Summary:

- Applied Materials remains a strong buy due to its potential in the semiconductor supply chain and the new o1 model from OpenAI.

- Despite a 19.93% stock drop, Applied Materials shows strong financials, record revenues, and solid cash flow, positioning it well for AI-driven demand.

- OpenAI’s o1 model offers advanced multi-step reasoning, enhancing AI reliability and increasing demand for energy-efficient chips, benefiting Applied Materials.

- Applied Materials trades below the sector median forward P/E ratio, presenting a 31% upside potential as AI demand accelerates and DRAM demand grows.

Kenneth Cheung

Investment Thesis

Applied Materials (NASDAQ:AMAT) shares have dropped by 19.93% since mid-summer (when I last covered them) after the slowdown in AI stocks, as investors began shifting funds away from tech stocks following a couple month route of underwhelming earnings forecasts and heavy capex spending without clear near-term returns.

Companies like Nvidia (NVDA) and Microsoft (MSFT) have faced investor skepticism regarding their AI investments, which have yet to materialize in terms of revenue gains.

Despite this, I think Applied Materials actually remains a strong buy due to their potential in the semiconductor supply chain and the new o1 model from OpenAI which I think is a game changer. The company’s Q3 earnings showed record revenue of $6.78 billion, up by 5% year over year. Their focus on AI-driven demand, especially in key semiconductor systems, has offered them incredible opportunities as the accelerating demand for AI infrastructure remains valuable in chip production to power AI innovations.

Given the company’s strong financial fundamentals, solid cash flow, and record revenues, I believe that Applied Materials will most likely benefit from the inevitable acceleration in AI demand driven by new models like o1.

Why I’m Doing Follow-up Coverage

Applied Materials at its core has demonstrated strong operating performance despite sector level volatility that has pushed shares lower. Since I last covered the company, their stock has fallen the 19.93% I mentioned before, after the market thought it was seeing the beginning of an AI-related slowdown that suppressed investor sentiment.

Nvidia has also seen similar pullbacks amid concerns over the return on heavy AI investments. While I am bearish on Nvidia due to valuation concerns and competition with AMD (AMD), I think Applied Materials has neither of these concerns.

The purpose of me doing this follow up coverage is to show how the company is firing on all cylinders at just the right time. Now, with o1 (and similar models) coming to the market, Applied Materials is needed more than ever.

