Summary:

- Applied Materials stock has seen significant growth since the introduction of OpenAI’s ChatGPT, riding the generative AI revolution.

- The company has significant long-term opportunities in AI, IoT, electric vehicles, and renewable energy.

- AMAT stock may be overvalued at its current price, with a high P/E ratio suggesting potential market overvaluation.

PhonlamaiPhoto

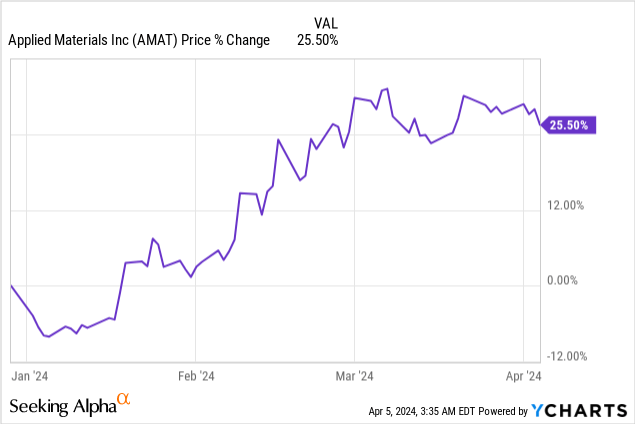

The semiconductor industry has boomed since the beginning of 2023, riding the tailwinds of OpenAI’s introduction of ChatGPT to the market, which sparked the generative AI revolution. Applied Materials (NASDAQ:AMAT) has ridden that wave higher; the stock was up 68% in 2023 and, as the following chart shows, was up 25.50% in 2024 as of April 4.

I last wrote about this stock on January 25, 2024, and recommended a buy. Since then, the stock has been up around 21% (As of April 5). The company reported its first quarter fiscal year (“FY”) earnings on February 15, and investors liked what they saw. Applied Materials reported revenue that beat analysts’ estimates by $220 million and non-GAAP earnings-per-share (“EPS”) by $0.22. The company also issued guidance above analysts’ expectations. The stock rose 6.3% after the company reported earnings. The best part was that Chief Executive Officer (“CEO”) Gary Dickerson said the magic words that get investors excited: Artificial Intelligence (“AI”). He said during the company’s earnings call, “The breadth of our technology capabilities, combined with our deep customer relationships, allows us to see inflections early and accelerate key technology innovations that are critical to scaling AI, IoT [Internet of Things], electric vehicles and renewable energy.“

Over the last year, companies that investors view as crucial enablers of generative AI’s proliferation have become an enormous investing theme. Applied Materials makes the tools that enable semiconductor manufacturers to build powerful enough memory and compute chips to run generative AI algorithms. Investors view the company as an AI beneficiary. Before the generative AI revolution, several other secular trends, such as IoT, electric vehicles, and renewable energy, made the stock an attractive long-term opportunity. However, in the short term, some investors are worried about an AI bubble and whether Applied Materials’ stock has gotten ahead of itself.

This article will examine the company’s long-term opportunities, why the stock price may stall in the short term, its valuation, a few risks, and why I am inclined to give this stock a rating of Hold.

It has significant long-term opportunities

Applied Materials spent $3.10 billion in Research and Development in FY 2023 to create the next-generation technology needed to manufacture future chips. The company published the following slide in its first quarter 2024 investor presentation, highlighting its future growth opportunities.

Applied Materials First Quarter 2024 Investor Presentation

A big part of management’s innovation strategy is identifying key chip technology trends that will significantly impact the industry’s future and investing heavily in developing them. This strategy has paid off over the last five years, as Applied Materials has outperformed its sector. What about the future?

The column on the above chart labeled “Key Inflections” represents trends the company has invested in for several years and believes will start paying off within the next five years. Applied Materials identifies “Key Inflections” chip trends early and creates some of the solutions, tools, and processes that enable the manufacturing of these complex chip architectures at scale. Let’s discuss a few of those trends from which Applied Materials should benefit.

