Summary:

- Applied Materials’ revenue grew 5% YoY to $7.05 billion, driven by Semiconductor Systems and Services, with improved gross margins due to better inventory management and value-based pricing.

- The company is in the third inning of implementing value-based pricing, enhancing operating margins, and exploring the Applied Global Services segment for predictable recurring revenue.

- Valuation metrics are in line with peers, with cyclicality evident in sales multiples and gross margins; AMAT projects significant growth in the semiconductor business by 2030.

Monty Rakusen

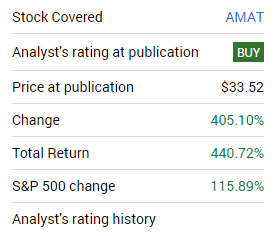

Back in 2018, I wrote a bullish piece on Applied Materials (NASDAQ:AMAT). I could not guess the crazy race for AI chips that would develop after the ChatGPT launch, but the need for chips was already there coming from industries, like autos, that traditionally didn’t use chips but now needed them desperately. My piece had a multi-year horizon and was intended to contextualize the wide cycles that the industry still enjoys. A couple of years down the road, with the latest earnings out, let’s give it a fresh look.

Seeking Alpha

Financials

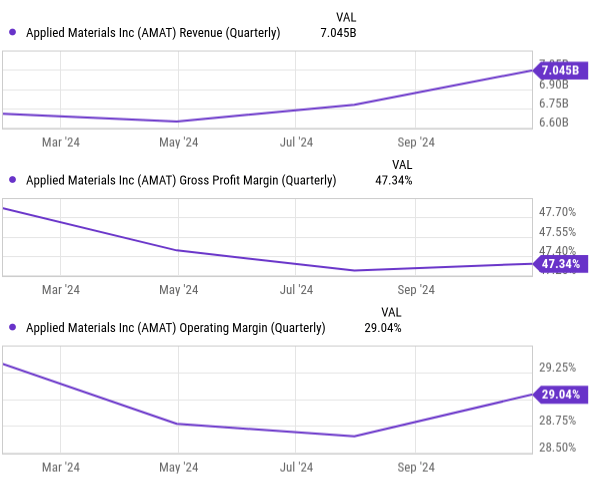

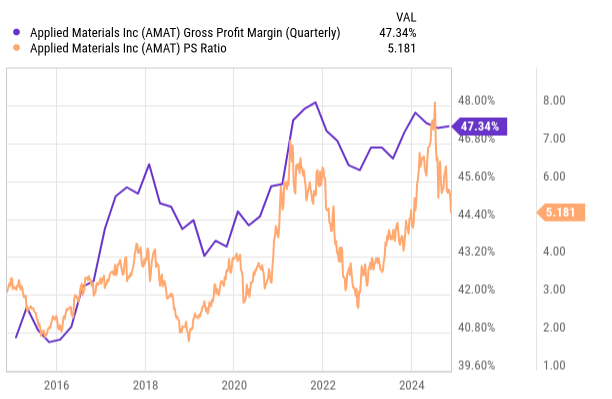

In the 4Q24 earnings, the company’s revenues grew 5%, year-over-year, to $7.05 billion driven mainly by Semiconductor Systems and Services. The gross margin stood at 47.5%, an improvement in relation to the prior quarter. The reasons for the improvement are mostly linked to inventory management and reduced scrap, while the implementation of value-based pricing has also helped. The company anticipates that, for the next quarter, the gross margin will be around 48.4%.

YCharts

In the 4Q24 earnings call, the management team did not reveal specific wafer fab equipment projections, nevertheless, the company revealed it expects the semiconductor business to reach $1 Trillion by 2030.

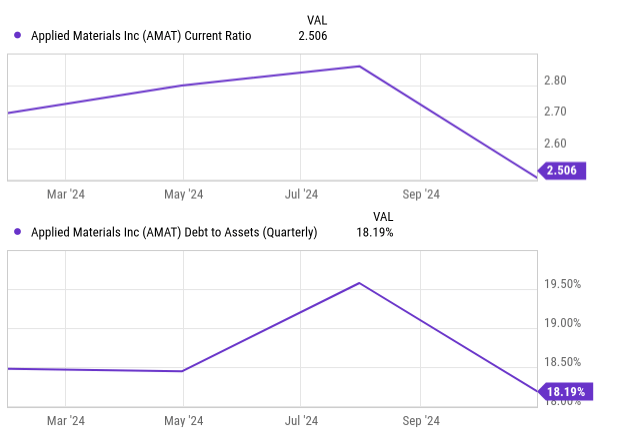

Looking at the balance sheet, we see that liquidity seems adequate with a current ratio of 2.5, while debt looks under control with a debt-to-assets ratio of around 18%.

