Summary:

- Perceived safe havens – Apple and Microsoft – have drastically outperformed the real safe havens in 2023.

- However, the equity risk premiums for Apple and Microsoft have moved deeper into the negative territory since our last update in March, leaving AAPL and MSFT at untenable valuations.

- Going into a potential economic recession, I continue to prefer real safe haven assets, i.e., US treasuries, with a strong preference for short-duration instruments [3-12 month T-bills yielding 5-5.5%].

SIphotography/iStock via Getty Images

Introduction

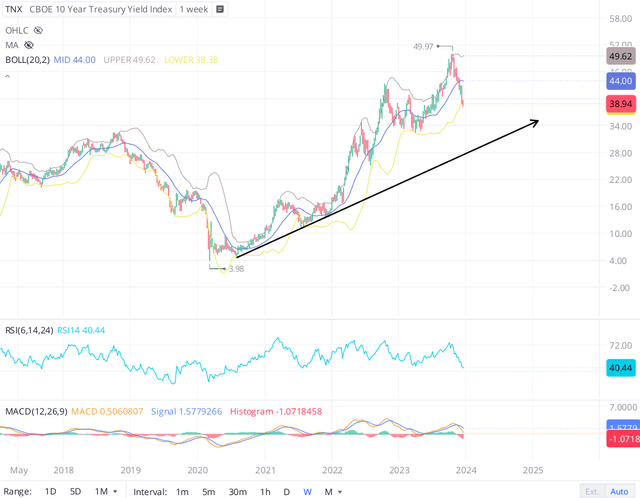

Over the last few weeks, long-duration treasury yields have dropped like a rock after the latest Treasury quarterly refunding announcement called for lower-than-expected issuance of long-duration treasury bonds in Q1 2024. Janet Yellen’s move to finance a larger portion of the US government’s huge fiscal deficit spending via short-term treasury bills caught bond vigilantes off guard, and subsequently, we have seen a drastic drop in long-duration treasury yields [the 10-year treasury yield is down ~135 bps in a month – falling from ~5.20% to ~3.85%]. And, this drop in treasury yields has been somewhat exacerbated by the Fed’s dovish pivot at the December FOMC meeting last week.

