Summary:

- Apple’s shares surged after the introduction of Apple Intelligence, but macro risks and Berkshire Hathaway’s selling signal caution.

- Q3 showed revenue growth and strong performance in services, Mac, and iPad, but challenges in China and AI revenue potential remain.

- Despite recent growth, Apple’s stock is overvalued with little margin of safety, making it a HOLD at best at the current price.

gece33

For a long time, Apple (NASDAQ:AAPL) was struggling to revive growth as its revenues were declining last year, its advantage in the smartphone market was slowly waning, and its shares were struggling to establish a solid support level at above $200 per share. However, after the introduction of Apple Intelligence earlier this summer, the shares have jumped, while analysts began to raise the growth forecasts to reflect Apple’s entrance into the generative AI field.

The problem though is that after the recent run-up, Apple’s shares appear to offer little margin of safety, while macro risks continue to increase and the selling of shares by Warren Buffett’s Berkshire Hathaway (BRK.A)(BRK.B) doesn’t send a positive signal to the market. That’s why even though Apple’s entrance into the generative AI field is likely to be beneficial for the company, its stock is a HOLD at best at the current market price.

Apple Makes A Comeback

Back in June, I noted that while Apple’s entrance into the generative AI field has been met with excitement, the upside to the company’s shares could be limited due to the rising number of challenges that the business is facing. While Apple’s shares have appreciated by around 5% since that time, I still believe that further growth is not guaranteed. However, it would be foolish not to state that the company’s performance has indeed improved in recent quarters, and the recent quarter was not an exception.

If we look closely at the Q3 earnings report, which was released earlier this month, we’ll see that Apple’s revenues were $85.78 billion. That translates to a Y/Y growth rate of 4.87%, which is the highest annual growth rate in nearly two years.

The successful performance of Apple’s services business has been one of the most notable things that happened in Q3. During the quarter, the services revenues increased by 14% Y/Y to $24.2 billion, which is a new record for the company. By having over 1 billion paid subscriptions, it makes sense to assume that the services business will continue to be a major cash cow for Apple, since customers who use the company’s products have no other choice but to be a part of its ecosystem. That’s why it’s not a surprise that the management expects the services business to continue to grow at a double-digit rate.

It’s also important to note that Apple’s Mac and iPad revenues were also up Y/Y primarily thanks to the recent launches of new laptops and tablets. With back-to-school season around the corner, Apple’s MacBooks and iPads will likely continue to be in high demand in Q4.

On top of all of that, some analysts believe that Apple will start charging up to $20 fee for the premium features of Apple Intelligence in the future. If true, this could help Apple create a new high-margin income stream in a relatively short time. By offering paid versions of their generative AI products, both OpenAI and Microsoft (MSFT) saw their revenues skyrocket recently. Apple could experience the same thing happening to it if enough of its customers opt in for Apple Intelligence’s paid features.

All of this points out the fact that Apple’s leadership team has finally found a way to revive growth, which was much needed after several quarters of Y/Y revenue declines in nearly two years. While Apple’s revenues are expected to increase by less than 2% this year, the upcoming release of the new iPhone, greater penetration of Apple Intelligence, and the potential increase in services sales, could indeed create a scenario under which the company’s revenues grow at top single-digit rates in FY25 and beyond. The street has already made dozens of upward revenue and earnings revisions in recent months, which is an indication that things are improving inside Apple.

Apple’s Revisions (Seeking Alpha)

The Growth Is Not Guaranteed

Despite all of the growth opportunities described earlier in this article, Apple also continues to face several major challenges that could undermine its growth story. While some of the company’s businesses experienced major growth during the recent quarter, its iPhone sales declined from $39.67 billion in Q3’23 to $39.30 billion in Q3’24. The decline could be attributed to the company’s poor performance in China.

The latest earnings report showed that Apple’s sales in Greater China were down 6.5% Y/Y to $14.7 billion. What’s more is that the iPhone’s market share in China decreased to only 14%, while China’s phone markets such as Huawei, Xiaomi, and others experienced growth and improved their positions in the Chinese smartphone market. Considering the inability of the company to revive growth in China, there’s a risk that it would be harder for Apple to meet its goals and especially exceed expectations in the future.

At the same time, some investors might be disappointed about the potential revenues that Apple Intelligence will generate, since the company’s major generative AI tools are not expected to be released in China and Europe in the foreseeable future.

What’s more, is that the recent selling of shares by Warren Buffett’s Berkshire Hathaway is not sending a positive signal to the market. While Warren Buffett stated that Apple will remain in his portfolio and his firm currently owns about 400 million shares, he nevertheless sold over ~500 million shares in the first half of the year. This could be viewed by someone as the signal to also sell shares as the upside could be limited, especially after the recent rally.

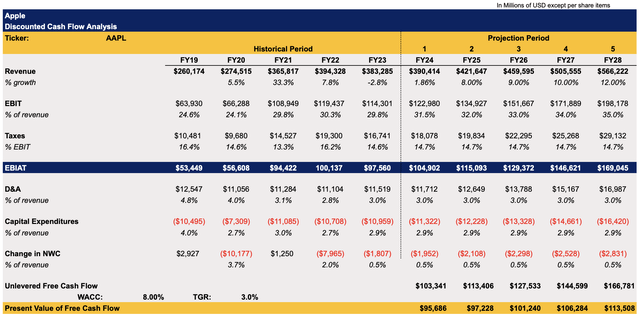

Considering all of this, it seems that Apple’s stock also doesn’t provide enough margin of safety for investors at the current price. My DCF model from June showed that the company’s fair value is $176.30 per share. Given the successful performance in Q3, I made some upward revisions to the revenues and EBIT in the new model, which can be seen below.

The assumptions for revenues and EBIT in the new model closely align with the overall expectations for the following years. The expectations for other metrics in my model correlate with Apple’s historical performance. The WACC of 8% closely aligns with the market’s average cost of capital, while the terminal growth rate of 3% mirrors the average inflation and GDP growth rate.

Apple’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

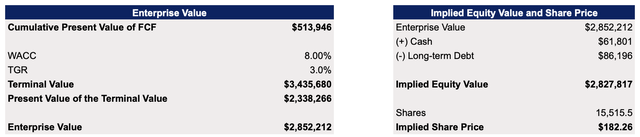

Thanks to several upward revisions, the updated model shows that Apple’s fair value is $182.26 per share. While it’s slightly above the previous calculations, we nevertheless see that Apple remains overvalued at the current price and offers little margin of safety for investors.

Apple’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

While the company’s shares mostly were able to recover from the latest depreciation caused by the broader market selloff, it’s still hard to justify a long position at the current price. By trading at over 30 times its forward earnings and over 8 times its forward sales, it seems that it’s better to look for alternative investment elsewhere, especially since the China-related risks remain.

The Bottom Line

Apple is, without a doubt, a great company; but unfortunately, it trades at a relatively high price right now, which offers little margin of safety for investors. While it’s good to see the company returning to growth, Apple’s upside is likely to be limited due to the rising challenges that it faces, which could undermine its growth story. The fact that one of its biggest investors is selling his position also doesn’t send a positive signal to the market. That’s why at this stage Apple is only a HOLD for me as it’s likely that its shares will trade in-line with the rest of the market until the release of the Q4 earnings report in November.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.