Summary:

- Apple Inc. reported 3Q24 revenue of $85.80 billion, marking a 5% year-on-year growth, driven by strong performance in Europe and the Americas.

- For the past quarters, AAPL showed lackluster growth. Moreover, AAPL failed to monetize its innovation effectively and does not have a strong growth driver to encourage growth.

- Deteriorating sales in China are likely to persist due to consumer nationalism and domestic policies, exacerbating AAPL’s growth outlook.

- Valuation analysis suggests that markets are pricing in an unrealistic growth outlook, suggesting that the company is overvalued with a potential downside of 17.91%.

Apisorn

Introduction

Apple Inc. (NASDAQ:AAPL) has been a stock market darling for many years. As one of the biggest companies in the world supported by a strong balance sheet and a history of generating cash flows, AAPL has been a core position in many investors’ portfolios.

Despite the company’s lackluster performance in the past few quarters, the company’s share price remains elevated. One of the major reason is due to the exuberance surrounding the company’s AI developments. However, there are multiple other issues weighing on AAPL that market participants are ignoring. In this report, I will demonstrate the major issues that will continue to weigh on the company and why AAPL’s valuation is no longer justifiable.

Improving Margins Despite Modest Revenue Growth

Segment Operating Performance (Company Filings 10Q)

For 3Q24, AAPL generated quarterly revenue of $85.80 billion, representing a year-on-year growth of 5%. In the Americas, the region posted a year-on-year growth of 6% due to higher revenue contribution by services. In Europe, net sales surged by 8% due to higher sales in both Services and iPhones. China continues to underperform all other regions due to lower net sales of iPhones, resulting in a decrease of 7% year-on-year. Despite weakness in foreign currencies, Asia Pacific saw the strongest growth, with revenues surging 13% year-on-year.

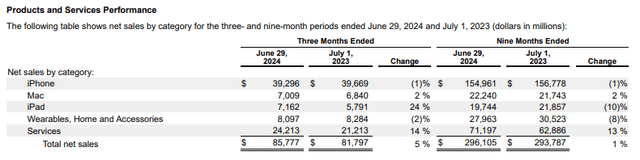

Revenue Breakdown by Product & Services (Company Filings 10Q)

In terms of sale categories, iPad posted the largest revenue growth of 24% due to higher sales of the iPad Pro and iPad Air. Apple’s Services such as App Store and Cloud services continue to show strength, growing 14% year-on-year. Conversely, the iPhone, Mac, and Wearables segment were relatively weak; iPhone and Wearables declined by 1% and 2% year-on-year; whereas Mac sales remained unchanged at 2%. It is important to note that on a 9-month basis, the company’s revenue remains largely unchanged, growing at a mere 1%.

Despite lackluster growth, the company has done well, optimizing its margins. Gross margin has improved from 44.5% in 3Q23 to 46.3% this quarter; on a 9-month basis, the company’s gross margin expanded from 43.8% last year to 46.20% this year. However, total operating expenses have increased slightly to 17% in 3Q24 from 16% in 2Q24; on a 9-month basis, 15% in FY2024 from 14% in FY2023.

Failing In the Game of Innovation

Despite maintaining its status as the King of Smartphones, AAPL seems to be stagnating and is facing challenges. Based on the last four quarters, the company’s revenue has only surged by 0.48% on average. To be honest, the company has not been successful in launching new products or services that have the potential and the ability to adequately capture growth substantially; after all, how much longer can the company rely on iPhones? All the recent new initiatives were either cancelled or failed to show any promising growth.

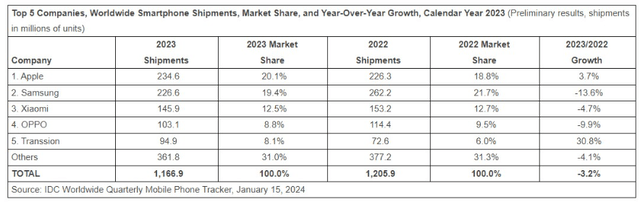

Worldwide Smartphone Shipments (IDC)

Previously, investors and consumers were excited about Project Titan; it was rumored to be either a fully self-driving car or an electric vehicle. To have a major product that can be potentially adopted by the masses and contribute to the company’s revenue will put the company in an exponential growth phase again. However, after 10 years of working on Project Titan with more than 1,000 automotive personnel and engineers, the company ended up with nothing; AAPL announced earlier this year that the entire car project was cancelled.

