Summary:

- Apple’s Glowtime event was a big dud.

- Huawei upstages Apple on the same day.

- What does a 5-year target price look like for Apple?

lcva2/iStock Editorial via Getty Images

On a day (Monday) when the Nasdaq was up 1.16%, it is instructive to note that Apple (NASDAQ:AAPL) was flat. If it were any other day, it would not matter that much, but Monday was “Showtime” for “Glowtime.” Obviously, the “Showtime” in the stock never showed up.

It was the day that Apple CEO, Tim Cook, introduced the all-new iPhone 16 line. This comes after a not so buoyant iPhone 15 line. It finally took a lot of discounting to unload that remaining iPhone 15 inventory.

How well was the new line met? I think that by judging the reaction of the stock, it is fair to say that there was not much enthusiasm for the latest version of the popular mobile device either.

According to Cook, the iPhone 16 is designed for AI from the ground up. Once again, the stock was totally flat the day of the news while the Nasdaq was up 1.2%. Cook announced “the beginning of an exciting new era,” but the market did not get very excited about it.

The new 16 plus version of the phone comes with a 6.7′ screen size. My current iPhone has a 6.2′ screen size, and I am not sure that I am ready to run out and plunk down $899 for that extra half inch in screen size. If the phone gets any bigger, I am afraid that it won’t fit into my pocket anymore.

The new colors of ultramarine, teal, and pink sound cool, but what about magenta? Why can’t I get magenta?

According to Cook, the iPhone 16 Pro uses titanium to make the phone stronger and more scratch-resistant and comes in four colors: black titanium, white titanium, natural titanium, and desert titanium. I am not so sure that this is a game changer either.

Maybe the 48MP fusion camera (whatever that is) is worth the costly trade-in. But, then again, I am pretty happy with the photos that my current camera produces. Will the 48MP fusion make me look any younger or the fish I catch any bigger? I wish Tim Cook could provide more details.

Apple’s new A18 chip will allow me to play Tencent’s Honor of Kings: World, but then I really don’t have time to play video games. Once again, the stock was flat at the end of the highly anticipated event.

The company’s new Apple Intelligence feature will allow me to create a new emoji by just typing in a description of what I want. That sounds cool, but I already have more emojis than I will ever use in my lifetime.

I have not yet decided if I will camp out at the Apple Store several days before the new phone is released, but I do not think that I will need to. There should be plenty of iPhone 16’s to meet the early demand. Maybe the Desert Titanium will be hard to get?

Is it just me, or do you miss Steve Jobs? It seems that he always had a surprise up the long sleeve of his black shirt. Tim Cook, not so much. Maybe it is time for a change at the top of Apple. There does not seem to be any more than just average upside to the stock at this point in time. More on that when we crunch the numbers in a bit.

On the other hand, Huawei already has 3M pre-orders for its triple-folding smartphone. That sounds pretty cool. Why didn’t Apple think of that? That looks like I get a much bigger screen to see, and it still fits in my pocket. Not sure about the Chinese spying on me, however.

Huawei’s new phone (Huawei.com)

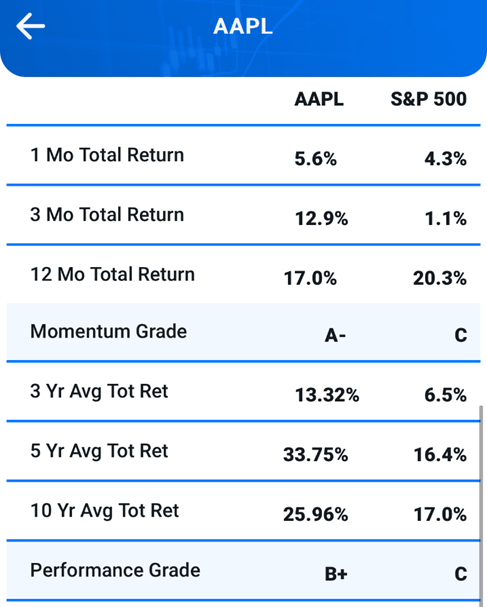

Now, let’s take a look in the rearview mirror to assess the returns that Apple has delivered to its investors over the years.

Apple’s Performance (BestStocksNowApp.com)

As you can see from the performance listed above, it has been one of those rare stocks that has delivered alpha over the last 3, 5, and 10 years, but lately, it has been slowing down to a market performer.

If you don’t learn any other lessons about the market, write this one down somewhere:

STOCKS AND INDEXES FOLLOW EARNINGS!

During my 25 years as a professional money manager that has been seeking alpha on a daily basis, there is no better indicator for the markets and stocks than earnings. As earnings have continued to grow at Apple over the years, the stock has followed. And because Apple has had superior earnings growth, it has delivered superior performance.

