Summary:

- In September 2023, the clouds around Apple, Warren Buffett’s top pick, continue to thicken.

- At the beginning of September 2023, The Wall Street Journal reported that the government led by General Secretary Xi Jinping banned civil servants from using iPhones.

- On September 12, 2023, the iPhone 15 series was introduced, disappointing us with the lack of revolutionary changes in its design compared to the previous generation.

- The continuation of the successful Ukrainian counter-offensive and the deterioration of the geopolitical situation around Nagorno-Karabakh will continue to weaken Russia’s weight in the international arena.

- We continue our analytics coverage of Apple with a “hold” rating for the next 12 months, but based on the above factors and technical analysis, we expect its share price to fall to $160-$161 by the end of 2023.

dima_sidelnikov/iStock via Getty Images

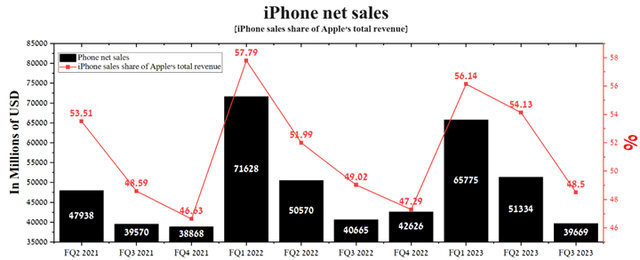

In 10 days, the third quarter of 2023 ends, marking a period filled with significant events that will continue to substantially influence Apple’s financial position (NASDAQ:AAPL). The iPhone, which revolutionized the global smartphone market in 2007, continues to generate the lion’s share of the company’s revenue despite its sales declining for the third quarter in a row.

Author’s elaboration, based on quarterly securities reports

Moreover, clouds continue to gather over Apple. Beijing’s ban on the use of the company’s flagship product by government officials, the small number of impressive changes in the new iPhone and Apple Watch models relative to previous generations, and the substantial weakening of the ruble are some of the factors due to which we are lowering our previous price range at which the risk/reward profile would be attractive.

We expect that by the end of 2023, Apple’s share price will drop to $160–$161, after which the accumulation phase will begin, during which we plan to buy its shares.

The impact of September events on Apple’s financial position

At the beginning of September 2023, The Wall Street Journal reported that the government led by General Secretary Xi Jinping banned Chinese civil servants from using iPhones. Just a couple of hours later, news appeared that China had decided to take more drastic steps and was planning to impose a ban on the use of Apple’s key product by employees of state-owned companies and government-supported agencies. With tens of millions working for 150,000 state-owned enterprises in 2021, that’s a significant financial risk that has had little impact on Apple’s share price so far.

The deteriorating business climate in China poses a challenge for the company as its product sales in Greater China have been the fastest relative to other segments. As a result, this calls into question Apple’s ability to continue to show impressive revenue growth as it has in past years.

Rising tensions between Beijing and Washington continue to gain momentum. China, experiencing a sharp increase in youth unemployment and the outflow of foreign capital, is in a significantly more vulnerable economic position than the United States in the current period of rising energy prices.

Although China has attempted to mitigate the situation by denying several media reports that it has banned government officials from using iPhones, we believe this is untrue. Thus, according to Business Insider, Weibo users say many employers have introduced restrictions on using the American giant’s phones. The Nikkei, one of the world’s largest financial newspapers, reported that at least one government-linked firm has begun advising its employees to stop using Apple products at work. Despite the wave of discontent among the Chinese population, we anticipate that some will choose Chinese smartphones to avoid potential troubles at work, ultimately reducing the demand for the iPhone 15 in this country.

