Summary:

- Applied Materials’ revenues in the $12 billion metrology inspection equipment market dropped 30% YoY in 2023.

- The Company’s market share in two main segments of the Metrology/Inspection market dropped, while market leader KLA gained share.

- AMAT is not only losing market share to competitors like KLAC, it is also underperforming in stock share price.

DNY59

Applied Materials (NASDAQ:AMAT) detailed its “eBeam Technology and Product Launch” in a webcast on December 14, 2022. The company uses this theatrical approach to introduce new products, and I discussed the launch in my December 20, 2022, Seeking Alpha article entitled “Applied Materials Ballyhooed E-Beam Inspection Sector Lost Share To KLA’s Optical.”

According to the bullets in that article:

- Applied Materials launched its new E-beam metrology/inspection technology on December 13, 2022.

- Despite efforts to promote its E-beam technology, Optical technology led by KLA continues to generate greater growth.

- Optical wafer inspection held a 5.4X market share value over E-beam technology promoted by Applied Materials.

- In the E-beam inspection sector, even ASML beats Applied Materials.

Applied Materials boasted about its “new” technology in 2022 but didn’t acknowledge that KLA (KLAC) dominated the market and that AMAT failed to mention that its “e-beam technology” isn’t surpassing KLA’s “optical technology” in market share, based on The Information Network’s report titled “Metrology, Inspection, and Process Control in VLSI Manufacturing.”

Later in this article, I compare market share for AMAT in the two main sectors its e-beam systems compete in.

AMAT vs. Competitors Metrology/Inspection Market Share

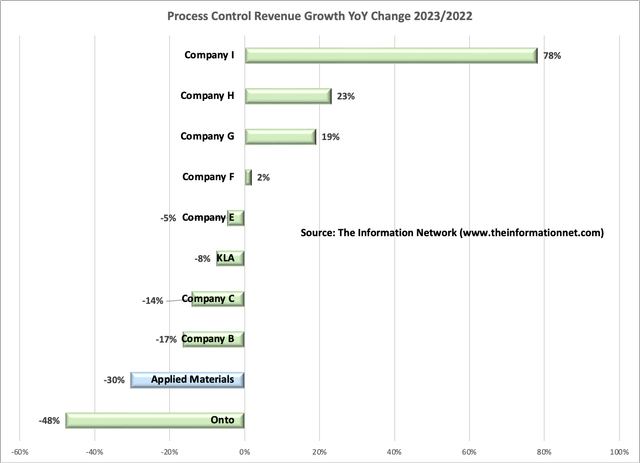

Chart 1 shows YoY revenue change of the Top 10 metrology companies for 2023 compared to 2022. These range from Company I growing +78% YoY to Onto (ONTO) growing -48%, according to The Information Network’s report.

AMAT’s revenue change, in the metrology/inspection segment of the overall WFE equipment market, was -30%. This compares to AMAT’s overall WFE growth of +0.1%, according to The Information Network’s report “Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.”

Chart 1

Table 1 shows revenues from semiconductor equipment sales to China between 2019 and 2023 for the Top 6 non-Chinese equipment companies. The last column is important and highlights that AMAT’s revenue growth for 2023 compared to 2022 was an impressive 66%, far outpacing competitors like Lam Research (LRCX), KLAC, Tokyo Electron (OTCPK:TOELY), and Screen.

Due to U.S. sanctions and China’s focus on producing trailing-edge chips (16nm and larger), AMAT’s sales of metrology/inspection equipment saw a 30% year-over-year decline, compared to AMAT’s overall WFE growth of +0.1%.

In contrast, KLAC experienced only a 12% YoY revenue growth from China in 2023. Consequently, their metrology/inspection equipment sales declined by only 8%, compared to a 14.2% decline in overall wafer fab equipment (WFE) sales.

This suggests that KLAC’s optical systems were not negatively impacted in China as they met the demands of process control for trailing-edge chips.

