Summary:

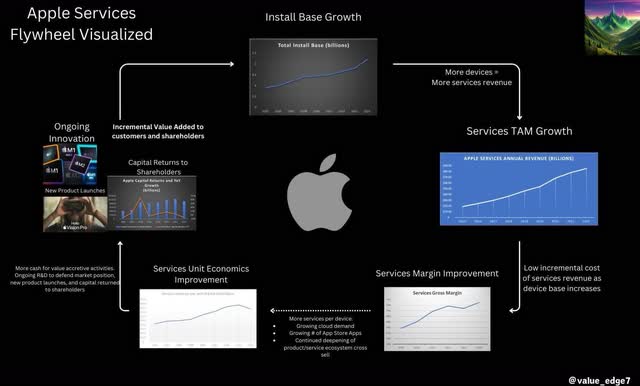

- This article explores the Apple Inc. product/service ecosystem and its Flywheel Effect.

- I review this Flywheel Effect in detail, with the total install base remaining the most critical metric for Apple’s long-term growth.

- The company’s focus on iterative innovation and ongoing product launches, such as the recent Vision Pro headset, strengthens its ecosystem and drives growth.

- I briefly discuss Vision Pro’s roadmap to becoming a mass-market product.

- Finally, we look at how Apple’s capital returns to shareholders have been exceptional, with over $685.6 billion returned since 2015 through buybacks and dividends.

DAVID SWANSON/AFP via Getty Images

I initiated coverage of Apple Inc. (NASDAQ:AAPL) in March of 2023 with a “Hold” rating, calling it the King of Ecosystems. I rated Apple a hold because it looked overvalued on a fundamental basis, but subsequently upgraded Apple to Buy in a September article. I maintain my Buy rating and will discuss why in detail.

An ecosystem in this context is a complimentary set of products and services that add incremental value to consumers as more products/services are used. Think of it this way: Apple AirPods add more value than unbranded headphones for iPhone users because of the cross-functionality with iPhone.

Now think about the likelihood of a consumer who owns an iPhone and AirPods buying Apple Music. You can then store your entire music and podcast library in iCloud, or download other music streaming apps from the App Store. Once you own an iPhone, you are launched into a never-ending cycle of Apple Services cross-sell opportunities.

It is this ecosystem that allowed Apple to transform the iPhone from a revolutionary handheld device into the perpetual revenue machines that require no incremental capital we have today. Once an iPhone is sold, it provides countless revenue-generating opportunities throughout its useful life.

The ecosystem model worked. Apple’s ascendence to global ubiquity has gone unnoticed by no one, and it has consistently improved this ecosystem at every step. This is what I believe to be Apple’s Flywheel Effect.

Q1 ’24 Earnings: Vision Pro is Key

Apple posted a double beat with meager revenue growth and solid EPS growth. At this point, there is little debate that Apple is a quality compounder. Revenue, earnings, and dividend per share have all been growing consistently since 2016, and Apple Services is becoming the flagship segment for Apple’s long-term durability. The consumer electronics market is cyclical, but Apple remains securely a top 2 smartphone provider. Samsung is competitive and Google Pixel is taking some share, but iPhone will not be disrupted any time soon.

Apple Vision Pro, the AR headset, is the key product for investors to monitor in 2024. Tim Cook, Apple CEO, had this to say on the Q1 earnings call: “There’s 5,000 patents in the product and it’s, of course, built on many innovations that Apple has spent multiple years on, from silicon to displays and significant AI and machine learning.”

There was also a notable change in rhetoric that saw Apple mentioning AI numerous times on the call. Throughout 2023, Apple was mostly silent on AI, but with the launch of Vision Pro they seem to be leaning heavier into the new tech.

While some don’t see the path forward for Vision Pro, I believe it’s a useful product to bolster Apple’s overall product lineup. I also believe Apple is taking the correct approach to marketing this product: starting with a high price point to target enthusiasts as they work to improve the product and margin profile so they can offer lower-priced models in the future. We’ll discuss that more later.

