Summary:

- I maintain a “Sell” rating on Apple stock due to a lack of margin of safety and a potentially negative reaction to the upcoming Q4 report.

- Despite record revenues and strong service growth, I expect weak Q4 FY2024 earnings, with low demand for new iPhone models as indicated by wait time data.

- AAPL’s valuation premium is high, trading at 31 times next year’s earnings, which is significantly above the historical average, raising concerns about future growth.

- Investors should monitor the Q4 FY2024 earnings release and management comments for any changes in business performance or strategy.

ozgurdonmaz

My Thesis Update

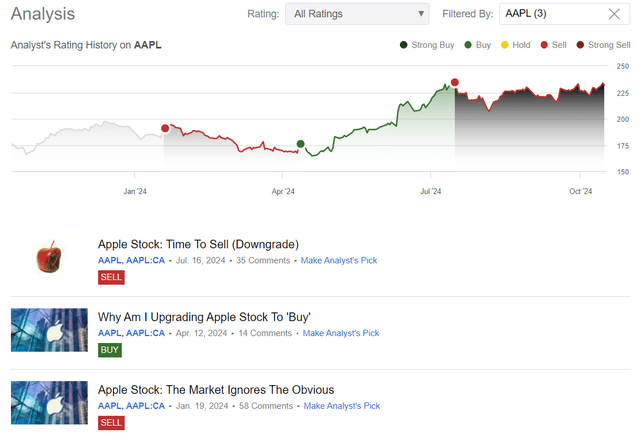

I initiated coverage on Apple Inc. (NASDAQ:AAPL) (NEOE:AAPL:CA) stock in January 2024 with a “Sell” rating when each share was trading at around $191. However, I upgraded my rating to “Buy” in mid-April 2024 when the stock fell to about $174/sh. I didn’t touch my bullish rating anyhow until mid-July, and during that period, Apple stock has grown by ~32.5%, outperforming the S&P 500 (SP500) (SPY) by nearly 4x. However, since I downgraded it (at $235/sh.), the stock started to adjust lower, underperforming the broader market. Now I see AAPL stock is down only -1.26% (total returns) since my bearish call, while the SPY went up by 3.5%:

Seeking Alpha, Oakoff’s AAPL coverage

Last time I was waiting for Q3 data, which came out and didn’t impress – as I expected. Currently, I still see no margin of safety for Apple stock, so I decided to leave my “Sell” rating unchanged, looking forward to seeing the company’s Q4 FY2024 earnings release on November 2, 2024 (about 2 weeks from now). Despite the Apple Intelligence hype, I expect Q4 numbers to be weak again – the wait time data analyses hint that investors may not like what they may see in the firm’s business metrics.

My Reasoning

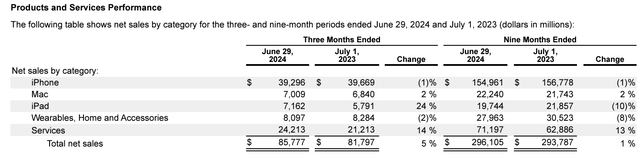

Last quarter (fiscal Q3 2024), Apple Inc. generated record revenues of ~$85.8 billion, but it was up only 5% YoY, all thanks to the services revenue, which closed at a record $24.2 billion (14% YoY). The main business – iPhone sales – kept contracting, albeit by just 1% YoY:

iPhone’s weakness was due to currency changes, as iPhone revenue actually grew in constant currency terms, according to AAPL’s 10-Q, while the number of active installed base rose to an all-time high. The Mac segment grew by a small 2% to $7 billion with M3-based MacBook Air’s success in emerging markets – this drove the iPad revenue up by 24% YoY to $7.2 billion (thanks to the introduction of the new iPad Pro and iPad Air devices). Retail wearables, home & accessories sales declined 2% to $8.1 billion with tough comparisons to last year’s launches. However, the Apple Watch still continued to generate new users, with 2/3 of buyers being new to the device. The services market dominated with $24.2 billion in revenue courtesy of solid increases in paid subscriptions and customer engagement. In fact, Apple now has >1 billion paid subscriptions across all of its offerings, which is nearly double the level of just 4 years ago.

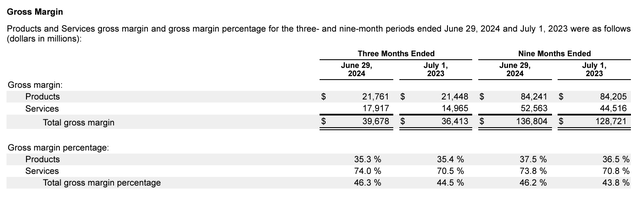

What I liked is the management’s continued focus on margins: the consolidated gross margin increased by 180 basis points YoY, which levered the top-line growth and led to a higher expansion rate in EBIT/EBITDA figures.

