Summary:

- Apple Inc. is valued at a forward P/E of 29 today compared to its 5-year average of 24. For several reasons, I find this premium to 5-year averages a market anomaly.

- Five years ago, the market was eagerly waiting for the 5G smartphone upgrade supercycle that was expected to accelerate Apple’s revenue growth – which it did.

- Today, this catalyst is no longer present, and the company has experienced YoY revenue declines in each of the last three quarters.

- Upon evaluating the expected impact of several challenges that are looming on the horizon, I find Apple expensively valued today.

Apisorn

Like most investors, I have been following and investing in Apple Inc. (NASDAQ:AAPL) ever since I started my investing journey. Over the last 5 years, I have never had a “buy now, sell never” opinion on AAPL stock as I believed – and continue to believe – that investing in Apple should be a decision purely based on valuation at this stage given that the company is no longer the growth machine it used to be. In contrast, I am comfortable holding my investment in Meta Platforms, Inc. (META) for the long run regardless of macroeconomic challenges or any other external risks. After carefully analyzing the prospects for Apple today, I believe its valuation does not make a lot of sense, and I would be wary of investing in the company at the current valuation levels.

Apple is valued at a forward P/E of 29 today compared to its 5-year average of 24. For several reasons, I find this premium to 5-year averages a market anomaly. Among the chief concerns is that global smartphone sales have experienced a decline, and the much-anticipated 5G smartphone upgrade supercycle, which buoyed expectations in recent years, is gradually reaching its maturity. Nevertheless, the company is undergoing significant transformations, including diversifying its production locations and experiencing noteworthy growth in its services category.

While Apple’s core business has inevitably experienced a slowdown as it reaches maturity, these emerging avenues hold promise for the company’s long-term prospects. I am not even remotely suggesting that Apple will fail to grow from here. Quite the opposite, as I believe there is no question about the company’s growth potential albeit at a slow pace. From a valuation viewpoint, though, Apple should not be trading at a premium to its 5-year averages today given that most of the growth drivers seen in the last 5 years are beginning to fade.

A Changing Smartphone Landscape: 5G Maturation, Declining iPhone Sales, And The Rise Of Google Pixel

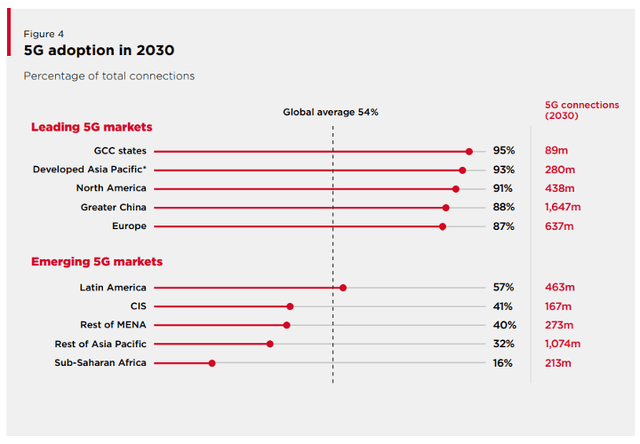

The evolution and widespread adoption of 5G technology represents a transformative shift in the telecommunications landscape. With recent developments, it becomes evident that 5G is poised to become the dominant force in global connectivity. Projections indicate that by 2030, over 85% of the top 5G markets will have fully embraced this cutting-edge technology. Already, certain markets have taken substantial strides toward integrating 5G into their connectivity ecosystems. South Korea and the United States have emerged as frontrunners in this regard, with 5G connections accounting for more than 40% of their total connections.

Exhibit 1: 5G adoption by 2030

Looking ahead to the next seven years, the projection that 5G subscriber penetration will exceed 80% of smartphone users underscores the technology’s unstoppable march into the mainstream. However, it is crucial to contextualize this forecast within the broader backdrop of global mobile penetration. In many markets worldwide, especially among adult and urban populations, mobile penetration is approaching saturation.

Turning our focus to recent developments in the smartphone market, Q2 2023 witnessed a notable 9% YoY decline in global smartphone shipments. According to Counterpoint Research, Apple secured the second position in Q2, with its market share expanding to 17%. This is not a poor performance considering that this was a 100 basis-point increase in market share compared to the second quarter of 2022.

Exhibit 2: Global smartphone market share

A closer look at the company’s performance in fiscal Q3 reveals a concerning trend, as revenue from its iPhone segment declined year-over-year. What’s worse is that the company expects the slowdown to persist in the September quarter as well. One significant factor contributing to this decline is the growing influence of Android smartphones and other challenges include price sensitivity and the challenging market environment in China.