Let’s discuss why I believe Vision Pro is the next key growth vector for Apple, specifically its incremental uplift on Apple Services growth.

Brief History: How Apple Built Its Flywheel

Developing the closed-source hardware-software stack for iPhone was an enormous undertaking. To successfully build a handheld device with internet connectivity and a proprietary operating system was no small feat. For a while, Apple was a price taker on the electrical components inside the iPhone, or MEMS (micro-electromechanical systems). These are things like accelerometers and gyroscopes (motion sensing), magnetometers (navigation & location services), barometers (altitude & GPS location data), and proximity sensors (haven’t you noticed your screen turns off when you raise your iPhone to your ear to talk?).

While the primary mobile processor has been built on proprietary “Apple Silicon” since 2010, many other components on the motherboard were outsourced. This outsourcing was expensive until Apple scaled enough that Apple contracts were make-or-break for component suppliers. Once Apple achieved this position, they started commoditizing these components by internally developing them to expand the gross margin of their hardware.

To this day, modems are one of the only non-commoditized components in an iPhone. They are still developed by Qualcomm (QCOM), a contract that Apple has been attempting to rid itself of for years to no avail. Apple still wants to commoditize or internally develop all the components in its hardware to minimize COGS. This COGS minimization allowed Apple to evolve into the FCF machine that it is today. The ample ongoing capital generated from its hardware brought with it the ability to increase production capacity, switch to an iterative innovation model, turn heads with new product launches, and continuously expand the Apple ecosystem and fortify its Flywheel.

This brings us to my second coverage of Apple, in which I compared the iPhone 15 to Huawei’s Mate 60 Pro. The launch of Mate 60 Pro stoked fear in analysts’ minds about Apple’s China segment growth slowing. Huawei and SMIC had developed a 5nm mobile processor, close enough to Apple’s A16 developed on Taiwan Semiconductor’s (TSM) 3nm process node. This jump in performance mixed with nationalistic adoration for Huawei has caused Huawei’s market share to improve sequentially in the Chinese market. This was all but confirmed for months, and Apple’s recent quarterly report solidified this reality: China growth is slowing.

While this growth decline is not good for obvious reasons, the thesis from my article Apple: Trouble In Paradise Or Undeserved FUD? still stands: the iPhone 15 is far better than the Mate 60 Pro. This stands true as Apple recently overtook Vivo as the market leader in China. Chinese consumers still want iPhones.

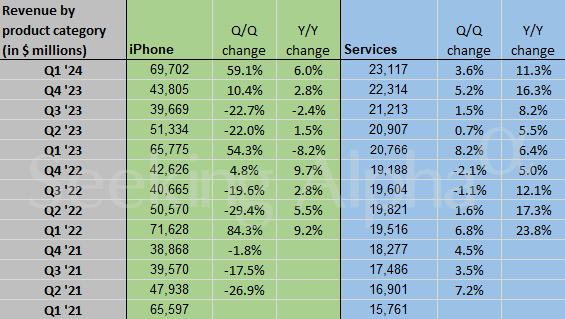

Despite the modest headwinds in sales growth, Apple continued to grow its total install base. Revenue from both iPhones and Services grew annually:

Seeking Alpha

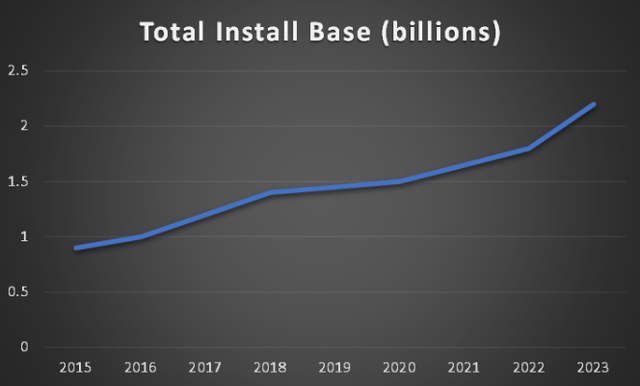

This growth corresponds to an all-time high in Apple’s total install base:

Author’s Calculation, Company and News Reports

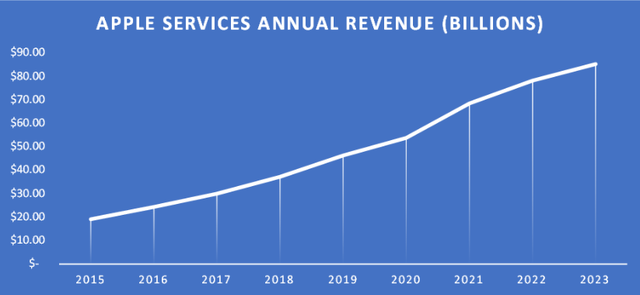

Apple is cemented in the top five largest global businesses in no small part because of Apple Services. The services segment captures sales from iCloud, AppleCare, advertising, payment services, and digital content (namely Apple TV+, Apple Music+, and the App Store).

Importantly, the key metric underpinning Services growth is growth in Apple’s total install base. Of course, the key product here is the iPhone as it is the gateway to the Apple Services Flywheel Effect.

Apple’s Ecosystem and The Flywheel Effect

Apple’s ecosystem is its greatest asset. Coupled with the Flywheel Effect, this ecosystem makes me confident that Apple will continue compounding shareholder wealth over time.

Apple Services total addressable market, or TAM, is equivalent to the total install base. Naturally, as this grows, Apple Services will enjoy organic TAM growth. This relationship holds historically, as Apple Services revenue over time mirrors install base growth:

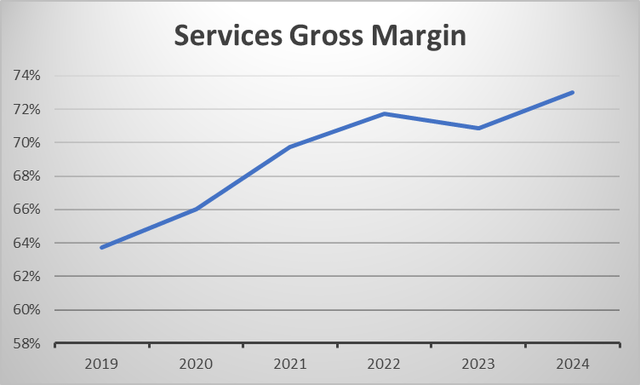

Within the Apple Services segment, the company enjoys a very low cost of incremental revenue and no customer acquisition cost. More devices in circulation simply means a larger Services TAM at no additional cost. For this reason, as Services TAM has increased, so too has gross margin:

This margin improvement allows Apple to deepen the breadth of Service offerings. Here’s a list of Apple Services releases over time (not exhaustive):

- 2008 – 2011: App Store and iCloud

- 2015-2019: Apple Music, Apple News+ and Apple TV+

- 2020: Apple Fitness+

Better yet, Apple One offers consumers a bundling option and provides Apple with recurring revenue. While it’s difficult to find the exact number of Apple One subscribers, we do know that Apple’s total number of subscriptions is approaching 1 billion.

Apple has worked hard to offer more services within its ecosystem and allows customers to bundle those services together, which effectively makes iPhone’s perpetual revenue machines even after the initial sale. The flagship offerings within the Services segment are the App Store and iCloud, which both enjoy organic growth in their own right.

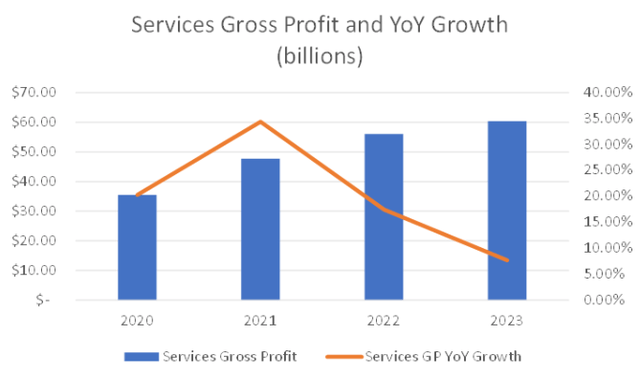

As Apple’s install base grows, developers have more incentive to develop on the App Store. As we continue to use Apple products to store more and more data, iCloud demand will grow. This organic growth in flagship services and TAM expansion has nearly doubled Services gross profit in the post-COVID era:

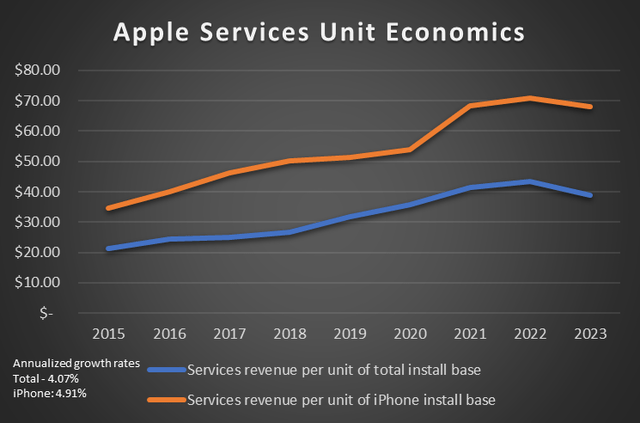

On top of that, Services revenue per unit of the installed base has also increased over the years, both exceeding a 4% CAGR over the 9 years from 2015-2023:

Author’s Creation, Company and News Reports

Improvement in unit economics brings us to my final piece of the Flywheel: ongoing value-add for customers and shareholders.

The FCF machine that is the iPhone allowed Apple to build a fortress balance sheet and produce market-beating returns for years. This is because of three things: iterative innovation, capital returns to shareholders, and new product launches.

Iterative Innovation

Much of the bear case around Apple is a lack of innovation. I view this as overwhelmingly false.

Long gone are the days of each new iPhone represented a monumental leap forward in capability, simply because they are currently too good for this innovation to be possible anymore. Accordingly, Apple switched from major annual innovations to an iterative innovation model, in which each subsequent Apple product is a little bit better than the last. Additionally, most of this rhetoric comes from the fact that most new iPhone models look the same as their immediate predecessors. Apple simply doesn’t focus on making a major headline with each new model anymore.

I view this as a good strategic shift for two reasons:

- It negates the Osborne Effect. If there was speculation that the iPhone 16 would be leaps and bounds better than the iPhone 15, demand for the 15 would fall off a cliff.

- It aligns well with Apple’s upgrade model. iPhones aren’t meant to be upgraded with each new product release. They are, at a minimum, on a 2-year upgrade cycle. Accordingly, the iPhone 15 has to be much better than the iPhone 13, not the 14, and so on.

In short, I have quite a contrarian view of the iterative innovation model: it doesn’t underpin a lack of innovation but consistent excellence in innovation, albeit at a slower pace.

Of course, much of this is held up by consistent chip scaling thanks to Moore’s Law. The good thing for Apple investors is that Moore’s Law still holds, and Apple Silicon will continue to improve by virtue of smaller process nodes in foundries over time.

New Product Launches

While Apple has lost most of its spectacle in annual iPhone releases, they have supplemented this with ongoing forays into new markets. They dove headfirst into the Wearable market in 2015 with the launch of the Apple Watch, and subsequently with the 2016 release of AirPods. With every new product launch, Apple makes headlines globally, as demonstrated by the recent launch of Vision Pro. When Apple releases a new product, the world watches.

Once the launch spectacle dies down, these new devices then fit nicely into Apple’s iterative innovation strategy. New models are released periodically with newer chips, more functionality, and overall better performance. Ongoing software updates and Apple’s closed-source stack make cross-functionality between products better and fortify Apple’s ecosystem.

Vision Pro: Making the Leap to Mass Market

Vision Pro may be the biggest risk Apple has taken in a product launch to date. They are diving headfirst into an entirely new market.

