Summary:

- Apple’s shares have appreciated 41% this year, but the company remains heavily reliant on the health of the device market, with 69% of its revenues coming from just 3 products.

- The newly launched Apple Vision Pro headset is unlikely to significantly impact Apple’s top and bottom line, as it appeals chiefly to a niche market.

- Apple remains vulnerable to a continual slowdown in the consumer electronics market.

- Shares of Apple are now richly valued, with a P/E of 28X, making stock buybacks increasingly unattractive.

Nikada/iStock Unreleased via Getty Images

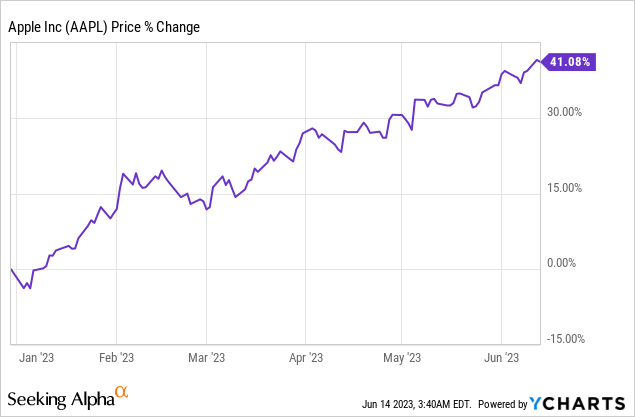

Shares of Apple (NASDAQ:AAPL) have appreciated almost 41% this year and are up 6% since I recommended investors to sell the rally. I previously recommended a cautious stance towards Apple due to the company’s reliance on hardware products and a weakening device market. Additionally, Apple didn’t launch any major, innovative products in the last few years… until last week.

Apple debuted its Apple Vision Pro mixed reality headset last week, revealing its most significant new product since the launch of Apple Watch nearly a decade ago. The announcement drove shares of Apple to a new all-time high. Considering that the device market remains weak and that the Vision Pro Headset is likely only appealing to a small niche segment, I believe the hype is not justified and shares remain a sell!

Apple’s hardware dependence and slowing revenue growth for key products will remain challenges

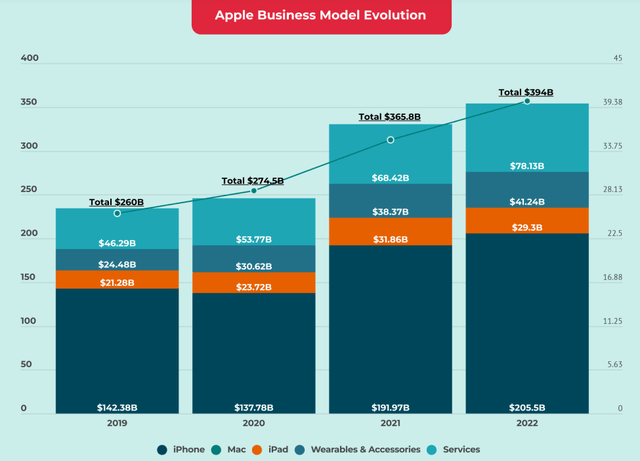

Apple is heavily reliant on its hardware business and therefore dependent on the state of the consumer electronics market. According to research company Gartner, global device shipments contracted a massive 30% in the first-quarter, showing an accelerating decline compared to the fourth-quarter which saw a 28% decline in shipments. Since the device market has likely not bottomed out yet (due to headwinds to consumer spending and high interest rates), the outlook for the second-quarter is challenged as well. The problem is that Apple generates approximately 69% of its revenues from hardware sales (iPhone, Mac and iPad, excluding Wearables). Another 9% of revenues come from the Wearable Segment (which includes the Apple Watch) and 22% from its fast-growing Services business. While Apple has had success in growing its Wearable category over time, the segment accounts for just 9% of revenues and while revenues for Apple Watch have grown, it has not been a major growth driver for the company.

Apple launched a new product last week that has led to Apple’s shares reaching a new all-time high, but that will add to Apple’s hardware dependence going forward. The firm launched the Apple Vision Pro, a mixed reality headset, last week which marks the company’s foray into the augmented/virtual reality world.

It was the first time since 2014, which is when Apple debuted Apple Watch, that the technology company has launched a major new product. The new Apple Vision Pro headset is a spatial computer which allows consumers to connect the digital with the real world and the first reactions to the product release were positive. The headset will cost $3,499 (for U.S. consumers) and will be available for purchase in early 2024.

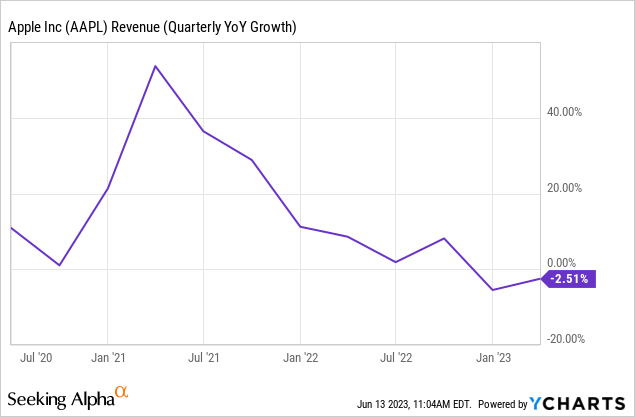

While the augmented reality market is growing rapidly (see further below), it is at least questionable as to whether the product could help reinvigorate Apple’s moderating top line growth. The company was hit hard by the down-turn in the consumer electronics market in the first-quarter of 2023 and reported a 31% decline in Mac revenues and a 13% drop-off in iPad revenues. The only segment that managed to post solid growth was the Services segment which saw 5% year over year growth in Q1’23. Apple’s Services segment includes revenue streams from Apple Music, TV+, iCloud, AppleCare, Apple Pay and other non-hardware related products. Apple’s results have been helped by resilience in iPhone sales, however, which increased 1.5% Y/Y.