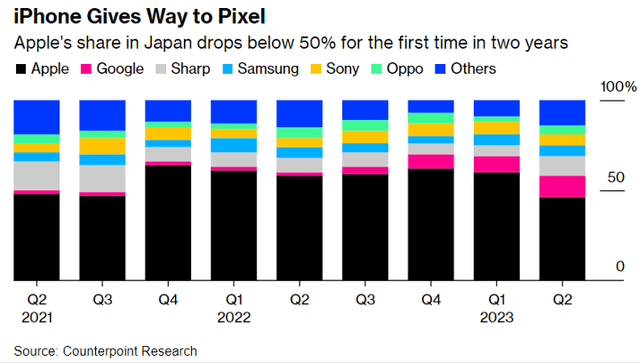

According to a Bloomberg report, Alphabet Inc.’s (GOOG) Google Pixel devices have surpassed Apple’s market share in Japan. Notably, Google Pixel devices carved out a remarkable 12% share in the Japanese market during the June quarter, marking a sixfold increase from the previous year. In stark contrast, the iPhone’s market share in Japan plummeted from 58% to 46% over the same period.

Exhibit 3: iPhone market share in Japan

The erosion of Apple’s dominance in Japan can be attributed to several factors, including the depreciation of the yen, which prompted Apple to raise iPhone prices in the country. This price increase, coupled with the absence of groundbreaking features in the latest iPhone models, has made consumers more price-sensitive and discerning in their purchasing decisions. Even with the launch of Apple’s highly anticipated iPhone 15 series, which generated considerable demand, the model has encountered critical feedback. This reception underscores the evolving consumer expectations and the heightened competition in the smartphone market, which is no longer solely driven by incremental technological advancements.

Escalating China-U.S. Tensions: A Growing Challenge For Apple

The escalating tensions between the United States and China present a multifaceted challenge for Apple, one that encompasses both geopolitical considerations and intensified competition within one of its largest markets. China, a key market for Apple, contributes nearly a fifth of the company’s revenue, underscoring its strategic significance. However, recent developments underscore the complexities that Apple faces in navigating this challenging landscape.

One significant hurdle is China’s increasing drive to reduce its reliance on foreign technologies, primarily fueled by growing concerns over data security. A notable illustration of this shift is China’s directive to officials at central government agencies to refrain from using Apple iPhones and other foreign-branded devices for work-related purposes or bringing them into government offices. This directive, while symbolic to some extent, reflects China’s broader push for technological self-sufficiency and raises uncertainties regarding Apple’s future presence in government and enterprise segments within the country.

Furthermore, the competitive landscape in China has become increasingly formidable. Huawei, a homegrown tech giant, has unveiled its latest flagship smartphone, the Mate 60 Pro, boasting a cutting-edge 7nm chip. Speed tests indicate that the Mate 60 Pro is capable of download speeds surpassing those of top-of-the-line 5G phones currently available. Notably, this chip was manufactured by China’s Semiconductor Manufacturing International Corporation, challenging prevailing U.S. sanctions against Huawei, which were designed to restrict its access to essential technologies. This development adds a layer of complexity to the competition in China’s smartphone market and raises questions about the resilience of Apple’s market share.

However, Apple’s position in China is still substantial, and it’s essential to consider the potential impact of recent developments in a justifiable way. As noted by Wedbush Securities analyst Dan Ives, the immediate impact of a potential government agency iPhone ban in China is relatively limited. Quantifying its effects, it is estimated that such a ban could impact fewer than 500,000 iPhones out of an expected 45 million device sales in China over the next year.

Nevertheless, beyond the near-term impact, the broader challenge remains substantial. Apple’s reliance on China for the majority of its manufacturing operations, with over 95% of iPhones, AirPods, Macs, and iPads produced in the country, underscores the intricacies of its relationship with China. While Apple has been working to diversify its production, particularly by increasing its manufacturing presence in India, the company faces significant hurdles in matching China’s scale and efficiency.

iPhone Demand Is Strong In India

While it’s true that mobile penetration has been approaching saturation in many mature markets, an intriguing opportunity for growth and market expansion emerges when one shifts his focus toward developing regions, especially the likes of India. In the context of Apple and its global market strategy, this presents a compelling avenue for potential growth.

India, with its burgeoning population, represents a particularly promising market for the company. As one of the world’s most populous countries, India continues to witness a steady influx of new mobile subscribers. Over the period from 2022 to 2030, it is estimated that India, along with Sub-Saharan Africa, will collectively contribute to approximately half of all new mobile subscribers added globally. This demographic trend signals a significant untapped market segment for Apple to explore and potentially capitalize on.

