Summary:

- Applied Materials, Lam Research, and Tokyo Electron are the three generalists in the Wafer Fab Equipment sector.

- With wide moats, fueled by scale, switching costs, and customer relationships, they wield high dominance over their markets and are indispensable to their customer base.

- Due to a very low valuation relative to its peers or the market, as well as on an absolute basis, I rate Tokyo Electron a “Strong buy”.

zorazhuang

Investment Thesis

As semiconductors have to deliver an ever-growing amount of performance while having strict heat and efficiency requirements, semiconductor equipment companies become increasingly important as they enable technological progress. With a wide moat, strategic relevance, and often high influence over their market, these companies are very attractive.

While Applied Materials (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), and Tokyo Electron (OTCPK:TOELY) all excel at different production steps, they still directly compete with each other.

With, by far, the lowest valuation and a, in part monopolistic, product offering, Tokyo Electron is my favorite out of the generalist triplet. I, therefore, rate it a “Strong Buy”.

Sector Overview

Semiconductors, the tiny chips that allow for the complex tasks our, among others, mobile phones, cars, and robots perform, are only made possible through a complex set of sub-sectors.

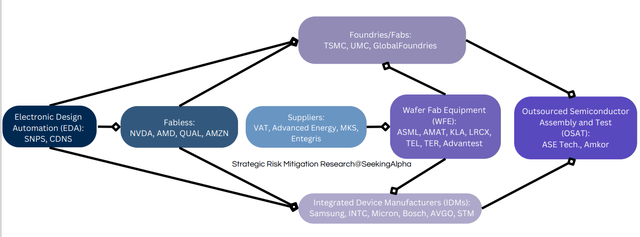

Semiconductor Sector Overview (Author)

As visible above, Foundries like TSMC (TSM) and IDMs like Intel (INTC) are dependent on the equipment the Wafer Fab Equipment (WFE) sector develops and sells, as the WFE sector makes any advancements in semiconductor technology possible in the first place.

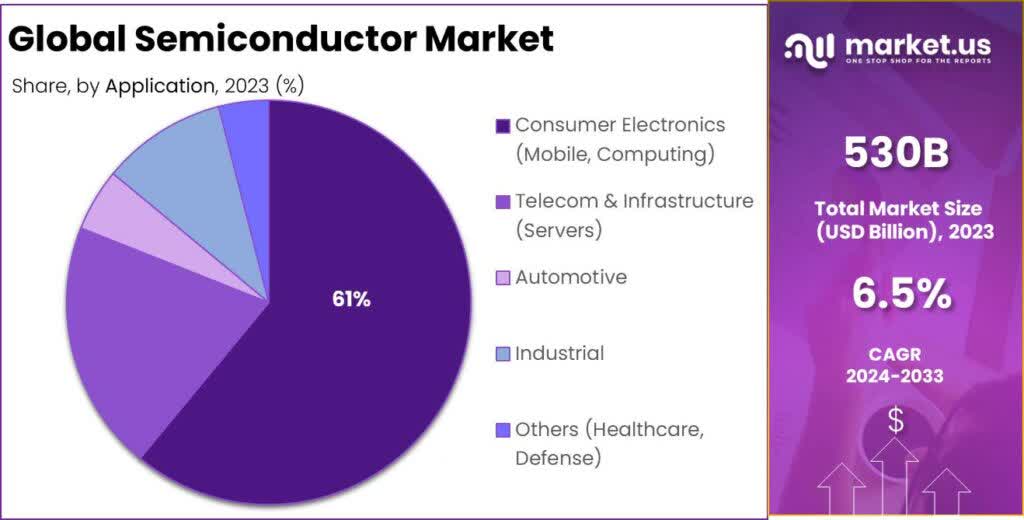

Semiconductor Market By Applications (market.us)

The direct correlation between any technological advancements (digital and analog) and semiconductor progress causes an ongoing struggle to shrink and stack chips to achieve higher performance, and better heat and energy efficiency. This means Fabs, the factories where semiconductors are produced, will need more high-tech equipment to achieve their technological goals while also increasing capacity, which leads to an increase in capital spending.

