Summary:

- Applied Materials stock has fallen to about break-even return over the last 12 months.

- Weak consumer demand is causing some short-term pain as OEMs scale back purchase from fabs.

- Despite short-term fluctuations, AMAT’s solid market position and financials make it a compelling long-term investment in the semiconductor manufacturing sector.

luza studios

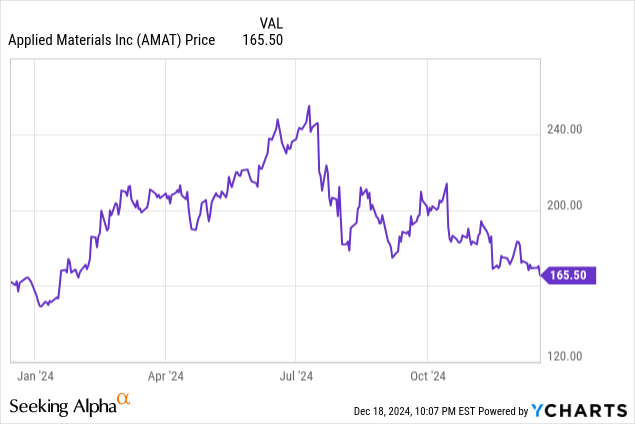

Applied Materials (NASDAQ:AMAT) stock has had its ups and downs in 2024 as the company has ridden the AI wave higher and then also been knocked down by the reality of operating results not matching that frenzy. In the short-term, shares may continue to fluctuate at the whims of the cyclical semiconductor sector, but long-term, Applied Materials has a strong market position, solid financials, and attractive upside.

Starting off 2024, any semi stock within a mile of the manufacturing process for AI chips saw shares explode and AMAT was no exception, rising more than 70% to a 52-week high close to $255 in July before gradually declining down to current levels over the previous months. This is a pattern that can be seen throughout the semi industry:

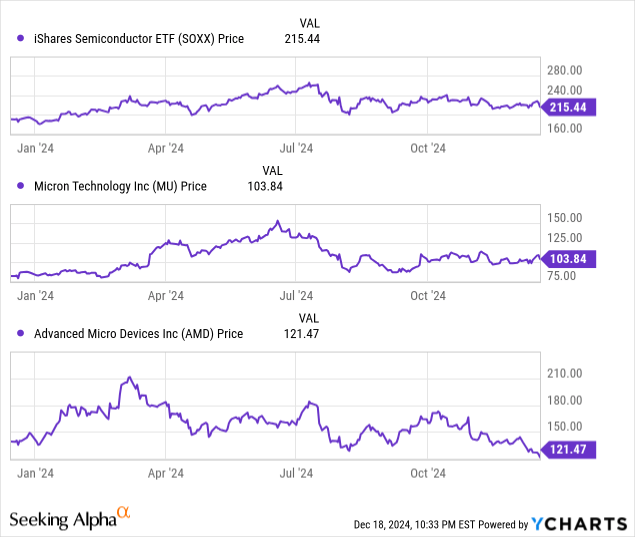

The SOXX (SOXX) has been spared some of the downturn due to its overweight holdings in the true winning stocks of the AI boom, but most semi stocks look like AMAT. So what happened?

Initially the market thought the AI wave would lift all boats, and it has definitely lifted some, but the majority of profits have been concentrated on the top AI chip design companies, like Nvidia (NVDA) and Broadcom (AVGO), and the only major AI chip manufacturer, TSMC (TSM). Other important companies in the supply chain like Applied Materials, ASML (ASML), and Lam Research (LRCX) have seen some modest revenue and margin boost, but nothing like the tens of billions in profits these top companies are raking in.

In the meantime, much of traditional revenue streams for semi manufacturing have been showing signs of weakness as consumer demand has struggled. On the memory side, Micron recently reported Q1 2025 earnings and provided guidance that was well below expectations, which CEO Sanjay Mehrotra blamed on weak consumer demand. Evidently, this has made its way up to original equipment manufacturers, who are likely scaling back purchases so as not to overbuild inventories. My analysis of the Micron earnings can be found here.

On the logic side, Advanced Micro Devices (AMD) has also seen a persistent weakness in consumer demand even as enterprise sales, and specifically data center sales, have been rapidly increasing.

Bottom line: fewer chips being manufactured means lower revenue for companies like Applied Materials that make the foundries go round. There was hope that these enterprise sales would offset or even outweigh the consumer slump, but this is shaping up to be an uncertain environment. As such, we’ve seen the stock prices of many involved players fall even as those blessed to be at the very top of the AI pyramid have flourished.