1. High Bandwidth Memory

The above image lists high-bandwidth memory (“HBM”) as a Key Inflection technology in the advanced packaging row. One use case for HBM is enabling large AI applications in data centers. Since HBM is excellent for applications requiring more memory capacity in areas with physical size limitations, IoT and wearable devices may be an additional use case for HBM. Let’s examine the use of HBM in those applications.

I recently wrote an article on Qualcomm (QCOM), which discussed how the management of that company believed in the idea of “Pervasive AI,” which simply means that manufacturers will eventually embed AI into everyday use items like clothes, appliances, furniture, and buildings, making AI widespread. Pervasive AI is related to wearables, devices like watches, augmented reality glasses, and fitness trackers and is associated with IoT, a physical device embedded with sensors. The definitions of pervasive AI, IoT, and wearables all overlap with each other. To enable this world where AI is ubiquitous, a pervasive AI world, manufacturers will likely use HBM chips, as many IoT and wearable applications are small devices with chip size limitations and sizable memory requirements.

HBM is a new Dynamic Random-Access Memory (“DRAM”) chip architecture. Computer manufacturers and other device makers use DRAM chips as short-term storage for data that a processor needs to access quickly. Traditional DRAM chips are simply flat chips laid out in two dimensions. These chips still have a purpose for devices without size limitations or heavy memory requirements, and cost is a consideration. Alternatively, HBM stacks DRAM dies on top of each other in a 3D structure instead of a 2D structure to stuff more memory into a smaller space.

You may hear management mention HBM on earnings calls more often, as the technology should grow significantly in 2024. In the company’s first quarter FY 2024 earnings call, CEO Gary Dickerson said (emphasis added):

In fiscal 2024, we expect our HBM packaging revenues to be four times larger than last year, growing to almost $0.5 billion. And across all device types, we expect revenue from our advanced packaging product portfolio to grow to approximately $1.5 billion. Looking further ahead, we see opportunities for this business to double again, as heterogeneous integration is more widely adopted, and we introduced new products that expand our served market.

The above quote mentions “heterogeneous integration,” a new way of connecting chiplets with different functions instead of putting all functions on one chip. The chip manufacturing industry is increasingly adopting heterogeneous integration and chiplet technology, with Advanced Micro Devices being one of the more prominent advocates.

2. Gate-All-Around (“GAA”) transistors

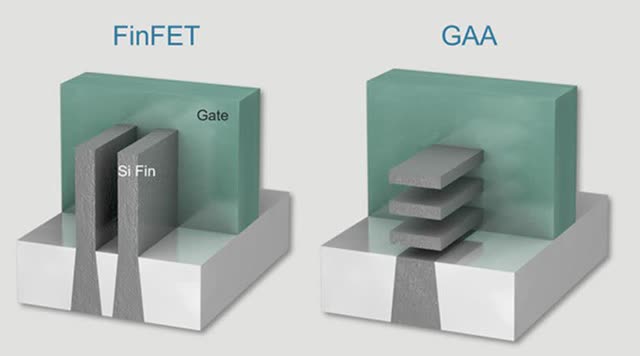

GAA transistors are another Key Inflection point in the New Structures/3D row. Let’s discuss transistors before discussing why chip manufacturers are moving to GAA technology over the next several years. The transistor image below is from the Applied Materials website.

Transistors are switches with three states: on, off, and partially on. The gate controls the switch states. Today, the predominant technology for transistors is FinFET. The fins have several purposes, including faster switching speeds, more effective gate control, and allowing manufacturers to build transistors at smaller nanometer (“nm”) sizes. As the image above shows, the main difference between FinFET and GAA is that the fins are changed from vertical in FinFET to horizontal in GAA.

From an investing standpoint, the most important thing to understand is that the GAA fin configuration can potentially pack more power into a smaller space, have better performance characteristics, and have reduced power consumption over FinFET. Samsung (OTCPK:SSNLF) was the first chip manufacturer to make GAA chips in 2022. Since then, other chip manufacturers have followed suit to build chips down to 2-nm size. CEO Gary Dickerson said the following about GAA during the first quarter earnings call (emphasis added):

Another key inflection that will transition to high-volume production beginning this year is gate-all-around transistors in leading-edge foundry-logic. These complex 3D structures can provide a more than 30% improvement in a chip’s energy efficiency. This is especially enabling for high-performance AI data center applications. The shift from FinFET to gate-all-around grows Applied’s available market by $1 billion for every 100,000 wafer starts per month of capacity. And we’re on track to gain share and capture over 50% of the spending for the process equipment used in this new transistor module.