For the WFE sector, this fuels pricing power, growth above the general semiconductor industry, and strategic relevance for its customers and, often unfortunately, political actors.

Although ASML (ASML) is the most popular WFE company, it is only one company in a sector with numerous interesting and dominant high-quality companies.

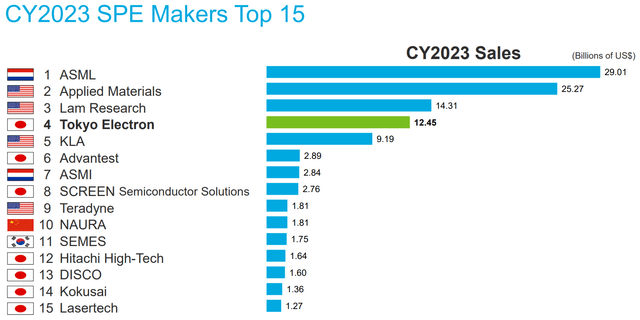

WFE companies by 2023 revenue (TEL investor presentation)

With semiconductor equipment being very expensive (usually 7-8 figures and above), and Foundries and IDMs only having limited insight into future demand, orders are, as usual in the industrial space, rather lumpy. This causes cyclicality, for the entire sector, despite the secular growth.

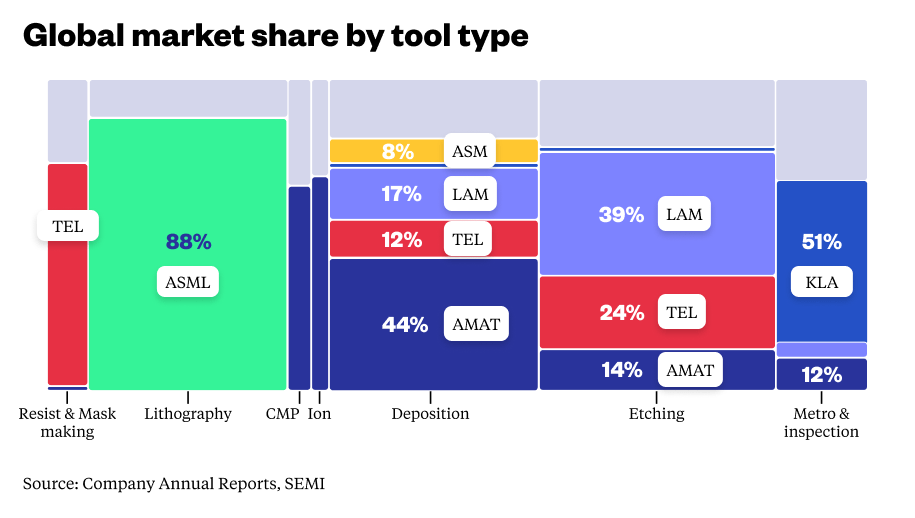

As is visible below, Applied Materials, Lam Research, and Tokyo Electron are the three generalists in the sector, with ASML and KLA Corporation (KLAC) being the specialists – mainly focusing on their single sub-sectors. This is the reason why I have decided to compare the three generalists in this piece, instead of all the big 5 WFE manufacturers.

WFE marketshare by company (thechinaproject.com)

What makes these generalists, very interesting is that they don’t rely on a single production process to stay relevant. ASML and KLA, on the other hand, do have slightly more risk attached to them from this perspective. As, should customers find a way to cut them out, as TSMC has attempted to in the past, they could become irrelevant very quickly. That is not to say that is easily achievable, likely to happen, or has happened at scale in the past.

