Summary:

- Apple’s share price has declined by about 12% since December 2023 due to regulatory problems, lack of AI innovation, lack of a killer new product, and stagnant revenue.

- The European Union Digital Markets Act could lead to lost revenue in Apple’s Services segment.

- Apple’s growth has been hindered by declining unit sales in all major device categories, but the company’s focus on Apple Silicon and on-device AI could drive future growth.

Justin Sullivan

Since Apple Inc.’s (NASDAQ:AAPL) share price peaked on Dec. 14, 2023, it has declined by about 12%. A number of factors have converged to darken Apple’s outlook, including regulatory problems, a perceived lack of AI innovation, lack of a killer new product, and most importantly, stagnant revenue. In order to be worthwhile for investors, Apple must resume growing. This article explores how Apple can resume growing revenue, particularly in devices.

Factors contributing to the recent share decline

In July 2022, I wrote that the European Union Digital Markets Act would force Apple to allow side-loading of apps for iOS, iPadOS, and watchOS. By the end of the year, Apple had signaled that it would comply with the EU.

A recent blog post on the Apple Developer site outlined how EU developers would be able to create their own “alternative app marketplaces” as well as distribute apps directly from their own websites (sideloading), much as many macOS apps are distributed now. The walled garden has indeed started to tumble, at least for EU developers and their customers.

I think it’s a wonderful development for developers and consumers, and I hope that eventually it becomes a worldwide norm for all of Apple’s app stores. But for Apple and its investors, maybe it’s not so great. The changes could lead to lost revenue in the Services segment.

I’ve argued that this could be mitigated by Apple’s increasing market share relative to Android. Becoming a more open platform removes one of the perceived advantages of Android, both for customers and developers. But this is certainly open to question, and I think the investor consensus is that this isn’t a positive for Apple.

On the AI front, Apple is widely perceived to have been caught flat-footed by the generative AI boom. Microsoft Corporation (MSFT), under the leadership of CEO Satya Nadella, moved with great alacrity to implement GPT (generative pre-trained transformers) copilots that are now almost universal in its products, from Windows to Bing. Many other companies have rushed to follow suit.

These GPTs can require enormous computing resources and are therefore mostly the creatures of cloud data centers. They were an excellent fit for Nadella’s emphasis on cloud services. Apple has tended to emphasize on-device AI as much as possible, in order to protect user privacy. Apple had nothing comparable to ChatGPT to offer.

In new products, the news has been a mixed bag. Apple recently killed the Apple Car after a long and torturous development process that reportedly cost about $1 billion a year and led nowhere. Investors didn’t seem particularly sorry to see the Car, often referred to internally as the “Breadloaf”, quietly disappear. A possible version of the Breadloaf was leaked by Motor Trend some years ago.

I was a fan of the car since it was one of the few new product concepts that had the power to really move the revenue needle. But it was clear that Apple didn’t have a product unless it could offer truly unique capability in the form of full SAE Level 5 autonomous driving. Level 5 is where there’s in effect no driver because the self-driving system is so safe and reliable.

Apple never achieved Level 5 and this doomed the car. It also called into question Apple’s AI chops. The demise of Apple Car left the Vision Pro as the sole new product category for Apple in the foreseeable future. Vision Pro, as interesting as it is, probably isn’t going to move the revenue needle anytime soon, given its $3500 price tag.

All of the above issues are but contributing factors to Apple’s central problem: Lack of growth. A few stats will illustrate the problem. For the 12 months ending Dec. 31, 2023, Apple had revenue of $385.706 billion for a year-over-year decline of about a half percent.

However, net income did grow by 6% to $100.9 billion on the strength of 10% year-over-year growth in higher margin Services. Growth in Services has largely offset the decline in device products of 3.25%.

Apple has long since stopped divulging unit sales, but according to my calculations based on Apple’s reported results for the 12-month period, every single device category suffered some year-over-year decline in units. iPhone had the lowest decline of 1.5% to 233.67 million units. This is in fairly close agreement with IDC, which estimated 2023 iPhone shipments of 234.6 million.

