Summary:

- We believe the current rally in Apple Inc. stock is sustainable.

- Volume analysis suggests that institutions may have been accumulating the stock for the last year or so.

- The current breakout – catalyzed by an improving growth story – will, we think, attract further institutional capital (since the name remains reportedly under-owned).

- In addition, to the extent retail investors withdraw capital from money-market accounts if and when rates fall, we believe Apple stock will be a preferred buy.

FlashMovie/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Under-Owned And Under-Appreciated

Apple Inc. (NASDAQ:AAPL), as everyone knows, has its best days behind it. The rate of innovation has slowed, competitor products are frequently superior, the devices are too expensive and blah.

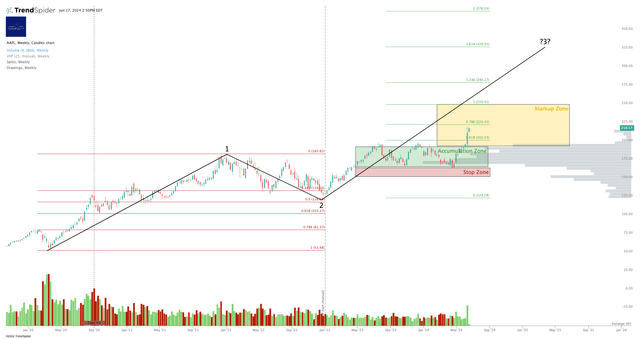

Well, that may be, but the stock doesn’t agree. Having put in a sideways accumulation pattern from April 2023 until earlier this month, the stock just broke out into a bullish pattern which, we believe, can run until $328 or so.

Allow me to explain that opinion. Pleased to discuss and debate it in the comments to this article, as always.

Apple Stock Analysis

Let’s deal with that chart first, then let’s turn to the underlying fundamentals which, I believe, provide supporting evidence for the notion of a continued run-up for the stock.

AAPL Chart (Cestrian Capital Research, Inc // TrendSpider)

The chart begins from the Covid crisis low, which increasingly looks like a righteous “trade point zero” for most all the charts we do. As you know, the violent about-turn in Fed liquidity provision plus the impact of 2020 Q1 quarterly options expiry started a huge rally in equities; the rally was further fueled by plentiful brought-forward spending on technology products made by the companies which dominate the S&P 500 (SP500) and the NASDAQ 100-Index (NDX); and the rate-hike cycle that followed delivered a brutal correction in 2022, setting up for the rally we have seen in 2023-4 to date.

Viewed this way, I believe Apple stock is in a “Wave Three” up in the larger degree right now. For anyone who has outside interests, family, friends, pets etc. and is not versed in the lore of Elliot Wave theory, you can think of a Wave Three as the most powerful move of a stock within an overall larger trend.

Whilst often decried, the reason technical analysis can be useful is that, used well, it can reveal the breadcrumbs left behind by institutional investors as they move large sums of capital around the market. For this, the volume x price indicator is often useful. On the chart above, you can see this in the gray bars on the right-hand side of the chart. This shows the volume of trading in any given price zone (each bar is a price zone defined by the height of the bar on the y-axis). Time = 0 is set at the recent January 2023 bear market low, meaning that all the volume you see there since that time has taken place during the upswing in the stock. And what it tells you is that there has been a big spike in volume between around $170/share – $197/share.

The data in this format is insufficiently granular to say whether this represents institutional buying or selling – so it’s important to use one’s judgment in this regard. We rated Apple at Accumulate in that range because, we believe, the stock was being bought up over time by institutions.

Apple Fundamental Analysis

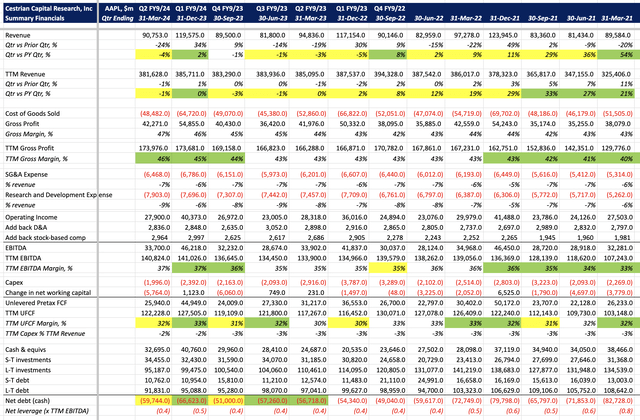

The December 2023 earnings print gave a clue as to why – growth had turned positive year-on-year for the first time since the December 2022 quarter.