Company Overview

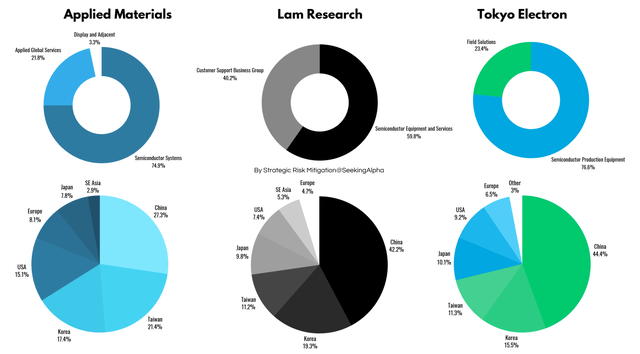

Revenue by segment and geography (Author using company data and marketscreener.com)

With revenues derived from China, Taiwan, and Korea colored differently than the rest, it becomes apparent just how geographically concentrated the WFE sector’s revenue is. Predominantly in areas with increased geopolitical risk, although this is a topic I will pick up on later on.

Applied Materials

Being the second largest WFE company by revenue, only behind ASML, AMAT is the US powerhouse when it comes to semiconductor equipment. With a 44% market share in Deposition, the process of depositing material, which will later be removed (etched away) to create a distinct pattern, AMAT is part of the very beginning of semiconductor production.

Applied Global Services service AMAT’s installed base of 45,000 and provides spare parts as well as software to optimize the performance of its machines. This provides recurring and reoccurring revenue and limits revenue drawdowns. It is, however, through its servicing and parts business, bound to utilization rates at customer fabs. On the other hand, equipment often stays in service for decades, constantly providing WFE companies with re(o)curring revenue.

Lam Research

With approximately 39% market share Lam dominates Etching, which is required to remove unwanted material and etch the desired pattern on the wafer. This step is crucial to semiconductor production because it essentially makes the pattern that allows the chip to perform various tasks.

With the second largest installed base of 90,000 tools at Fabs, Lam’s second segment “Customer Support Business Group” (CSBG) focuses on providing servicing, spare parts, training, and modification to its customers. Just like for other WFE makers, much of this revenue is recurring or reoccurring in nature, which helps dampen cyclicality and protect the downside of the company’s revenue.

Tokyo Electron

With a 90% market share in Coater/Developer, and a monopoly for its EUV application, the 15th largest company in Japan, Tokyo Electron, is an often overlooked Japanese giant. When coated, a wafer is prepared for lithography by applying a UV filter. Developing is then required to ensure the pattern, made by lithography, is “printed” onto the chip. This assures that only a very specific pattern is etched onto the wafer.

The monopoly on ASML’s EUV deployment is a significant advantage, as TEL can capture upside from ASML’s new machines, while not being dependent on them – which is a good thing, as ASML’s latest earnings have shown.

Further, the company is very dominant in Etch and is Lam’s largest direct competitor in the space.

Field Solutions is TEL’s service, parts, and software segment. It services TEL’s installed base, the largest in the world, of 93,000 tools, and provides software as well as parts and training to its customers.

Moats

Unsurprisingly, all three companies have very similar moat sources.

Scale

The immense scale, and resources, of all three companies not only create high barriers to entry for smaller and potential new competitors, but it also makes it hard to displace existing players.

With Fabs all around the world being equipped by the triplet, with installed bases in the tens of thousands, it is unlikely any of them will virtually ever be displaced.

Switching Costs

This also creates switching costs for their customers. Replacing the equipment, in aggregate worth hundreds of billions, makes it practically impossible to replace them. This often results in repurposing, which often also leads to revenue for the WFE makers through modification.

Customer Relationship

Further, smaller competitors are forced to fight an uphill battle against very close customer relationships. These are expressed through WFE manufacturers often being consulted when customers plan new Fabs, as equipment has long lead times and the OEMs know their new equipment better than anyone else.

Technology

While TEL comes the closest to a technological monopoly with its Coater/Developer product offerings, all three companies provide equipment at the forefront of what is possible with today’s technology. An edge that they constantly expand by investing billions into R&D, making any catch-up highly unlikely.

As all of the big 5 semiconductor equipment companies are more than well-known to their customers, I don’t see strong brands as a differentiator or moat source here.

Being indispensable to their customers and the world economy in general, I rate all three a “wide/strong” moat. Although I see TEL’s differentiation as slightly higher when taking in its absolute C/D dominance.