Mac had the highest y/y unit decline of 23.7% to 18.43 million units. This estimate is lower than IDC’s at 21.7 million and Gartner’s at 21.9. However, both of those estimates were published before Apple reported fiscal 2024 Q1 results.

The Mac unit sales decline was closely followed by iPad at -20.7% to 52.8 million units. Even the Apple Watch declined by 8% to 43 million units.

The unit declines are concerning because it’s expansion of the installed device base that feeds Services growth. For the fiscal 2024 Q1 earnings report, Apple claimed that its installed base had grown to 2.2 billion active devices.

The installed base can keep growing even with declining unit sales up to a point. We don’t know what that point is because Apple hasn’t divulged the rate at which devices exit the ecosystem due to failure, obsolescence, etc. If devices leave the system faster than they are replaced with new units, the installed base will begin to shrink.

With Services revenue growth potentially impaired by regulatory action, I consider it essential for Apple to get unit sales growing again in all its major device categories.

Apple Silicon becomes even more dominant in performance and efficiency

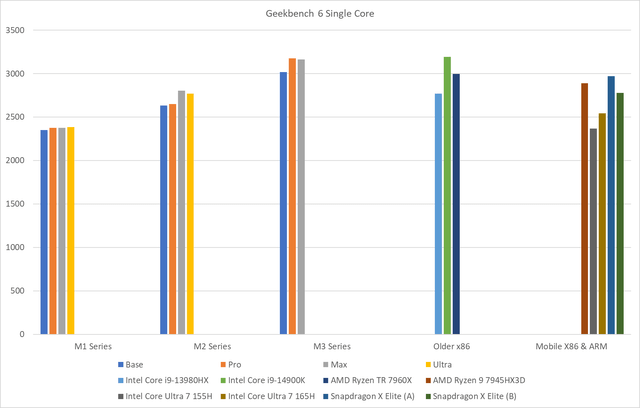

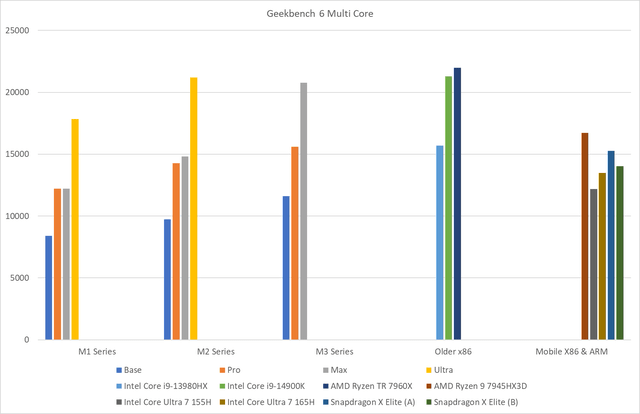

In the December quarter, Mac revenue was flat y/y at about 0.6% growth to $7.78 billion. Despite the lackluster sales performance, Apple introduced a remarkable series of new Macs using its M3 series Apple Silicon. With the M3 series, Apple finally delivered low-power mobile processors with true desktop-class performance, as illustrated in the Geekbench scores shown below:

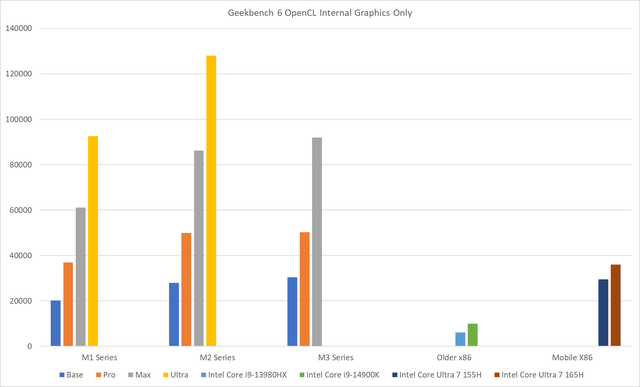

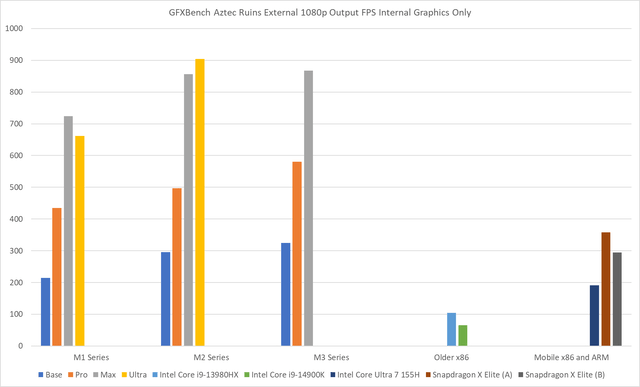

The M3 Max, while delivering desktop-class performance, consumes only about 50 watts under full CPU load. And it put the latest mobile offerings from AMD, Intel, and Qualcomm to shame, especially in multi-core CPU performance. The performance of the internal GPU of the M3 series was likewise very superior to the x86 and ARM competition:

Reviewers generally praised the performance and efficiency of the M3 series in the new MacBook Pros.

Overcoming the discrete GPU challenge

Yet, the sales figures suggest that consumers were not excited by the new Macs. The barrier to greater acceptance of Apple Silicon Macs may reside in the lack of a discrete GPU option. The GPU performance of the M3 series may not be enough for creators and power users who demand the performance of a discrete GPU.

Even when that GPU is carried in an x86 laptop, with the consequent reduction in performance compared to a desktop version, the mobile GPU will outperform Apple Silicon. And while the price is high in power consumption, many users are willing to pay the price for the extra performance. For many professional users, the lack of an option for a powerful discrete GPU is a dealbreaker, whether for a MacBook Pro or a Mac Pro. It certainly was for me.

The discrete GPU represents for Apple the last unconquered territory in the PC space. Can Apple overcome the performance advantage of a discrete GPU with its internal GPU architecture? I doubt it, at least for desktop GPUs, given the strong competition from Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA), which have access to the same Taiwan Semiconductor Manufacturing Company Limited (TSM) fabrication processes as Apple.

Even if it can’t compete with high-powered desktop GPUs, it may be enough for Apple to provide the best mobile GPU option, whether discrete or internal. Since MacBooks are Apple’s most important macOS products, ensuring that its users are not disadvantaged compared to inefficient but powerful x86 laptops is key. Apple did not accomplish this with the current M3 generation, but it probably will with future generations.

Overcoming the generative AI challenge

The perception that Apple is lagging in generative AI is only partially correct and is somewhat the result of generative AI hype by Apple’s competition. When Intel held its “AI Everywhere” event last December to roll out its new Core Ultra mobile chips, Intel seemed to convey that on-chip AI acceleration was somehow new.

Intel CEO Pat Gelsinger declared that while 2023 was the year of generative AI, 2024 would be the year of edge AI and that Intel would bring forth “AI PCs” as if this were an Intel invention. Qualcomm has made similarly grandiose claims for its forthcoming Snapdragon X Elite processors for mobile PCs.

The fact is that Apple has had a Neural Engine coprocessor built into every A series chip for iPhone since the A11 Bionic released in September 2017 for iPhone 8 and X. The first Neural Engine was designed to support the new feature of Face ID. And, of course, every M series SOC has had even more powerful Neural Engines than are available in the A series.

Generative AI is nothing new to Apple either. As I pointed out in my article on iPhone 15, Apple’s Neural Engine on the A17 Pro provides acceleration of transformer models, the basis for generative AI. Apple uses pre-trained transformers extensively in the A17 Pro for speech recognition, text completion and computational photography.

Where Apple has genuinely lagged is in data center-based generative AI. In wanting to protect user privacy by minimizing links to data centers in Apple devices, Apple missed the boat for cloud GPTs.

Apple was certainly caught off guard by Microsoft’s rapid deployment of AI Copilots. But I actually think Apple has been correct in being more cautious about GPTs. Microsoft’s Copilots are constantly looking over the shoulder of the user in order to make “helpful” suggestions. Microsoft’s Copilots are almost certainly huge privacy leaks for users since so much user activity is tracked and sent back to Microsoft’s cloud centers for processing by the AIs.