Due to Apple’s hardware dependence, the company was hit by the down-turn in post-pandemic PC shipments with full force: Apple reported a 2.5% decline in its revenue base, year over year, and the company is under increasing pressure to release a new blockbuster product.

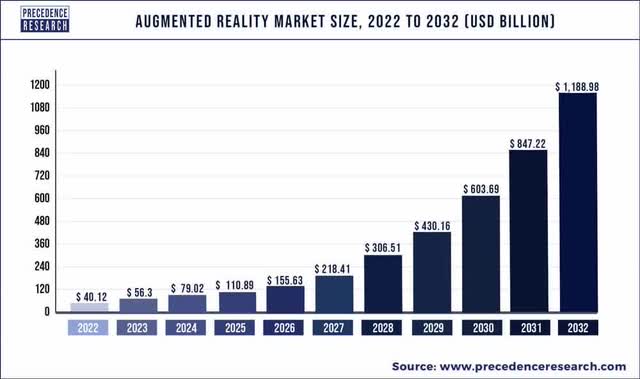

Augmented reality market size

According to Precedence Research, the augmented reality market is set for strong growth over the next decade with the market size expected to increase by a factor of 30X to $1.2B in 2032. Apple is tapping therefore into a promising market with the release of the Apple Vision Pro, but augmented reality is still in its very early stages and the mixed reality headset is likely to only appeal to a small segment of early adopters. The product will still have to prove its mass market appeal and is unlikely to be a major revenue driver for Apple.

Apple is conducting stock buybacks at all-time highs, Apple’s valuation increasingly rich

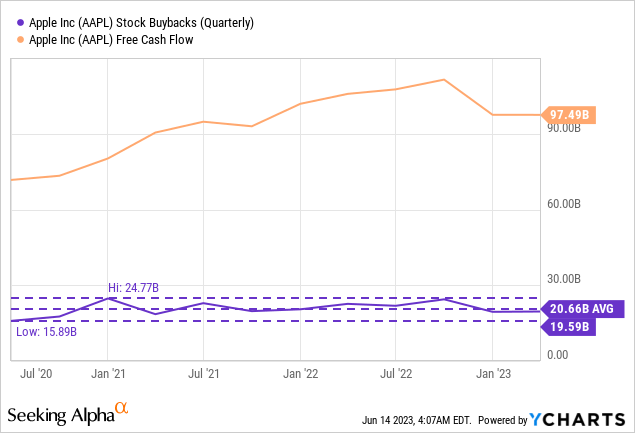

Apple announced a $90B stock buyback authorization earlier this year which sets the company up to spending billions of dollars each quarter to buy back its own expensive shares. Apple tends to buy back between $16-25B quarterly of its own stock and in the last six months Apple invested approximately $39.1B into its own shares. Although Apple is generous with its free cash flow, I believe the company is overpaying for its stock.

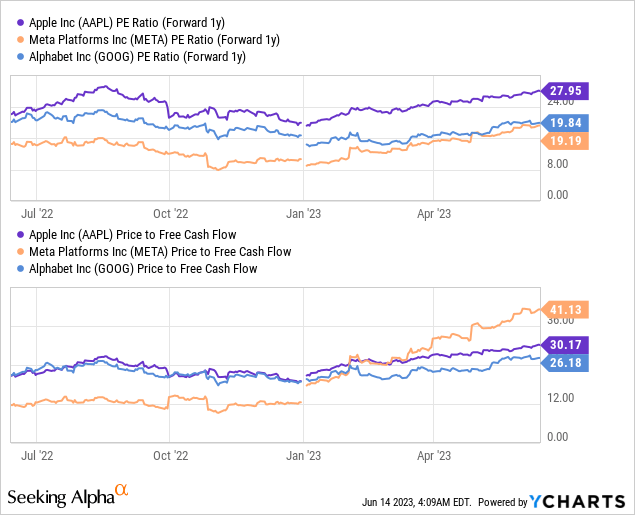

Shares of Apple are now quite expensive with a P/E ratio closing in on 28X. Other FAANG companies including Alphabet (GOOG) or Meta Platforms (META) are trading at much lower P/E ratios (of around 19-20X) and therefore offer investors deeper value, in my opinion. Apple’s shares are also trading at a P/FCF ratio of 30.2X which also suggests that Apple is overpaying for its shares.

Risks with Apple

The biggest commercial risk for Apple, as I see it, is a slowdown in the market for consumer electronics as there are no signs yet that the market has bottomed. Since Apple achieves almost 70% of its revenues from its main products (iPhone, iMac and iPad), I believe Apple will be overly vulnerable to a continual deterioration of operating conditions in the consumer electronics industry. Since shares are highly valued with a P/E ratio of 28X, there is a risk that Apple is overpaying for its stock buyback.

Final thoughts

Apple debuted its first major new product last week, the Apple Vision Pro, a mixed reality headset which was generally well-received. However, the Apple Vision Pro is unlikely to be a major revenue driver for Apple because the product likely appeals only to a small niche of passionate consumers and early adopters. Considering that Apple’s Wearable segment accounts for less than 10% of revenues after a decade of growth, I believe the impact of Apple Vision Pro on the firm’s top and bottom line is likely going to be relatively small. I don’t consider the hype surrounding the Apple Vision Pro to be justified and believe that Apple’s shares are currently overvalued!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.