So what are AMAT investors to do now? In the short-term, there will likely be some increased volatility as the market continues to weigh the effect of weak consumer demand on semi companies and as OEMs scale back to accommodate this trend. However, long-term, I think this stock provides a great play on the increasing complexity of devices, the secular trends that are driving capacity expansions around the world, and the rising number of new entrants into the space who are trying to capture some of the billions in profits currently going into the pockets of the AI kings.

Before going over the earnings results, I should note that Applied Materials is not really that cyclical of a company, though it can trade like one in sympathy with other cyclical semi stocks. Semiconductor manufacturing timelines are very long and so even during bust cycles, Applied Materials’ customers are looking to add fab capacity and prepare for boom cycles. The company’s revenues will certainly fluctuate with this ebb and flow, but not to the extent that the companies that use the equipment to make chips or the companies that sell the chips made by said equipment do. As such, you likely won’t see any eye-popping growth numbers, as this is a gradual and iterative business.

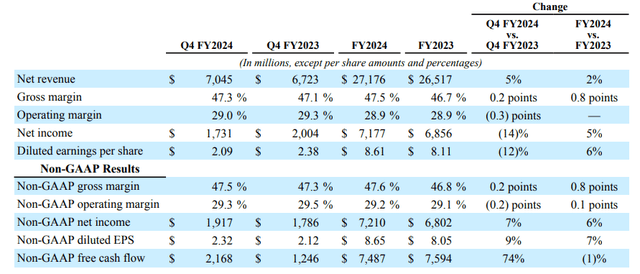

With that context, let’s start with a recap of the Q4 2024 earnings results (I’ll be looking at mostly non-GAAP numbers in this analysis):

Revenue for the quarter came in at $7.05 billion (+5% YoY/+4% QoQ) and EPS was $2.32 (+9% YoY/+9.4% QoQ) both of which were records highs, on strength in the Semiconductor Systems segment (more on this later). The company saw an 80 bps improvement in gross margin and a 10 bps improvement in operating margin for FY2024 over FY2023, though these were less pronounced for Q4 which had a difficult YoY comp due to a reduction in revenue from China caused by export bans. But as far as organic growth and incremental margin improvement goes, this is a fairly bullish report.

The growth in the Semiconductor Systems segment was mainly driven by foundry-logic sales, which increased 12% YoY, on increased demand for leading-edge (gate-all-around or GAA). The other major component of this segment, DRAM, saw a 10% YoY decline due to the aforementioned tough comp, but saw a 60% YoY increase in FY2024 due in part to the growth in high-bandwidth memory (“HBM”). This is the memory used in AI accelerators, and it is more complex and requires more processing than conventional DRAM. CEO Gary Dickerson explained this on the earnings call as such:

The dies used in high-bandwidth memory are much larger than standard DRAM, which means that more than 3 times the wafer capacity is needed to produce the same volume of chips. On top of this, the packaging steps needed for die-stacking further increase our available market. In fiscal 2024, our HBM packaging revenues grew to more than $700 million.

HBM has become a major growth driver for the big 3 memory makers, Micron, SK Hynix, and Samsung, and that has evidently carried over to Applied Materials as well.

More broadly, the semiconductor industry is at the forefront of most new technologies, and providing the cutting-edge products to manufacture these chips is a business that will remain important and lucrative for a long while. Applied Materials has a strong moat, customer base, and market position to benefit from this AI trend and whatever other secular trends materialize in the coming years and decades.

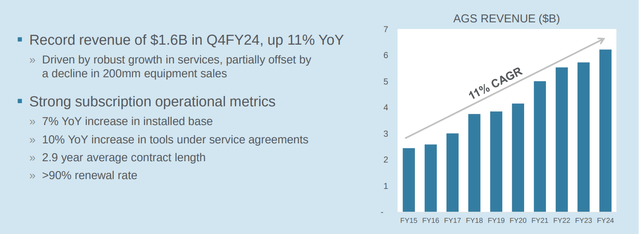

There’s also the Applied Global Services segment, which has grown into a robust contributor to the company’s operating results:

Applied Materials Earnings Presentation

This part of the company is especially interesting because it is growing at a decent CAGR, provides a recurring revenue base, is seeing margin expansion at a higher rate (+270 bps YoY in Q4) than can reasonably be achieved by Semiconductor Systems, and can provide a decent amount of insulation from cyclical factors. Long-term, this dependable and recurring business will be a substantial boon to Applied Materials as the market subjects it to the volatility borne by semi stocks as a whole.