Strong Performance Despite A Weak Stock

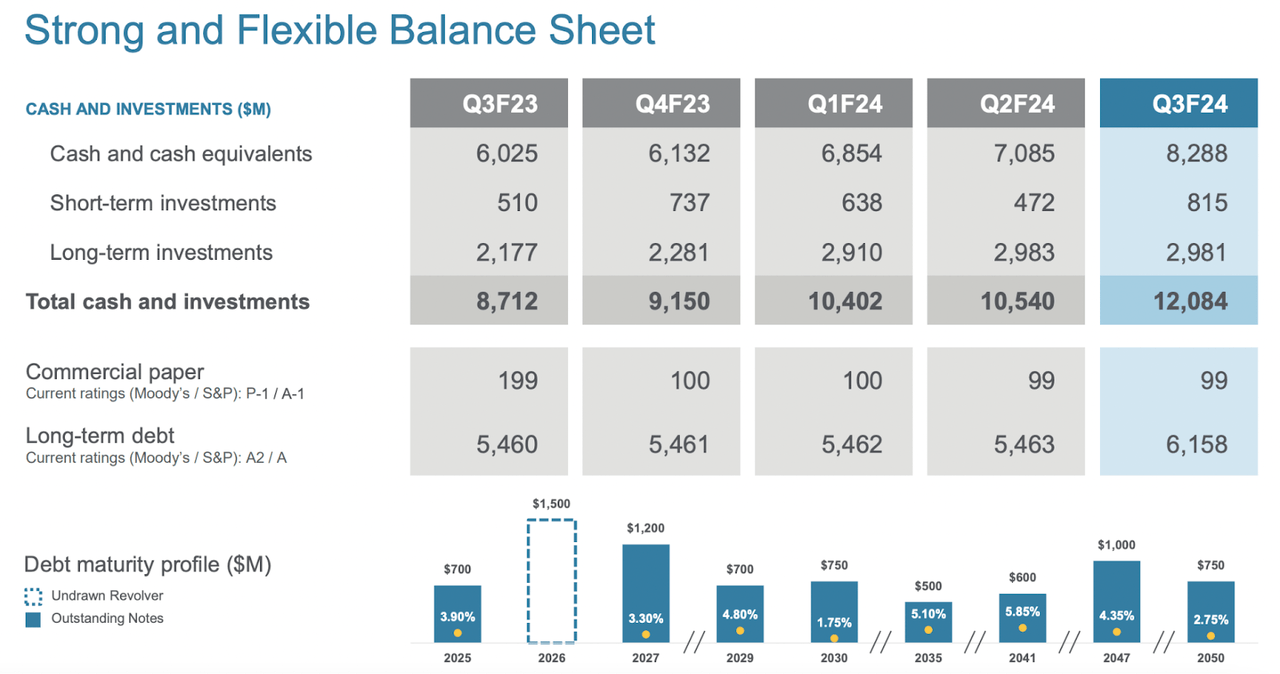

I already mentioned how revenue continues to grow, but the underlying company financials are also still strong. Applied Materials had $8.288 billion in cash and cash equivalents, with an additional $815 million in short-term investments.

AMAT Balance Sheet (AMAT)

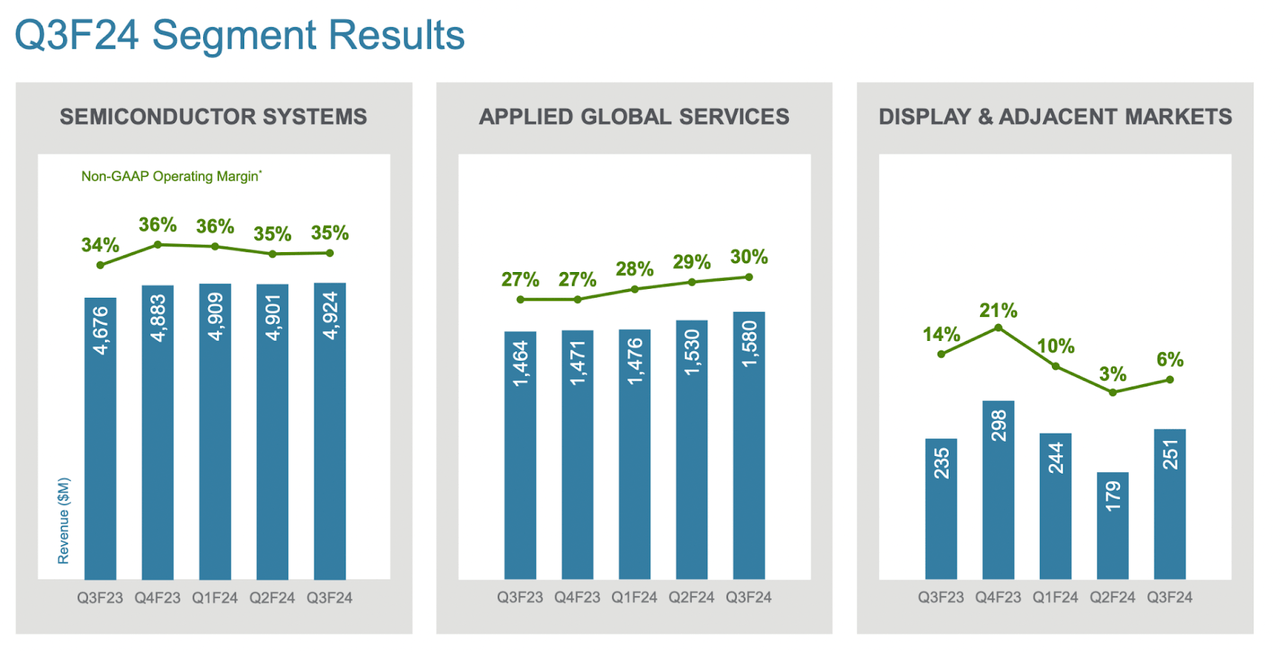

On the margin side, operating margins continue to sit near (or at) multi-year highs. What’s nice here is that we’re seeing AI cause margin expansion. This is exactly what you want from new business lines.

Gross Margins (AMAT)