When compared with all of the 4,849 equities in my Best Stocks Now Database, Apple earns a performance grade of B+. Not bad, but can it continue to deliver alpha over the coming years?

For that, we now need to look down the road at the future earnings prospects ahead for Apple in order to assess its target price and upside potential.

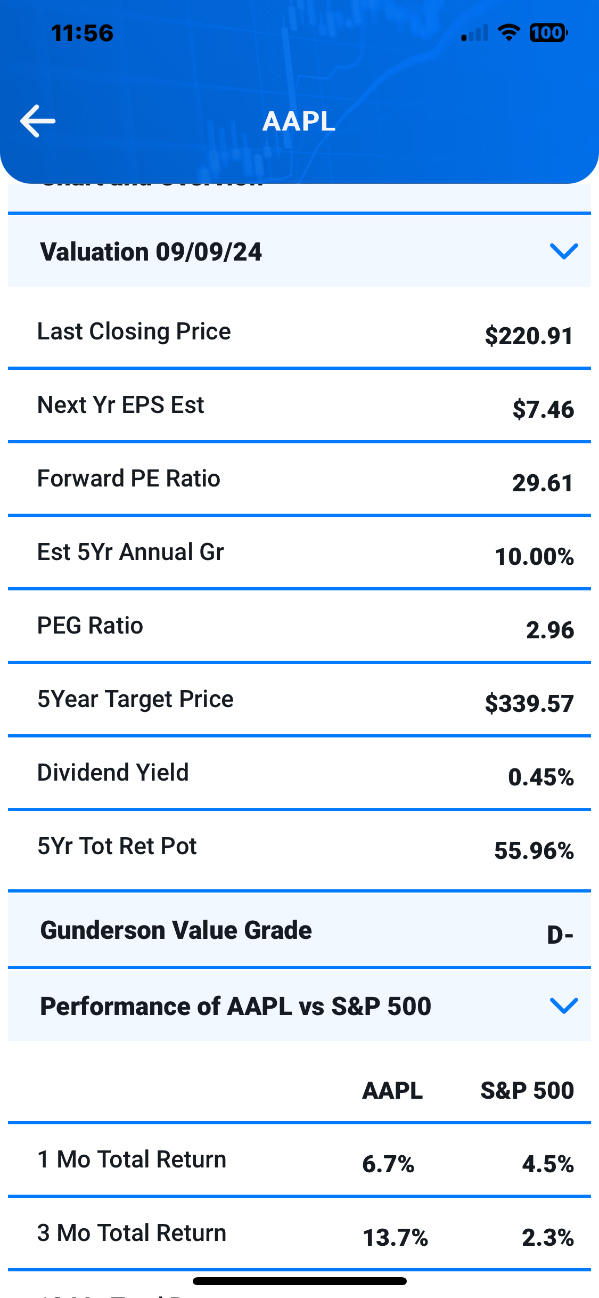

Apple Valuation (BestStocksNowApp.com)

Apple currently is expected to make $7.46 per share in 2025. Over the last five years, their earnings have been growing at an average annual clip of 20% per year, but that number has been slowing down considerably in the last few years. The consensus analyst growth rate going forward (according to Factset.com) is 9.8% avg. per year. That is one-half of the growth from the last five years.

When I extrapolate those earnings out over the next five years at 9.8% per year and apply a multiple (30X) that I think the stock will be trading at, I come up with a 5-year target price of $339.46. This represents 55.98% upside potential over that period of time. When I compare this upside with the rest of the stock in my database, Apple earns a valuation grade of D-.

I generally like to have 85% or more upside potential over the next five years in order to meet my risk/reward requirements. I also like to see some strong recent performance (relative strength) in a stock, along with that valuation. Apple lacks both of those criteria.

Despite being the largest overall market cap stock in the U.S. and possessing one of the greatest brands of all-time, I currently do not have a position in it, nor do I plan on establishing one at this level. Yesterday’s Glowtime event did nothing at all to move the needle for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with 24 years of experience.

You get Bill’s daily “live” buys and sells in his four portfolios: Emerging Growth, Ultra-Growth, Premier Growth, Dividend & Growth, and Best Bonds Now. These portfolios have done very well since their 1/1/2019 inception.

Both our Premier and Ultra-Growth Portfolio were up over 30% in 2023.

JOIN NOW to get daily “live” buys and sells, and weekly in-depth market-timing newsletter, access to Bill’s proprietary database with daily rankings on almost 6,000 securities, a daily chat room (mon-fri), and a daily live radio show (mon-fri.)!