Summary:

- Even though Apple beat expectations on both its top and bottom lines, shares pulled back in after-hours trading.

- Overall financial health is solid and the future for the business looks fine, but this is the problem with buying pricey shares.

- This neutral assessment is in spite of the fact that the potential for the business, from an AI and services perspective, is phenomenal.

ozgurdonmaz

After the market closed on Oct. 31, the management team at computer giant Apple (NASDAQ:AAPL) announced financial results covering the final quarter of the company’s 2024 fiscal year. Leading up to the announcement, it seems as though market participants were a bit concerned. I say that because shares pulled back by 1.8% during trading for the day. Interestingly, the company exceeded forecasts on both its top and bottom lines. But even so, the stock fell another 1.8% in after-hours trading.

To be honest with you, there’s not really anything significant that I see that would justify the pessimism that the company experienced during this window of time. However, this does seem to be the risk that comes with buying into expensive businesses. On Oct. 20, I wrote an article that looked into what analysts were expecting for the quarter. I acknowledged that the company is a high-quality business and that the long-term outlook for it will probably be fine, even as it faces challenges in certain parts of the world such as China. But because of how expensive shares are, I maintained that it was a better “hold” than it was a “buy.”

Between that time and the time the market closed on Oct. 31, shares are down 3.6% while the S&P 500 is down 2.6%. But if the after-hours dip is indicative of what the company will experience when the market opens on Nov. 1, shares will effectively be down 5.4%. Some might view the positive performance and the decline in price as a good buying opportunity. But I certainly don’t. Even though I’m a fan of the business, and I believe it will be a larger and more profitable firm in the future than it is today, shares just are not compelling at this moment. Because of that, I’ve decided to keep the business rated a “hold” to reflect my view that the stock is unlikely to perform a materially different than what the broader market should see for the foreseeable future.

A solid quarter, all things considered

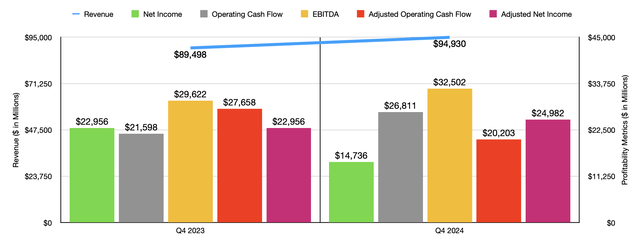

Author – SEC EDGAR Data

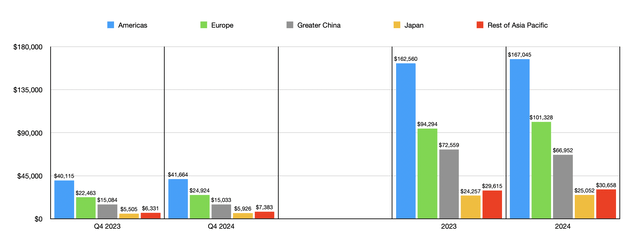

For the final quarter of the 2024 fiscal year, Apple performed better than what analysts had hoped to see. Total revenue came in at a robust $94.93 billion. That’s an increase of 6.1% compared to the $89.50 billion the business reported just one year earlier. It also happens to be $510 million greater than what analysts were hoping to see. Digging into the numbers even deeper, we can look at things on a region-by-region basis and on a category-by-category basis. Regionally, the business saw growth everywhere, with the exception of Greater China. There, revenue dipped ever so slightly from $15.08 billion to $15.03 billion.

Author – SEC EDGAR Data

Frankly, I’m a bit surprised by this performance. That’s because, for the 2024 fiscal year in its entirety, revenue totaled $66.95 billion. That happens to be 7.7% below the $72.56 billion reported last year. As I wrote about in my previous article, which I already linked to earlier in this piece, and as I detailed in another article, China has been a source of concern for the behemoth. Increased competition from firms that are domestic to that country is eating away at the business. But for the final quarter of this year, the picture was a bit different. In the investor conference call that the company hosted, CEO Tim Cook claimed that the company’s installed base of active devices reached an all-time high during the quarter. Despite troubles with competition there, management claims that Apple had the top two selling smartphones in urban centers throughout the country. They also have seen robust demand for their Mac and iPad devices.

