Summary:

- Apple’s next iPhone iteration is expected to launch a supercycle for the company as it includes new AI tools that can push more customers to upgrade.

- A short-term correction in many big tech stocks after the recent earnings shows that Wall Street is becoming more cautious towards AI hype.

- AAPL has been good at marketing new initiatives in the past, but it is doubtful if new AI tools would allow the company to increase ASP or unit sales significantly.

- Most of the incremental profit for Apple is coming through the Services segment, and a few percentage points increase in iPhone sales is unlikely to create a big bullish run.

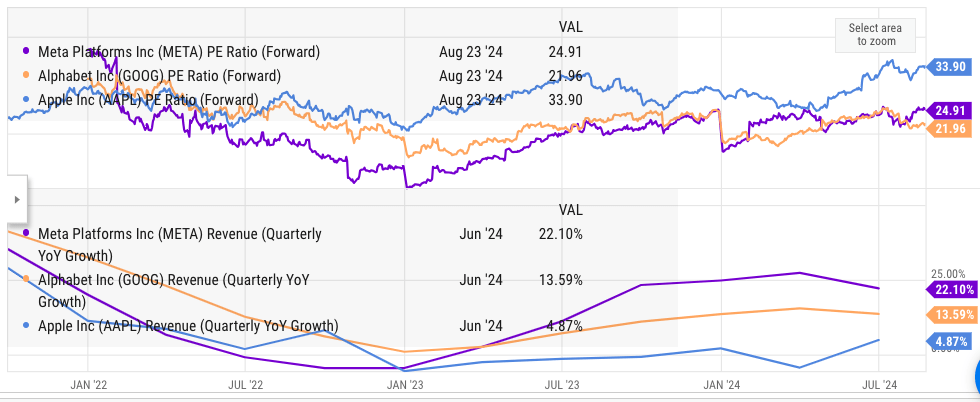

- The recent AI hype is already priced in Apple stock, as it trades at a forward PE ratio of 34, which is 50% higher than Google’s forward PE multiple and 40% higher than Meta.

Nikada/iStock Unreleased via Getty Images

Apple (NASDAQ:AAPL) is planning to launch its next iteration of iPhones, watches and AirPods on September 10th. There is a lot of hype this year as new AI features could improve the attraction of Apple’s devices. Many bullish analysts have cited these features as a sufficient reason to expect a major upgrade cycle in iPhone. The sales of the iPhone segment have been lagging for the past few years, which has pushed down the overall revenue growth of the company. The iPhone segment still contributes close to 50% of the total revenue base. In the previous article, it was mentioned that Apple is facing headwinds in other services as well as Vision Pro. These challenges can have a negative impact on the EPS trajectory while the stock is trading at a high valuation multiple.

Wall Street has shown a strong cautionary sign over the AI hype in the recent earnings. Many big tech stocks saw a correction as their management announced new capex for investment in AI. However, there are still no clear signs of how these investments will impact the bottom line. The monetization of AI tools is a long process, and it is unlikely to change near-term EPS estimates.

Another important challenge for Apple stock is that most of the AI hype has already been priced into the stock. The stock is trading at a forward PE ratio of 34 compared to 21 for Google (GOOG) stock and 25 for Meta (META). The forward EPS growth projections are also not very strong. Apple stock is trading at more than 27X the EPS estimate for fiscal year 2026. A lot can happen during this time. If the monetization of AI tools is underwhelming, we could see big downward revisions in EPS, which could push the stock down.

Wall Street Getting Cautious With AI Hype

Over the last few quarters, AI hype has been the only game in the town. Lot of attention is given to how a company plans to use AI tools and monetize them in the future. However, there has been a significant change in Wall Street’s attitude in the last few weeks. We have seen in the recent earnings season that many big tech companies suffered a correction as they announced massive capex for AI. On the other hand, the roadmap for monetization of AI was not clear. It is becoming more important for companies to show the impact of AI investment on their bottom line instead of focusing on the long-term potential.