YCharts

Improvements in the business model

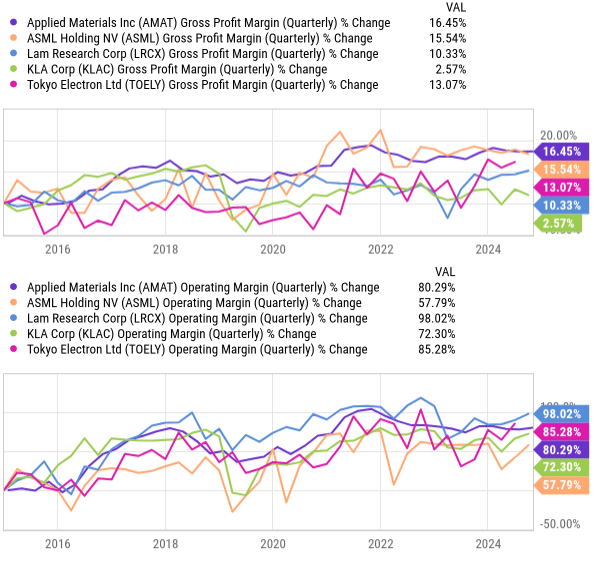

In the earnings call, the management team stated they consider Applied Materials to be in the third inning of implementing value-based pricing. They strengthened their analysis process in order to align pricing with the value delivered, and this is especially true for integrated and unique applications, in part due to the complexity of energy-efficient computing. Technologies like gate-all-around, backside power delivery, and advanced DRAM architectures require a lot of development effort, and the company believes it can reflect that in pricing. This is very important given that it helps explain how the company has been capable of improving its operating margins.

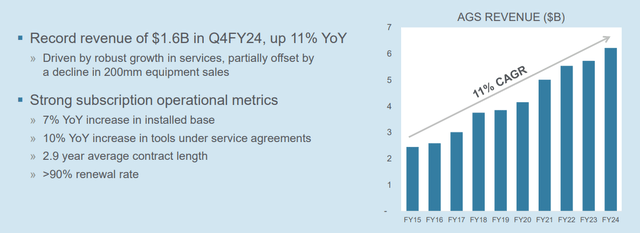

Another important segment the company has been exploring is Applied Global Services (AGS). This service division exists to support the performance of semiconductor manufacturing equipment. These services help manufacturers support the equipment throughout the entire lifecycle of the equipment. That works through a long-term service agreement designed to provide maintenance and upgrades to the customers. This includes services in the form of scheduled maintenance, and analytics to predict equipment failure and repairs. A more advanced service deal will include spare part inventory management and equipment upgrades, including technology retrofits.

The benefit of this system is obvious for the company. It has allowed them to build a predictable recurring revenue stream in an industry known for its pronounced cycles. The company also mentions high levels of client retention, which is a sign of the utility of the service. This doesn’t surprise me since once a manufacturer wants to adopt a new technology, like moving from Fin-FET to gate-all-around transistors, AGS can be a tremendous help in getting the upgrades and supporting the transition to make it smooth and cost-effective.

Applied Materials

Valuation

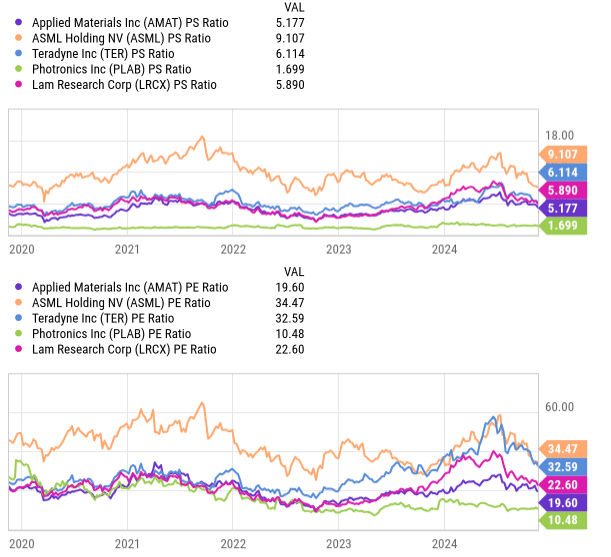

A look at valuation tells us that the company’s valuation metrics seem in line with peers. The company is actually on the low end of the peer set in both the PS ratio and PE ratio.