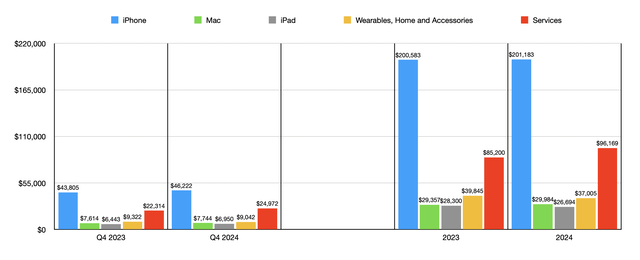

Author – SEC EDGAR Data

When it comes to individual products, the picture was great for the quarter. iPhone sales totaled $46.22 billion. That represents an increase of 5.5% compared to the $43.81 billion worth of units sold one year earlier. Mac sales grew 1.7% year over year, climbing from $7.61 billion to $7.77 billion. Meanwhile, iPad sales popped 7.9% from $6.44 billion to $6.95 billion. The company also saw robust growth when it came to the services that it provides. Revenue there grew by 11.9% from $22.31 billion to $24.97 billion.

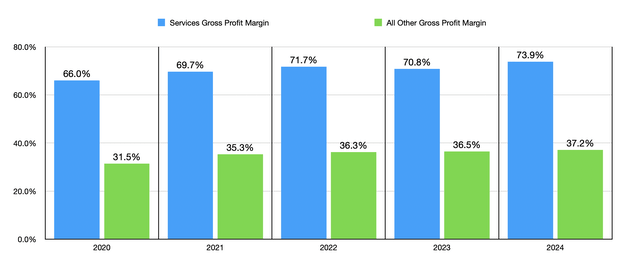

Even though Tim Cook was noncommittal, he did indicate that there could be significant potential for services to grow even further thanks to Apple Intelligence and the appeal it could have for developers. Any sort of growth on this front should be a net positive for the company. I say this because margins associated with services are almost always higher than they are for products. In the case of Apple, the gross margin from services was 74%. By comparison, when it came to products, this number was only 36.3%. The only weak spot for the company involved its wearables, home, and accessories products. Revenue there pulled back 3% from $9.32 billion to $9.04 billion.

On the bottom line, the picture was more complicated. Year over year, earnings per share dropped from $1.46 to $0.97. Even though earnings ended up being $0.02 per share greater than what analysts were anticipating, that still translates to a decline in net income from $22.96 billion to $14.74 billion. As worrisome as this might look, this is only because of a $10.25 billion charge that the company took because of a judgment in Europe against the company whereby it has to pay Ireland $15.8 billion for unfair tax advantages that the company received from the country. If we adjust for this, actual earnings would have been $1.64 per share, which would have exceeded analysts’ forecasts by $0.04 per share. That translates to $24.98 billion in profit for the quarter. That happens to be 8.8% above the $22.96 billion the company reported one year earlier.

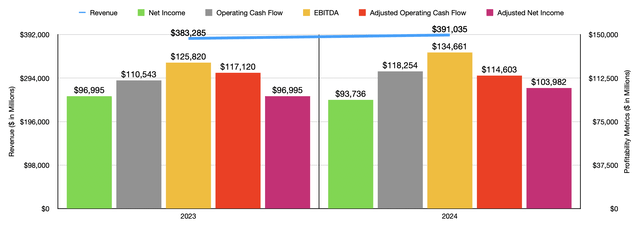

Author – SEC EDGAR Data

Other profitability metrics for the business were largely positive. Operating cash flow, for instance, jumped from $21.60 billion to $26.81 billion. If we adjust for changes in working capital, however, we get a drop from $27.66 billion to $20.20 billion. And finally, EBITDA for the company grew from $29.62 billion to $32.50 billion. In the chart above, you can also see financial results for the business for the 2024 fiscal year in its entirety. Data for 2023 can also be seen.