Apple is reported to be working on its own generative AI systems and integrating them into its products. These products will likely include a revamped Siri and a mixture of data center and on-device AI. Apple will endeavor to protect user privacy and security as much as possible in the new Siri service. Apple will try to keep as much Siri functionality on-device, as it does now.

Apple also may make GPT services available to developers in the form of new APIs that can be used in apps for Apple devices. These GPT services will be hosted in Apple’s data centers, thereby reducing the AI gap with other cloud service providers.

Turning Vision Pro into a high-volume product success

In a previous article, I called the Vision Pro “a sign of things to come.” Since its arrival, I’ve been more impressed with Apple’s accomplishments, although I still consider it mainly a pathfinder device and development platform.

Apple appears to have solved a long-standing problem with VR/AR systems, which is eye strain and headaches that can result from long-term use of stereoscopic 3D systems. The importance of this problem, and solving it, should not be underestimated. The US Army initially had problems using Microsoft’s Hololens-based AR goggles, with soldiers reporting headaches and nausea.

Reviewers have been wearing Vision Pro for 8 hours or more at a stretch with little or no side effects. Mostly the problem that’s cited by wearers is simply the weight of the system and the pressure it puts on the face.

Vision Pro is probably a decisive achievement by Apple that will greatly expand the addressable market for VR/AR systems. It’s still not the kind of system that people would wear out in public for hours on end, although it’s been tried, but it does appear to be something that could enable many workflows, especially when in confined spaces such as automobiles, buses, or airplanes.

In effect, the Vision Pro enables the user to carry around a massive 4K display attached to an M2-powered computing device and interact with it easily using gestures and eye movement. It’s also very easy to pair it with a Mac and use the Mac through the Vision Pro.

The barriers to long-term use seem to be the weight and the heat produced by the device. These will be curable over time through continuing miniaturization of electronics and components, and predictable improvements in efficiency.

Thus, I think the Vision Pro and future iterations have a much brighter future than I would have predicted prior to its release. And I think with further technology development, we will eventually see smart glasses as an offshoot of the Vision Pro.

The current Vision Pro is too bulky, heavy, and expensive to be a huge sales success. Apple is betting that it can eventually cure these problems based on the general trends in semiconductors and Apple Silicon. This seems like a safe bet.

Investor takeaways: The critical role of Apple Silicon

I’ve been asked what could Apple offer in the future that it doesn’t already offer, the implication being that consumers have no motivation to upgrade to future Apple products. I haven’t been able to come up with a particularly satisfactory answer to that question.

Part of the reason is that I’m not particularly good at anticipating future technology trends. For instance, I was taken by surprise by the rapid growth and adoption of generative AI. I was surprised at how good Vision Pro turned out to be.

I’m more of a technology historian, and I think in this case, history may provide the best answer to the question. Let’s flip the question around and ask how far back in time a typical consumer would be willing to go in technology usage. Would a consumer be willing to use a five-year-old smartphone or computer? Maybe. Would a consumer be willing to go back 10 years? Probably not.