The bear case is quite simple: consumers simply don’t want a big clunky AR (Augmented Reality) headset. It looks goofy. No one will want to walk around wearing ski goggles. It’s important to recall though that much discontent was generated by AirPods, when people believed no one would want to walk around with tiny wireless white things in their ears. Now AirPods are ubiquitous; a status symbol even.

My Vision Pro bull case relies heavily on Apple’s iterative innovation model. The key difference here is that Vision Pro’s initial launch is just for enthusiasts and technologists. Apple priced out the mass market with a high base price. Vision Pro won’t penetrate the mass market soon, but I can see the path to it becoming a mass-market product.

I expect a Vision Pro v2, v3, v4, etc… and each model will be sleeker, smaller, and more performant. v1 is only targeted at enthusiasts, those who can build it into a status symbol akin to AirPods. Those who don’t care if they look goofy walking around with ski goggles on.

Apple will now work on a slightly improved model, perhaps at a better price point for v2 to expand TAM. They’ll adjust the design based on consumer preferences, improve the silicon, and release marginally better products at regular intervals, then rinse and repeat periodically.

Importantly, better silicon improves battery life. Apple’s ultimate goal is to have a mass-market product and I don’t see how that can be anything other than sunglasses, albeit slightly clunkier than traditional sunglasses. Eventually, the Vision Pro will resemble sunglasses more than goggles.

That’s the path I see Vision Pro taking, but the chips inside need to improve materially before ultra-low latency AR on sunglasses is possible. AR requires a lot of on-device processing and the 5nm M2 and R1 chips aren’t at a level yet that they can process this amount of data with a reasonable battery life. Especially not packed into tiny sunglasses. So we need smaller and more efficient chips.

For that we need time, foundries need to continue pushing manufacturing capabilities ahead. Future iterations of M2 and R1 will likely move to smaller TSMC nodes. No telling when though. The A17 Bionic chip is already on the 3nm node and it’s rumored that the iPhone 17 chip will be on the 2nm node.

As an aside, the internal architecture of Vision Pro is pretty brilliant. Apple designed a new chip, the R1, to handle the compute-intensive spatial aspects of AR. Things like hand and eye tracking. It’s bundled with an M2 chip (used in Macs) to handle visionOS compute needs. The R1 chip is built for ultra-low latency which makes it necessary for effective AR experiences, while M2 will be a workhorse of traditional compute tasks. This heterogeneous architecture is a wonderful starting point but needs immense improvement before Vision Pro is ready for the leap to mass market.

Capital Returns to Shareholders

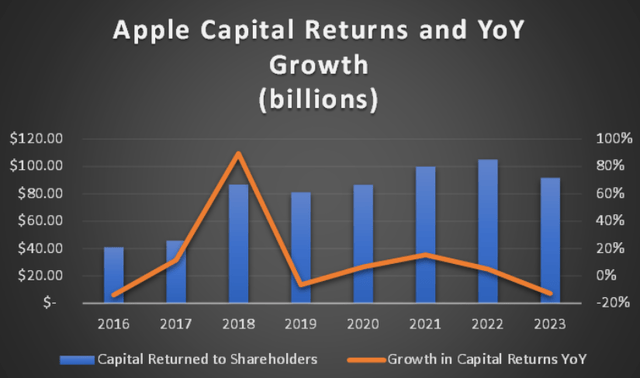

Finally, let’s take a look at Apple’s capital returns to shareholders over time. This section will be brief because all there is to say is that this is phenomenal. Take a look:

Author’s Creation from Company Reports

Apple has returned $685.6 billion to shareholders since 2015 between buybacks and dividends. There’s not much else to say. That figure exceeds the market cap of all but 8 publicly traded companies at the time of writing.

Conclusion

Apple has grown into one of the most well-known and loved brands globally. Its products are sleek, interfaces simple, and operating systems effective. Apple Inc. has built what I believe to be the most prolific product/service ecosystem in history that enjoys a flywheel effect designed to compound shareholder wealth over time. I maintain my Buy rating on Apple.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.