Summary:

- Apple experienced an FX headwind of -800 bps, which took analysts by surprise, as it was an added -4 percentage point impact that wasn’t anticipated given geographic mix was unfavorable.

- Apple reported a 5% sales decline, and earnings missed estimates; however, we find ourselves raising our expectations on FY ’24 and FY ’25 results given the weak shipments this quarter.

- Apple’s hardware business is cyclical in nature, we anticipate demand and supply will improve over the course of the year, we expect 12% revenue growth in FY ’24.

- We expect Apple to build up inventory to offset shortage like conditions, which creates a directional bias that’s more positive heading into FY ’24.

- We expect AAPL will generate more sales as a consequence, and we value the stock on FY ’25 estimates, so we raise our price target by $5 from $155 to $160 to reflect demand recovery over the next couple of years.

Justin Sullivan

Apple (NASDAQ:AAPL) managed to recover in the afterhours session following Q1 FY ’23 results despite the softening revenue and earnings headwinds where the stock underperformed primarily due to FX swinging revenue by -800 basis points, and handset revenue decline. However, we expect more device demand heading into FY ’24 results, as indications from Qualcomm (QCOM) suggest that most of the macro sensitivity was in the lower price ASPs range, and demand for QCT chips positive heading into the summer months with OEMs building up to a stronger production cycle in FY ’24.

We think Apple missed out on selling 5-6 million high-end iPhone Pro variants, translating to an approximate $5 billion revenue headwind on $900 ASPs. We also anticipate that the -800bp FX impact went against our model by a lot more than expected, translating to a Q1 ’23 revenue headwind of about -$10 billion on top line revenue. Exiting the earnings report, AAPL missed analysts expectations by -$3.95 billion on Q1 ’23 revenue mostly driven by -$5 billion in supply constrained high-end iPhone shipments, and an added -$10 billion headwind from FX.

We think these two factors went against AAPL’s top-line figure by -$15 billion, which was also reflected in the lower dil. EPS and operating profit figures on lower sales volume. We think investors and analysts were gearing for a much worse earnings report, however. We find ourselves increasingly optimistic about the upcoming device cycle as we anticipate demand for better chips, namely Apple, AMD, and NVDA is expected to return by 2H ’23. However, the immediate indication from Qualcomm is that mobile demand and particularly high-end demand will likely recover sooner than lower price categories, and that macro sensitivity tied to lifting COVID restrictions in China could play favorably for AAPL, and smartphone OEMs in FY ’24.

What went wrong this quarter?

Despite the broadly anticipated weakness on quarterly earnings results, we find ourselves sort of astonished by the inventory adjustment to the AAPL thesis. Not to mention, we don’t proclaim to be Nostradamus of the FX markets. Absent the FX headwind, and also the $5 billion in missing devices that never got built, the company would’ve reported $71.175 billion iPhone revenue versus $65.57 billion handset revenue for the quarter (implying flat or slightly positive revenue growth). We cannot overstate the complexity of the Apple thesis given the fact that we’re in a device transition year, missing production, and FX volatility.

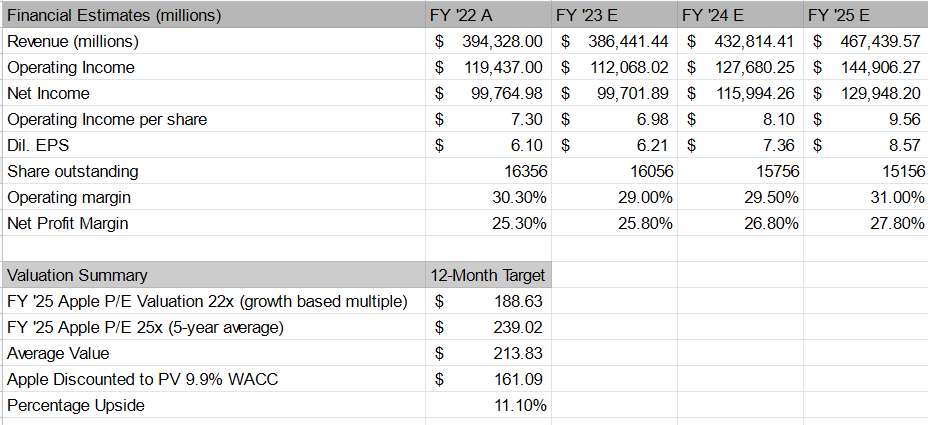

We anticipate that some of the demand shift to next-gen devices will be felt in Q4 ’23. However, growth in 2024 likely comes as a result of missed customers and also because the demand recovery thesis in China pushes to FY ’24. We cut back our FY ’23 revenue estimate by -$20 billion to reflect on-going FX headwinds and the impact from fewer devices shipped over the course of FY ’23 translating to a revised estimate of $386 billion FY ’23 revenue, and GAAP dil. EPS of $6.21 versus $6.58 (prior). Our new estimate is more consistent with consensus estimates at $6.14 dil. EPS. We anticipate very little impact on device operating margins and profitability, though reduced volumes could impact margins, it’s not like it’s a semiconductor company.

We’re dealing with finished products, so whenever there’s excess chips and those chips can’t get sold, the inventory markdown hits a semiconductor company a bit differently than a device OEM. This is because OEMs don’t own factories or fabs, so whenever purchase volumes drop for chip makers, they have to capitalize amortization at a flat rate over the useful life of equipment as shipment volumes drop, which is why the Op margin and gross margin among semiconductor names drops whenever demand drops because the on-going capitalization of equipment on lower revenue drives the gross margin down.