YCharts

More interestingly, we see that the company enjoys a high sales multiple for a manufacturing company. However, when we overlay the sales multiple against the gross margin, we see that variations in the gross margin during the last decade have walked hand-in-hand with changes in the sales multiple. As ever, the cyclicality has been present.

YCharts

Investment Takeaways

Six years after I wrote about the company, the long-term secular growth thesis in chip applications remains intact. The company is one of the most critical players in the equipment industry for semiconductor manufacturing with solutions for material deposition, etch, patterning, and process control. With the company projecting a $1 trillion semiconductor market, the company is in a good position to capture part of this secular growth trend. If we add the demand for even more energy-efficient solutions that allow more AI workloads, the thesis in favor of Applied Materials gains even more support on the back of their energy-efficient architectures like gate-all-around transistors and backside power distribution.

A second thesis is that the company still enjoys great strength in materials engineering. Semiconductor technology nodes are becoming increasingly complex, while at the same time, there is huge pressure to deliver on energy efficiency. The company seems ready to deliver on the materials engineering required to enable technologies like gate-all-around transistors, backside power distribution, and 4F-squared DRAM. The evolution of gross and operating margins compared to the peer set below indicates that the company has had strong execution.

YCharts

Finally, the annuity-like revenue profile provided by the AGS segment will be of great value during semiconductor downturns. On the other hand, during good times, the segment has the potential to drive higher margins.

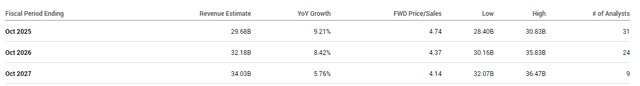

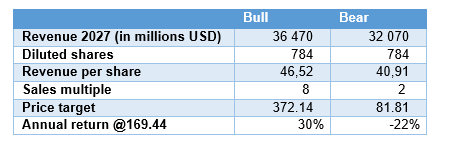

With that said we can create a bull and bear scenario for 2027. We will use the high and low revenue estimates available for the company.

Seeking Alpha

We will also assume that the diluted shares outstanding will drop 2% every year (lower than the last four-year average), and finally, we will consider an 8x sales multiple for the bull scenario, and 2x for the bear scenario, in line with the range in P/S multiple in the last ten years.

Author’s computations

The results suggest an asymmetric return profile favoring the upside.

Risks

Now, that we have seen the investment story for this stock, we need to ponder the risks. The most obvious risk is the cyclicality of the semiconductor industry. The sector is plagued by periods of high demand followed by periods of downturns due to macro factors or even inventory adjustments. A potential downturn will impact CapEx from the company’s clients which will likely lead to a period of lower revenues. The AGS segment is potentially an offset for that, but it will only partially mitigate the risk.

Another risk that has become increasingly higher is the geopolitical risk. The current tension between China and the US might bring headwinds in the form of trade restrictions, export controls or even sanctions that could diminish the company’s ability to serve a market that currently represents 30% of its revenues. That said, the company went through this in 2016 and still managed to thrive.

Investors should also consider technological execution risks. In a fast-paced industry like this one, Applied Materials will need to continuously innovate and bring advancements to the market. For instance, the transition from FinFET to GAA transistors requires complex materials engineering and manufacturing solutions. If the company fails to deliver, other competitors might beat it and take share from the company. So far, the company has been able to keep competition at bay, and so far the execution is a testament to their ability to do so.

Another risk comes from customer concentration. Companies like TSMC, Intel, and Samsung are big customers, and problems specific to these companies, like Intel’s current woes, or tensions between China and Taiwan in TSMC’s case, can be significant headwinds.

Conclusion

Back in 2018, when I wrote my long-term thesis for the stock, I couldn’t imagine how the chip industry would evolve so positively. Although I couldn’t really tell the future, I had a strong conviction that the tailwinds would be generous, and the company completely surpassed my optimistic scenario at the time. Right now, the feeling is similar, the company is on a secular trend for more processing power, and they will likely be in demand going forward.

Adjustments to the business model, like the rise of the AGS, are welcome and will provide some cover for the wild swings that will likely remain a feature of the industry. Given our assessment of the latest earnings and the points discussed, I keep the buy rating on this company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.