Financials

All numbers are presented in USD to provide a common base, TEL reports in Japanese yen, however, which might cause smaller deviations due to exchange rates.

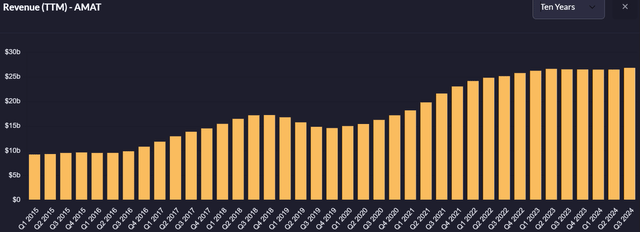

As is visible when looking at the quarterly TTM revenue for the last decade, the WFE sector is rather cyclical – although AMAT is less cyclical than the rest of the sector. Additionally, AMAT grew the fastest of the three, at a CAGR of 13.5% over the last decade.

AMAT quarterly trailing twelve month revenue for the last decade (Qualtrim)

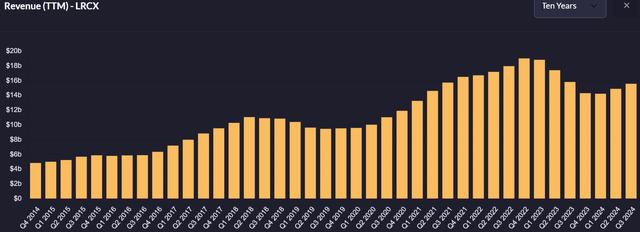

While Lam seems to rebound more abruptly, it also experiences higher drawdowns. The company grew its revenue at a CAGR of 12.5% over the last decade.

LRCX quarterly trailing twelve month revenue for the last decade (Qualtrim)

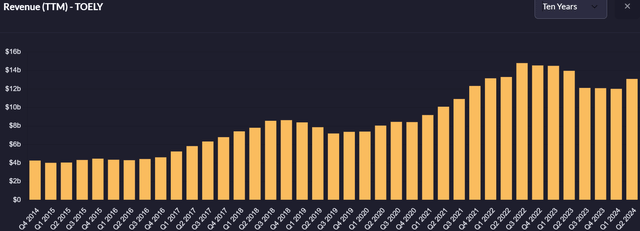

Very similar to LRCX’s revenue profile, TEL is very cyclical. Yet, the company grew revenues by 11.6% over the past decade.

TEL quarterly trailing twelve month revenue for the last decade (Qualtrim)

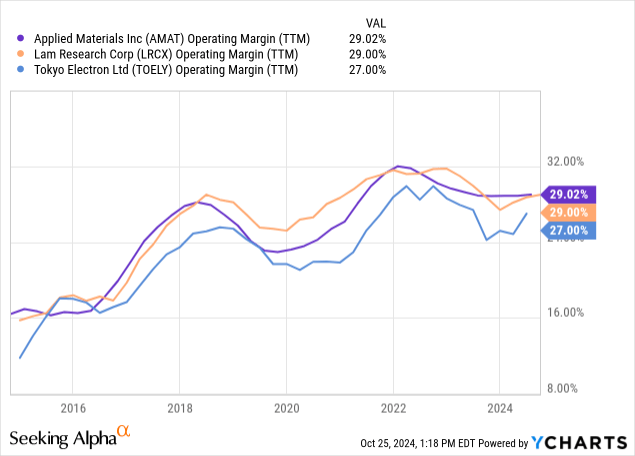

The sector’s cyclicality is also visible in the company’s margins. Despite consistent medium and long-term margin expansion, operating leverage and pricing likely suffer in industry downturns.