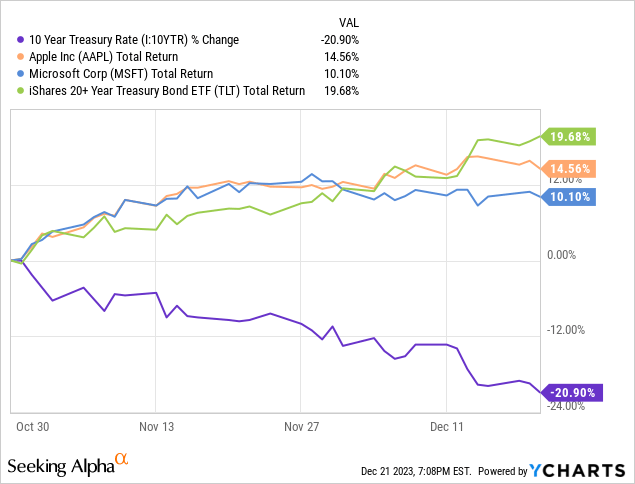

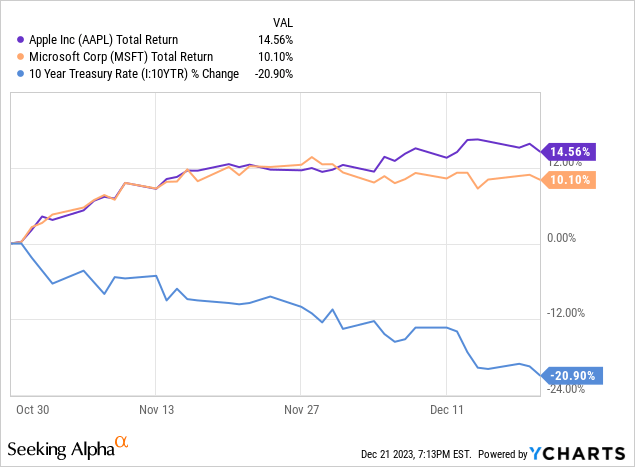

Typically, falling yields (lower discount rates) are supportive of asset prices (especially for long-duration assets). Hence, the ongoing rally in stocks and bonds isn’t all that surprising. However, the battle of safe havens is at an intriguing state, with long-duration treasury bonds (TLT) outperforming perceived safe havens like Apple (NASDAQ:AAPL) and Microsoft (MSFT) since late October 2023:

Amid these sharp moves, many of our investing group members have requested a fresh update on the battle of safe havens. If you haven’t followed our SA coverage on the battle of safe havens, please feel free to read:

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-2

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-3

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-4

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-5

- Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round-6 [Latest publication: 30th March 2023]

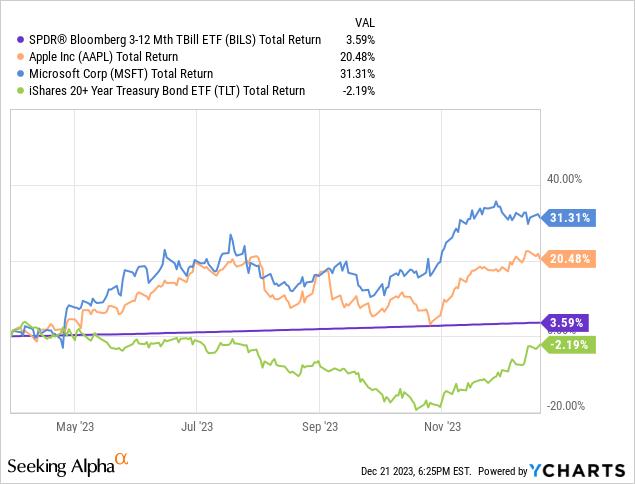

Since the first publication of this series on 20th April 2022, I have preferred cash (short-duration treasuries (BILS) (NASDAQ:SHY) [risk-free yield of 4-5%]) over long-duration treasury bonds and perceived safe havens, i.e., Apple and Microsoft. And, as of our latest update in late March 2023, cash was winning the battle of safe havens. However, mega-cap tech stocks have delivered significant outperformance since early summer, with AAPL and MSFT up ~21% and 31% from our last update.

In today’s note, we will discuss recent market action and risk/reward dynamics to find the better investment among treasury bonds, Apple, and Microsoft at this moment in time.