Moving away from cars, we have AAPL’s $3,400 Vision Pro. After one of the most exciting and hyped-up announcements in 2023, the company has reduced the number of shipments it initially planned from 700k to 400k units. As a reference, it is estimated that Meta’s Quest 2 and Quest 3 sold around 1.25 million and 760k units in a quarter. Currently, AAPL’s Vision Pro remains a niche product. Based on the latest earnings call, the Vision Pro is used by organizations such as Lufthansa to build innovative spatial computing experiences. Although impressive, similar to Microsoft’s Surface Hub, it is a very niche product that is out of touch with the masses; in other words, no scalability to contribute to revenue meaningfully.

Finally, we have the long-awaited Apple Intelligence. After intensive research efforts, our iPhones can finally summarize our notifications and allow us to generate new emojis; truly groundbreaking. Sarcasm aside, more importantly, Apple Intelligence will likely be a core component of the next generation of iPhones; in other words, the company probably will not be able to truly monetize it. At best, it will most likely serve as a catalyst to accelerate the replacement cycle of iPhones. Moreover, many analysts have doubts about whether big technology firms can monetize AI effectively.

Revenue Decay in China is Likely to Persist And Accelerate

Just like any American giant, AAPL has a huge China problem. Based on the latest 10-Q, about 18% of the company’s revenue was derived from China. Sales from China have declined 7% year-on-year for 3Q24 and 10% year-on-year for the past 9 months. Although the company cited weakness in the Chinese Yuan as the primary reason, that does not tell the full story.

China’s economy, since the implementation of tight government policies such as the zero-Covid and real estate’s three red lines, has remained weak and has yet to recover. Moreover, macroeconomic conditions are likely to continue affecting consumer spending negatively. In fact, the unemployment rate remains high with youth unemployment standing at a staggering 17%.

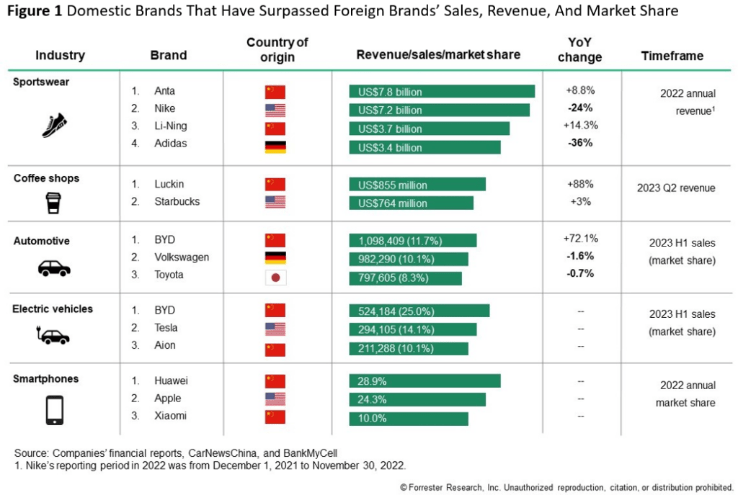

International Brands Dethroned (Forrester Research)

More importantly, there is a massive shift in consumer behavior and perception due to consumer nationalism and domestic policies. Global brands such as Nike, Starbucks, and Volkswagen have already ceded market share to China’s domestic brands. Currently, Huawei has already overtaken Apple and is the largest company by sales in China in the smartphone industry. Moreover, the Chinese administration banned the use of AAPL’s products in government agencies and state-owned companies. As the relationship between China and the United States continues to deteriorate, causing further paranoia about cyber espionage, we should not expect the ban to be reversed anytime soon.