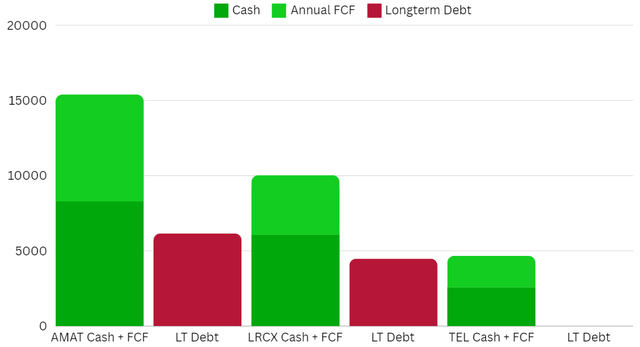

Companies cash + FCF vs long-term debt (Author with company data)

Numbers based on the last reported quarter as of 10/25/24

While Tokyo Electron generates the least free cash flow, it comes with a perk relatively common in the Japanese corporate world – being debt-free. While I don’t consider this very material due to the generally very strong competitive positioning of all big WFE companies, it does significantly reduce risk against “unknown unknowns”.

Shareholder Returns

| Company | AMAT | LRCX | TEL |

| Dividend Yield | 0.87% | 1.2% | 2.25% |

| 5y Dividend Growth CAGR | 11.9% | 13.5% | 20% |

| 5y Share Buyback CAGR | 3.8% | 3.7% | 1.2% |

AMAT and LRCX’s share repurchases have most likely bolstered their outperformance over the market over the last decade. This is a more attractive approach to capital allocation for investors focused on capital appreciation.

With a much higher dividend yield than Applied and Lam, TEL seems like a better choice for investors more focused on income, instead of capital appreciation. However, for US-based investors, this potentially creates additional tax implications. Additionally, I expect the growth rate to be lower when normalized, as TEL has a, comparatively, volatile dividend, in line with the sector’s cyclicality.

To conclude, I like the high shareholder returns and mix of dividends and buybacks a lot, especially as the companies still heavily reinvest into their businesses.

Valuation

| Company | AMAT | LRCX | TEL |

| P/E ratio | 22.8x | 25.3x | 29.4x |

| 2y EPS CAGR estimates | 12.65% | 18% | 28.9% |

| 2yPEG | 1.8x | 1.4x | 1.02x |

Using analyst estimates and prices from 10/26/24

As is usual with cyclical companies, the up-cycle makes their valuation look inexpensive, while the down-cycle makes them look expensive, due to growth materializing unevenly. As the upcycle is expected to fully set in the next year, this makes all of the companies look reasonably valued when compared to the S&P500, which trades at a higher Price-to-Earnings ratio and grows much slower. However, AMAT’s relatively high growth-adjusted valuation can be explained by a relatively weaker return to growth as it is less cyclical.

Especially TEL’s expected abrupt rebound makes analysts expect, for the sector, extremely high growth rates over the next two to three years, as the up-cycle gains full traction. Yet, when looking at past cycles of explosive returns to growth, the estimates do not seem exaggerated to me.

When looking at the past 5 years’ annual EPS beat (or miss), TEL leads the triplet with an average beat of 6.1% above annual EPS estimates. While Lam beats by 3.3% on average, AMAT is the least consistent, being the only one with a miss, and the weakest performer, only beating by 1.65%.

As the market logically values companies with higher earnings performance and predictability, it is even more surprising to see TEL trade at this valuation. Although due to its 1x PEG ratio, likely “only” considered around fair value by many value investors, I believe the company to be undervalued at the current price when comparing it to the market’s PEG of at least 2x. The same holds true when comparing it to peers, despite the virtually identical moat.

When adjusting for expectation beats/misses, TEL is still, by far, the cheapest of the three, for no apparent reason, and should provide an adequate margin of safety.

Risk

China

China, just like all Foundries and IDMs, requires the WFE sector’s advanced equipment to manufacture chips used in, besides others, AI and 5G technologies. Due to the rivalry between the USA and China that has developed in the past few years, all equipment makers are subject to trade restrictions for selling equipment to China.

Should this relationship sour, which it could regardless of the election outcome, it would become even harder for all WFE makers to sell equipment to Chinese customers and even to international customers’ facilities in China.

China, Taiwan, Korea

As China, just last week, held its first naval blockade test on Taiwan, an invasion remains a potential risk. Should China invade Taiwan, North Korea is, in my opinion, highly likely to use the chance to attack its southern neighbor as well.