Apple’s performance in the Indian market underscores the significance of this strategic focus. Despite facing challenges in global iPhone sales, the company has managed to establish a foothold in India, which has translated into impressive growth. According to Reuters, Apple’s share of the Indian smartphone market is expected to rise from 5% in the first half of 2023 to 7% by December. Currently, Vivo, Samsung, and Realme are dominating the Indian smartphone market.

Exhibit 4: Smartphone market share in India

Furthermore, the anticipation that the iPhone 15 models will constitute 25% of the overall iPhone shipments in India during the fourth quarter represents a notable surge. This 4% increase from the previous generation’s market share demonstrates a growing affinity among Indian consumers for Apple’s latest offerings. Despite the price-conscious nature of the Indian market, this demand signals a resilient appetite for premium smartphones, especially those associated with the Apple brand. However, in the long term, Apple’s success in price-sensitive markets like India will hinge on its ability to adapt its approach to the unique economic constraints of consumers in these regions. Therefore, Apple may need to explore more cost-effective offerings or financing options to make its products accessible to a broader audience.

It’s noteworthy that the 5G smartphone market in India, as reported by IDC, witnessed shifts in pricing dynamics in Q2, with an average selling price of $366, marking a 3% year-over-year decline. In this context, the Apple iPhone 13, along with models like the OnePlus Nord CE3 Lite, emerged as top-performing 5G devices during this period. The market also witnessed a decline in the sub-$200 segment, suggesting consumers’ willingness to invest slightly more for enhanced features. The mid-range segment remained stable, while the mid-to-high-end and premium segments experienced notable growth, underlining the potential for Apple to explore a range of price points to cater to diverse consumer preferences. This pricing flexibility will help Apple navigate and expand in price-sensitive markets while retaining its premium brand image and global market presence.

Apple’s Future Depends On Its Services Segment

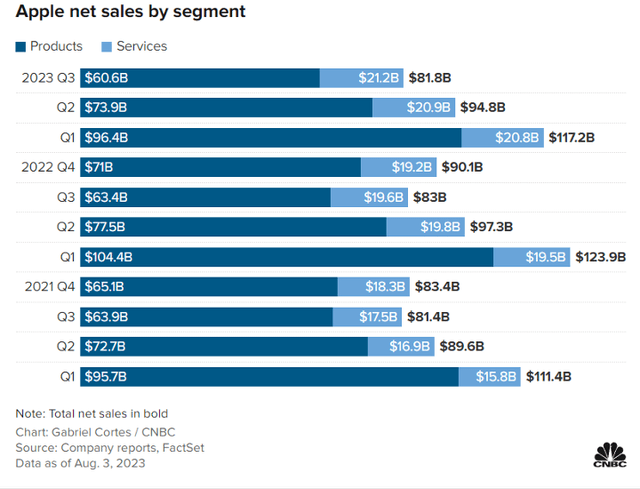

Apple’s strategic shift toward expanding its services category as a key driver of future growth is gaining significant traction and becoming increasingly evident. The third-quarter performance of the services business has reaffirmed this transition, with notable achievements in terms of revenue and customer engagement.

Apple’s services business, while smaller than its hardware segment, has exhibited remarkable consistency and resilience. During the third quarter, services revenue surged to an impressive $21.2 billion, marking an 8% year-over-year increase and underlining its growing significance to the company’s overall financial landscape.

Exhibit 5: Apple’s net sales by segment

One remarkable milestone achieved during this period was the surpassing of 1 billion paid subscriptions across the various services offered on Apple’s platform. This represents an impressive 150 million increase over the past year and nearly double the number of paid subscriptions recorded just three years ago. This exponential growth in paid subscriptions highlights the strong consumer appeal and adoption of Apple’s services, ranging from video streaming to AppleCare, cloud services, and payment offerings.

Apple’s vast and expanding installed base, which now comprises over 2 billion active devices, plays a pivotal role in the future expansion of its ecosystem. This extensive user base provides a solid foundation for driving continued growth in the services segment. As users integrate more Apple devices into their lives, the potential for increased engagement with the company’s services ecosystem grows, offering opportunities for further monetization.

Takeaway

Five years ago, the market was eagerly waiting for the 5G smartphone upgrade supercycle that was expected to accelerate Apple’s revenue growth – which it did. Today, this catalyst is no longer present, and the company has experienced YoY revenue declines in each of the last three quarters. Adding salt to the wound, the future does not look as bright as it did at any time in the last 5 years with escalating tensions between the U.S. and China threatening the company’s supply chain, forcing the company to look for alternatives. What’s more, Apple’s future now lies in its ability to penetrate highly price-sensitive markets such as India, so I would not be surprised if iPhone revenue remains stagnant or even decline.

Considering all this, Apple’s premium valuation in comparison to its historical averages makes little sense to me. For this reason, I will avoid investing in the company today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!