HBM and GAA transistors are two of several key technologies that should drive growth for Applied Materials over the next five years.

The picture over the next year

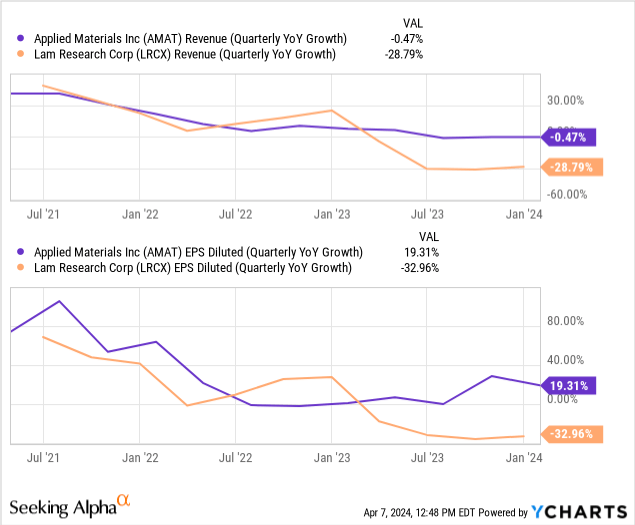

Before we discuss Applied Materials’ prospects for this year, let’s examine the company’s performance over the last year compared to its primary U.S.-based competitor, Lam Research (LRCX). Although 2023 was a stinker of a year for the parts of the chip industry serving the personal computer (“PC”) and smartphone industry, the chart below shows that Applied Materials has outperformed LAM from early 2023 to January 2024 on a quarterly year-over-year basis for revenue and EPS growth.

Applied Materials outperformed in 2023 because the company has focused on the tools and processes involved in manufacturing chips for the IoT, Communications, Automotive, Power, and Sensors (ICAPS) market, and ICAPS outperformed in 2023. CEO Gary Dickerson discussed ICAPS on the first quarter earnings call:

In recent years, ICAPS customers have invested about 10% of their revenues or about $30 billion annually in research and development to accelerate the roadmap for IoT, communications, automotive, power and sensor technologies. ICAPS technology depends less on shrinking device features and customer investments are heavily weighted towards new structures, new materials and new integration approaches, playing to the core strengths of Applied. ICAPS is another area where we saw market inflections early. And five years ago, we formed a dedicated team to focus on the needs of these customers. Since then, we’ve released more than 20 new ICAPS products that target the highest value device innovations in these markets and we have a robust development pipeline of unit process and integrated solutions.

The company’s Chief Financial Officer (“CFO”), Brice Hill, further talked about the strength of the ICAPS market over the last two years at the Morgan Stanley Technology, Media & Telecom Conference on March 4, 2024. He said (Emphasis added):

The ICAPS market, which we use ICAPS, the acronym, to describe the more mature technologies, IoT, communications, auto, power, sensors; those types of devices. That market was very strong for us and it was so strong over the past two years that it outweighed weakness we saw in the NAND market, weakness we saw in the leading-edge market et cetera. ICAPS has been an area where the company started a group that focused five years ago on developing new products for that market and that’s an example of an inflection that is manifesting in today’s market.

What Brice Hill was talking about when he talked about weakness in the leading-edge market is that sales were down for tools for the most advanced chip manufacturing processes using FinFET or even GAA transistors. As for NAND being down, PCs, smartphones, and other consumer electronics manufacturers use NAND flash memory chips as solid-state hard drives. When demand for consumer electronics dropped over the last year or two, it negatively impacted demand for NAND chips.