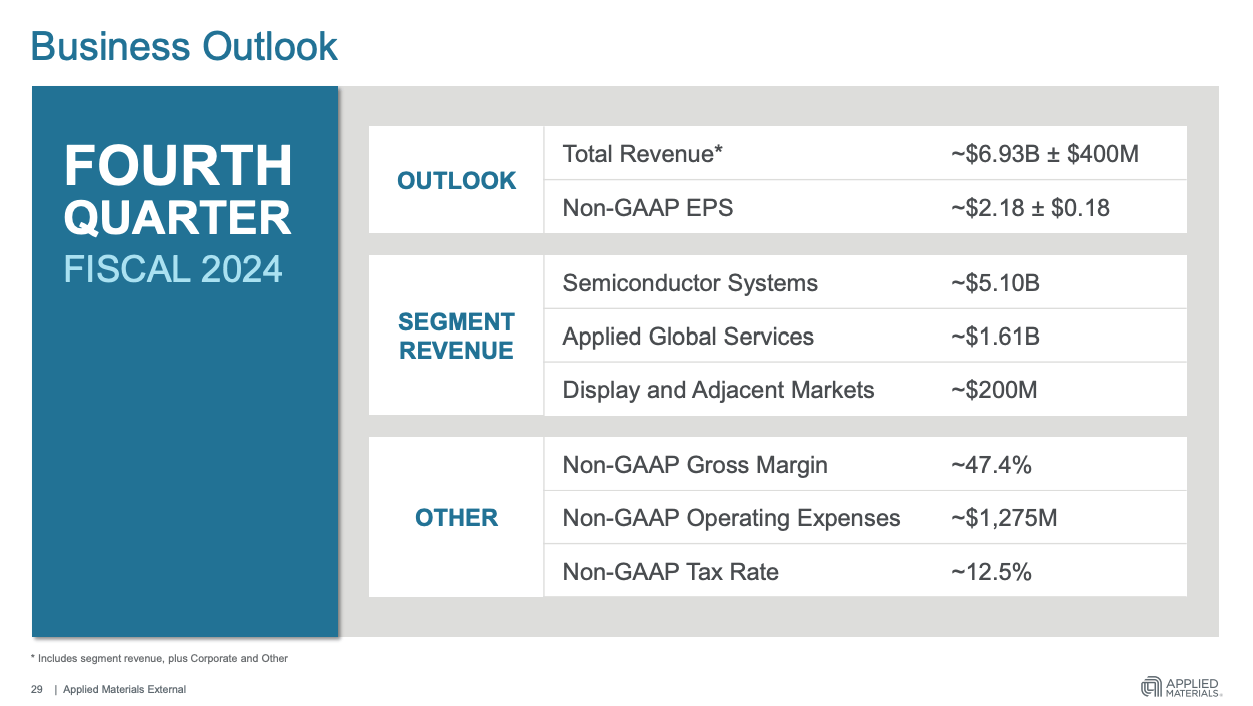

The company projects Q4 revenue to come in at approx. $6.93 billion, with a potential variance of $400 million. I think there’s a lot of room to the upside here as growth from AI accelerates. This is compared to revenue of $6.723 billion from Q3 2023.

AMAT Outlook (AMAT )

In essence, the company has strong performance even before o1 is factored in. Now, with this new model released, I think this model has the potential to accelerate the industry like ChatGPT did.

What Makes OpenAI o1 Big

OpenAI’s new o1 LLM offers far advanced AI reasoning and computational analysis, according to the company and independent testing. Unlike previous models, which often generated responses in a single step, the o1 series incorporates a multi-step, iterative approach to reasoning that makes it capable of breaking down complex questions into smaller, manageable components, processing each step, and then reconstructing the final solution. The goal is to allow the model to “think” before it answers like mimicking human deductive reasoning. This is incredible.

Rather than jumping to conclusions, OpenAI o1 processes information methodically, so it can evaluate each component before reaching a final answer. OpenAI’s older models employed a “one-shot” methodology, where a question was posed, and they would immediately generate a response (which, even when you ask a human a question this way, ends up wrong). OpenAI has designed the o1 model series to solve more complex tasks, such as advanced scientific, mathematical, and coding problems, with a high degree of accuracy. For example, o1 was found to solve 83% of the mathematical problems in a qualifying exam for the International Mathematics Olympiad, compared to 13% by earlier models like GPT-4. This is a huge jump and opens up a whole new league of use cases in the enterprise. All enterprises need to do to scale this is swap out their API keys from GPT 4o to the o1 model.

Although this model does not yet represent Artificial General Intelligence (AGI), the multi-step reasoning enables better performance in domains requiring high-level analysis, such as legal document reviews, algorithm generation, and multi-stage workflows.

This makes the model in ways much more similar to human cognition and makes it more versatile for practical use cases across multiple knowledge-based industries. With inference computing now requiring to be exponentially more powerful in order to reduce computation time from minutes into seconds, this model is a huge step.

With this, while I am not particularly bullish on Nvidia’s stock, I do strongly believe in the long-term potential of the technology behind their new Blackwell chips, which offer huge improvements in computational capabilities, according to CEO Jensen Huang. The Blackwell chips are expected to be about 50 times faster for more powerful inference capabilities. This speed is crucial for AI-related workloads, particularly in applications requiring real-time data processing for enterprises. This is the secret sauce that makes o1 work well.

