Summary:

- Applied Materials is well-positioned in the semiconductor equipment market, driven by growth in HBM, DRAM, and advanced packaging, with a ‘Buy’ rating and a $220 price target.

- Investments in advanced technologies and energy-efficient computing solutions are expected to serve as long-term growth tailwinds for the company.

- Recent financial results show 5.5% revenue growth and 7.4% adjusted operating profit growth, with a revenue forecast of $27 billion for FY24.

- Key risks include customer concentration, volatility in the display market, and exposure to semiconductor industry CAPEX cycles.

Monty Rakusen

Applied Materials (NASDAQ:AMAT) sells equipment, services and software to the semiconductor and display markets. I think the company is well positioned in the overall semiconductor equipment market, particularly in capturing the growth in HBM, DRAM and advanced packaging. The energy-efficient computing could potentially serve as a long-term growth tailwind for Applied Materials, in my view. I am initiating a ‘Buy’ rating with a one-year price target of $220 per share.

High-bandwidth Memory and Advanced Packaging

DRAM business represents around 25% of total Semiconductor Systems revenue. In Q3 FY24, Applied Materials achieved 50% year-over-year growth in their DRAM business, despite an 11% decline in China. There are several factors contributing to Applied Materials’ growth in DRAM, HBM and advanced packaging:

- Over the past few years, Applied Materials has been investing in some key advanced technologies including Gate-All-Around transistors, backside power delivery, advanced DRAM and High Bandwidth Memory (HBM). Due to the rapid growth in AI, the HBM market has experienced robust expansion. The most advanced GPUs require more HBMs to perform high-performance computing for AI workloads. Micron (MU), a leading player in the HBM market, delivered more than 50% revenue growth on a sequential basis in Q3 FY24, propelled by AI-related product categories such as HBM, and data center SSDs. As such, I believe DRAM and HBM will be key growth drivers for Applied Materials in the near future.

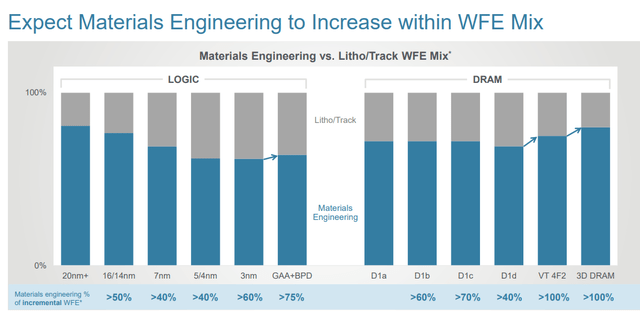

- As shown in the chart below, the more advanced semiconductor node, the higher Applied Materials are as a percentage of incremental Semiconductor Wafer Fab Equipment (WFE). As such, as chip technology advances, Applied Materials is likely to achieve higher market share.

Applied Materials Investor Presentation

- Lastly, Applied Materials has been investing in its advanced packaging technology, enabling semiconductor companies to establish accurate statistical process control and improve production yield. Applied Materials achieved $1.1 billion in advanced packaging revenue in FY23 and anticipates the business will grow to $1.7 billion in FY24.

Energy-efficient Computing

Energy-efficient computing is mission-critical for AI computing and data center operators, as it can both save costs and improve computing power for data centers. Over the latest earnings call, the management emphasized that Applied Materials will continue to invest in energy-efficient computing solutions. Several key initiatives that Applied Materials has been investing in include:

- Applied Materials provides Vistara platform, which can utilize a variety of chamber types, sizes and configurations from Applied Materials and their partners. As disclosed, the Vistara platform can reduce the energy consumption by 30% by 2030. It is an ongoing project that Applied Materials has been developing.

- On July 8th 2024, the company announced the Industry’s first use of ruthenium, enabling copper wiring to scale to the 2nm logic node and beyond. The narrow copper wires could potentially increase electrical resistance that increases energy consumption.

I anticipate Applied Materials will continue to invest in energy-efficient computing technologies in the near future, and I believe these investments will serve as long-term growth tailwinds for the company.