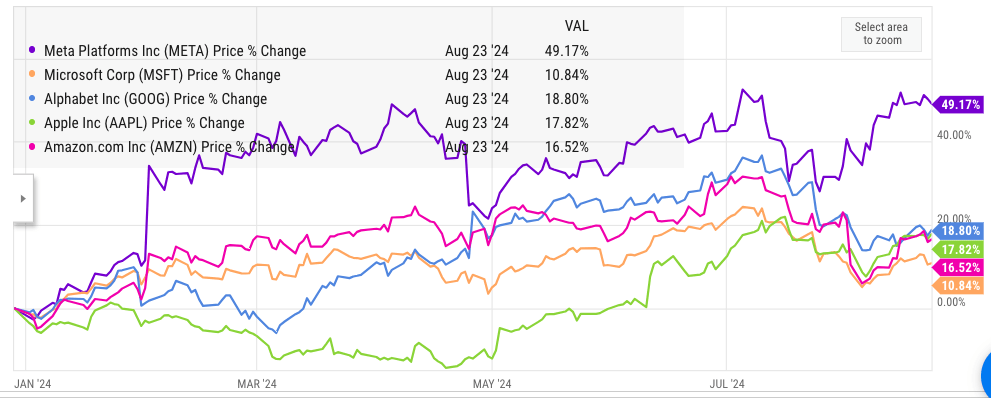

YCharts

Figure: YTD returns of Apple and other big tech companies.

In the above chart, we can look at the YTD stock price movement of big tech companies to see the change in the AI story. Meta has been able to rapidly monetize its AI investments by building new AI tools for advertisers and getting higher prices per ad. This has helped the stock perform significantly better than all other peers. Google, Amazon (AMZN), and Microsoft (MSFT) have also invested massively in AI, but these investments have not moved the needle in terms of revenue or EPS. We can see in the above chart a major difference after the recent earnings season. Meta’s outperformance is directly related to its better results by using the AI tools on its platform.

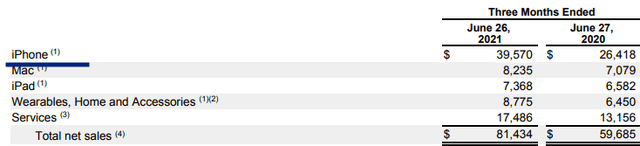

Figure: Apple’s iPhone sales in 2021.

Apple Filings

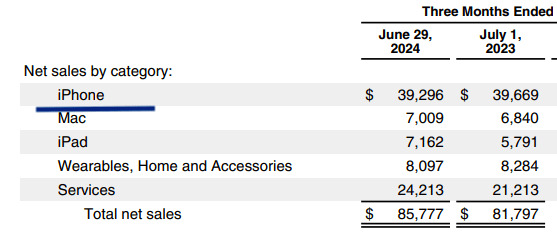

Figure: Apple’s iPhone sales in 2024.

We can see from the above image that Apple’s iPhone revenue in the recent quarter was $39.2 billion. Three years back, Apple’s iPhone revenue in the June-ending quarter of 2021 was $39.5 billion. Hence, Apple’s iPhone sales have actually decreased over the last three years despite an increase in prices. A lot is at stake in the next iPhone iteration. If the next iPhone does not live up to the hype, and we do not see a big bump in iPhone revenue, Wall Street could take it as a negative signal and turn bearish towards the stock, which is already trading at a very high valuation multiple.