Understanding The Moves In AAPL & MSFT

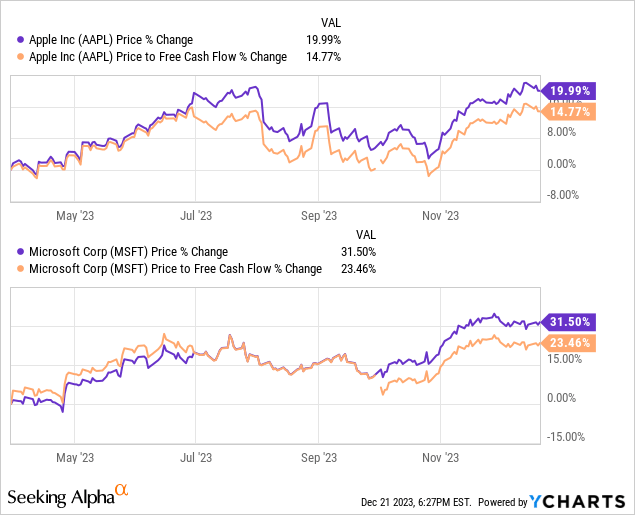

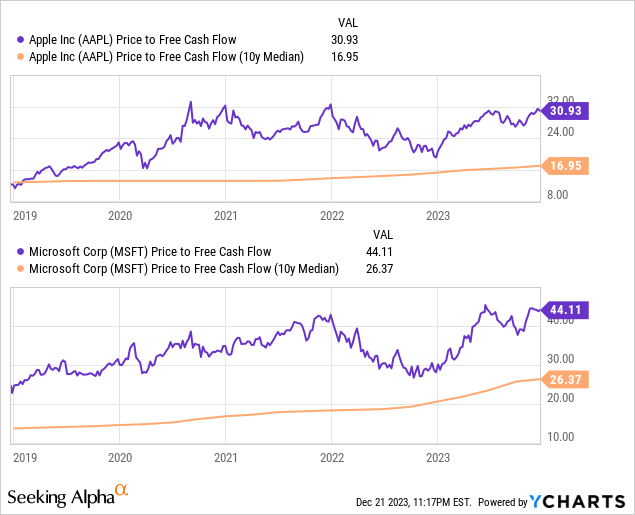

Amidst rapidly moderating inflation and healthy consumer spending, equities have experienced an epic rebound this year after the malaise of 2022, with mega-cap tech stocks leading the charge higher [boosted by the AI narrative]. While monstrous cash flows and robust balance sheets are valid reasons for investors taking a flight to safety into the mega-cap tech complex, a large chunk (~75-80%) of the price moves in Apple and Microsoft are a direct function of an increase in P/FCF trading multiples!

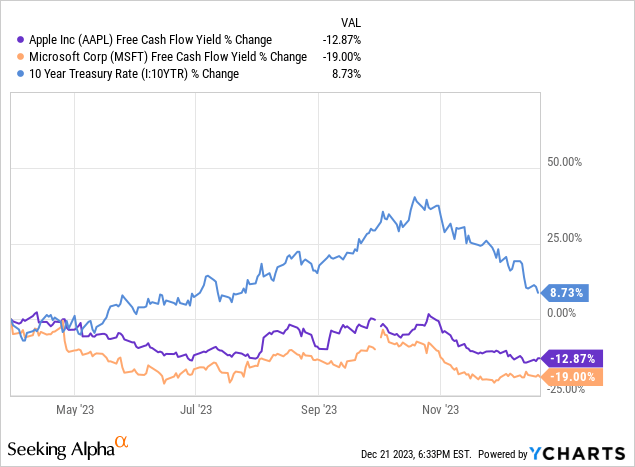

While long-duration treasury yields have been sinking lower in recent weeks, the 10-year treasury yield is almost 9% higher than where it was back in late March 2023. Hence, investors are currently accepting lower free cash flow yields on Apple and Microsoft than at the time of our previous update.

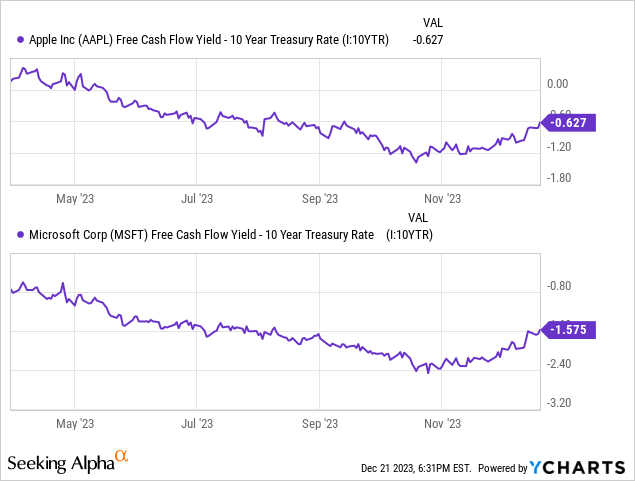

On the back of their respective rallies in recent months, the equity risk premiums for both Apple and Microsoft have moved deeper into negative territory. According to the immutable laws of money, negative equity risk premiums are simply unsustainable, which renders current valuations for Apple and Microsoft untenable.