AAPL Fundamentals (Company SEC Filings, Cestrian Analysis, YCharts.com)

The break to the upside came, of course, with the recent product updates centered around the introduction of AI capabilities on the device – in the case of the iPhone, not backwards-compatible with older versions. So if you want AI, you need to buy a new high-end phone, simple. And whilst we can argue the merits of this, I suspect the fact is that many people will go buy the high-end phone. And this has led to an ex-post-facto narrative about Apple now being a major AI on-ramp; which has gotten late bulls all excited about the stock; which has led to buyers jumping on the breakout and fueling this new rally. This is the kind of thing that drives Wave 3s.

Apple has been deemed an “under-owned” stock for some time now, as this recent Seeking Alpha article explains. The article is from summer 2023, but recent commentary from institutional sales desks suggests the name remains under-owned.

Finally, there remains a wall of money in money-market funds, as investors have elected to keep it there earning higher rates of return than has been available for cash for some years. We can debate if and when the Fed will cut rates; I believe it will, and I believe this, plus an ongoing bull market, will draw in a substantial sum of fresh cash from those money market accounts. By definition, holders will be of the conservative type; and if I were to guess one stock, they might like to buy? I would guess Apple because (1) it’s a longtime biggest-company name, (2) the company is known to be well-managed and careful with capital, (3) the valuation isn’t silly even after the breakout, and also (4) it’s Apple.

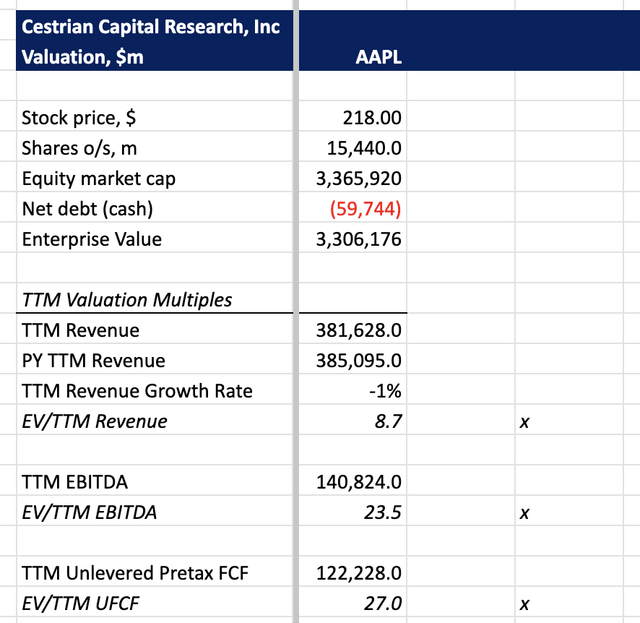

Apple Valuation Analysis

Here’s that valuation, by the way. Always a matter of judgment, of course, but I doubt that 27x TTM unlevered pretax FCF is particularly expensive for this stock.

AAPL Valuation Analysis (Company SEC filings, YCharts.com, Cestrian Analysis)

Conclusions, Price Target And Rating

So I believe conditions are ripe for a continued rally in the name.

1 – Technical factors suggest it, and whilst technicals can always be wrong, when there is supporting evidence from the real world, one’s belief in the technicals may justifiably rise.

2 – Apple Inc. fundamentals are turning up – I would be surprised if iPhone sales did not respond well to the “you have to buy the expensive new one if you want the good AI” strategy.

3 – Institutional investors are likely under-exposed still, and,

4 – Late-bull retail investors are likely to want to buy the name if and when rates drop and money-market accounts become a less attractive place to park capital.

The 1.618 Wave 3 extension, a common topping zone, is $328. So that’s our price target on the name.

We rate Apple Inc. stock at Hold, having been at “Accumulate” between $166-194.

Alex King, Cestrian Capital Research, Inc – 17 June 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text at the top of this article. Please note that we are an affiliate partner of TrendSpider; no affiliate links have been included in this article. If you click on a link we have provided elsewhere to a TrendSpider web page, and subsequently take out a paid subscription plan to a TrendSpider service, we may receive a referral fee.

Cestrian Capital Research, Inc staff personal accounts hold long AAPL positions both directly and via ETFs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.