By most measures that matter, I would say that Apple had a pretty solid quarter. And if everything goes according to plan moving forward, growth should continue. For the first quarter of the 2025 fiscal year, management expects revenue for the business as a whole to grow at a low to mid single-digit range on a year-over-year basis, with double-digit revenue growth for services leading the way. The top brass at the giant is so confident that they continue to focus on returning capital to shareholders. During the quarter, management put about $3.8 billion toward dividends. However, they also repurchased 112 million shares on the market for roughly $25 billion. This brings total returns of capital during the quarter to $28.8 billion.

Author – SEC EDGAR Data

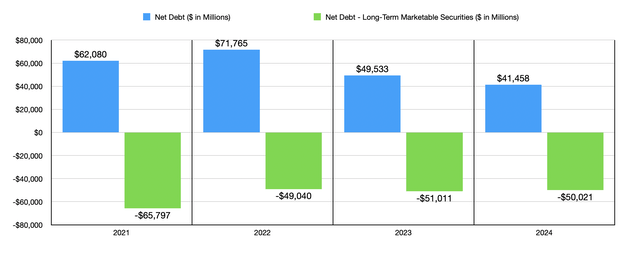

Despite allocating all of this capital to these direct shareholder payments, Apple continues to be in a great position from a balance sheet perspective. The business ended the 2024 fiscal year with $41.46 billion worth of net debt. While this is up from the $39.50 billion the company recorded for the third quarter of this year, it does mark a nice improvement from the $49.53 billion worth of net debt that management ended the 2023 fiscal year with. If we factor marketable securities that are long term in nature back into the picture, we end up with a net cash and securities position of $50.02 billion. That’s only marginally worse than the $50.01 billion the company recorded one year ago.

Author – SEC EDGAR Data

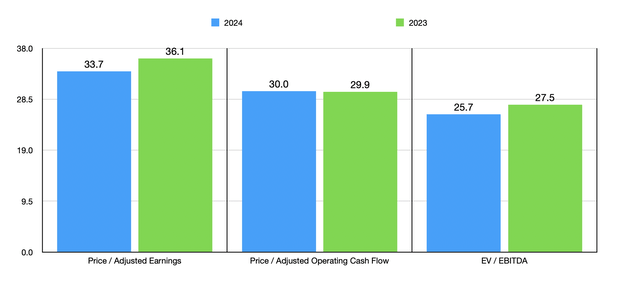

No matter how you stack it, things seem to be looking pretty good for Apple at this point in time. Unfortunately, this does not make the company a great opportunity to buy into. If we were seeing rapid growth, I probably would be more flexible. But with total revenue for 2024 coming in only 2% above what it was in 2023, and with adjusted income rising just 7.2% year over year, I believe that pricing the company like a growth play is a mistake unless we start to see some major progress in using the AI revolution to its advantage. In the chart above, however, you can see just how expensive shares are. These are multiples that I would typically associate with a business that’s overvalued. But because of the high-quality nature of the firm, its track record, and its robust balance sheet, I think that a more neutral assessment is appropriate.

Apple’s big AI bet

Outside of the fundamental performance and valuation sides of the company, there are some things that we should discuss in additional detail. Even though I have made clear that I am keeping the company rated a “hold” throughout this piece, this does not mean that I don’t believe in the business or its long-term potential. I’m bullish about Apple in the long run, just not bullish enough to have a bullish rating. My optimism regarding the company comes not only from the quality of its financial performance. It also comes from initiatives that management continues to roll out aimed at achieving greater growth and value creation for investors in the long run.

The greatest recent example of this that I could point to is Apple Intelligence, which is essentially the company’s generative AI feature that it’s now rolling out. In June of this year, management announced Apple Intelligence and has since described it as a “personal intelligence system that combines the power of generative models with personal context to deliver intelligence that is incredibly useful and relevant.” In the latest investor call, management stated that this marks the start of a new chapter for the company and its innovation. Just before earnings came out, on Oct. 28 to be precise, management launched Apple Intelligence in the US for users of the iPhone, iPad, and Mac.