The quandary of these negative equity risk premiums can be resolved in three ways:

- Massive growth in FCF (improvement in FCF yield),

- Continued decline in treasury yields (lower discount rate), and/or

- A significant decline in AAPL/MSFT stock price

Given my expectation of an economic slowdown in 2024, I can’t see rapid growth in free cash flow at bellwethers like Apple and Microsoft for the foreseeable future. While low-double-digit free cash flow growth is certainly plausible, it will likely not be enough to compress AAPL’s and MSFT’s ultra-high trading multiples fast enough.

Now, a decline in risk-free yields can certainly boost the equity risk premiums for AAPL and MSFT [as they have done in November-December]. Equity market bulls are hoping that the Fed will follow through on its guidance for three rate cuts next year and that there will be little to no economic pain.

Will Long-Duration Bond Yields Keep Going Lower In 2024? Is It Time To Extend Duration?

With inflation moderating rapidly amid early signs of economic weakness, the bond market is pricing in six rate cuts for next year versus the Fed’s dot-plot guide of three cuts [25 bps each]. Given the sharp rise in long-duration yields during 2023, there’s certainly room to fall further on the downside.

However, if the economy is to stay resilient, long-duration bond yields should stabilize in the 4-5% range for the foreseeable future as massive amounts of long-dated treasury bond issuance (fresh supply) are set to flood the market in 2024.

Bond market volatility remains elevated, and yields could continue to fluctuate up and down in upcoming months depending on incoming economic data. While the recent data points have indicated a “Goldilocks” environment, things can change very quickly, with all past hard landings looking like soft landings until they didn’t.

Concluding Thoughts: Who Will Win The Battle Of Safe Havens In 2024?

Given an uncertain macro backdrop, I am not a big fan of extending the duration on treasuries right now; and I continue to believe that cash (i.e., short-term treasuries yielding 5-5.5% is the way to go).

The perceived safe havens – Apple and Microsoft – have significantly outperformed cash in recent months; however, the era of free money is over, and buying AAPL/MSFT at negative equity risk premiums is a perfect recipe for trouble. In my view, the risk/reward for a near to medium-term investment in Apple and Microsoft has gotten even worse than our last update from late March 2023, and even then, I viewed the risk/reward on offer as highly unfavorable. I continue to like short-term treasuries over long-term treasury bonds, Apple, and/or Microsoft to ride out an inevitable economic recession.

A Risky Pair Trade: Sell AAPL, Buy SHY

In Apple Stock: China Woes Are Just The Tip Of The Iceberg, I highlighted Apple’s reliance on financed product sales as a bigger risk than a China ban. And while sales have held up thus far, Google Trends data are showing a slump in iPhone searches [-14% globally, -24% in the US].

While the Fed is unlikely to raise interest rates further in this cycle [as long as inflation stays in control], they are unlikely to cut rates back down to zero anytime soon. A deeply inverted yield curve and 20 months of negative LEI readings tell me that a recession is coming our way in the next 6-18 months. Given Apple’s heavy exposure to (discretionary) consumer electronics, I expect to see pressure on both top and bottom lines at the Cupertino giant next year. Now, Apple will still generate billions of dollars in sales and profits; however, I think continued financial performance weakness (low single-digit growth) and a rotation out of over-crowded “Magnificent 7” stocks will force a long overdue valuation de-rating in AAPL stock from ~30x P/E to a more reasonable trading multiple in the 15-20x P/E range.

While it is undoubtedly a risky trade, I like the idea of selling AAPL and buying SHY 1-3 year treasury bond ETF as a long/short pair trade for 2024.

Key Takeaway: Sell AAPL, Buy SHY

Thanks for reading, and happy investing. Please share your thoughts, questions, and/or concerns in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

How To Invest In This Environment?

In order to navigate this tricky economic period, we are pursuing “Bold, Active Investing with Proactive Risk Management” at our investing group – “The Quantamental Investor“. With a laser focus on valuations, profitability, and balance sheet strength, we are buying the winners of tomorrow! Furthermore, we are utilizing index-based options to guard against significant broad-market declines. Join us today to prepare for whatever the market may throw at you in 2024!