Fighting Against the Government is Costly and a Huge Waste of Resources

Apart from growth-related issues, the company has many other challenges. Perhaps the most obvious problem is that major governments are clamping down hard on AAPL. Recently, the European Court of Justice has ordered AAPL to pay €13 billion in back taxes to Ireland. The European Union has always been a costly issue for the company. Previously, AAPL was fined €1.8 billion over app store rules; in addition, the company has three other investigations that may result in more fines for not complying with the EU’s Digital Market Acts.

AAPL’s home country, the United States, also has a case against the company for flaunting antitrust rules. The United States Department of Justice has sued AAPL three times over the past 14 years. In the most recent case, the United States Department of Justice is going after AAPL’s fight on super apps. Given that Microsoft had spent 21 years fighting antitrust battles against the United States, it is unlikely that we will see AAPL’s issues revolving around antitrust abate anytime soon.

Current Valuation Implies that Market Participants Are Pricing In Too Much Growth

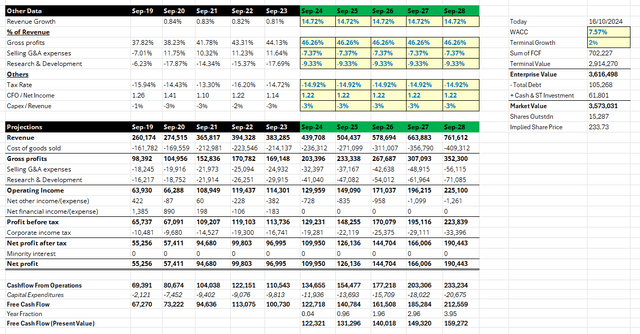

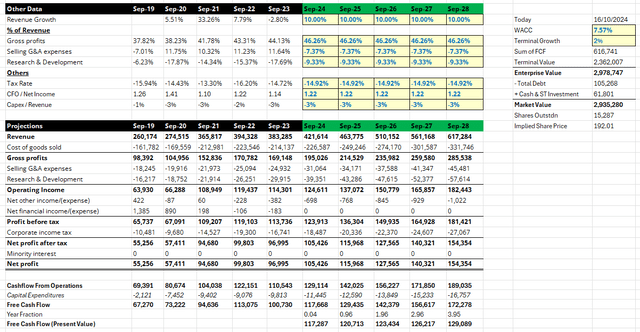

Valuation Analysis (Author’s Projections, Company Filings)

On a year-to-date basis, the company has surged 21.35% and is currently trading at a price of $233.89 and a P/E ratio of 35.57x. In an attempt to understand what kind of revenue growth the market is factoring in, I have built a discounted cash flow model based on the following assumptions: (1) all operational and financial margins remain consistent as per the latest quarter, implying that the company has improved its operational efficiencies, (2) WACC of 7.57%, and (3) Terminal Growth of 2%. Utilizing these assumptions, it will take AAPL an annualized growth of 14.72% for five years to have an implied share price of 233.73.

Given that the company is facing multiple revenue and growth related challenges, I strongly believe that the market is overpricing AAPL. Moreover, a 14.72% growth per year is quite unrealistic. For comparison and perspective purposes, China’s current sales contributes to about 18% of the company’s current revenue.

Valuation Analysis (Author’s Projections, Company Filings)

Realistically, given the current situation, AAPL’s sales are likely to deteriorate. However, for the sake of argument and erring on the safe side, I have utilized a 10% growth rate; according to the valuation model, AAPL’s share price is only worth $192, implying a potential downside of 17.91%.

Closing Remarks

I have always been an ardent supporter of AAPL’s products. In fact, over the most recent weekend, I was binge-watching Tehran on Apple TV+ on my iPad. However, there are far too many issues weighing on AAPL. If I were to buy in at this price, I would ultimately be paying for the company’s shortcomings. Even though the company’s balance sheet is healthy and can provide consistent and sustainable cashflows, the current valuation is simply unjustifiable.

AAPL will report its earnings on 31st October 2024, given that geopolitical tensions remain escalated, investors should closely monitor the company’s developments surrounding its sales in China. Additionally, any signs of margin deterioration will further undermine the current valuation of the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in AAPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.