Summary:

- Last Thursday, both Apple and Meta presented their latest quarterly results.

- Apple presented a quarterly revenue of $117.2B, down 5% on a year-over-year basis and earnings per diluted share of $1.88.

- Meta presented a quarterly revenue of $32.17B, which is a decrease of 4% when compared to the same quarter of the previous year.

- In this comparative analysis of Apple and Meta, I will show you which of the two I consider to be the more attractive choice at this moment in time.

Wirestock/iStock Editorial via Getty Images

Investment Thesis

Even though Apple (NASDAQ:AAPL) presented quarterly results that were lower than expected (a revenue of $117.2B and earnings per diluted share of $1.88 while analysts’ projections were $1.95 per share and a revenue of $121.65B), I still prefer the company over Meta (NASDAQ:META) when having to choose one of the two companies to invest in.

Even though both currently receive my buy rating, I would overweight the Apple stock in a long-term investment-portfolio while I would not do the same with Meta. The reasons for my opinion are varied:

My DCF Model indicates a slightly higher compound annual rate of return for Apple when compared to Meta (9% for Apple and 8% for Meta). In addition to that, I consider Apple’s competitive advantages (such as its broad product portfolio, high customer loyalty and strong brand image) to be superior when compared to those of Meta. This contributes to the fact that I consider Apple’s economic moat to be significantly higher than Meta’s.

Furthermore, I believe that the risk factors that come attached to an investment in Apple are significantly lower when compared to its competitor. I see Meta’s enormous dependency on its Advertising business unit (which generates 97.17% of its revenue) as a strong risk factor for investors, while Apple has a much broader product portfolio. Although Apple currently faces strong macroeconomic challenges, I see these risk factors as being less significant for long-term investors.

These factors contribute significantly to the fact that I believe Apple to be the much better risk / reward choice when compared to Meta. Therefore, I would select the Cupertino based company over its opponent when deciding to invest in only one of the two.

Apple’s and Meta’s Performance Within the Past 12 Months

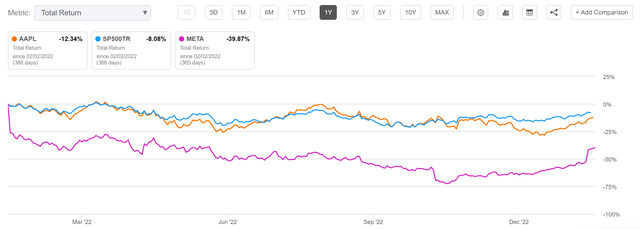

When comparing Apple and Meta’s performance within the past 12 month period, it can be highlighted that the performance of both companies has been below that of the S&P500. However, Apple has shown a significantly better performance than Meta: while the S&P500 showed a Total Return of -8.08% within the past 12 months, Apple’s performance was -12.34% in the same time period while Meta’s was -39.87%.

From my point of view, Apple’s superior performance when compared to Meta is a strong indicator of its much more robust business model and broader and more diversified product portfolio. Both factors contribute significantly to the fact that I would choose Apple over Meta when selecting only one out of the two companies.

The Valuation of Apple and Meta

Discounted Cash Flow [DCF]-Model

My DCF Model calculates an Intrinsic Value of $156.37 for Apple, giving it an upside of 0.2%. At Apple’s current stock price, my DCF Model calculates an Internal Rate of Return of approximately 9% for the company. For Meta, my DCF Model indicates an Intrinsic Value of $169.40, giving the company a downside of 13.6% and indicating a compound annual rate of return of approximately 8%.

Internal Rate of Return for Apple

Below you can find the Internal Rate of Return calculated with my DCF Model where I have assumed different purchase prices for the Apple stock.