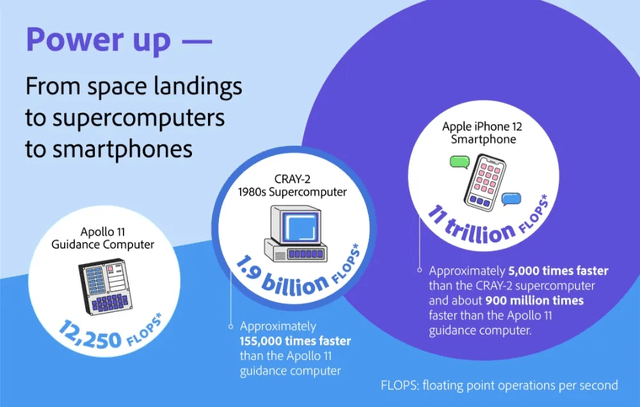

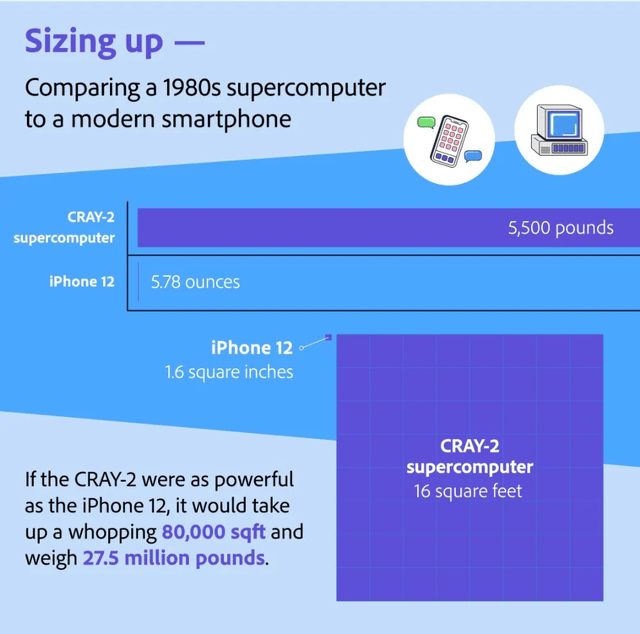

We tend to be oblivious to the changes and benefits of the latest technology until we’re deprived of them. Going even further back in time underscores just how far we’ve come in computing technology. An article in the Adobe Blog illustrates the advantages of the iPhone 12 vs. a CRAY-2 supercomputer of the 1980s:

Apple Silicon advances have followed the general trend of computing evident in the CRAY-2 vs. iPhone comparison. Processors will become more powerful and useful while enabling smaller and more energy-efficient devices.

There are virtually no challenges to Apple’s growth in devices that are not addressable, wholly or in part, by Apple Silicon. Apple Silicon made Vision Pro possible. The broad technology trend of miniaturization favors wearable devices, and I think this is the motivation for Apple’s emphasis on wearable tech.

Apple’s ability to converge hardware and software innovation seems particularly suited to enable on-device AI. As difficult as it may be to imagine, eventually the massive GPTs that now have to run in data centers may be moved to edge devices. Consider this to be analogous to the development from the CRAY-2 to the iPhone. In terms of 1980s computing, we’re already carrying around supercomputers in our pockets.

So, I think Apple’s AI development will continue to be focused mostly on on-device AI, with the expectation that capability will continue to grow. And this will be part of the overall focus at Apple on wearable tech.

Apple has proved that it can develop superior semiconductors that lead the industry in performance and efficiency in terms of CPU performance. It’s not a stretch to expect Apple to demonstrate similar excellence in edge AI and graphics performance.

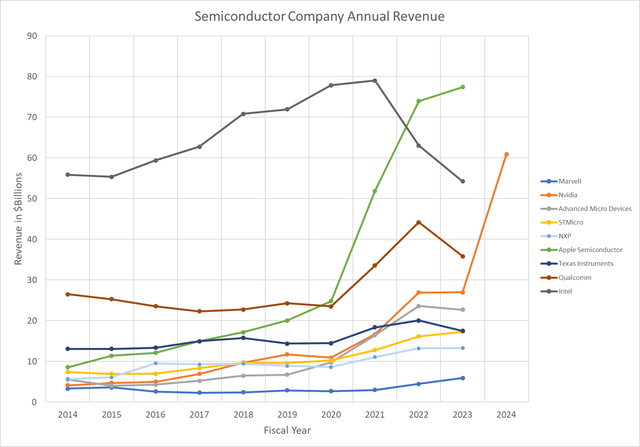

Nvidia has been called the largest semiconductor company by revenue, but this isn’t quite true if the value of Apple Silicon is considered. About a year ago, I estimated the value of Apple Silicon, up to Apple’s fiscal 2022. Using the methods that I outlined in the article, I’ve updated the chart below with Apple’s fiscal 2023 results and Nvidia’s just completed fiscal 2024 results:

The revenue generated by Apple devices provides enormous resources for continuing to develop Apple Silicon and perfect the integration of Apple’s hardware and software into unique products. As long as Apple continues to expand its investment in Apple Silicon, it will overcome the challenges to growth faced by its devices. I remain long Apple and rate it a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT, NVDA, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Rethink Technology offers unique insights into technology trends and companies.