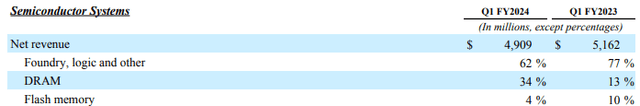

A lower percentage of its revenue from NAND flash memory chips helped Applied Materials over the last year and a half, as it avoided some of the impact of the downdraft in the PC and smartphone markets. The following table comes from Applied Materials first-quarter FY 2024 earnings release:

Applied Materials First-Quarter FY 2024 earnings release

The above table shows that in the first quarter of FY 2023, NAND flash memory was only 10% of revenue and has since declined to 4% in this year’s fiscal first quarter. During the first quarter earnings call, CEO Gary Dickerson said the following about NAND: “We expect our NAND revenues to be up year-on-year, but NAND to remain less than 10% of total wafer fab equipment spending.” In contrast, Lam Research generates most of its revenue from NAND flash memory, which significantly hurt its results in 2023.

However, the tailwinds that helped Applied Materials outperform in 2023 may not appear in 2024. For instance, a decent portion of its ICAPS growth in the previous year was from China, and the company expects that growth to cool off in 2024. CFO Brice Hill said on the company’s first-quarter earnings call (Emphasis added):

Just to be crystal clear, we had enormous growth for two years in ICAPS and the China-related ICAPS business. And so we won’t see that enormous growth this year. It may be a little bit smaller. We think there’s some digestion with that capacity. But we expect that market to grow over time along with the underlying rates for the company.

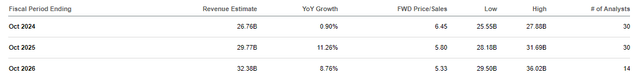

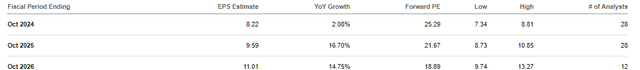

Revenue growth from tools used to build chips for AI applications, HBM, DRAM chips, and Applied Materials services business should help the company withstand the worst of the expected ICAPS downturn. The tables below show how analysts expect muted annual revenue growth of 2.08% and EPS growth of 0.90% in FY 2024 before revenue and EPS growth rebound into double digits in FY 2025 and FY 2026.

Before prospective investors decide to invest in Applied Materials this year, they should understand that the stock may have little upside in 2024. So, despite the potential high upside from Applied Materials’ innovation strategy over the long term, the stock might disappoint investors in the short term until the projected rebound in the ICAPS market occurs in FY 2025 and FY 2026.

Additional risks

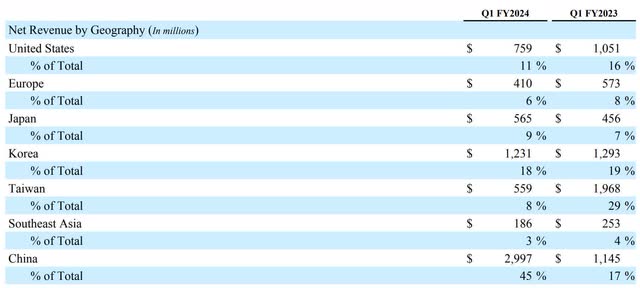

The table below comes from Applied Materials’ first quarter of FY 2024. It shows that year-over-year revenue grew to 45% of total revenue. Having that much business from China presents a massive risk to the company.

Applied Materials FY 2023 10-K

The U.S. government is currently investigating Applied Materials for potentially shipping restricted chip-making equipment to China. There is a risk that the company could underperform if the investigation leads to penalties or restrictions on future sales. Additionally, a great deal of political tension between the U.S. and China may lead to further trade restrictions on products that Applied Materials currently sells to Chinese companies. If that should happen, the company may fail to reach its revenue and earnings projections.