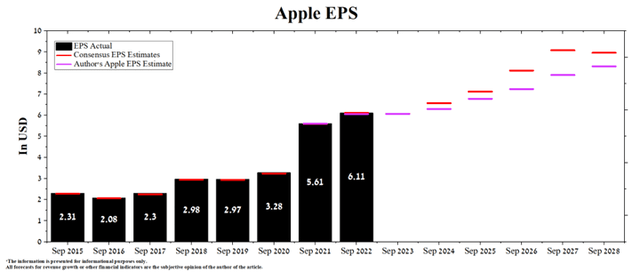

As a result, this is the first factor that necessitated a downward revision of our DCF model for the next five years. We expect Apple’s revenue to reach $395 billion by 2024, which is $10.92 billion below analysts’ consensus estimates.

Created by author

The second factor that led to our model’s revision is that the new generations of iPhone and Apple Watch presented at the September event did not cause a great excitement in society.

On September 12, 2023, the iPhone 15 series was introduced, disappointing us with the lack of revolutionary changes in its design compared to the previous generation. The new generation of iPhones runs on a chip based on TSMC’s (TSM) 3nm process technology and supports hardware-accelerated ray tracing. The relatively modest increase in transistor count from 16 billion to 19 billion didn’t bring as much of an impressive boost in performance and efficiency to the A17 Pro chip as we expected over its predecessor, the A16 Bionic.

On the other hand, replacing the Lightning port with USB-C, the appearance of a 48-megapixel main camera with 2x optical zoom in the base iPhone, and a significantly brighter screen are prerequisites that will attract people to upgrade their smartphones to the iPhone 15 models in the first weeks after the start of their sales. However, we believe that after the winter holidays, interest in new Apple devices will wane, and Tim Cook will have to introduce new products to the market that will be able to generate new sources of income so that the company can continue to implement an aggressive share repurchase program.

The third key factor that has contributed to the need for a downward revision of our expectations for Apple’s EPS over the next five years is the significant weakening of the ruble against the US dollar. We expect this financial metric to reach $6.3 for 2024, which is 4.1% below analysts’ consensus estimates.

Created by author

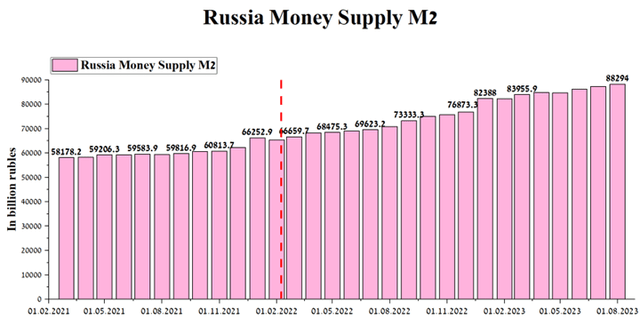

Since the beginning of 2023, the US dollar has continued to soar to new heights despite the Kremlin’s efforts to contain it. So, over the past ten months, the US dollar has grown by more than 35%, once again approaching the psychological level of 100 rubles per dollar.

TradingView

The continuation of the successful Ukrainian counter-offensive and the deterioration of the geopolitical situation around Nagorno-Karabakh will continue to weaken Russia’s weight in the international arena. Given the increase in the M2 supply by more than a trillion rubles every month since the start of the war against Ukraine, we expect the ruble to continue to weaken. As a result, this will not only affect ordinary Russians’ purchasing power negatively but also the ability for most of them to purchase Apple devices.

Author’s elaboration, based on the Central Bank of the Russian Federation

Conclusion

In September 2023, the clouds around Apple, Warren Buffett’s top pick, continue to thicken. This is caused not only by the temporary termination of sales of the iPhone 12 in France due to its excessive radiation levels but also by the lack of significant innovations in its devices. From year to year, developing something revolutionary that can surprise and provoke people to buy the latest versions of the company’s products is increasingly challenging.

The need for central banks to keep interest rates high and rising hydrocarbon prices in recent weeks have put pressure on consumers’ budgets, creating additional barriers for Apple to convince people to upgrade to the next generation of iPhones.

We continue our analytics coverage of Apple with a “hold” rating for the next 12 months, but based on the above factors and technical analysis, we expect its share price to fall to $160-$161 by the end of 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.