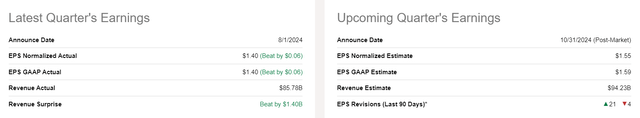

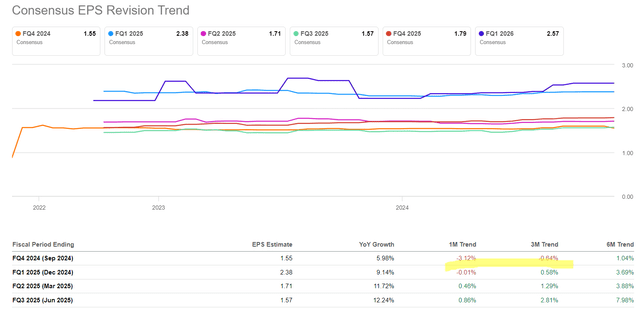

As a result, Apple’s EPS was up 11% compared to last year, amounting to a record-breaking $1.40 in the June quarter. So overall, the company managed to beat the consensus expectations, which led to further strengthening of expectations for Q4 2024 numbers, according to Seeking Alpha Premium data:

On the other hand, during the past month, we saw how analysts lowered their estimates by 3.12%, leaving more room for another beat in early November:

Seeking Alpha, AAPL, notes added

Apple keeps the prices for its new devices at their present levels, but it hopes to increase demand with new functionality and enhancements. At the same time, Apple’s recent announcements of the iPhone 16 family, and the upcoming Watch Series 10, show the firm’s attention to AI and improving the user experience. AI in general became a key factor in its future expansion strategy as part of its Apple Intelligence initiative. Apple’s goal in implementing AI capabilities on its devices is to improve user experience and engagement. However, the full potential of such features will become evident only with time, as most AI features are going to be released in future software releases.

In my opinion, services have become a significantly larger portion of Apple’s total revenue in recent years, giving the company considerable leverage and influence over future margins. However, I’m skeptical that artificial intelligence will become the primary driver of Apple’s revenue growth in the next couple of quarters.

According to the management’s commentary, Apple’s September quarter revenue should continue to climb at about the same pace as the June quarter, around 5%, despite the 1.5% foreign exchange drag. Apple expects recurring double-digit growth in services revenue and a gross margin of 45.5%-46.5% (so the mid-range should be lower than the actual figure in Q3). The annual operating expenses are expected to be between $14.2 billion and $14.4 billion. The management is still looking forward to more integrations of AI across its product portfolio that should create even better user experiences and spur innovation. But, given the current wait time, there is no significant revenue expansion we can expect to see in the near term.

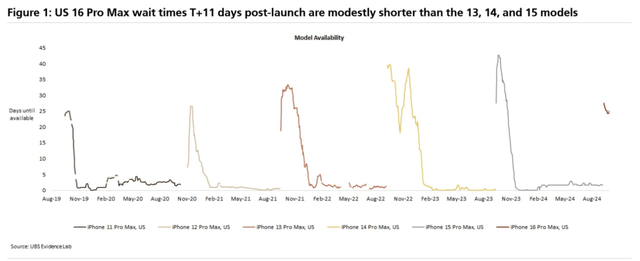

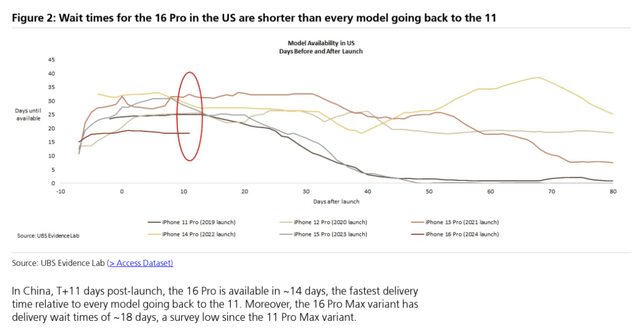

Data from the UBS Evidence Lab (proprietary source, October 2024), which monitors iPhone availability in 30 countries, shows relatively less demand compared to last year. About 11 days after the iPhone 16 release, the data predicts very little global demand, contrary to all of the hope in the market right now. Wait times for the Pro Max in the US and China are 25 days and 18 days respectively, which is similar week to week but lower than 12 days and 17 days respectively year-to-year. In the meantime, Base and Plus availability is moving up faster than last week and last year (even though higher-end models are being manufactured later this year – estimated 65% vs. 63% last year).