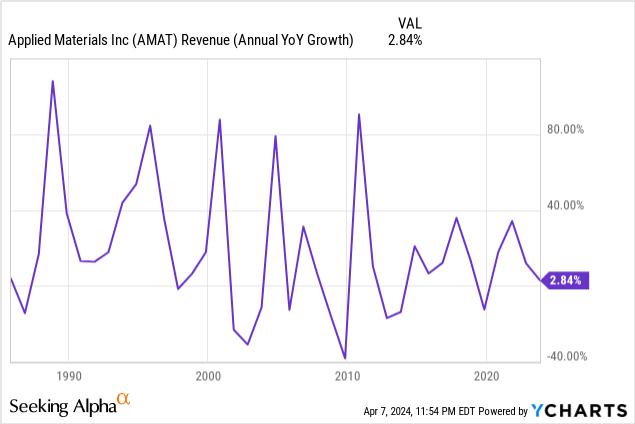

Another risk that investors face is that the semiconductor equipment industry is cyclical. Although generative AI and high-performance computing seem like secular growth trends that can power the semiconductor equipment industry higher for many years, historically, the sector has cycled up and down every two or three years. The following chart shows the extreme cyclicality in Applied Materials’ annual year-over-year revenue growth since the 1980s.

Investors who are impatient and unable to deal with several years of lower sales and margin compression during a down cycle should probably avoid this investment. After the stock’s impressive 383% run higher over the previous five years, its valuation may have gotten ahead of its current fundamentals. Let’s examine its valuation.

Valuation

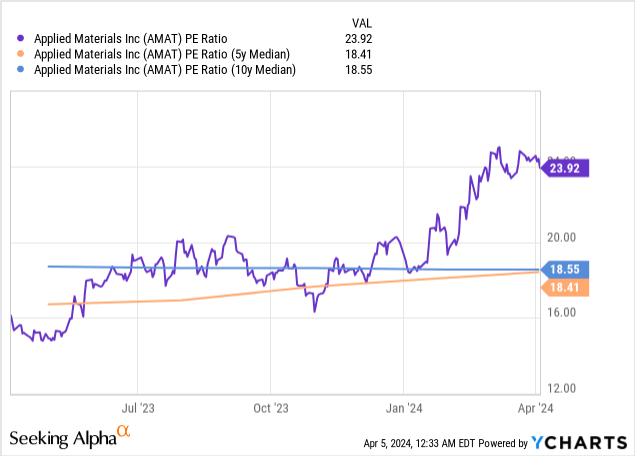

Applied Material’s TTM price-to-earnings (P/E) ratio of 23.92 sells well above its 5- and 10-year median ratio, which suggests the market may overvalue the stock at current prices. If the stock traded at its 10-year median P/E ratio, it would trade at $157.68, which is 22.5% below the April 4, 2024, closing price of $203.39.

Generally, the market may overvalue the stock when a company’s EPS growth is below its forward P/E. The following table shows Applied Materials EPS growth is below its forward P/E, suggesting overvaluation. This fiscal year will likely be a down EPS growth rate year for the company. However, fiscal 2025 should be a rebound year. If the stock traded at an October FY 2025 forward P/E of 16.70%, its EPS growth rate, the stock price would be $160.53, down 21% from the April 4, 2024, closing price of $203.39.

| Fiscal Period Ending | EPS estimate | Year-over-year EPS growth | Forward P/E | Low | High | # of Analysts |

| October 2024 | 8.22 | 2.08% | 25.24 | 7.34 | 8.81 | 28 |

| October 2025 | 9.59 | 16.70% | 21.62 | 8.73 | 10.85 | 28 |

Data Source: Seeking Alpha

I avoid doing a discounted cash flow (“DCF”) analysis on Wafer Fabrication Equipment companies like Applied Material because the results of a DCF can be inaccurate due to the industry being cyclical, and FCF can vary widely from year to year.

The stock is a Hold at this valuation

Considering the risk of the company potentially losing its Chinese revenue due to further trade restrictions or possible penalties resulting from an unfavorable finding from its U.S. government investigation, I think Applied Materials has no margin of safety at its current valuation.

Long-term investors can continue to hold the stock for the potential upside from its innovation strategies over the next five years. However, investors who do not currently hold the stock and lack the patience to see the stock swing into an uptrend should proceed cautiously. The stock price has a strong potential to flat line or decrease in 2024. I would only feel comfortable buying this stock if it dropped at least 20%, at a bare minimum, to around $160. I downgraded the stock to a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LRCX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.