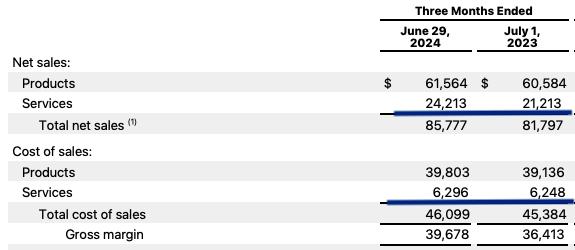

Services Is More Important

In the recent earnings, Apple’s Services revenue increased from $21.2 billion in the year-ago quarter to $24.2 billion. On the other hand, the cost of sales did not increase for the Services segment. Hence, most of the incremental Services revenue went into increasing the gross margin, which increased by $3 billion. The Products segment had very low impact on gross margin as most of the incremental net sales led to higher cost of sales.

Apple Filings

Figure: Impact of Services on gross margin.

Apple has a very lucrative revenue stream from licensing rights with Google. It also earns a very high margin from the commissions on its App Store. Both these revenue streams are under threat due to regulatory pushbacks. The European regulators have pushed for greater restrictions on Apple and its ability to gain lucrative commissions on the App Store.

If any of these two revenue streams are negatively impacted, the overall challenge for future margins would be very high. These threats are not adequately priced in the stock which is currently trading at close to its peak valuation multiple.

Risk To The Thesis

There are a lot of new tools and services being launched which are based on AI. Apple has always been very good at monetizing new services launched by other vendors. Even if Apple takes a small commission from new AI services, it could improve the revenue trajectory of Services business and improve the sentiment towards the stock.

A higher-than-expected iPhone upgrade cycle could also signal strong brand loyalty for the company. This could be taken positively by Wall Street improving the bullish sentiment towards the stock.

Future Stock Trajectory

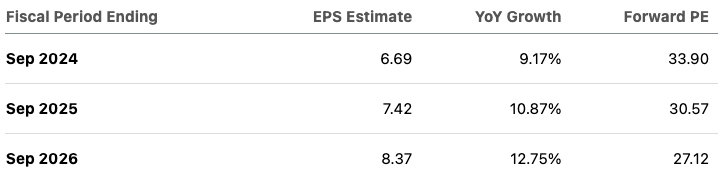

Apple’s EPS estimate for fiscal period ending Sep 2024 is $6.69. For fiscal period ending Sep 2025, the EPS estimate is $7.42 showing a 10.8% growth. For fiscal period ending Sep 2026, the EPS estimate is $8.37 with 12.7% EPS growth. However, even if Apple is able to meet these high EPS growth estimates, the stock is currently trading at 27 times the EPS estimate for fiscal period ending Sep 2026. This is a very high multiple when we look at other peers.

Seeking Alpha

Figure: EPS estimate of Apple in the next few years.

Alphabet stock is trading at a forward PE multiple of only 22 and Meta is trading at a forward PE of less than 25. This means that Apple’s forward PE multiple is more than 50% higher than Alphabet and close to 40% higher than Meta. On the other hand, both Alphabet and Meta have shown a lot higher YoY revenue growth than Apple. Their forward EPS growth estimates are also higher than Apple.

YCharts

Figure: YTD returns of Apple and other big tech companies.

Investors should be very cautious at this valuation multiple. Despite the massive hype around the next AI-enabled iPhone, Wall Street will closely look at the actual impact on the bottom line and EPS. If the near-term impact of new AI services on the EPS trajectory is not significant, we could see a loss of bullish sentiment towards the stock.

Investor Takeaway

Apple’s new AI iPhone has been overhyped, and it could be a while before Apple is able to adequately monetize the AI tools in its devices. Wall Street has grown very cautious towards the AI hype, and it would need to see actual numbers in order to build a bullish rally. It is difficult to see if a few AI tools alone will be able to push Apple’s stock higher. In the latest earnings, Apple gained most of the incremental profits from Services, especially the revenue from the App Store and licensing rights with Google. Both these revenue streams are facing increasing regulatory headwinds that have not been priced in.

Apple’s valuation is sky-high, with a forward PE multiple of 34. This is significantly higher than Alphabet and Meta, both of which have a higher revenue growth trajectory. Currently, I believe the risks outweigh the rewards for Apple stock, making it a Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.