From a balance sheet perspective, the company has $9.4 billion in cash & equivalents & short-term investments relative to $5.5 billion in long-term debt, which is quite reasonable. In addition, more than half of that debt load matures over 10 years from now and retains a manageable weighted-average effective interest rate of 4.4%.

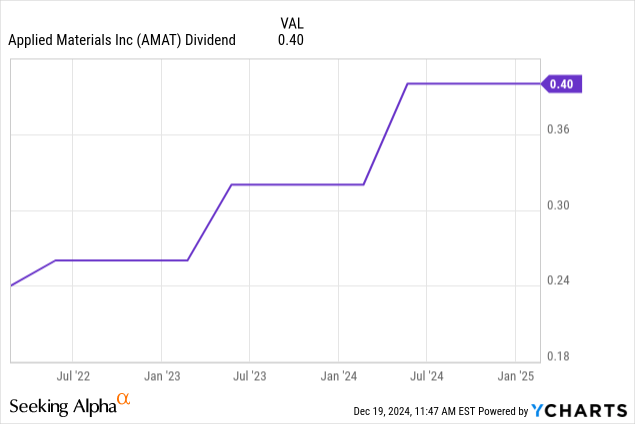

Applied Materials has made an effort to return capital to shareholders in the form of a dividend, which it has been growing by a fairly significant amount over the past few years:

As the company noted in its earnings presentation, Applied Global Services alone generates enough cash flow to cover the dividend and the company as a whole generates enough to sustain dividend growth far into the foreseeable future, even if we factor in a no-growth scenario.

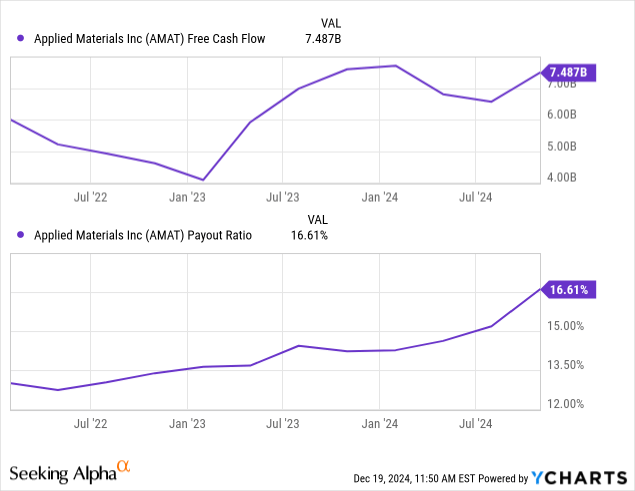

The payout ratio illustrates as much:

While TTM FCF has stalled a bit this year on the weak consumer demand I’ve been harping on throughout this article, the payout ratio has only risen to 16.6%, which leaves ample room for continued expansion. Years down the road from now, I think we’ll look back on AMAT’s current price as an attractive entry point for a dividend growth staple.

I think AMAT is being discounted by a market that is prioritizing growth, especially as the AI wave continues to mint multi-baggers throughout the market, and so is overlooking a company that has a bright long-term future. The valuation metrics tell the story of a company that’s earning well but not growing as much as its peers:

The P/E ratios are looking extremely attractive, while the PEG ratio, which factors in growth, is indicating that Applied Materials isn’t growing as fast as peers and should therefore be avoided. As I mentioned earlier, this company is not as cyclical as its peers, so its operating results won’t swing as wildly, and it won’t put up the crazy growth numbers that actual chip sellers see. This works to its detriment short-term as investors chase those high-growth numbers, but works to its benefit long-term as it gradually increases sales, makes incremental margin improvements, and benefits from the myriad of secular trends that the future holds.

Investor Takeaway

Though AMAT shares are currently below 52-week highs and might continue to see short-term volatility as the semiconductor sector as a whole reckons with weak consumer demand, I think the stock has long-term potential for modest capital gains returns and is in the early innings of becoming a dividend growth name as well. Semiconductor manufacturing is a vitally important industry, and the increasing complexity of chips along with new players entering the field who need the equipment Applied Materials sells will sustain gradual income and cash flow growth. As the saying goes, “in a gold rush, it’s best to sell shovels.”

For those looking for semi exposure without as much of the volatility as the rest of the field, I think AMAT offers an attractive alternative. It will still swing more than your average conservative stock, but if you’re willing to hold long-term and believe in the potential I’ve mentioned, I think it offers a favorable opportunity. I am initiating AMAT as a Buy.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.