With Samsung and SK Hynix being major customers for all WFE companies, this would amplify the revenue loss inflicted by an escalation in the Malacca Strait and the Yellow Sea.

AI

With much of the semiconductor market expected to benefit from massive AI adoption, this creates risk in the form of an unproven market, as many AI-focused companies yet have to generate meaningful revenue let alone realize profits.

Economy

With the vast majority of semiconductors being used in consumer goods and non-essential applications, the state of the economy, specifically consumer spending, is indirectly very relevant for the WFE sector. Although this might trend towards more corporate and industrial applications as automation and other trends gain traction over the coming decades.

Competition

As shown in the very beginning of this article, all three companies compete with each other, especially in Deposition and Etching. While the three don’t compete in all of their product lines, I expect competition to heat up as they compete for increasing customer demand.

Mitigation

I covered a possible hedge to China and general geopolitical risk in a previous article. Additionally, defense exposure is likely the best hedge against any armed conflict. As it allows for non-lethal defense exposure, Avon Technologies (OTCPK:AVNBF), which Analyst Dhierin Bechai covered here, is my personal choice.

Competition is a secondary risk to me. Readers who see competition as a major risk might build a “mini WFE-ETF” containing all of the big 5 WFE manufacturers or at the least buy multiple WFE makers to mitigate this risk.

Further, I recommend readers to routinely reassess their entire portfolio and specifically monitor their China exposure, as well as other risk overlaps from different positions.

Selling

A situation in which I can see a “Sell” rating as justified for any WFE maker is in the case of a Chinese invasion of Taiwan.

While the sector is undoubtedly isolated against direct exposure, compared to TSMC or Samsung Electronics (OTCPK:SSNLF), and should rebound much quicker than the rest of the semiconductor industry, it will likely take multiple years before new Western fabs are ready to be equipped. Subsequently, the drawdowns experienced in both the company’s revenue and stock price would inflict too heavy losses to future performance to warrant holding the stocks.

Significant market share losses would, understandably, worry investors, and potentially make me rate any company a “Sell”. Although usually not immediately apparent, through keeping track of the entire sector it should be discernible over a few quarters. Monitoring this is important for shareholders, and should not be taken lightly.

Conclusion

As largely discussed in the “Moats” paragraph, the three companies’ quality, expressed through predictability, does not differ much. Although AMAT is less cyclical, it underperforms in beating the market’s estimates. While this is not material, the comparably high valuation, even when adjusted for growth, makes less sense to me.

All three are excellent companies with wide and deep moats, which will likely do well at the current valuation.

Applied Materials is a household name in the WFE sector and widely known among investors. Yet, due to its relatively high valuation when compared to peers, I see no reason for investors to buy or add to AMAT over its peers at the current price, and rate it a “Hold”, despite slightly lower exposure to China, Taiwan, and Korea.

With a much lower valuation and a very similar, wide moat and dominance, I rate LRCX a “Buy”.

TEL is my favorite candidate due to its superior earnings performance, and a super-dominant product line (Coater/Developer) that enables the company to up and cross-sell. As well as its objectively very low valuation for the quality (predictability) investors can add to their portfolio.

I do not recommend buying TEL’s ADR (OTCPK:TOELY), as it has vastly underperformed its Japanese counterpart. Additionally, it has a higher Beta (Volatility) and lower liquidity. Therefore, I recommend buying the Tokyo-listed shares. A downside that comes with this, is that the Tokyo Stock Exchange only allows for orders of hundreds of shares. This makes the smallest possible order 100 shares, equating to 2.3 million yen or approximately 15,000 USD, which creates a significant barrier to entry for most private investors.

For those with the capital to responsibly buy Tokyo Electron, or 8035 as its Japanese ticker is called, I rate the company a “Strong Buy”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KLAC, TER, SNPS, VACNY, AVNBF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Although I aim to always give actionable recommendations based on doing my research to the best of my abilities, this should never be seen as investment advice – please never skip doing your own research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.