When the program was initially announced earlier this year, it received a mixed reception from the investment community. However, I’m very optimistic about this in the long run. When Warren Buffett first invested in Apple back in 2016, it was because he viewed the firm as a consumer products company rather than as a technology firm. In 2023, he touted the loyalty that users have to the business when he said that people who have paid $35,000 to own a second car would give that car up before giving up their iPhone. This strikes at the heart of what makes the company truly special.

Even though it initially started as a technology company, it has used improvements in technology to create stickiness with its users. I can point to myself as an example. I bought my first Apple laptop back in 2008 when I was entering into college. Since then, I have owned two other laptops, both of which are Apple products. I do have a non-Apple desktop, but I only use that for gaming. All of my other technology, save my Remarkable 2 tablet, are Apple products. This includes every smartphone that I have ever purchased, and my iPad. The ability to easily share content from one platform to another, or to access your content from anywhere in the world, all through Apple’s cloud, creates stickiness. The compatibility from one product to the next does the same. And when you add all of this together with a well running machine that gives you little to no problems, even years after purchasing it, you end up wanting nothing else.

I know this soliloquy is a bit long. But my point here is the new product that adds something to a user’s experience, with that something bringing value, further increases the stickiness for the company and creates long-term potential for additional revenue. But of course, it would be helpful to add some numbers to this. Because at the end of the day, something like Apple Intelligence is only valuable if it improves the lives and experiences of those that utilize it.

While the jury is still out when it comes to Apple Intelligence specifically, there has been a lot of research over the past couple of years on the impact that AI has for productivity. Across three different case studies, performance improvements stemming from the use of generative AI came in at a robust 66%. In one of these studies, support agents that used AI were found to be able to handle 13.8% more customer inquiries per hour. In a second study, business professionals that used AI could write 59% more business documents in a given timeframe. And in a third study, programmers that used AI could code 126% more projects each week.

Obviously, this definitely shows that the impact will vary tremendously depending on how the AI is used. However, there have been some estimates regarding the ultimate impact that it could have on the global economy. Last year, consulting giant McKinsey and Co. came out with their own assessment of the impact that generative AI could have globally. This involved more than 60 different organizational use cases spread across roughly 2,100 detailed work activities. They found that generative AI could boost the global economy by between $2.6 trillion and $4.4 trillion. And according to one source, it’s believed that by the year 2032 generative AI could add $1.3 trillion in market value.

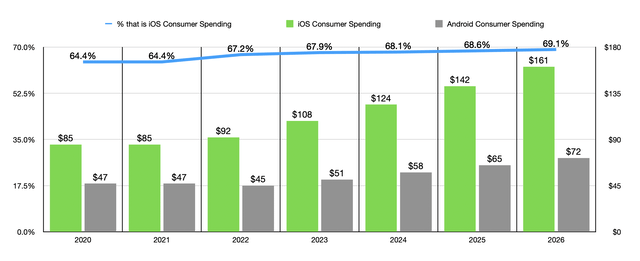

Author – Data from Backlinko

Why does this apply to Apple? Simply, it’s because the primary interface for consumers when it comes to the Internet would be their smartphones. This year, it’s estimated that iPhone users will spend around $124 billion on consumer goods and services through their smartphones. That’s up from $85 billion in 2021. And by 2026, it could grow to $161 billion a year. This is significantly greater than those that utilize phones with the Android operating system. That number for this year is only $58 billion. And by 2026, that number should grow to $72 billion. What’s really striking from this is that these disparities exist even though there are far more Android users than there are iPhone users in the world. In total, it’s estimated that there are over 3 billion active Android users. For the iPhone, that number is about 1.38 billion. Furthermore, the disparity is becoming greater every year. Between the two systems, the share of consumer spending attributable to iPhone is expected to grow from 64.4% in 2021 to 69.1% by 2026.