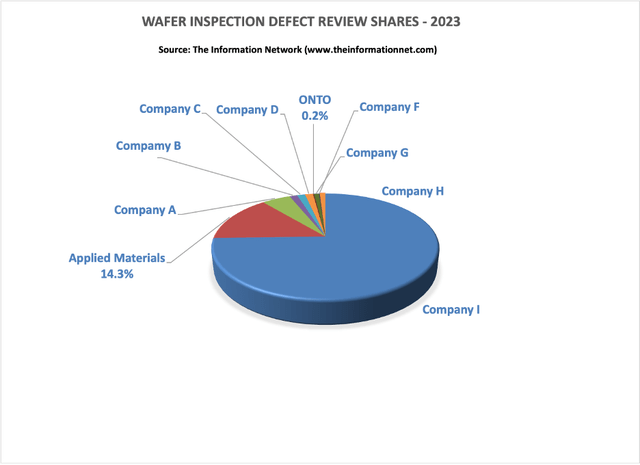

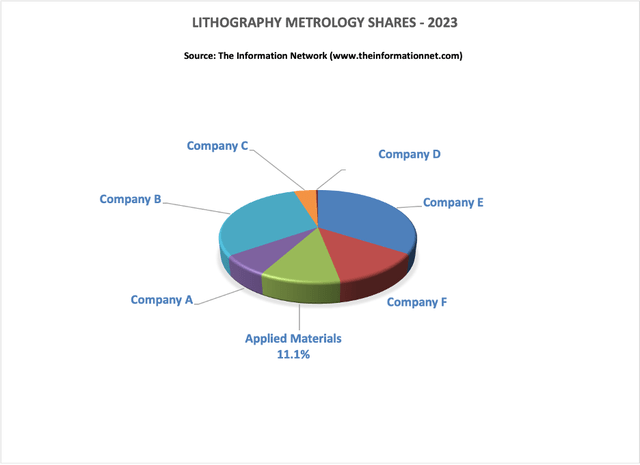

According to The Information Network’s above mention report, there are two major segments comprising the $12 billion Metrology/Inspection market in which AMAT competes:

- Wafer Inspection/Defect Review

- Lithography Metrology

In Chart 2, I show that AMAT had a 14.3% share of the Wafer Inspection/Defect Review segment in 2023, which dropped from a 15.2% share in 2022.

Chart 2

In Chart 3, I show that AMAT had an 11.1% share of the Lithography Metrology segment in 2023, which dropped from a 12.7% share in 2022.

Chart 3

Investor Takeaway

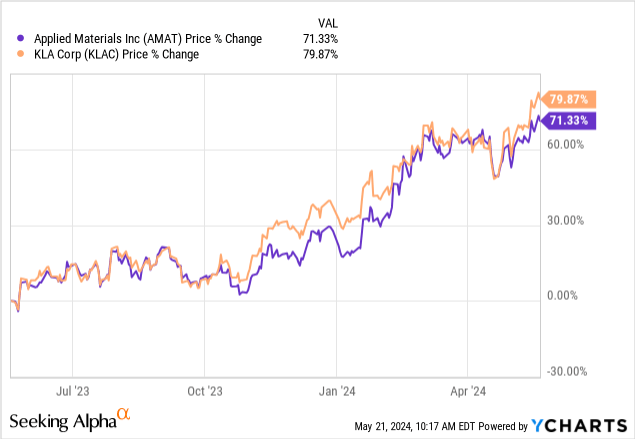

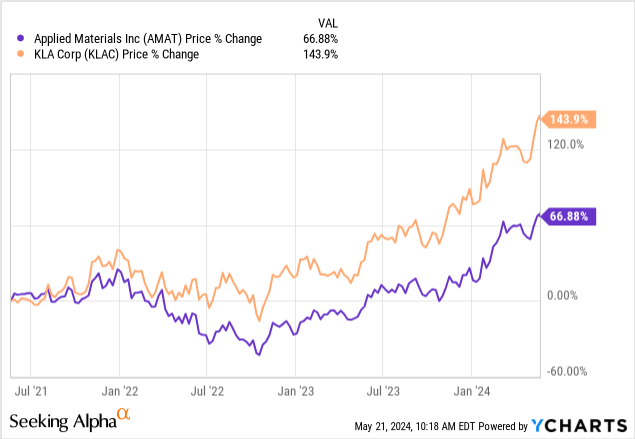

Not only is AMAT losing share in the metrology/inspection sector to competitors, including market leader KLAC, it is also underperforming in share price.

Chart 4 shows share price change for KLAC and AMAT over a 1-year period, showing a performance gain for KLAC (79.87%) over AMAT (71.33%).

YCharts

Chart 4

Chart 5 shows share price change for KLAC and AMAT over a 3-year period, showing a significant performance gain for KLAC (143.9%) over AMAT (66.88%).

YCharts

Chart 5

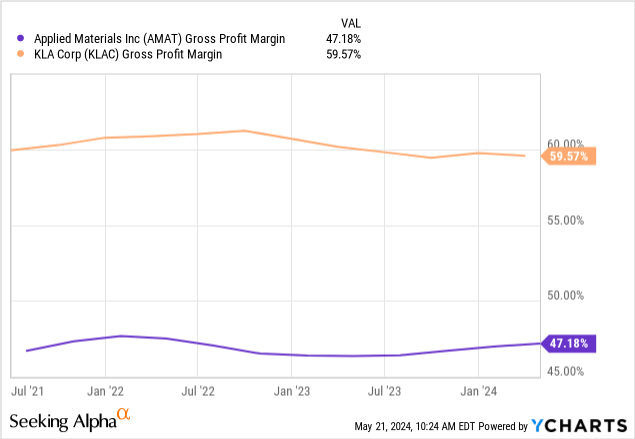

Chart 6 shows a significantly higher gross profit margin for KLAC than AMAT over a 3-year period.

YCharts

Chart 6

The hype behind AMAT’s theatrical montage for its new e-beam equipment doesn’t hold water considering market share data I’ve provided in this article.

Despite the strong growth of revenues from China, these sales actually hurts its business in metrology/inspection. Also, despite China sales, ASML overtook AMAT as the top WFE equipment company in 2023, as I detailed in a February 7, 2024, Semiconductor Deep Dive Investing Group article entitled ASML Led Global WFE Equipment Market In 2023 As China’s Naura Maintains 9th Position.

I continue to rate AMAT a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk-free 2-week trial now.