Recent Result, Outlook & Valuation

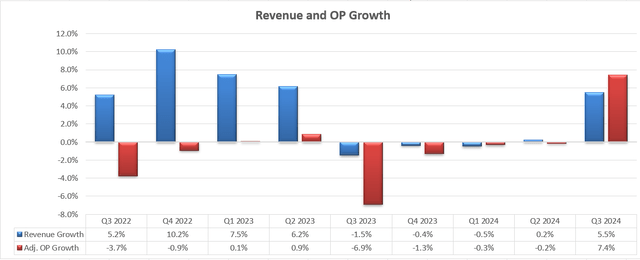

Applied Materials released its Q3 FY24 result on August 15th, reporting 5.5% growth in revenue and 7.4% in adjusted operating profits, as shown below:

Applied Materials Quarterly Earnings

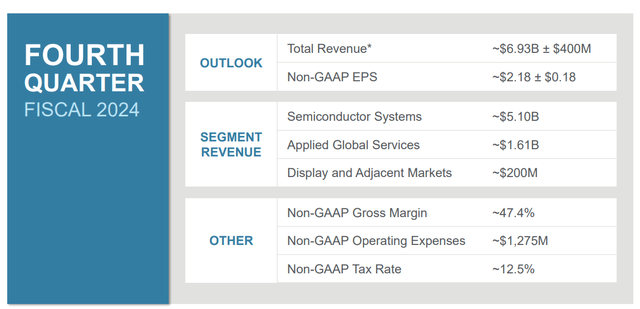

Applied Materials is guiding for around $27 billion in revenue for FY24, representing around 3% year-over-year growth.

Applied Materials Investor Presentation

There are several ways to think about Applied Materials’ growth in the future:

- During a recent conference, the management indicated that the overall semiconductor market is more likely to grow at about 3x the rate of GDP growth, with semiconductor equipment growth expected to surpass overall semiconductor growth. Assuming a 2.5% GDP growth, the semiconductor equipment market is more likely to grow at high-single-digit in the near future.

- As reported by the media, Micron’s EVP and chief business officer, Sumit Sadana, estimates that DRAM will grow by 15% annually while HBM is projected to grow at 3x the rate of DRAM. As Applied Materials’ equipment is widely used in the DRAM and HBM fabs. I estimate the fast growth in DRAM and HBM will contribute 3%-5% to the overall topline growth.

- I forecast Applied Materials’ traditional business will grow by around 4%, aligned with the historical average. As such, I estimate the organic revenue growth will be around 8% in the near future.

- Lastly, I assume Applied Materials will allocate 2% of total revenue towards acquisitions, resulting in 1% growth to the topline.

Applied Materials has been consistently improving their product pricing and optimizing the operating costs, as communicated over the earnings call. These initiatives could potentially help the company expand their operating margin. I anticipate the company will achieve 20bps annual margin improvement in the near future, driven by 10bps from new product and pricing increase, and 10bps from operating leverage from R&D expenses. I calculate that Applied Materials will grow their total operating expenses by 8.5% annually.

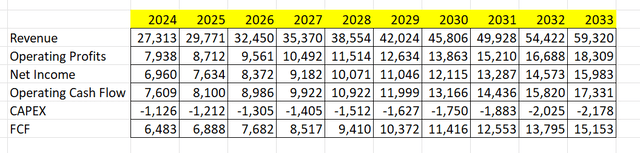

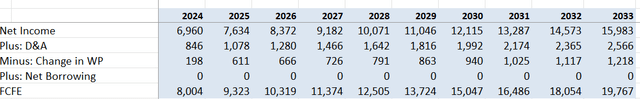

With these assumptions, the DCF summary can be found below:

Applied Materials DCF

I calculate the free cash flow from equity as follows:

Applied Materials DCF

The cost of equity is estimated to be 16% assuming: risk-free rate 3.8%; beta 1.8%; equity risk premium 7%.

Discounting all the future FCFE, the one-year price target is calculated to be $220 per share, according to my DCF model.

Downside Risks

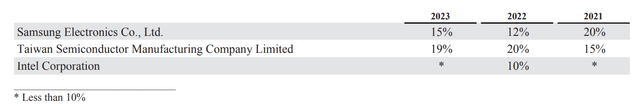

- Customer Concentration: As shown in the table below, Applied Materials faces significant customer concentration risk, with Samsung (OTCPK:SSNLF), Taiwan Semiconductor Manufacturing (TSM) and Intel (INTC) being the largest customers. If Applied Materials loses any of these customers, the company will lose a significant portion of total revenue.

Applied Materials 10K

- Display Market: Applied Materials’ Display business accounts for around 3.3% of total revenues and is exposed to the volatility of the overall sluggish display markets. The segment’s revenue declined by 18.5% in FY22 and 34.8% in FY23. I view the Display business as a non-core business without any growth potential.

- Volatility: As Applied Materials provided equipment and services to semiconductor companies; therefore, the company is exposed to the CAPEX cycle of semiconductor industries. If the economy is heading into a recession, Applied Materials is more likely to encounter financial difficulties.

End Note

Applied Materials’ equipment, software and services are well-positioned to benefit from the rising AI computing, DRAM/HBM demands, and energy-efficient computing. I am initiating a ‘Buy’ rating with a one-year price target of $220 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.