This is where Applied Materials comes in.

Over the next five to 10 years, the company is projected to capture over 50% of the served addressable market (SAM) for DRAM production technology because of its use in the performance of more energy-efficient chips.

Their enhanced memory architecture, particularly the integration of stronger DRAM (dynamic random-access memory) chips will ensure that data can be processed quickly and far more efficiently, which is especially important for the inference era of machine learning, where the model applies what it has learned to new data. Stronger DRAM technology allows for smoother handling of massive datasets to boost the chip’s performance.

Applied Material’s long-term ambition is to make chips more energy efficient over the next few years, given the increasing reliance on inference computing in powering complex multi-step reasoning models, such as OpenAI’s new o1 model. As AI models become more sophisticated, requiring more steps and iterations to solve complex problems, the computational demands will increase, placing a substantial strain on data centers. These demands will further strain the U.S. energy grid, which is already under pressure from growing data consumption.

As mentioned by CEO Gary Dickerson during the Q3 earnings call:

The race for AI leadership depends on delivering significant improvements in energy-efficient compute performance in the range of 10,000 times over the next 15 years. The need for more energy-efficient compute is driving major device architecture inflections within the semiconductor roadmap that are enabled by materials engineering and Applied Materials’ innovations. This expands our served market and is accretive to our share, and the increasingly complex industry roadmap creates new collaboration and growth opportunities for Applied, enabled by our broad, unique and connected portfolio of capabilities, products and services.

Currently, most chips are not energy-efficient enough to handle large-scale deployment of models like OpenAI’s o1 without pushing the energy grid to near its limits. I believe that Applied Materials can bring one of the best solutions on the market to provide for the growing demand for powerful AI computing and the need for more energy-efficient infrastructure.

Valuation

Applied Materials is making the right moves as the industry accelerates. Analysts are starting to notice, as the company has seen both their revenue estimates revised upward. There have been 24 upward revisions for their revenue in the last three months, with projected growth of 2.16% in 2024, and growth accelerating through fiscal year 2028 to 10.78%.

Ironically, I think these growth estimates are low especially given that Blackwell chips (and similar chips from competitors) will bring about a new era of inference that means DRAM demand will accelerate. 10.78% revenue growth in a white hot market feels low.

Despite these positive revisions, Applied Materials’ shares have pulled back from their all-time highs. As I mentioned before, the decline appears to be more of a market response to sector movements rather than a reflection of the company’s core performance or slowing demand for their products.

I think that the fundamentals remain solid, and their leadership in the semiconductor equipment market positions them well for future growth.

Currently, Applied Materials trades below the sector median forward P/E ratio with a forward P/E ratio of 23.09, while the sector median is 24.19, reflecting a discount of 4.58%. I think their forward P/E actually needs to be about 25% higher than the sector median to account for the key opportunity they have. Other AI names trade at a premium. I think they should too.

If we saw shares go from the 4.58% discount to a 25% premium, this would represent roughly 31% upside in shares.

Risks

A big concern I had later in the summer over what appeared to be the slowing AI market centered around the nondeterministic nature of many AI models. Nondeterministic here means that most AI models are inconsistent in their results. For AI models to be effective (and become a part of everyday life), they need a consistent level of quality output and reasoning.

OpenAI’s new o1 model does a good job at mitigating this risk by using a multi-step reasoning process to enhance the reliability of its outputs.

The new o1 model is said to mitigate its error rate by employing a multi-step process so it can break down complex problems and solve them step-by-step, similar to human reasoning.

Like humans, AI models are not perfect in their logic. However, just as a person’s reasoning becomes more reliable by using multiple steps in their thought process, the o1 model increases its probability of reaching a stable, logical conclusion through iterative analysis. As AI adoption scales, especially in areas requiring inference, this technological advance supports the demand for more advanced and energy-efficient chips. These chips will need superior DRAM. This is where Applied Materials comes in.

Bottom Line

This o1 model from OpenAI is a key improvement over the original ChatGPT/GPT 3 model that put the company on the map. It offers what I believe is the missing link in AI, or enhanced multi-step reasoning capabilities that mimic human deductive processes.

I think the evidence here is clear: multi-step reasoning lowers the error rate compared to previous models, making it more reliable for complex tasks (especially in the enterprise). The market for AI just got a whole lot bigger because of this.

Applied Materials will benefit from this shift, since the increased demand for energy-efficient chips will power the next generation of AI models. Despite the recent stock decline, I believe shares are still a strong buy given their leadership in this key semiconductor technology and potential for long-term growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMAT, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.