In the case of Apple however, the effect is less revenue, and as such the variable margin shifts and the amount of devices on hand tends to shift between quarters depending on when it’s most advantageous to clear the channel at the highest possible retail price. Meaning, even if production were to meet demand we don’t actually anticipate that all the lost demand will come back immediately. We anticipate that demand will return in the next fiscal year, and quarterly comps are likely less bad when compared to the Q1 ’23 announced earnings. So, if the customers do come back, they’re going to come back during the seasonally weak period of the year, and it’s not going to be the buying frenzy of Christmas in the middle of summer for iPhone, which is why seasonal impact paired with the missing customers basically translates to a more pent-up demand cycle for iPhone 15 Pro and iPhone 15.

We anticipate that OEMs are doubling down on added manufacturing, which according to Qualcomm implies that Q3 ’23 shipments will increase as they work through inventory adjustments due to build-up. Qualcomm’s situation is a bit differentiated further upstream, but we believe that AAPL gained market share against OEMs and experienced less price sensitivity, which is why among a choice of alternative big tech names, AAPL seems the best positioned even with missing smartphones this quarter. After all, AAPL didn’t experience much of a volume drop on iPhone units whereas the remaining smartphone OEMs all reported declines on shipments on declines in demand. We can only imagine that AAPL gained share this quarter if everyone else sold fewer phones y/y and the only reason Apple reported a decline was due to a production shortage not an absence of demand.

Financial model revision

We think sell side analysts under-estimated the regression by about -$4 billion and given the conservatism we felt we had when modeling estimates on FY ’23 results we revise our estimate to reflect the quarterly impact, and shift our growth estimate for FY ’24 higher as we expect loosening Chinese restrictions, and build-up of supply to reach end-consumer demand in 2024.

Basically, AAPL is going to overbuild this upcoming cycle, and then if things go wrong, they can always move inventory at a slower pace, and argue the opposite dynamic of too much production as they clear inventory throughout the course of the year. Basically, we anticipate that AAPL will be well-supplied next year as it works to address the Foxconn related worker shortage which seems addressable over the span of 12-months.

Figure 1. Apple Estimate Revised Lower

Apple Financial Model Q1’23 (Trade Theory)

We expect Apple will recover some demand from the lost production, but we’re really gearing expectations towards customers returning next year for the iPhone 15 Pro launch, and it’s why we move our FY ’24 revenue estimate up to $432 billion from $418 billion, representing an additional $14 billion in revenue recovery heading into the next year, as we expect a combination of demand pull-forward from the iPhone 14, and once dormant Chinese consumer returning in FY ’24 thus driving revenue growth of 12% paired with a more favorable PC shipment, and smartphone shipment cycle. We model 8% revenue growth in FY ’25 as we anticipate less macro uncertainty over the next two-years, as we’re either heading into a recession, or we’re getting head faked into a fake recession that’s not going to happen over the next two years. We don’t believe the recession is coming, which is why we anticipate a recovery in corporate earnings, or a growth hiccup on macro translating to an earnings hiccup across S&P 500 companies.

We find ourselves being just slightly more optimistic about margins, and have corrected our model to better conform with the difficult currency environment, and difficulty with PC comps. However, we expect growth to accelerate heading into FY ’24 and FY ’25 given the backdrop of different devices and indicators.

Given the cyclical nature of consumer hardware, and the trough parts of the cycle, we’re not expecting the stock to drop materially lower from present levels, and the bias is to accumulate on momentum into FY ’24 results. We revise our estimate on AAPL upwards from $155 to $160 price target, as the loss of AAPL smartphones, and weak FX environment are temporary headwinds to the longer-term investment thesis. Instead, we anticipate that the lost customers from the recent iPhone shortage will simply re-emerge for the iPhone 15 and 16 device cycle thus driving our estimates considerably higher into FY ’24 and FY ’25 thus justifying higher revenue, and dil. EPS estimates for those two years, which is why we end up with a slightly higher price target from $155 to $160 as we value the stock on the basis of long-term results.

The reason why we do this is because it helps us reduce the impact of cyclicality on our price estimates on companies. Furthermore, we think investors will walk into the realization that the stock will price-in the perceived gains from the iPhone 15-cycle as the near-term management commentary mostly works to deflect and deter bears from pursuing the stock any further as opposed to necessarily driving positive sentiment among bulls.

Final updates to our AAPL thesis

Basically, we value AAPL on the basis of longer-term growth potential, and we like the set-up heading out of the quarter, we continue to recommend AAPL to our readers. It’s difficult to piece together the positives. We think the stock could drop lower on temporary confusion, but eventually the market’s going to revise up expectations on future growth tied to FY’ 24 and FY ’25 device volumes. We anticipate that the semiconductor market bottoms out in 2023. Assuming investors have patience and accumulate through a confusing device cycle the stock price should generate more returns in 2024 and 2025.

We think the stock could drop on short-term technical indicators perhaps 4-5%, basically a near-term dip. We would buy the stock on weakness at this point, and assuming the impact of the revenue miss is perceived similarly by the rest of Wall Street, we think AAPL eventually trades at $150 again within several weeks. The stock’s trading range tightens until we get material news that favors bulls. For now, expect the stock to trade between $130 to $160 for the duration of the year until the markets start pricing FY ’24 earnings growth on better than expected demand recovery for semiconductors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.