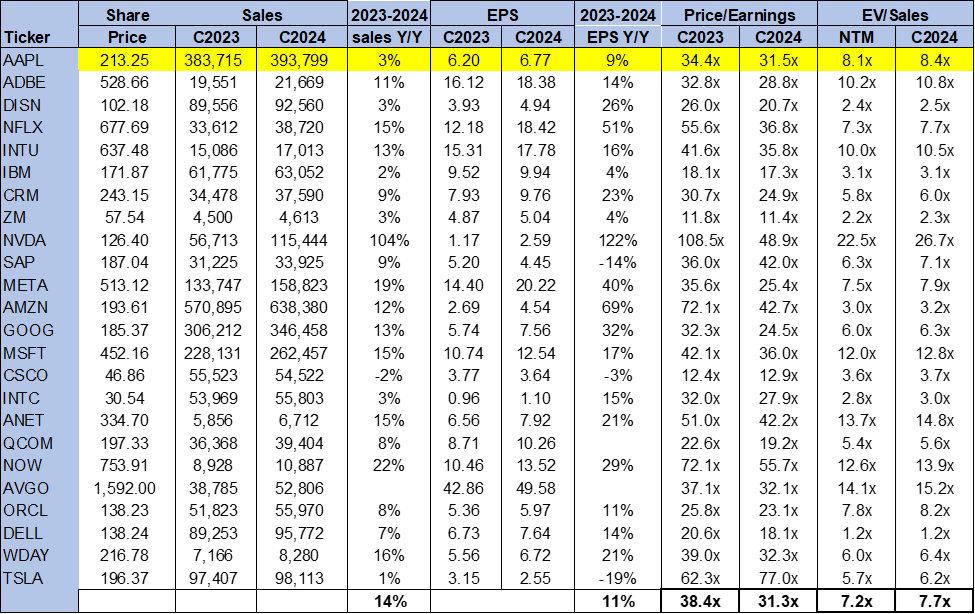

Valuation & word on Wall Street

The stock is trading above its large-cap peer group average, despite this, we think Apple is fairly valued at current levels. The higher multiple is justified by the company’s position in the smartphone industry, in time for its anticipated recovery in 2025 and Apple Intelligence tailwinds. On a P/E basis, the stock is trading at 31.5x C2024 EPS $6.77 compared to the peer group average of 31.3x. The stock is trading at 8.4x EV/C2024 Sales, versus the peer group average of 5.6x. We understand investors’ concern about the continued competition on the smartphone front, but we believe iOS 18 will provide a competitive edge for the iPhone against the competition in China. We believe the higher valuation can be justified by Apple’s mid to long-term secular growth tailwinds for its iPhone sales as the smartphone TAM expands and service business growth. The latter is not only the company’s fastest-growing business but the most profitable one.

The following chart outlines Apple’s valuation against the peer group average.

TechStockPros

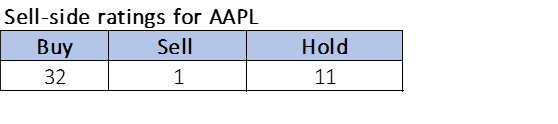

Wall Street shares our positive sentiment on the stock. Of the 44 analysts covering the stock, 32 are buy-rated, 11 are hold-rated, and the remaining are sell-rated. Wall Street has been more positive on the stock even though the smartphone downturn in 1H24, but we’ve seen more of the negatives be digested over the past two quarters with downward revisions for consensus expectations. Part of our upgrade is based on our belief that expectations are manageable enough to support another beat.

The stock is currently priced at $214 per share. The median sell-side price target is $210, while $212 is the sell-side mean target, with a potential upside of -1% to -2%. The following charts outline Apple’s sell-side ratings.

TechStockPros

What to do with the stock?

We’re moving Apple to a buy. We think the stock has more upside on investor confidence in Apple Intelligence and management’s go-to strategy to monetize it through iOS18. We’re also monitoring Apple’s service business. Some expect Apple’s “shift to a service business model is a robust approach to compensate for its dependence on iPhone sales performance.” We agree with this statement. With the arrival of Apple Intelligence, we think there’s more potential for services as management clearly fills the gap between itself and other large-cap players focusing on AI monetization, i.e., Microsoft (MSFT) and Google (GOOGL), among others. The main question is where the adoption of Apple Intelligence and the rebound in smartphone demand will overlap; we see this happening in 2025 and would recommend investors jump into the stock as we think Apple can outperform the S&P 500 into 2025.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service.