Every day, on average, iPhone users spend an average of 4 hours and 45 minutes on their phones. By comparison, that number for Android users is 3 hours and 42 minutes. When you do the math here, this means that iPhone users spend almost 20% of their lives on their devices. And if you adjust this to strip out an average of seven hours of sleep per night, then we end up with almost 28% of their conscious existence. Now, we can debate whether this is good or bad for the individual or society. But what is indisputable is that a good generative AI program has the potential to increase what users are using their devices for and how much they are accomplishing with their tasks.

This doesn’t mean that there is not risk. According to one source, 81% of consumers think that the information collected by AI companies will be used in ways that they are uncomfortable with. And 63% of consumers are concerned about the potential of AI to compromise an individual’s privacy. However, this is not surprising when it comes to new technology. Back in February 2005, only 27% of Americans said that they had ever used the internet to do any banking online. By 2022, 78% of adults in the US said that they now prefer to bank using an app or website. By comparison, only 29% of Americans today prefer to bank in person. So as time goes on, consumers will get more comfortable with AI as well.

There’s another dimension to this as well. Unfortunately, it might be years before we know the exact financial impact that Apple Intelligence will have for Apple. For starters, the launch that occurred on Oct. 28 was only in US English. But in December of this year, the company will also be rolling out the platform on a localized basis for the UK, Australia, Canada, Ireland, and New Zealand. By next April, they will be adding more languages that Apple Intelligence works with.

Author – SEC EDGAR Data

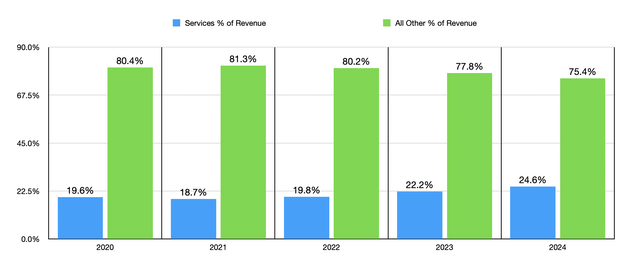

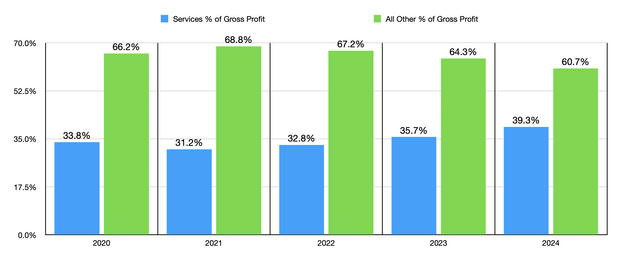

Seeing as how the services part of the company includes things like advertising, cloud services, a wide array of digital content such as books, music, fitness programs, and more, as well as payment services, there’s a high probability that much of the upside associated with Apple Intelligence will be on this side of the company. This is a very important part of the business as I detailed earlier in this article. I already talked about how profitable it is. But I do think a bit of a deeper dig is appropriate.

Author – SEC EDGAR Data

Back in 2020, services accounted for 19.6% of all of Apple’s revenue. And yet, because of its 66% gross profit margin, it was responsible for 33.8% of Apple’s profitability. Over the years, the company as a whole has increased in size. However, as the gross profit margin associated with services has increased, its contribution to the company and its significance to Apple’s overall financial health has also grown. For 2024, the $96.17 billion generated from services translated to 24.6% of the company’s overall sales. But with a gross profit margin of 73.9%, it now accounted for 39.3% of the company’s profits. Assuming that Apple Intelligence does add value for users, it’s highly likely that the company will be able to use it in order to create not only additional stickiness as I mentioned earlier, but also to better monetize its other revenue streams. With revenue growing and margins improving along the way, the company as a whole should do quite well.

Author – SEC EDGAR Data

Takeaway

As things stand, I remain a big fan of Apple from a consumer perspective. But that does not mean that I have to be bullish about the stock. Even though the business performed better than analysts expected it to, shares are still very pricey. And absent a scenario where we start to see rapid bottom line improvements, I don’t see the stock becoming undervalued in the near term. Because of this, I’ve decided to keep the firm rated a “hold” for the moment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!