At Apple’s current stock price of $156, my DCF Model indicates a compound annual rate of return of approximately 9%. (In bold you can see the compound annual rate of return for the company’s current stock price of $156.)

|

Purchase Price of the Apple Stock |

Internal Rate of Return as according to my DCF Model |

|

$140.00 |

11% |

|

$145.00 |

10% |

|

$150.00 |

10% |

|

$155.00 |

9% |

|

$156.00 |

9% |

|

$160.00 |

8% |

|

$165.00 |

7% |

|

$170.00 |

7% |

|

$175.00 |

6% |

Source: The Author

Internal Rate of Return for Meta

At Meta’s current stock price of $196.00, my DCF Model indicates an Internal Rate of Return of approximately 8%.

|

Purchase Price of the Meta Stock |

Internal Rate of Return as according to my DCF Model |

|

$180.00 |

10% |

|

$185.00 |

9% |

|

$190.00 |

9% |

|

$195.00 |

8% |

|

$196.00 |

8% |

|

$200.00 |

7% |

|

$205.00 |

7% |

|

$210.00 |

6% |

|

$215.00 |

6% |

Source: The Author

Fundamentals: Apple vs. Meta

In terms of Profitability, I see Apple as being ahead of Meta. Even though both companies have a similar EBIT Margin [TTM] of 30.29% (Apple) and 30.09% (Meta), which reflect the companies’ strong competitive position within their industry, Apple has the significantly higher Return on Equity: while Apple’s Return on Equity is 175.46%, Meta’s is significantly lower at 22.40%, providing evidence that Apple is superior to its competitor in terms of Profitability.

When considering the current Valuation of the companies, we can see that Meta’s P/E [FWD] Ratio of 21.39 is below the one of Apple (23.72). However, in my opinion, Apple should be rated with a premium when compared to Meta. This is for a number of varying reasons: Apple has a much broader and more diversified product portfolio than Meta, which makes the company more resistant in times of recession. This is also reflected in Apple’s Total Return of -12.34% within the past 12 months while Meta’s was -39.87%. In addition, the company from Cupertino has a much higher brand value (according to Kantar BrandZ, Apple’s brand value is estimated to be around $947,062M, while Meta’s is estimated to be approximately $186,421M). Another reason why I think Apple should be rated with a premium when compared to its competitors is its enormous customer loyalty. In my opinion, this will continue to generate substantial future income streams for the company.

In addition to the above, my DCF Model shows the slightly higher Internal Rate of Return for Apple when compared to Meta, which serves as an additional indicator that Apple’s Valuation is currently slightly more attractive.

When it comes to Growth, I also see Apple as being ahead of Meta: my opinion is reflected in its EBIT Growth 3 Year [CAGR] of 23.16%, which is significantly higher than Meta’s (8.34%). Apple’s EPS Diluted 3 Year [CAGR] of 27.18% is also significantly higher than its rival (18.92%). Both of these figures provide further indicators that Apple is ahead of Meta in terms of Growth.

Below you can find an overview of Apple’s and Meta’s Fundamental Data:

|

Apple |

Meta |

||

|

General Information |

Ticker |

AAPL |

META |

|

Sector |

Information Technology |

Communication Services |

|

|

Industry |

Technology Hardware, Storage and Peripherals |

Interactive Media and Services |

|

|

Market Cap |

2.30T |

401.51B |

|

|

Profitability |

EBIT Margin |

30.29% |

30.09% |

|

ROE |

175.46% |

22.40% |

|

|

Valuation |

P/E GAAP [FWD] |

23.72 |

21.39 |

|

Growth |

Revenue Growth 3 Year [CAGR] |

14.87% |

21.09% |

|

Revenue Growth 5 Year [CAGR] |

11.46% |

26.48% |

|

|

EBIT Growth 3 Year [CAGR] |

23.16% |

8.34% |

|

|

EPS Diluted 3 Year [CAGR] |

27.18% |

18.92% |

|

|

Income Statement |

Revenue |

394.33B |

118.12B |

|

EBITDA |

130.54B |

43.87B |

|

|

Balance Sheet |

Total Debt to Equity Ratio |

261.45% |

21.34% |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

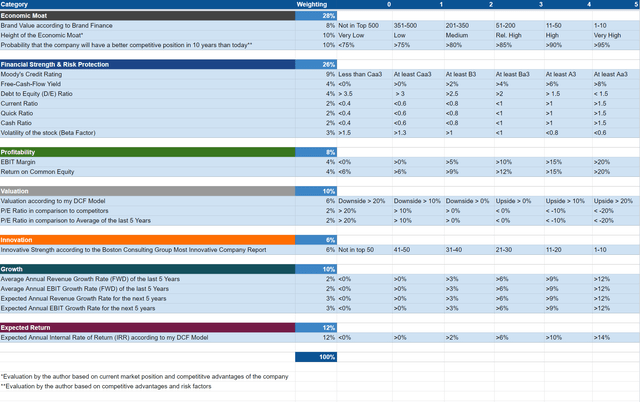

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

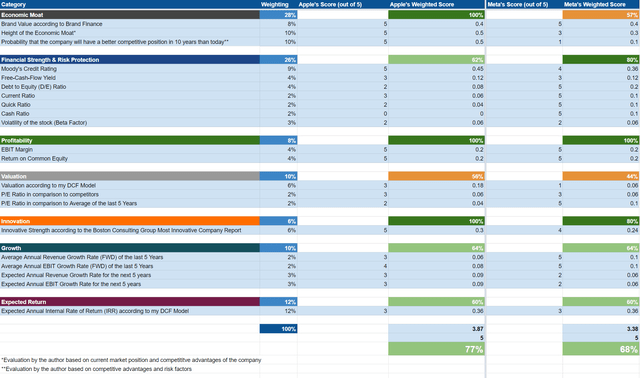

Apple vs. Meta According to the HQC Scorecard

The results of the HQC Scorecard confirm that Apple is currently the more attractive choice when compared to Meta: while Apple receives 77/100 points, Meta only gets 68/100.

Apple’s rating, as according to the Scorecard, is significantly superior to Meta’s in the categories of Economic Moat (Apple receives 100/100 compared to Meta’s rating of 57/100). In the categories of Valuation and Innovation, Apple is also rated slightly higher.

The results of the HQC Scorecard strengthen once again my belief to rate Apple over Meta at this moment.

Risks

When it comes to risk, I see significantly more risk factors for Meta investors than for Apple investors. I will demonstrate this in the following:

Apple’s strong brand image and high customer loyalty are factors that will continue to secure revenue and profit for the company in the future. Due to its broad and diversified product portfolio, which helps Apple to build an economic moat over its opponents, the company is less dependent on individual business units than Meta is. Meta is highly dependent on the revenue it generates from Advertising: proof of this is the fact that the company generates 97.17% of its revenue from its Advertising business unit (in the Quarter that ended 31 December, Meta generated a revenue of $31,254M within its business unit of Advertising while its total revenue was $32,165M).

All of these factors make Apple the clearly less risky investment from my point of view. The fact that I consider Apple to be the significantly lower risk investment also strengthens my belief that I would overweight its stock in an investment portfolio that has been built with a long investment-horizon. This is not the case for Meta: Although I would add the company to a long-term investment portfolio, since I believe that it still has significant growth potential in the years ahead. But I see the risk factors that come attached to a Meta investment as being too high and the future revenue stream currently not being predictable enough in order to overweight the company in an investment portfolio. Therefore, I would only underweight its stock in a portfolio. The same strategy is implemented in my own personal investment portfolio, in which Apple is the largest position, while Meta is one of the companies that I underweight for the same reasons mentioned before.

In my opinion, the lower risk level that comes attached to an investment in Apple and the more predictable revenue streams when compared to Meta, make it the more attractive long-term investment and the more adequate buy-and-hold investment. These factors once again strengthen my belief to rate Apple over Meta when selecting only one out of the two FAANG stocks.

The Bottom Line

In this comparative analysis on Apple and Meta, I have shown that I consider Apple to be the more attractive choice for investors out of the two, particularly for those aiming to invest with a long investment-horizon. Not only is the Internal Rate of Return for Apple higher than for Meta (as according to my DCF Model, the compound annual rate of return is 9% for Apple and 8% for Meta at the companies’ current price levels); I also see significantly less risk factors for Apple investors than for those who opt for Meta.

Although I concede that the company from Cupertino faces significant macroeconomic risks including its dependency on its production in China, I consider these risk factors to be less important when investing with a long investment horizon.

Apple’s strong competitive advantages (including its strong brand image, loyal customers and broad product portfolio) contribute to its economic moat, which helps to significantly decrease the risks for investors. In my opinion, decreasing the risk when investing also implies that you will achieve your investment goals with a higher probability. This is why I see Apple as being ahead of Meta and would continue to overweight the company in an investment portfolio. However, I would only choose to underweight Meta: one of the reasons being that the company is still extremely dependent on its advertising business, thus implying a larger risk for investors.

I would love to hear your opinion on this comparative analysis on Apple and Meta. Which of these stocks do you currently prefer?

Disclosure: I/we have a beneficial long position in the shares of AAPL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.