UBS Lab data (proprietary source)

Also, even if the wait time for the 16 Pro is about one day shorter than last week in the US, there is no change in Chinese availability. Because of the low-end sizing still comprising about 40% of launch-month volume, as they have discussed, the sell-through is probably flat this September quarter versus last year.

UBS Lab data (proprietary source)

So I believe the current situation presents an unstable outlook for Apple stock, as the market seems to overestimate the strength of Q4 sales.

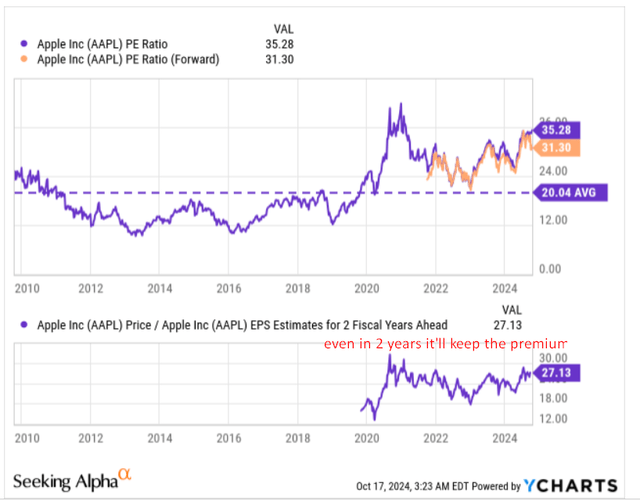

Over the years, Apple’s valuation premium has grown as the company consistently repurchased its shares from the market and maintained dominance across various product segments. This growth was further supported by increasing service revenue, which offered higher margins. However, if we examine current analyst forecasts, they predict only a 10-15% growth in EPS over the next few years. Meanwhile, the stock’s current multiple is a bit above 31 times its earnings for the next year, which is significantly higher than the 20x average over the past 15 years. Even looking two years ahead, the stock is trading at a 36% premium to the historical average, which looks quite substantial, in my opinion.

I do not presume to speculate on whether Apple will beat consensus estimates for the coming quarter. Historically, Apple has a good track record on this front, having missed forecasts only once in the last 2 years. However, I’m concerned that the company’s revenue growth may not meet management’s expectations, as indicated by several factors I mentioned earlier (say, the wait times are a significant indicator). In addition, as far as I see the management has projected a lower gross profit margin than we saw in the 3rd quarter of this year, which could mean that operating leverage might work against the company in Q4. Prices for Apple’s products have remained largely unchanged, and while the company’s active investment in artificial intelligence is promising in the long term, it could have a negative impact on free cash flow in the short term. This could reduce the likelihood of Apple increasing its share buyback volumes over the next couple of years. This risk can’t be ignored, and if the market starts to consider these factors after management’s comments or the release of the quarterly report, we could see the stock start to fall again.

So this is why I’m not changing my bearish view today – risks outweigh rewards in the medium term.

Upside Risks To My Thesis

I should note I could be wrong about many bearish things I listed above.

For example, Argus Research’s analysts (proprietary source, September 2024) view the situation differently: They believe that, following a significant underperformance in the last quarter, AAPL has a strong chance to rise and outperform the market in the upcoming quarter.

After lagging the peer group through mid-2024, AAPL shares have rallied lately on prospects for its first AI phone. We believe the current environment represents an opportunity to establish or dollar-average into positions in AAPL.

Overall, sell-side analysts are generally optimistic about the innovations expected to appear in Apple’s products shortly – these analysts provide quite an optimistic narrative for the growth of Apple’s stock based on that, and this sentiment is largely prevailing in the market right now. So underestimating the bullish thesis here while maintaining my bearish rating could be misleading.

Also, I may be wrong in my conclusions about the company’s valuation. If Apple continues to repurchase its shares at the same volume as before, this could create an artificial premium to its valuation, which might remain high regardless of any slowdown in the business growth rate.

In addition, Apple’s revenue could unexpectedly begin to grow much faster than before if the products that Apple is currently introducing and upgrading turn out to be more successful than I’m anticipating.

Your Takeaway

Anyway, while Apple stock has been resilient and growth-oriented with AI and service revenue focus in the future, lack of meaningful margin of safety, short-term headwinds like low product pricing, and potential negative free cash flow impact point towards a defensive investor sentiment.

Investors should keep an eye on the Q4 FY2024 earnings release and management comments for any changes in business performance or strategy. I think that at the beginning of November, we may see a negative market reaction to Apple’s Q4 report, as some early indicators suggest that there’s no growth in demand for the company’s main products.

With the current valuation premium and associated risks, I maintain my “Sell” rating and would recommend evaluating the risks/rewards for the medium term.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.